deepblue4you

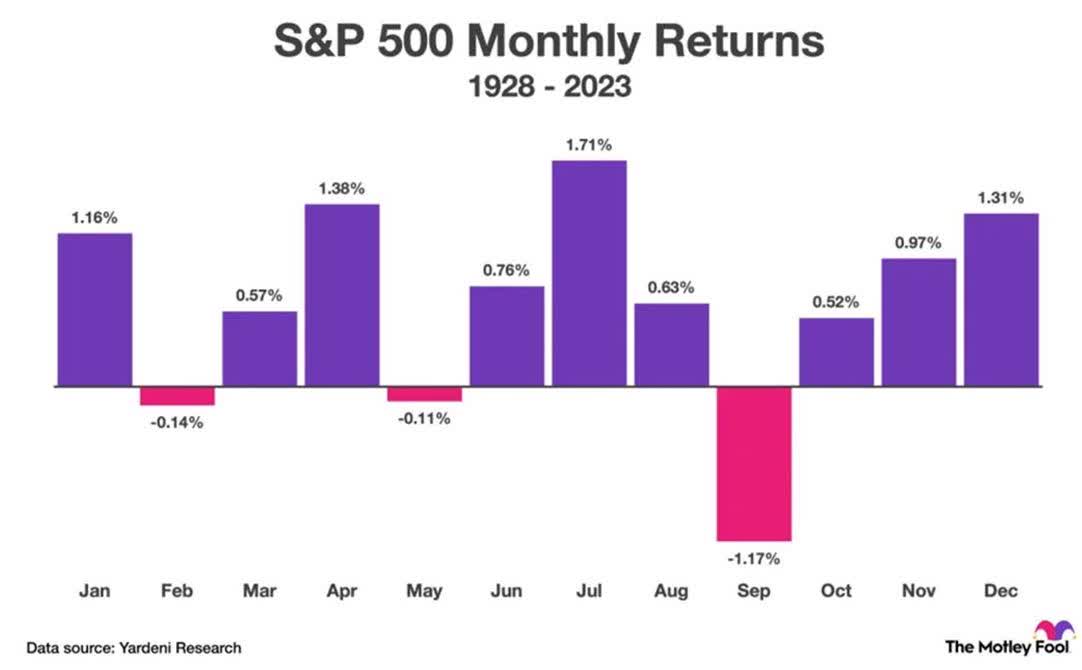

Over the last 95 years, September has been the worst month of the year, when it comes to seasonality, and the only month with average negative returns of over 1% (-1.17%, to be exact). This year, its seasonality record overlaps with another event that is quite powerful, and that is the presidential election year cycle.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

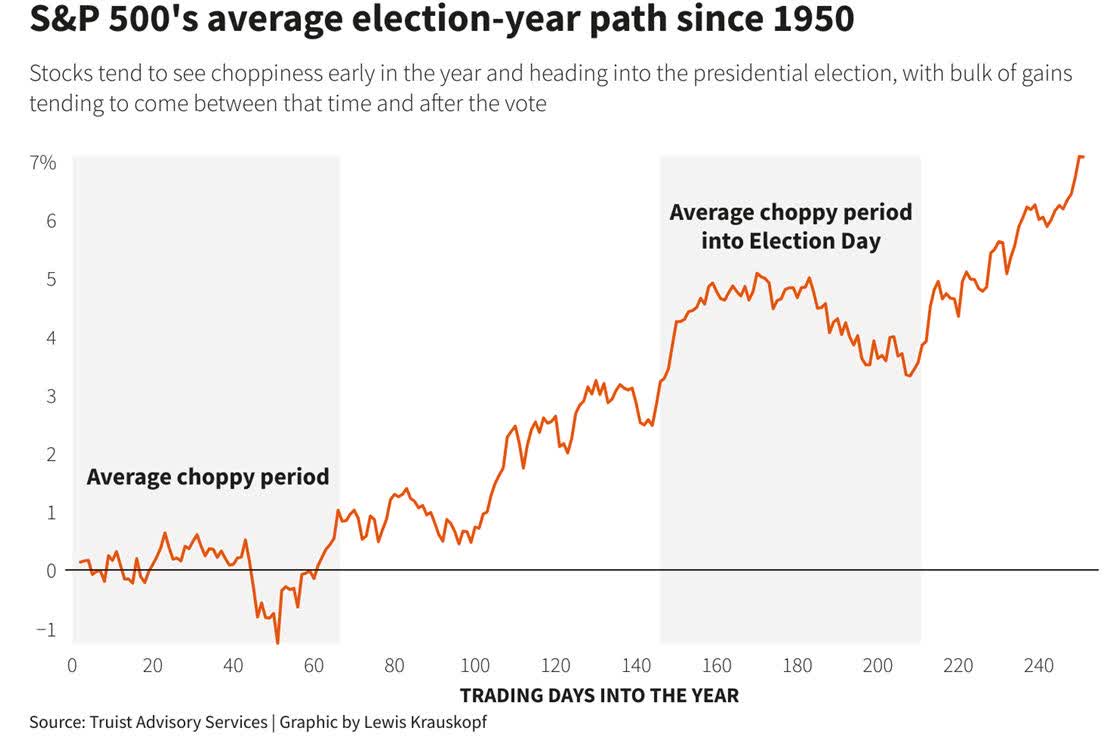

In presidential election years, the stock market tends to do very well. The theory is that the party in power tries to ensure that the economy is doing well so that the incumbent gets reelected – or their party’s candidate wins.

This year, the stock market has done well, with some jitters in April and quite a bit bigger jitters in late July and early August. But as we enter the last two months before the presidential election, the broad stock market, as measured by the S&P 500 Equal Weight Index, is at an all-time high.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

We do have the convergence of two cycles in September, namely the long-term average expected return on stocks, and the presidential cycle return, which suggests a choppy market in the two months before the election (shaded area, above right).

No one can guarantee that September will be down, other than to say that history is just a suggestion. We also have an expected interest rate cut by the Federal Reserve on September 18th, which most likely will be 25 basis points, unless we get a bad employment report, and spiking weekly jobless claims before the FOMC meeting, at which point we would most likely get 50 bps.

I think that the Federal Reserve is late in cutting interest rates, but Jerome Powell will be forgiven a lot of mistakes if he avoids a recession, which at this stage is still unknowable. Right now, it looks like a soft landing for the U.S. economy, but as far as I am concerned, the difference between a soft landing and a mild recession is becoming quite blurred.

The Bank of Japan May Rock the Markets Again

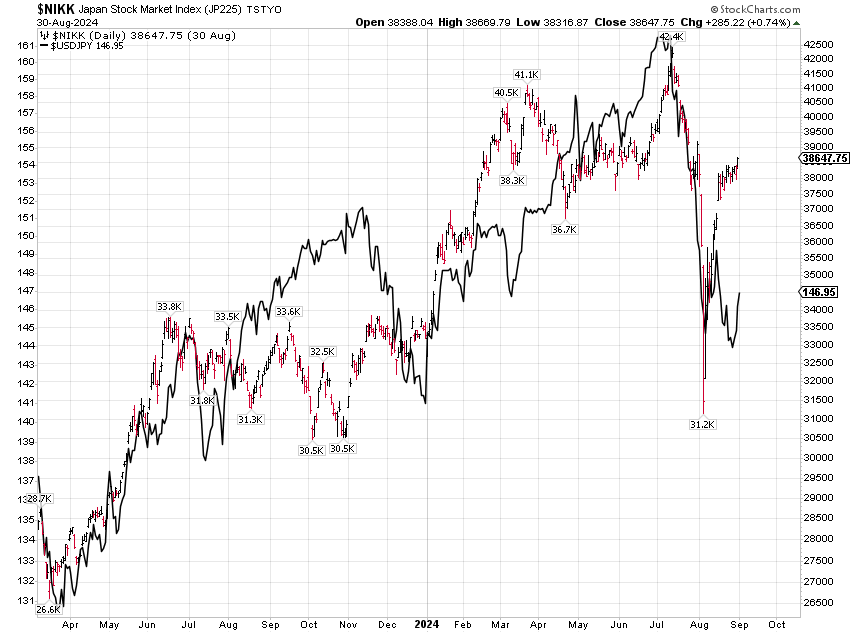

While the Nikkei 225 Index loves a weaker yen due to the nature of the index, filled with major Japanese exporters, it has not been a straightforward relationship over time.

Recently, the sharp strengthening in the yen pressures the index in extreme fashion, but we have had periods of time where a stronger yen has meant a stronger Nikkei and vice versa, when the moves in the yen had been less extreme.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The Nikkei has recovered three quarters of the losses it saw this summer, while the yen has not weakened all that much. It is possible that the BOJ will not raise rates in September, as was their original plan.

Then again, the big recovery in the Nikkei might persuade them to raise rates anyway, which could unleash another round of volatility if the yen makes further gains past the strongest level it saw over the summer.

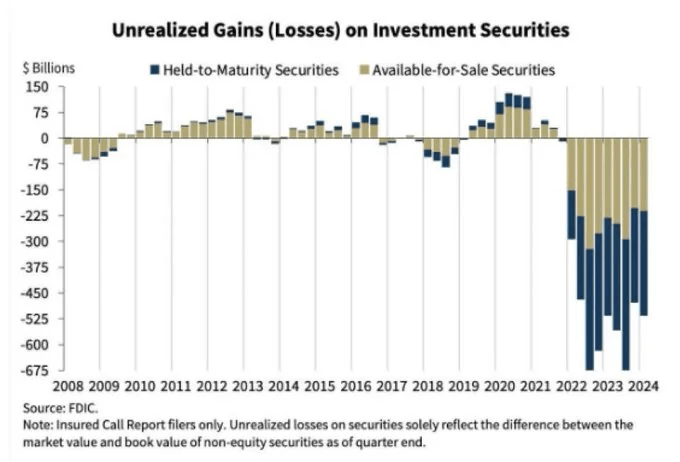

The problem with Japan is that it had a negative policy rate for a long time when bond yields were ultra low. No one can be sure how the Japanese financial system will handle slightly rising interest rates and the losses they will cause in the system.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

In the U.S., we have a rough idea of the unrealized losses in the held-to-maturity portfolios in the banking system, which is north of $600 billion (see chart, above).

As U.S. interest rates fall, those losses become somewhat smaller, but they are still sizable. Interest rates have not risen all that much yet in Japan and the BOJ is vowing to go really slow, precisely because they don’t know the size of the problem, which may ultimately turn out to be similar to what we have in the U.S. when interest rates rise more appreciably.

If the BOJ hikes in September, I expect more fireworks, similar to what we saw over the summer, although I hope they won’t be as large. It all depends on how violently the yen moves. If the Fed will be cutting rates as the BOJ is possibly hiking rates, it is not out of the realm of possibility that the yen will make a new high for the year. I sure hope the infamous yen carry trade is mostly unwound if that happens.

All content above represents the opinion of Ivan Martchev of Navellier & Associates, Inc.

Disclaimer: Please click here for important disclosures located in the “About” section of the Navellier & Associates profile that accompany this article.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.