gustavofrazao

Manole Capital Management

6th Annual Gen Z Survey: Brokerages

August 2024

Introduction:

Manole Capital Management is a boutique asset management firm based in Tampa, Florida, that exclusively concentrates on the emerging FINTECH industry. Manole Capital defines FINTECH as “anything utilizing technology to improve an established process.”

Manole Capital has asked its interns to research the Gen-Z demographic for the last seven years. Manole Capital’s goal with this research is to better understand Gen-Z perspectives and knowledge of financial services. We inquire about current opinions, perspectives, and trends in four key financial services: digital currencies, brokerage, banking, and the payments industry. This prior research can be viewed by clicking here or visiting: www.manolecapital.com/research.

2024 Interns:

This year, our research was conducted by 12 interns, all from different colleges and universities across the United States. We want to thank Luis Jasso (California State University, Fullerton), Cameron McCann (Virginia Tech), Aleksander Jopek (New York University), Moda Kurma (Cornell University), Kerwin Xu (Cornell University), Shruti Pokharna (Cornell University), Cameron Keaton (University of Notre Dame), Sai Vetcha (University of North Carolina, Chapel Hill), Noah Akiona (Newman University), Anish Gundimeda (University of Southern California), Jigyasa Nabh (Northeastern University), Joshua Missaghi (Yeshiva University), and Arvin Anbarasu (University of Virginia).

Participants:

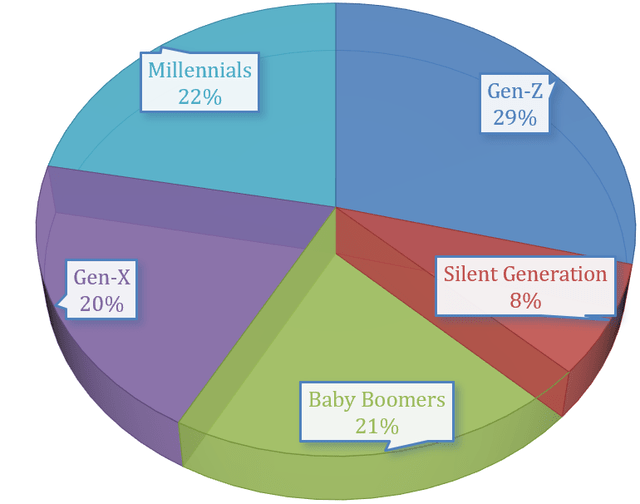

As part of our study, we surveyed and received insights from over 275 participants, with 94% in our targeted Gen-Z demographic. 24% of respondents identify as female and 76% identify as male. 80% of our responses were from the United States and 20% were international. We had strong participation from individuals in India and England. Our surveyed population came from over 85 different colleges and universities and included dozens of high school students. Thank you to all who participated.

Generations:

- Baby Boomers were born from 1946 to 1964

- Gen-X was born between 1965 and 1980

- Millennials were born between 1981 and 1996

- Gen-Z was born from 1997 to 2012

Having been brought up in a world that predates modern technology, Baby Boomers value personal relationships immensely and have strong interpersonal skills. Having lived through the dawn of the digital age, Baby Boomers were forced to learn new technologies quickly. Baby Boomers are often characterized as optimistic, idealistic, self-driven and have shown a tendency to be loyal. From a financial standpoint, studies show that Baby Boomers spend an average of 15 years with their bank or brokerage. After years of climbing the corporate ladder, many are currently exiting the workforce, enjoying retirement, and spending time with their family.

Gen-X is sometimes referred to as the “lost generation.” Many Gen-Xers had parents who worked around the clock, while others were raised by single or divorced parents. Because of this, Gen-X tends to place a greater emphasis on work-life balance. Often, Gen-X cohorts have more individualistic ideals and are often self-sufficient, skeptical, and resourceful.

Having been the first generation to master modern technology, Millennials are successful and driven. However, some have become too dependent on technology and thus, their interpersonal skills have suffered. As opposed to being raised by authoritative Baby Boomers, Millennials have been raised by Gen-X individuals, who tend to view parenthood as a partnership. Accordingly, Millennials were given more leeway and leniency, paving the way for some to display a degree of selfishness and greed.

Why Study Gen-Z?

Recent research from the United Nations and Jefferies indicates that there are over 2 billion Gen-Zer’s worldwide, representing over 30% of the global population. Asia has the largest concentration of Gen-Zer’s, being home to 58% of this demographic. Africa is 2nd at 23%, Latin America/Caribbean is 3rd at 9%, Europe is 4th at 6%, and North America being 5th at 4%. 90% of Gen-Zer’s are currently in emerging markets, with India being the single largest country with exposure. For perspective, the United States is the 6th largest Gen-Z population with 68.6 million.

In the last few decades, Baby Boomers have dominated the workforce in the US, but recently gave way to Millennials. This title will shortly switch from Millennials to Gen-Z; by 2025, Gen-Z should make up 27% of the workforce. In the US alone, Gen-Z’s 2023 income amounted to $360 billion, and by 2030, their global income is expected to reach $33 trillion, representing more than a quarter of the world’s total income. Gen-Z represents the future of our economy, and thus, we ought to give weightage and importance to their views.

In terms of wealth, this group is slated to inherit a significant amount of money from their Baby Boomer, Millennial, and Gen-X relatives. The transfer of wealth from Baby Boomers, Generation X, and Millennials to Gen-Z is projected to exceed $68 trillion over the next few decades. Understanding how Gen-Z views financial services should provide valuable insight into banking, brokerage, and spending trends that will impact various facets of our global economy. We hope this analysis provides a keen understanding of Gen-Z perspectives and behaviors.

Optimism?

We started our survey by asking, “Are you positive or negative about the US economy?”

We anticipated that Gen-Z would be generally optimistic about the US economy, and believed the responses would skew significantly positive (in the 75% to 80% range). However, our results did not reflect this type of encouraging outlook. While 60% of our respondents were positive on the US economy, there were 40% that skewed negative.

In the below sections, you will find each question that the Brokerage team asked of its respondents, as well as our opinions and big-picture takeaways from our survey results.

Question #1:

We started our survey with a very simple question. Do you have a brokerage account?

We have been doing these Gen-Z surveys for the last six years and the results are beginning to show some dramatic changes. Back in 2018, Manole Capital’s Gen-Z survey found that only 17% of Gen-Z had a brokerage account.

In this year’s survey, 56% reported having a brokerage account, 17% of respondents currently do not have a brokerage account but are interested in opening one and surprisingly, 27% of our respondents are NOT interested in opening a brokerage account right now.

Over the last six years, Gen-Z has clearly embraced investing – with account interest up by 3.5x! However, the results seem to be plateauing. For example, our 2021 survey found that 64% of Gen-Z had a brokerage account and another 23% were interested in opening one. Combining account owners and those interested, our results are modestly lower than three years ago.

In our opinion, we believe there are a few factors that could explain the decrease of Gen-Z brokerage accounts versus a few years ago. For some, it might not be a lack of interest, but a lack of resources and capital. Skyrocketing college tuition costs and persistently high inflation pressures could be responsible for the lack of brokerage account growth. Another potential reason why people may be less inclined to open a brokerage account is that they are afraid to take risks. Plus, some might prefer keeping their money at their bank, where cash is now earning a healthy return of 4% to 5%. Our takeaway is more “glass half full”, and we believe that Gen-Z is interested in the stock market and continues to open up brokerage accounts (17% in 2018 versus 56% in 2024). Over the next few questions, we will try to uncover where Gen-Z is investing, what they are investing in and what they want to get from their brokerage firm.

Question #2:

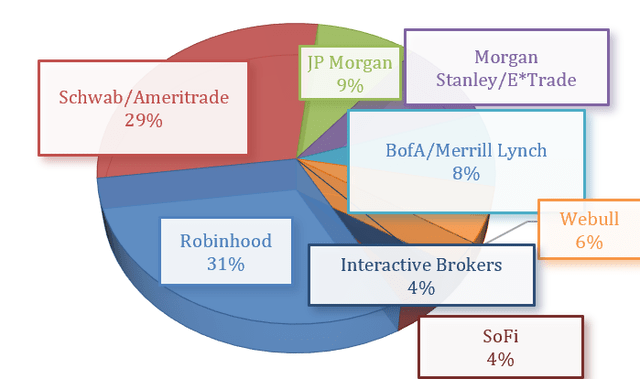

In this question, we sought to pinpoint where Gen-Z had their brokerage accounts. The results were interesting…

Our survey work is depicted in this pie chart below, which shows that Robinhood is in 1st place, with 31% market share of Gen-Z. In 2nd place and relinquishing its title is Charles Schwab/TD Ameritrade, which now sits at 29%.

A distant 3rd, 4th, and 5th place were JPMorgan Chase, Morgan Stanley/E*TRADE, and Bank of America’s Merrill Lynch. The rest of the pack were Webull, SoFi, and Interactive Brokers, which combined for just 14%.

This year, it is clear that Robinhood has made the largest jump forward, while Schwab had the largest decline. Back in 2022, the last time this Gen-Z brokerage survey was conducted, Schwab dominated, with 38% (down 9% in ’24) of respondents reporting them as their preferred brokerage platform. Robinhood was in 2nd place, with 28% (up 3% in ‘24), Bank of America’s Merrill Lynch placed 3rd at 14%, followed closely by Morgan Stanley/E*TRADE at 11%. So, Robinhood is gaining market share, while more established players like Schwab, Merrill Lynch and Morgan Stanley/E*TRADE are all declining.

In Robinhood’s May 2024 Monthly Metrics Press Release, it stated that investment accounts grew by 120,000 and are now at 24.1 million. While this is healthy growth in new accounts, the average account at Robinhood is only $4,000. In comparison to Schwab, new accounts grew by 314,000, with the total accounts being 35.5 million and the average account is $234,000, Gen-Z simply does not have the amount of money that seems to be at the more traditional and larger brokerage firms.

Based on our results from this question, we can analyze why Robinhood is currently the most popular brokerage for Gen-Z. Interestingly, Robinhood has stated that they have “picked up new customers since the last group of TD Ameritrade users moved to Charles Schwab”.

According to a May 2024 article in MarketWatch (attached here), some Schwab customers are unhappy with its mobile application and user interface. As our next question discusses, ease of use is an important factor for Gen-Z when selecting their preferred brokerage platform. We believe that Gen-Z clearly favors Robinhood for its easy-to-use mobile interface.

Question #3:

Our next question attempts to understand what is influencing Gen-Z to select their preferred brokerage firm. We asked, “What factors influenced your brokerage choice?”

The most important factors this year were:

- ease of use

- no fees/commissions

- recommendations from others

The survey in 2022 asked the question in a somewhat different way. They asked what the most important factor was when choosing a brokerage, not all factors that influenced their choice. The data from 2022 shows that although 43% of people chose “free trading” as the most important quality, only 1% of respondents chose “ease of use” as the most important quality. With most brokerages now offering free trading, it has become a less crucial factor for Gen-Z. In turn, ease of use has become the most important characteristic for Gen-Z when choosing a brokerage. With brokerages today constantly updating their intuitive mobile apps, it will be interesting to see what factors will influence these choices in the future.

Another crucial quality that Gen-Z is looking for in a brokerage platform is how recommended it is by their peers. This year, we asked respondents if “recommendation from others” influenced them to choose a brokerage, and nearly 21% responded in the affirmative. With Gen-Z being the youngest cohort that can invest, it is intuitive that they will be picking a brokerage platform that many people say is the best, with factors of how easy the app is to use and if trading is free. Therefore, it makes sense that they will be more likely to open a brokerage account with a firm that has a good reputation and/or recommended by their parents, older siblings or friends. The members of Gen-Z who do not find recommendations from others important may be in the older portion of the cohort who are already established and experienced investors.

Two traits that do not seem to be important to Gen-Z are banking and robo-advisor services. It is notable that as we move into a generation where more and more services are accessible from one firm, banking services are still not an important feature within a brokerage app. Another 2024 intern team is focused on the trends experienced by Gen-Z in the banking industry. Please look at their note to better understand what Gen-Z looks for in banking products. In early July 2024, Robinhood acquired Pluto Capital, which will offer investment research powered by artificial intelligence to Robinhood users. With advancements in AI and machine learning, it will be interesting to see if Gen-Z gravitates more or less towards brokerages with these financial advisory and robo-advisor capabilities.

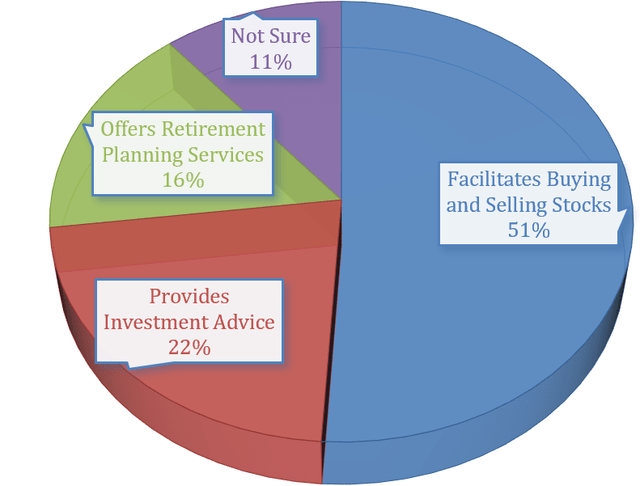

Question #4:

Just over half of our respondents believe that a brokerage facilitates buying and selling stocks. It is important to note that brokerages facilitate the trading of stocks, offer IRA/margin accounts, but offer much, much more.

In a traditional system, you can think of a broker as a middleman who ensures that transactions run smoothly. Some brokerages, like Charles Schwab and Morgan Stanley, provide investment advice (for a fee). Decades ago, financial advisors were called stockbrokers, earning their living from trading commissions and fees. Now, the industry is mostly commission-free, generating fees for advisors based off a percentage of assets under management. It is important to understand that brokerages can specialize in so much more than just trading stocks. For example, firms can offer wrap accounts, provide investment advice, actively manage a security portfolio, etc.

When it comes to advice, 22% of our Gen-Z survey respondents believe that this is what their brokerage should be providing. 16% of people answered that brokers offer retirement planning services. We were surprised that this was as high as it was, as most Gen-Z individuals aren’t thinking too much about their retirement right now. As Gen-Z begins their careers, we are beginning to learn more about 401(k)s, IRAs, Roth IRAs, and other retirement accounts. These are great vehicles to help us prepare for retirement, so we are pleased this was mentioned in our survey.

The S&P is near an all-time high, and more people are investing than ever before. Gen-Z needs to continue to learn and gain an understanding of the importance of bonds, options, and stocks.

Question #5:

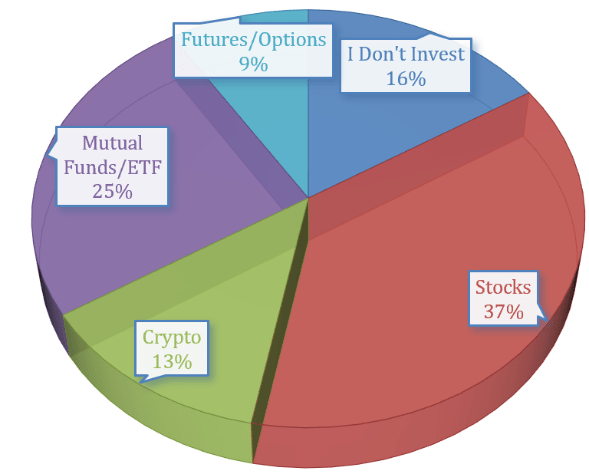

This question aims to answer what type of investments Gen-Z is making.

Manole Capital chart

Based on the survey results, 37% invest in stocks, 13% invest in crypto, 25% invest in mutual funds/ETFs, 9% invest in futures/options, and 16% don’t invest at all.

We gave the option for respondents to select multiple investments, and it provided some helpful insights. Building a diversified portfolio is important, and 16% of our participants invested in 3 or more of the 4 options and 25% invested in 2 out of the 4 options. Also, 25% of our respondents prefer to invest in funds or ETFs, which provide increased diversification benefits. Only 4 individuals are investing in crypto and only digital currencies.

We were surprised by some of these results, especially the 9% in futures and options. Derivatives are some of the most complicated investments, but Gen-Z seems to be putting their money into futures and options. On Robinhood’s recent conference call, it highlighted continued growth in derivative trading. Only time will tell if Gen-Z is successfully able to navigate the challenging futures and options trading market.

We asked this question two years ago, and we found a noticeable change. Back in 2022, combining mutual funds, ETFs and stocks equated to 44%, so there is clearly more interest in investing in the market.

Question #6:

With this new question, we wanted to better understand the personal reasons why Gen-Z invests. Understanding the reasons why Gen-Z invests can help brokerages in marketing and growing accounts.

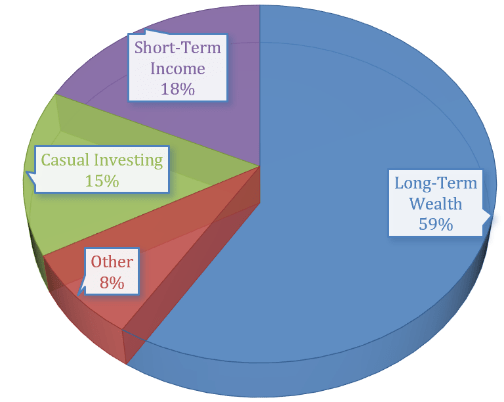

Manole Capital chart

As shown in our pie chart below, 59% of Gen-Z is interested in generating long-term wealth and another 18% is looking for short-term gains. That’s over 3/4th of our survey, investing for personal gains.

While many view stock trading as a short-term venture, we were pleasantly surprised to see so many Gen-Z individuals understand that investing is a long-term process.

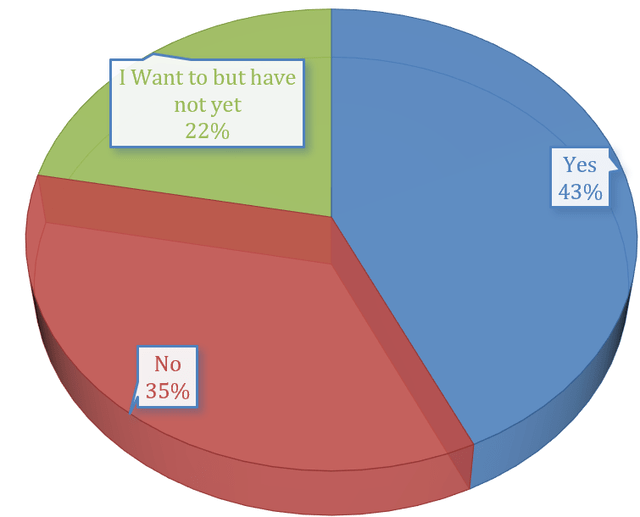

Question #7:

With the S&P 500 at an all-time high, we were curious if Gen-Z was fully embracing the “Mag 7”. With 63% of our Gen-Z participants investing in stocks, we wanted to see if Gen-Z portfolios were heavily filled with “Mag 7” stocks like the S&P 500.

In 2017, some of the top stocks in the S&P 500 were called FAANG stocks, comprising owning Facebook, Apple, Amazon, Netflix, and Google. Now, Microsoft, Nvidia and Tesla joined the party, and that Michael Hartnett named it the “Mag 7”.

Today, the “Mag 7” composes roughly 30% of the S&P 500 and has played a massive role in bringing the index to its near record high.

We can see that 43% of our Gen-Z participants are already investing in these stocks, and another 22% want to. With 64% of Gen-Z invested or about to invest in “Mag 7” stocks, it indicates a fair amount of concentration.

With additional media coverage and the impressive growth prospects these companies are posting, we would be surprised if this percentage doesn’t materially increase from these levels. The market is infatuated with AI right now, and Gen-Z (and all investors) feels that investing in the “Mag 7” provides access to this critical growth segment.

Question #8:

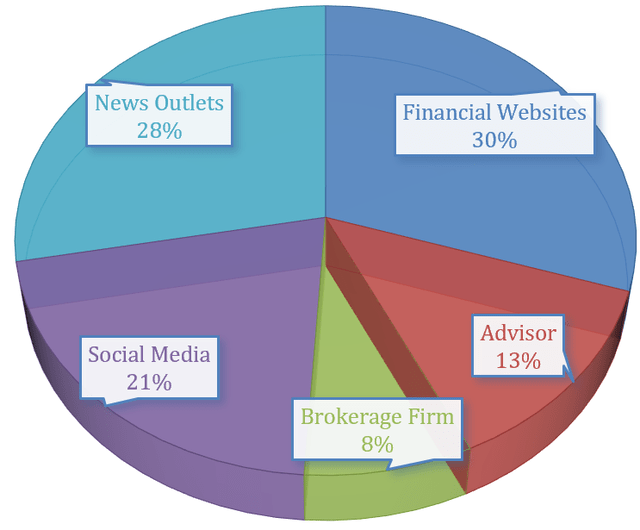

Our next question involves where Gen-Z is getting their financial information.

Our survey found that Gen-Z is getting its financial information from various sources. The two leading platforms were financial websites at 30%, followed closely by news outlets at 28%.

Financial websites are a logical information source, as they provide comprehensive and specialized content. Established news outlets like the Wall Street Journal and The New York Times were a close 2nd, indicating a strong trust in traditional media for accurate and reliable financial news. These sources are valued for their in-depth analysis and journalistic integrity, which help readers make informed financial decisions.

As we wrote this question, we assumed that social media would be the primary information source. Interestingly, social media came in 3rd place with 21%. While we might spend a considerable amount of time on platforms like Instagram, YouTube, TikTok, X (formerly Twitter), and Reddit, it apparently isn’t the best place for us to get our financial information.

However, we don’t want to discount the importance of social media too much. Social media continues to trend higher, and it remains a growing influence on Gen-Z. Social media is easily accessibile, has diverse viewpoints, and can provide real-time updates that we value.

Unlike our parents, who often rely on financial advisors, only 13% of Gen-Z is speaking with an advisor for financial information. We imagine this might change (as we age), but it shows that this channel isn’t that important for us right now. At the low end of valuable sources of financial information, at only 8%, were brokerage firms. Logging into a website and downloading a research report requires effort, patience and time. Gen-Z simply prefers a more dynamic platform for its financial information. We crave the convenience and immediacy of digital media, with the reliability and expertise of traditional and professional sources.

Question #9:

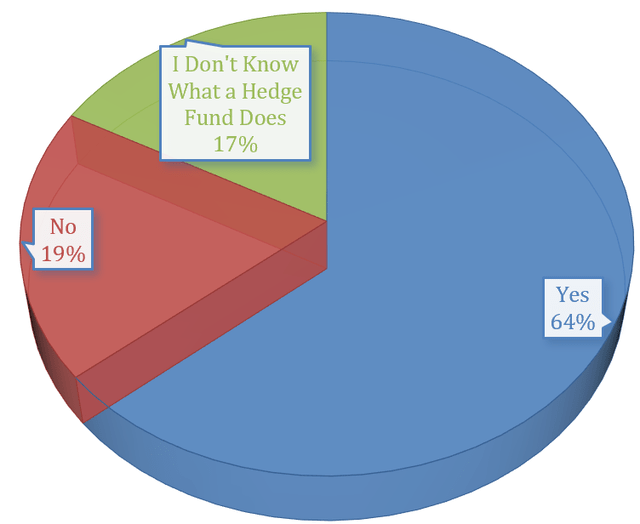

This year’s summer interns wanted to ask a bunch of different questions. For example, we were curious if Gen-Z was familiar with hedge funds.

While most of Gen-Z is knowledgeable about mutual funds, hedge funds are a slightly different vehicle – providing short exposure. There are dozens of types and versions of hedge funds (i.e., arbitrage, short-term traders, quantitative, algorithmic, fundamental, momentum, relative value, event driven, etc.) across thousands of different firms and funds.

64% of our survey respondents answered yes, which surprised us. The media often discusses hedge funds, and movies have glamorized their business and wealth generation. Movies like Wall Street and TV shows like Billions have improved the familiarity we have with hedge funds.

We combined “no” and “I don’t know what a hedge fund does” into the 36% group that aren’t familiar with hedge funds. Since hedge funds are only for accredited and qualified investors (i.e., high net worth individuals), it is probably better for us to focus on long-term investing and lower fees associated with index funds.

Question #10:

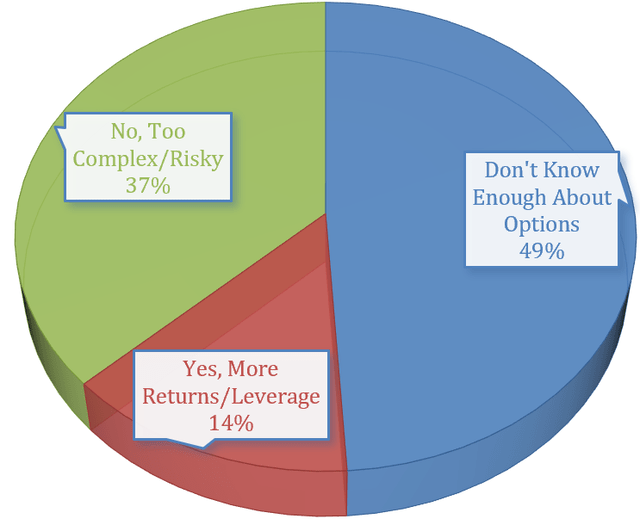

Our last question involved options. We asked Gen-Z if they trade options.

We didn’t expect that many Gen-Z individuals would be options traders, and we were right. Nearly half (at 49%) answered that they “Don’t know enough about options trading”. We were pleased to see that Gen-Z doesn’t trade options – without enough insight, knowledge and know how to succeed.

37% of our participants answered that they didn’t trade options because the asset class was either too risky or too complex. Many knowledgeable investors utilize options to decrease volatility and risk, but that typically comes from years and years of experience.

14% of our respondents answered “Yes” and highlighted better returns and the desire to utilize the natural leverage inherent in options. This indicates that a small percentage of respondents are knowledgeable about the benefits of options and how they can be used to hedge existing positions.

The takeaway here is that 86% of Gen-Z isn’t ready yet for options. This isn’t surprising and should be entirely logical for Gen-Z. Over the next decade, we envision that Gen-Z will begin to dabble into the options market. Financial institutions and educators are constantly providing more information and demystifying the perceived complexity of options trading. As we become more educated on options, it will likely become more investible and approachable.

Conclusion:

With this year’s Gen-Z brokerage survey, we can make a few generalizations and identify some trends.

- Over half of Gen-Z has a brokerage account

- Robinhood has surpassed Schwab as the leading brokerage firm

- The factors driving this market shift are eases of use + recos from others

- Robinhood is succeeding because of its intuitive, mobile-based platform

- Stocks remain the most important asset class for Gen-Z

- 43% of Gen-Z is invested in “Mag 7” stocks

- Another 22% is likely to invest soon

- 64% of Gen-Z knows about hedge funds

- Lastly, only 14% of Gen-Z is currently trading options

- Mainly due to limited knowledge

Wayne Gretzky said that “you miss 100% of the shots you don’t take.” While investing in stocks (and options) can be risky, you can’t double, triple or quadruple your capital in a money market. In order to increase your net worth, Gen-Z understands that it comes with some level of risk.

Thank you for your interest in our brokerage Gen-Z research note. Please let us know if you agree or disagree with any of our broader takeaways. We hope you have a wonderful summer, and thanks for reading our research.

The Manole Capital 2024 Summer Intern Team

DISCLAIMER:

Firm: Manole Capital Management LLC is a registered investment adviser. The firm is defined to include all accounts managed by Manole Capital Management LLC. In general: This disclaimer applies to this document and the verbal or written comments of any person representing it. The information presented is available for client or potential client use only. This summary, which has been furnished on a confidential basis to the recipient, does not constitute an offer of any securities or investment advisory services, which may be made only by means of a private placement memorandum or similar materials which contain a description of material terms and risks. This summary is intended exclusively for the use of the person it has been delivered to by Warren Fisher, and it is not to be reproduced or redistributed to any other person without the prior consent of Warren Fisher. Past Performance: Past performance generally is not, and should not be construed as, an indication of future results. The information provided should not be relied upon as the basis for making any investment decisions or for selecting The Firm. Past portfolio characteristics are not necessarily indicative of future portfolio characteristics and can be changed. Past strategy allocations are not necessarily indicative of future allocations. Strategy allocations are based on the capital used for the strategy mentioned. This document may contain forward-looking statements and projections that are based on current beliefs and assumptions and on information currently available. Risk of Loss: An investment involves a high degree of risk, including the possibility of a total loss thereof. Any investment or strategy managed by The Firm is speculative in nature, and there can be no assurance that the investment objective(s) will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. Distribution: Manole Capital expressly prohibits any reproduction, in hard copy, electronic or any other form, or any re-distribution of this presentation to any third party without the prior written consent of Manole. This presentation is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use is contrary to local law or regulation. Additional information: Prospective investors are urged to carefully read the applicable memorandums in their entirety. All information is believed to be reasonable, but involves risks, uncertainties and assumptions and prospective investors may not put undue reliance on any of these statements. Information provided herein is presented as of the date in the header (unless otherwise noted) and is derived from sources Warren Fisher considers reliable, but it cannot guarantee its complete accuracy. Any information may be changed or updated without notice to the recipient. Tax, legal or accounting advice: This presentation is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any statements of the US federal tax consequences contained in this presentation were not intended to be used and cannot be used to avoid penalties under the US Internal Revenue Code or to promote, market or recommend to another party any tax related matters addressed herein.