Daniel Wright/iStock Editorial via Getty Images

Note:

I have covered ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) previously, so investors should view this as an update to my earlier articles on the company.

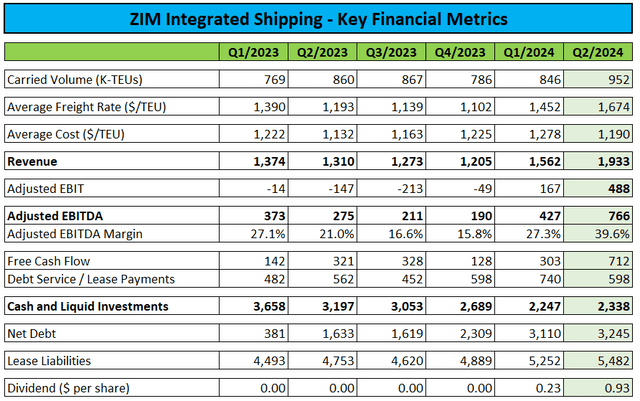

On Monday, Israel-based liner company ZIM Integrated Shipping Services Ltd. or “ZIM” reported Q2/2024 results well ahead of consensus expectations due to a favorable combination of higher volumes, increased freight rates and lower average costs.

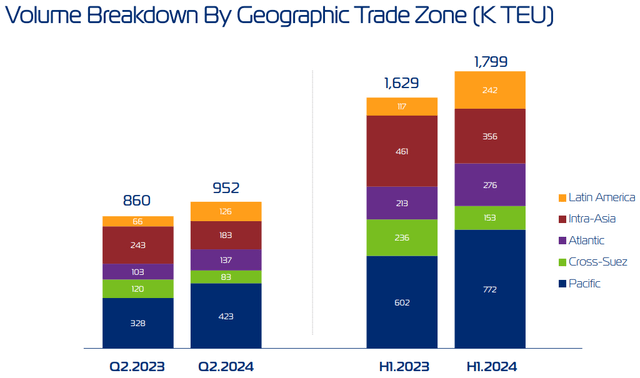

Results were buoyed by strength in Transpacific volumes and substantial growth in Latin America:

According to management on the conference call, the company remains on track for double-digit volume growth this year.

Adjusted EBITDA of $766 million increased by almost 80% sequentially, with the resulting margin approaching 40%.

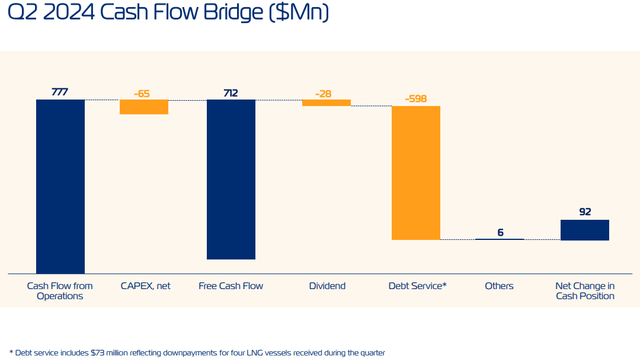

Free cash flow of $712 million more than doubled on a quarter-over-quarter basis. Please note that this number does not include an aggregate $598 million in lease payments and related interest for the company’s vessels.

As a result, cash and liquid investments increased by $92 million to $2.34 billion. However, net debt continued to move up as the company took delivery of additional newbuilds with long-term lease commitments during the quarter.

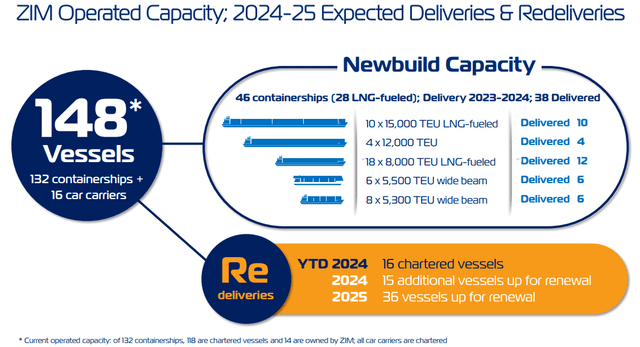

ZIM expects to take delivery of the remaining eight newbuilds over the remainder of the year, thus resulting in required down payments of $120 million in aggregate.

With the company’s newbuild program soon to be completed and 36 vessels coming up for renewal next year, ZIM will have plenty of flexibility to adapt to potential changes in the marketplace.

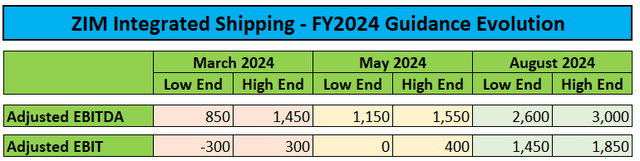

In the near-term, management expects business conditions to remain favorable. Consequently, the company has raised full-year guidance significantly:

Based on the new guidance range, I would expect Q3 Adjusted EBITDA to exceed $1 billion, with earnings per share potentially reaching $7. Assuming a 30% payout ratio, the quarterly dividend would calculate to $2.10.

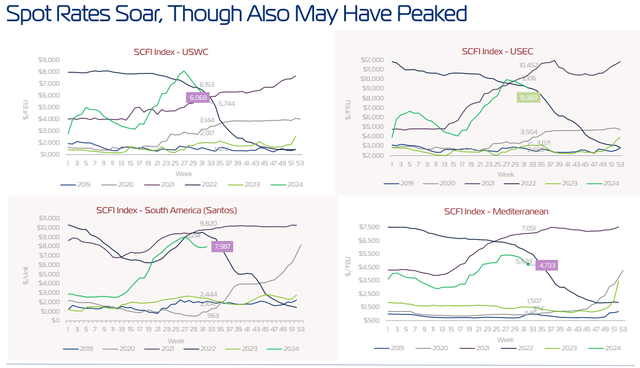

However, with U.S. inventories on the rise and spot rates already down meaningfully from July peak levels, Q4 is likely to see some deterioration.

While peak season might be ending soon, ongoing Red Sea disruptions should keep a floor under freight rates for the time being even when considering additional newbuild deliveries into the global fleet over the next couple of quarters.

On the flip side, Shanghai container futures are currently signaling a steep drop in freight rates in the first half of next year:

Shanghai Futures Exchange

While there’s considerable uncertainty regarding the industry’s medium-term prospects, I would expect ZIM’s very strong H2/2024 outlook and resulting expectations for material dividend increases to attract additional buyers going into the company’s third quarter report in November.

With ZIM being a volatile stock, I would abstain from chasing the shares following Monday’s 17% rally and rather wait for a better entry point in the coming weeks.

Please note that the investment thesis is not without risk. While unlikely at this point, a Gaza ceasefire agreement would almost certainly result in a selloff in the shares as market participants assume an end to the Red Sea disruptions, which would push the industry back into material oversupply.

Personally, I do not expect the Houthi to stop their attacks even in the unlikely case of a near-term ceasefire agreement, but a reopening of the Suez Canal route would almost certainly cause freight rates to crater.

Bottom Line

ZIM Integrated Shipping Services reported very strong second quarter results and raised full-year expectations materially as the company benefited from a healthy mix of increased volumes, higher freight rates, and lower unit costs.

Assuming full-year results coming in at the upper end of management’s increased guidance, the company’s annual dividend could approximate $5 per share, and this does not assume any sort of true-up payment early next year.

On the flip side, H1/2025 container futures don’t look great at this point, and a potential end to the Red Sea disruption would almost certainly push the industry back into oversupply.

Absent a Gaze ceasefire agreement or massive near-term declines in container spot rates, I would expect ZIM Integrated Shipping Services’ shares to trade strongly into an anticipated blow-out Q3 report in November.

While I wouldn’t chase the stock following Monday’s 17% rally, investors might consider accumulating shares on potential weakness over the coming weeks.

Consequently, I am reiterating my “Buy” rating on the stock.