hapabapa

Summary

Following my coverage of Zillow Group (NASDAQ:ZG) in May’24, for which I recommended a buy rating due to the various visible growth catalysts ahead that can help sustain high-teen growth, this post is to provide an update on my thoughts on the business and stock. ZG remains buy-rated as the growth outlook has gotten brighter because of an improving macro backdrop. In addition, execution on penetrating enhanced markets and improving top-of-funnel awareness continues to be solid. The market also appears to appreciate the strong results, as seen from the share price movement.

Investment thesis

On 07-08-2024, ZG released its 2Q24 earnings, which saw revenue of $572 million, 6% ahead of consensus ($538 million). Total revenue grew 13%, driven by the residential segment growing 7.6% to $409 million, the mortgage segment growing 41.7% to $34 million, the rental segment growing 28.6% to $117 million, and others growing $12 million. Total adj EBITDA also did better than expected, coming in at $134 million, ahead of consensus $99 million by 36%, implying an adj EBITDA margin of 23.4% (vs. 2Q23 of 21.9%).

ZG’s 2Q24 results dismissed my worry about the residential segment, as it did way better than guided (prior guidance called for $372 to $382 million, but 2Q24 reported $409 million). 2Q24 was also another quarter of solid share gains, as the residential industry only grew 3%, implying ZG gained ~500bps of share. With various macro indicators pointing to a positive growth outlook for the US residential housing market (as I have written in my post for The Middleby Corporation, and I quote below), I foresee this segment to see solid growth accelerating in the coming years.

- Housing starts have continued to improve since the trough saw in May.

- Existing home inventories have improved since the start of the year.

- Mortgage rates have come down, which should continue to go down as the fed cuts rate, and this should cause the above two points to further improve (lower rates drive housing demand, which drives housing starts; lower rates cause more existing homeowners to list their homes, which improves the housing supply situation).

Moreover, ZG has invested a lot in the top of the funnel, which now gives it a dominant position against even its closest peers. This further supports a solid growth outlook when the demand situation recovers.

And our top-of-funnel advantage today has never been stronger. Zillow has searched more on Google than the category term real estate and three times more than the next brand in the category. 80% of our traffic is organic and our app usage is more than three times anyone else in the category. We have more than 217 million average monthly unique users across the Zillow ecosystem of apps and sites and 109 million total unique visitors according to ComScore, a third-party data tracker that allows for comparison across sites. 2Q24 earnings results call

Recall in my previous post that the second growth catalyst—ZG expansion into enhanced markets—has continued to play out well in 2Q24. To recap, the management target was for ZG to penetrate the 40 Enhanced Market. In 2Q24, ZG has penetrated into 6 additional markets (19) and is on track to reach 36 markets by the end of August, which means it is well ahead of schedule to meet the target of 40. As I noted previously about the implications of penetrating these markets:

Since home loan products are typically associated with transactions in enhanced markets, penetrating these markets also brings the advantage of higher revenue per transaction

Management gave an updated figure this quarter that enabled investors to better quantify this revenue uplift in these markets. Using the four most mature enhanced markets as references, management noted revenue growth per total transaction value was up by more than 80% since the beginning of 2023. Even if we account for the fact that not all markets will reach this level of uplift, it is still a substantial uplift even at a 50% discount (i.e., 40% growth in revenue per transaction). The markets that ZG entered in 1Q24 also saw positive growth; as such, I expect mortgage revenue to continue growing at robust rates as ZG penetrates into more enhanced markets. Another point of reference to show the effectiveness of this strategy is that ZG Home Loan purchase loan origination volumes grew 125% y/y to $756 million in 2Q24, despite the mortgage market being down by mid-single-digits y/y.

In our first four Enhanced Markets, we’ve seen revenue growth per total transaction value increase by more than 80% since the beginning of 2023, compared with the more than 50% growth we reported back on the February call. 2Q24 earnings results call

As for the last growth catalyst—rentals—it was another solid quarter of performance where ZG delivered its eighth consecutive quarter of growth. I don’t see any signs of slowing down here as ZG flywheels continue to drive growth, where it continues to add a significant number of housing units (multifamily listings grew 38% y/y to 44,000 properties), which attracts more consumers (multifamily revenue grew 44% in 2Q24, showing that new supply translates to new homes), which in turn attracts more homeowners to list their homes. With ZG stepping up on investing in brand marketing campaigns, the growth outlook remains solid, in my opinion.

Valuation

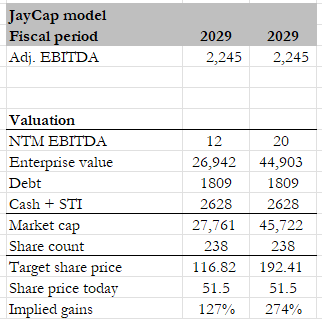

Based on how the share price has moved post-earnings, the market clearly loves this set of results. Like how I have always valued ZG since I started covering this stock, my focus is always on when ZG can achieve its long-term target of $5 billion in revenue and a 45% margin. Based on the recent performance, where growth should accelerate (from 1H24 13% revenue growth) given the positive setup ahead, I think my 17% CAGR assumption (through FY29) is still valid. I am also still optimistic that the adj EBITDA margin can hit 45% by then, which translates to $2.245 billion of adj EBITDA in FY29.

Own calculation

In my last model, I used the S&P500 historical average forward EBITDA multiple to value the business. This seems to be too conservative, as the market is valuing ZG at 20x forward EBITDA today. Assuming ZG multiple stays at this level, the upside is going to be much more significant than I originally modeled (ZG share price peaked at $212, so there is a precedent for share price to hit my upside case of $192).

Risk

The ongoing NAR settlement case is the biggest risk for ZG. Z relies on brokers purchasing leads and ads for revenue, so if commissions were to drop, brokers might cut back on spending. I should also mention that the need to have written agreements with home buyers before touring is a big friction that may limit ZG ability to grow.

Conclusion

In conclusion, my rating for ZG remains a buy. 2Q24 results exceeded expectations across all key metrics, and with the significant share gained, ZG has further solidified its position as a market leader. With an improving macroeconomic backdrop, coupled with ZG’s strategic initiatives in enhanced markets and top-of-funnel dominance, I expect growth to get more robust ahead.