The exterior and parking lot of a Williams-Sonoma retail location.

Brycia James

As a dividend growth investor, it’s a beautiful sight to behold when my holdings announce stock splits. Astute readers may be asking why I would hold this opinion.

A stock split makes no difference to the fundamentals of the underlying business, right? Yes, that’s true.

A stock split simply means there are more pieces (shares) of the same profit pie. However, we have to consider the dynamics behind why a company would be announcing a stock split in the first place.

There are probably exceptions to the rule. But stock splits tend to mean that an underlying business has executed at a high level for years or decades. In turn, these strong fundamentals push the share price ever higher over time.

In the days before fractional shares, share prices sometimes in the thousands of dollars, kept retail investors out of stocks. This isn’t as much of an issue anymore.

So, I would wager that the reason for stock splits today mostly comes down to investor psychology. I hope that I’m not the only one, but I dislike buying fractional shares of a stock.

I know that owning 0.5 shares of a stock makes little difference versus owning a whole share. Yet, there’s something about fractional shares that just seem less neat to me overall and in my spreadsheets.

Williams-Sonoma (NYSE:WSM) is a major holding in my portfolio. Comprising 2.2% of my portfolio, the omnichannel specialty home products retailer is my fifth-biggest holding.

On June 13, WSM announced a two-for-one stock split. Shareholders of record on June 27 will receive an additional share of common stock for each share of common stock held, payable after the close of market on July 8. At the market open on July 9, shares will commence trading on a split-adjusted basis.

When I last covered WSM with a hold rating in March, I appreciated its top-notch brand portfolio, decent growth prospects, and vigorous balance sheet. The valuation was the only notable downside that I observed at that time.

Today, I’m going to be maintaining my hold rating. WSM posted blowout fiscal first-quarter results to begin its current fiscal year. E-commerce trends in housewares and home furnishings bode well for the company’s future. WSM’s exceptional financial positioning remains stable. WSM isn’t quite a buy yet, but it’s closer to a buy now than just a few months ago. Finally, I’ll provide my updated fair value estimate and where I would consider adding to my position.

Masterfully Navigating A Challenging Environment

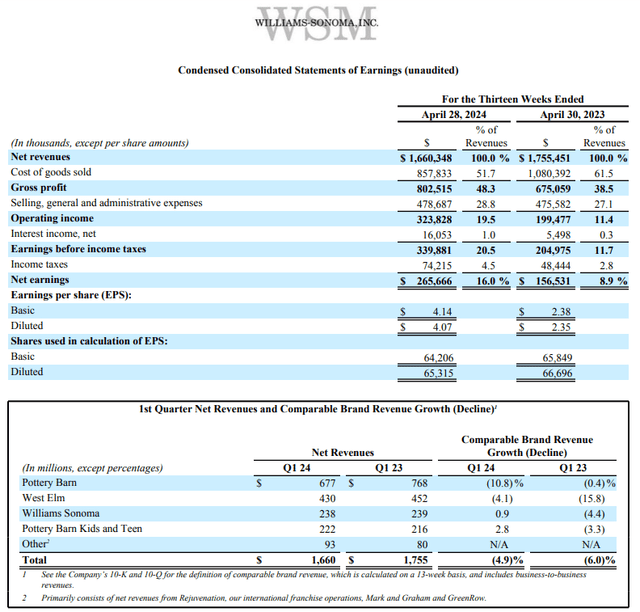

WSM Q1 2024 Earnings Press Release

WSM shared what I thought were respectable financial results for the fiscal first quarter on May 22. The company’s net revenue decreased by 5.4% year-over-year to approximately $1.7 billion during the quarter. That registered $10 million ahead of Seeking Alpha’s analyst revenue consensus in the quarter.

So, how could I be satisfied with a decline in WSM’s topline? As has been the case in recent quarters, the macroeconomic environment has negatively impacted consumers’ perceptions.

In June, Gallup’s Economic Confidence Index reading was -33. What this means is that 33% more Americans rate current economic conditions as poor/getting worse than those who rate current economic conditions as excellent or good/getting better. For more context, that was about the same as the -34 reading in May.

This suggests that the economic outlook among most Americans is far from positive. Now, the ECI doesn’t provide a breakdown by income brackets. But with the index being so far underwater, it’s a safe bet that even some of WSM’s more affluent customer base is downbeat about the economy as well.

This economic pessimism has manifested itself in consumer spending habits. WSM’s Pottery Barn and West Elm brands each posted comparable brand revenue declines in the fiscal first quarter (10.8% and 4.1%). This wasn’t completely offset by modest comparable brand revenue growth rates in the Williams-Sonoma and Pottery Barn Kids and Teen brands (0.9% and 2.8%).

These results weren’t all doom and gloom, though. According to President and CEO Laura Alber’s opening remarks during the Q1 2024 Earnings Call, WSM has pulled back on promotions. This was most prominent with the Pottery Barn and West Elm brands, which is part of why they experienced the aforementioned comparable brand revenue declines.

The fact that WSM can transition toward running little to no promotions to aid with the topline and post as stable of net revenue as it did is encouraging. This is because while the company may be taking a small hit on the top line, it is protecting and expanding the bottom line.

Adjusting for a $0.59 lift to EPS from the reversal of freight-related accruals, WSM posted $3.48 in non-GAAP diluted EPS for the fiscal first quarter. That was a 31.8% year-over-year growth rate over the year-ago period and $0.74 better than Seeking Alpha’s analyst consensus.

A light volume of sales promotions and disciplined cost management helped WSM’s operating income margin expand by 520 basis points to 16.6% (excluding the reversal of freight-related accruals) during the quarter.

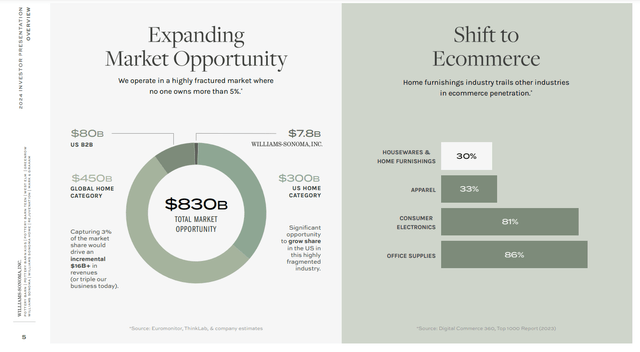

WSM 2024 Investor Presentation

Over the next few years, the analyst outlook is solid (especially for the environment). The FAST Graphs consensus among 24 analysts is that non-GAAP diluted EPS will rise by 8.1% in the fiscal year ending January 2025 to $16.05. For the fiscal year ending January 2026, another 3% growth in non-GAAP diluted EPS to $16.54 is anticipated among 24 analysts. In the fiscal year ending January 2027, an additional 4.7% growth in non-GAAP diluted EPS to $17.32 is the current consensus among 8 analysts.

Despite current economic headwinds, WSM has a few things going for it.

The company is the largest omnichannel player in the specialty home furnishings category. Net revenue last fiscal year was about as much as the next five players combined.

This comes as the e-commerce penetration rate of the housewares & home furnishings industry remains low at around just 30%. As consumers increasingly transition to e-commerce in this industry as well, I believe WSM is poised to capture much of that share. That’s also why I think the company’s long-term forecast of mid-to-high single-digit net revenue growth for the long haul is realistic.

As the company achieves supply chain efficiencies and scales back promotions, margins should also remain relatively steady in the mid-to-high teens. Coupled with share repurchases, this is why I expect a return to high-single-digit annual non-GAAP diluted EPS beyond the next few years.

No conversation about WSM would be complete without a mention of its phenomenal balance sheet. As of April 28, the company had almost $1.3 billion in cash and cash equivalents and no long-term debt. That means nearly 7% of the company’s approximately $18 billion market cap is strictly net cash. This is why I expect the outstanding diluted share count to continue declining by 2% to 3% annually (unless otherwise sourced or hyperlinked, all details in this subhead were according to WSM’s Q1 2024 Earnings Press Release and WSM’s 2024 Investor Presentation).

Fair Value Has Surpassed $250 A Share

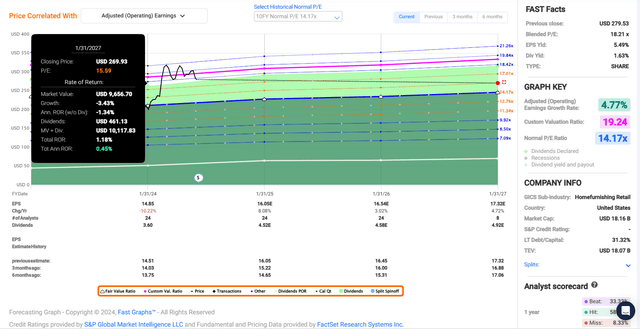

FAST Graphs, FactSet

As the S&P 500 index (SP500) has rallied another 8%, shares of WSM have pulled back 1% since my last article. In my view, the retailer isn’t buyable yet.

The slightly lower share price helps, though. As does a higher fair value estimate from the passage of time (as the earnings inputs guiding my fair value move further into a future with likely higher earnings).

WSM’s current-year P/E ratio of 17.5 is above its 10-year normal P/E ratio of 14.2 per FAST Graphs. Taking the current environment into consideration, I would argue the company’s growth story remains mostly intact.

Additionally, WSM’s profitability has improved immensely in recent years. The company anticipates that its operating margin will be between 17% and 17.4% for this fiscal year. That’s much better than the 10.5% operating margin in 2014.

This is why I think a valuation re-rating to one standard deviation above the 10-year normal P/E ratio is justified. That would be a P/E ratio of 15.6.

The current fiscal year for WSM is about 42% complete. That leaves 58% of the current fiscal year and 42% of the next fiscal year ahead in the next 12 months. This is how I get a forward 12-month non-GAAP diluted EPS input of $16.26.

Applying this valuation multiple, I get a fair value of $253 a share. Compared to the $281 share price (as of July 3, 2024), this would be an 11% premium to fair value. If WSM grows as anticipated and returns to fair value, it could deliver 1% cumulative total returns through January 2027.

More Dividend Growth To Come

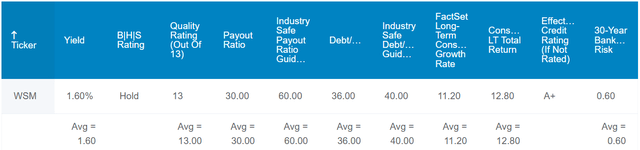

The Dividend Kings’ Zen Research Terminal

According to Seeking Alpha’s Quant System, WSM’s 1.6% forward dividend yield is below the consumer discretionary sector median forward yield of 2.4%.

The company has established itself as an impressive dividend grower over the years. Its 10-year compound annual growth rate of 11.8% is above the sector median 10-year dividend growth rate of 8.3%. This is enough to earn a B+ grade from the Quant System for this metric.

Dividend growth probably won’t be quite that strong in the years to come. It should remain respectable, however.

This is because WSM’s payout ratio will likely come in between the high-20% and low-30% range for the current fiscal year. That is well below the 60% EPS payout ratio that rating agencies prefer for the industry, per The Dividend Kings’ Zen Research Terminal. So, along with the excellent balance sheet, WSM has the flexibility to hand out generous dividend hikes in the years ahead.

That will build on a 17-year dividend growth streak. This is much greater than the sector median of 1 year, which is why the Quant System awards an A grade for consecutive years of dividend growth.

Risks To Consider

WSM is a quality business, but it isn’t completely insulated from risks.

As of last fiscal year, 81% of WSM’s merchandise purchases were sourced from foreign suppliers, with 25% of purchases coming from China (page 23 of 89 of WSM’s 10-K Filing). If tensions between the U.S. and China worsened further, that could throw the company’s supply chain into turmoil. This could weigh on the company’s margins.

Just as I noted in my previous article, WSM’s continued success hinges on maintaining its brand reputation. If any incidents like cyber breaches compromising sensitive customer data or an inability to fill orders in a timely and effective manner happened, the company’s image could be harmed. This could result in a loss of market share and a shattering of the investment thesis.

As a consumer discretionary, WSM’s results are also vulnerable to economic cycles. Any severe or protracted recessions could temporarily impact the company’s operating results.

Summary: Waiting On A Correction And/or Higher Fair Value

Sitting on 431% capital gains on my shares of WSM, the retailer is my portfolio’s biggest winner. My shares purchased in March 2020 are even up nearly 700% at this time. The share price relative to fair value is trending in the right direction but has a way to go before I’d be a buyer.

To be clear, I still believe in WSM’s ability to be a compounder for the long haul. Considering that my fair value estimate is around $250 a share, I would start to consider buying in the $230s.

This is because I require a margin of safety and a roughly 10% margin of safety for a high-quality consumer discretionary company like WSM is sufficient in my opinion. Until shares grow more in fair value and/or correct, I am content to hold on to this amazing dividend growth stock, though.