bjdlzx

Yangarra Resources (OTCPK:YGRAF) has a goal to get the net debt down to C$80 million. This Canadian producer (that reports in Canadian dollars unless otherwise stated) noted that net debt in the second quarter is now C$96 million. This is the lowest the debt has been in roughly six or seven years. Now the lower net debt did not involve much of a repayment to the bank line because the winter activity levels necessitate repaying accounts payable first. However, the improvement in working capital likely means more bank payments to get the bank debt away from the maximum amount on the current bank line.

The last article discussed how lower net debt would be an objective. This article digs into the very big step that the company made in the right direction. With the current accounts receivable balance (especially compared to the now far lower accounts payable balance), it is easy to see that the cash to repay some loans is coming.

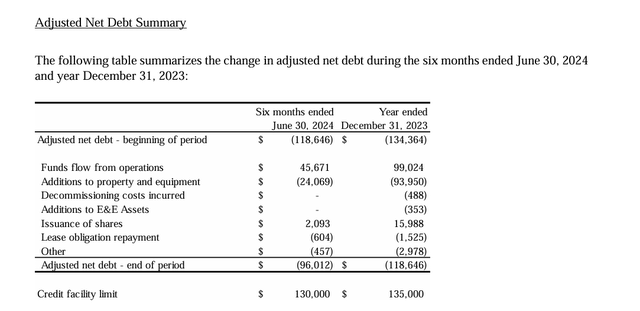

Net Debt Detail

The second quarter is Spring Breakup for Canadian companies. That often means repairs and maintenance rather than drilling and completing new wells. The low natural gas prices will also mean a turnaround that will take much of the company’s production offline for about 2 weeks. For a company with significant natural gas production, usually the time to do this is when prices are seasonally weak. Right now, that is definitely the case.

Yangarra Resources Net Debt Calculation Second Quarter 2024 (Yangarra Resources Second Quarter 2024, Earnings Press Release)

The much lower capital budget is likely influenced by the natural gas prices. The company does produce enough valuable liquids to remain profitable. But obviously the time to work on liquidity is when at least part of what is produced gets low prices. Hopefully, the whole situation will be fixed once natural gas prices begin to recover.

In the meantime, the net debt figure bodes well for the bank line once the sizable accounts receivable account is collected because the lower activity levels resulted in a far lower accounts payable budget.

The Canadian companies usually do not show cash on the balance sheet. This is because all cash is deposited against the credit line and then all payments are likewise written against the same credit line.

Therefore, the current working capital balance will likely move against the bank line in the future. American companies, in contrast, would show an increase in cash to a certain extent. This also explains why there needs to be room between the current bank line and the maximum amount shown above. No matter the arrangements, the company cannot go above the maximum limit.

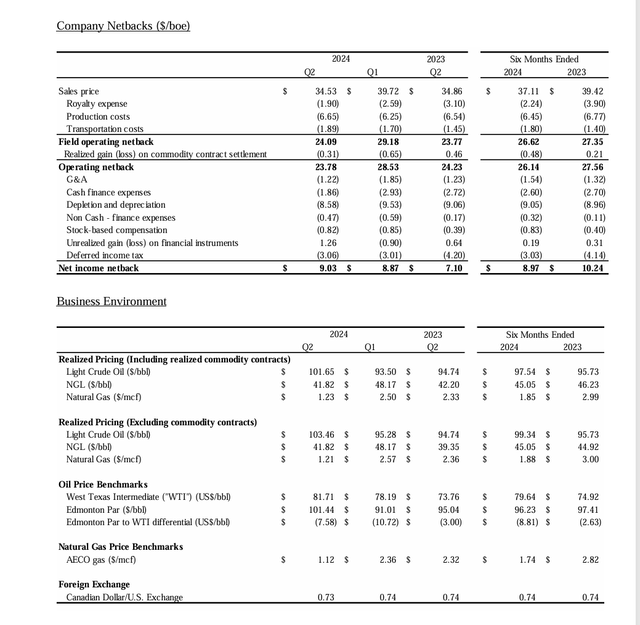

Earnings And Commodity Prices

The price of oil was a bit stronger to largely offset the effects of the decline in natural gas prices.

Yangarra Resources Summary Of Second Quarter 2024, Results (Yangarra Resources Second Quarter 2024, Earnings Press Release)

The net operating netback as well as the operating netback is down from both the first quarter and the previous year comparison. The year-to-date comparison is similarly down. However, the company was still profitable at a time when some competitors are reporting losses.

Note that the net income netback held up rather well as depreciation and depletion dropped due to the addition of new production. Supposedly the reason that production costs did not follow is that management spent some money on some other expenses likewise classified as production costs to hopefully save money in the future.

There was also a big unrealized gain to help things along as well in the second quarter. Unrealized gains and losses really represent an opportunity cost of selling products into the future through hedging rather than waiting for that future to become current (and then selling at the then current price). As such those valuation allowances really do not affect operations at all.

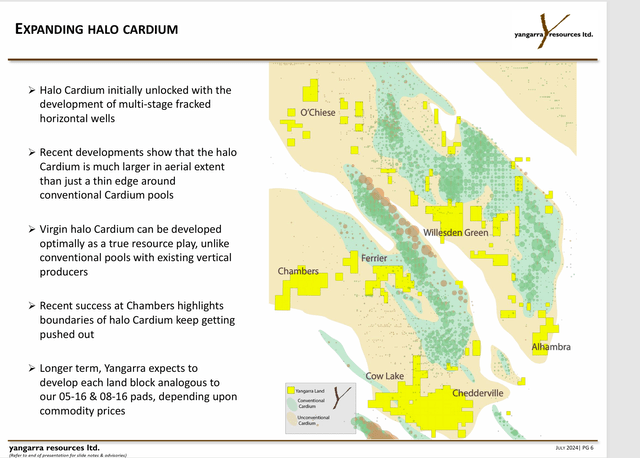

Area Of Operation

Usually, the thing that distinguishes between conventional and unconventional is porosity. That is a measurement that is rarely visible to the average investors. Therefore, a conventional opportunity completed with “modern completion techniques (like fracking) is rarely all that different from an unconventional opportunity also completed with “modern completion techniques”.

Yangarra Resources Summary Of Second Quarter 2024, Results (Yangarra Resources Second Quarter 2024, Corporate Presentation)

This company is exploiting an interval that had been ignored until now. Of course, one of the rewards of success is that others rush to jump in. Now in Canada, there is plenty of room for others to gain acreage. But this company has enough acreage to keep itself busy for many years to come.

Much of Canada has stacked plays. Therefore, there could be some upside to other intervals in the future.

Probably the biggest consideration right now is the price of natural gas needs to improve some to encourage production growth. The industry seems to be expecting that improvement. However, expectations and the timing of reality can be a very disjointed situation.

Management has mentioned that certain areas have a higher liquids percentage of production. Most likely management will hi-grade the acreage based upon the current pricing situation and plan to drill accordingly.

Summary

The company has already warned that the third quarter production will be lower due to both a third-party turnaround and the fact that activity is lower during Spring Breakup.

On the other hand, any idle time is likely to add to the working capital balance that the company built during the second quarter. Activity in the fourth quarter will likely be natural gas price dependent. However, some of the companies that I cover are expecting that by then a natural gas price resurgence will be obvious in addition to seasonally strong heating season prices. Whether that will actually happen as many in the industry seem to think is a topic for discussion.

La Nina winters are “supposed” to be cold which would be very good at bringing down natural gas storage levels. But every now and then Mother Nature throws a curve ball.

This company remains a strong buy as it is one of the more profitable small companies I follow. The debt ratio remains close to one and the net debt has materially declined in the second quarter.

This management has built and sold companies before. That takes a lot of the small company risk out of the investment idea. With decent finances, this company would likely interest a wider variety of investors than is usually the case. However, small companies can remain cheap for a long time. Therefore, patience is definitely necessary with a company like this.

Risks

Smaller companies are usually dependent upon one or two key people. The loss of one of those key people could set the company back or even be fatal.

The market is not real efficient with small companies. The old saying that “the market can stay irrational longer than you can stay solvent” applies. Therefore, a suggestion like this one is likely a candidate for a basket of similar choices. Small companies have a habit of “turning left” when you least expect it.

Any upstream company is subject to the volatility and low visibility of future commodity prices. AECO, in Canada is particularly known for its destructive volatility. Most companies, like this one, take measures to avoid the worst of that volatility and they are successful doing it. But that is no guarantee about the future.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.