serggn

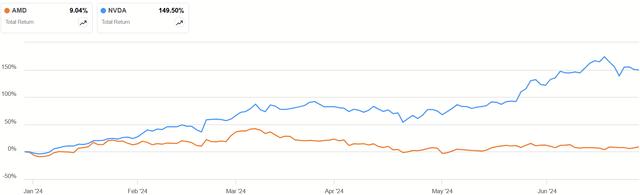

It’s been about a year since the craze of generative AI took off, triggering a spike in the share price of semiconductor companies, whose GPUs naturally feed into that market. The most prominent of the two have been Advanced Micro Devices, Inc. (NASDAQ:AMD) and NVIDIA Corporation (NVDA), the former being my focus today. While both stocks initially took off, the first half of 2024 hasn’t been as favorable to AMD.

AMD vs. NVDA 6M Total Returns (Seeking Alpha)

Of course, this doesn’t necessarily say anything about fundamentals. It could just reflect market sentiment. That said, the conventional wisdom seems to be that while Nvidia and AMD are both better chipmakers than Intel Corporation (INTC), Nvidia still beats AMD.

Yet, with a much flatter stock movement, it could even be the case that AMD is attractively priced for what has been a context of rapidly improving fundamentals for both companies. While I covered AMD before and was dismissive, I decided to look at what AMD brings to the table and evaluate it on its own merits, even if it’s just #2.

Previously, I considered that AMD was unrealistically valued and that the future of AI was too uncertain to pay that much of a premium. With more up-to-date information on business trends, however, we can see a clearer future for AMD’s role in it.

With the current cash flows, trends, and capital allocation, I don’t think the $160 is a great entry price, and I’ll explain why the stock is just a Hold for now.

Financials

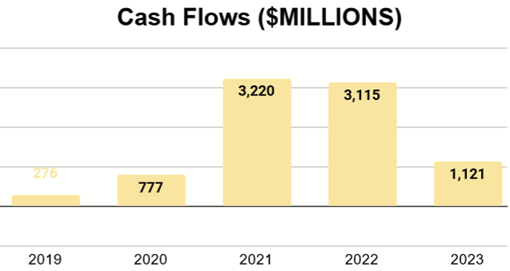

AMD’s free cash flow experienced significant growth over the last five years, with a dip in 2023 after 2022, showing signs of their industry’s cyclicality.

Author’s display of 10K data

This dip was largely driven by slightly less revenue and an uptick in R&D, which makes sense considering the AI opportunity that opened up that year.

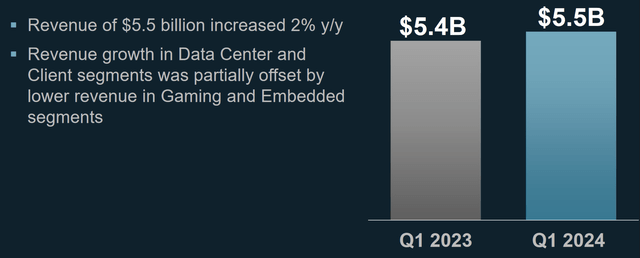

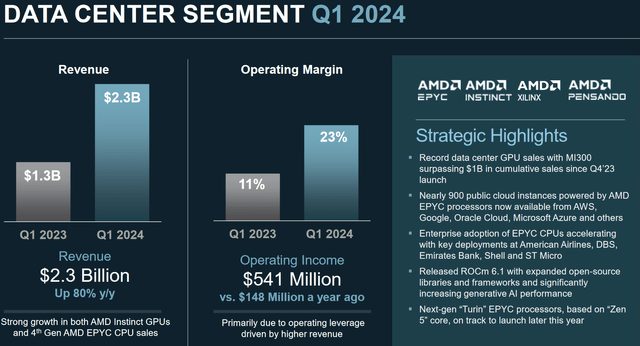

Q1 Results, meanwhile, showed that revenues are on the rise again. It was only a slight increase, but a substantial amount of this came from their Data Center Segment.

This is a $1 billion difference compared to a year prior. It’s also a segment that shows an improving margin.

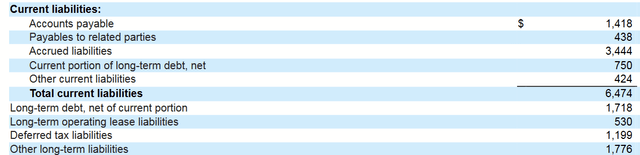

Liabilities (Q1 2024 Form 10Q)

The recent 10-Q shows very little debt, indicating a very lean and healthy balance sheet.

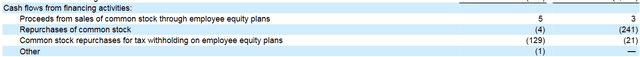

Cash Flow Statement (Q1 2024 Form 10Q)

Meanwhile, proper buybacks on the open market (not those related to stock-based compensation) fell to near-zero year-over-year, which I actually find to be a positive (I’ll elaborate later).

AMD’s Strong Suits

One interesting pattern that AMD has been touting recently is what preferences consumers are displaying in regard to their data center needs, as this is also where NVDA has seen significant growth.

CFO Jean Hu has been on a tour of multiple investor conferences in the past couple of months. In each of those, she has spoken about where AMD is showing strength. I’ll quote her (emphasis added) from the June 2024 NASDAQ Investor Conference about cost savings:

…when you look at the CIOs today, they are facing a lot of challenges. They are limited by power, by space. And also, they are trying to figure out how to adopt AI. So with all those things, the TCO will become really important, when you look at the AMD Solution, we actually can provide the same amount of compute with 40% less servers with our Gen 4 family. What that means is you can cut CapEx by half at the very beginning and the operation cost to operate those servers will be also 40% less, so when you look at the whole TCO, we do think that will help the refresh cycle, right?

At the June BofA Securities Conference, she also elaborated:

…we have been working with our customers, hyperscale enterprise customers for a multiyear roadmap. So, when you think about the kind of decisions they are making and the CapEx they’re spending, it got to be multiyear. You’ve got to plan out not only this generation but future generations.

In summary, throughout these conference calls, she argued that AMD has a role to play in cost reduction for the long term. This necessarily makes it a long-dated sales process, one that requires AMD to win over the CIOs of an organization for big commitments. It’s not a fast win, but it is a valuable one that will be long-dated too.

Much of this is owed to AMD’s products are being preferred for inferencing. As she put it:

People need to train the model first, then the inference is where they make money.

Moreover, she explained that generative AI isn’t just a GPU sale; CPUs have something to offer too:

When you look at the traditional foundational applications, your ERP system, your database and your shopping website, your Meta, Facebook, Instagram, and all those things, you don’t need the GPU. The CPU has the best TCO for that kind of foundational traditional applications.

These are important customers and uses that she is describing here, part of our mainstream idea of tech and how it’s practically used.

Even on the GPU front, AMD has won the confidence of Microsoft Corporation (MSFT), teaming up with them to provide a competitive cloud product.

It is for all of these reasons that I expect AMD will have some level of certainty about its growth going forward, as uncertain as the future around AI still is.

Share-Based Compensation and Buybacks

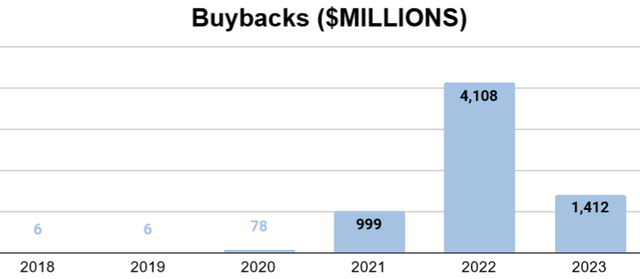

Another thing we need to consider is how the future looks for share-based compensation and buybacks. I mentioned earlier that I thought it was good the buybacks had declined, a problem I highlighted when I covered NVDA.

Long-term returns on individual shares, whatever is true of the whole company, are hurt when shares are repurchased at a premium. Similarly, they are value-additive when repurchased discounted. A common trend I’ve seen across tech stocks, whether they are tied to AI hype or not, are buybacks at high multiples and thus fairly low returns on capital.

As we can see, buybacks didn’t really take off until free cash flow did, so we only have a few years to use for our own “inferencing” about how AMD will allocate capital going forward. 2022 was a year when free cash flow was about as high as 2021, but the buybacks were far less.

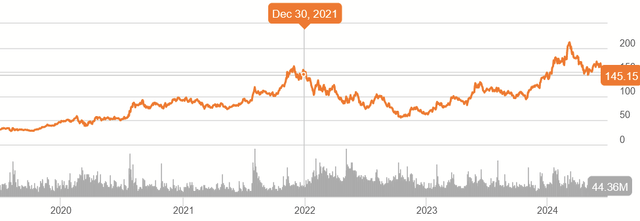

AMD 5Y Price History (Seeking Alpha)

As seen here, 2021 ended on something of a peak and then proceeded to decline through 2022, presenting great buying opportunities.

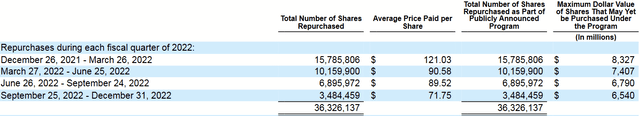

2022 Average Price Per Share (2022 Form 10K)

The repurchases were more concentrated in the upper end of that decline, with very little ultimately used for the lower price. All of these are lower than the current price, and the sharp reduction in buybacks in 2023 and especially in Q1 2024 seem to show that the company has developed a taste for a good price.

Still, we have to consider the effect of stock-based compensation, or SBC, which has increased every year for the past decade, with 2023’s levels rivaling the total free cash flow. Buybacks in this context effectively turn SBC into an operating expense that simply isn’t reported as such, but nevertheless is felt through the reality of the cash flows.

Semi Cycles

While some of these segments are growing, some of them are still exposed to the cyclicality that is common to the semiconductor industry.

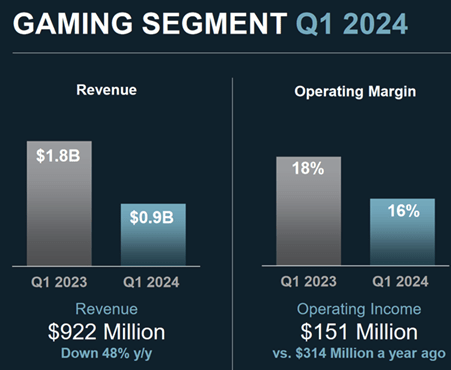

Q1 2024 Company Presentation

For example, gaming segment revenue declines were almost as much as the data center’s gains. In particular, gaming is influenced by the cycle of its new consoles, and things are at a bit of a lull, particularly as this is non-essential and doesn’t improve most business bottom or top lines like data centers can.

My point? Expect some noise in the signal of free cash flow growth, namely, as the other segments ebb and flow while the data center grows.

Valuation

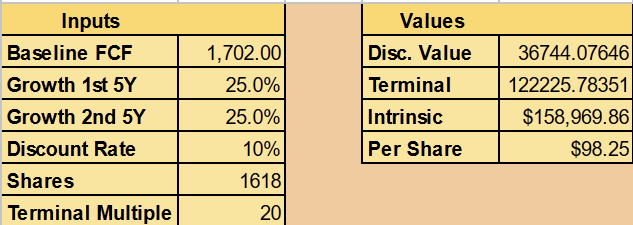

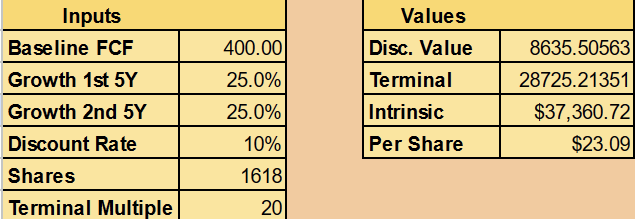

Based on this summary, I’m going to show two valuations, both using a Discounted Cash Flow, or DCF, model. I’ll make the following assumptions:

- $1,702M in annual free cash flow.

- CAGR of 25% for the next decade.

- Terminal multiple of 20.

My FCF figure is the average for 2019-2023, which I think captures the recent patterns with cycles. With the opportunity presented by AI, I think a very high growth rate like 25% is feasible, even as long as a decade. I give a terminal multiple of 20 just to allow for some potential decline as we reach the other side and as perhaps current levels of hype may not exist.

Author’s calculation

This suggests a fair value per share of about $98. This is priced at a 10% discount rate (typical return of a broad market index), so positive returns are still possible, maybe not as high as that of the market. Still, we need to consider the potential downside posed by the SBC and buybacks.

Author’s calculation

If we factor in the outflows from past buybacks that have coincided with SBC, that roughly brings current levels of FCF down to about $400M, suggesting a much lower intrinsic value.

Conclusion

With strong financial results and a recent campaign by CFO Jean Hu to clarify where AMD thrives, the company is poised to remain in the game and give Nvidia a run for their money. The main risks to long-term Advanced Micro Devices, Inc. investors aren’t on the operational side, but in the potential for free cash flow lost on stock-based compensation and buybacks. We should continue to observe what kind of appetite the company has for its own shares and if this regime of SBC will continue.

Even if that plays out favorably, the current price isn’t signaling a clear discount to that future. Considering how easily the market was able to sour on AMD in 2022, perhaps today’s prospective buyers would be better served by asking for a better entry price. For these reasons, I consider AMD to be a pretty solid Hold.