Melpomenem/iStock via Getty Images

Investment summary

My recommendation for Weave Communications (NYSE:WEAV) is a buy rating. WEAV is a leader in the space it is competing in, and I expect it to continue winning market share given the strong value proposition that its platform offers to small businesses. Since it can sustain 20% growth even in the current tough macro environment, I believe it can sustain 20% growth in the coming years.

Business Overview

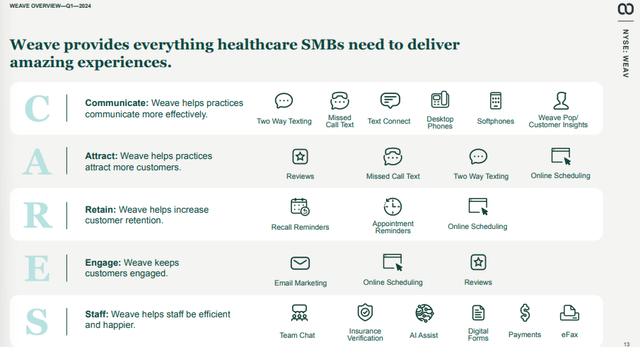

WEAV provides a customer engagement platform for small businesses such as dental offices, optometry, veterinary, home services, and others. The WEAV platform combines four key functions—unified communications as a service, communications platform as a service, marketing, and payment processing—into one product.

Making the lives of small businesses a lot easier

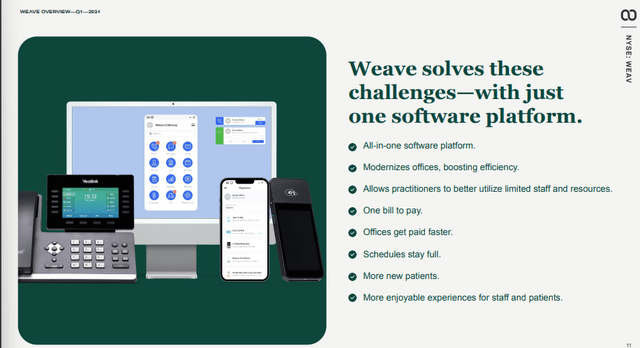

Small businesses generally have neither the right set of IT expertise nor enough spare resources to invest in the best digital solutions. Even if they do, it is typically done by stringing together multiple-point solutions that do not work well together. As such, this results in poor efficiency: employees need to learn multiple platforms; work with multiple platforms for one workflow as they do not integrate well together; etc. Ultimately, this leads to poor customer satisfaction. A good example is when you dial in to a neighborhood dentist to make an appointment but are put on hold for 15 minutes. (I would hang up and call another dentist if I had to wait this long.) This is why WEAV is a game changer for these businesses. WEAV’s offering is essentially an all-in-one platform for practice management (answering phones, scheduling appointments, text reminders), and they also include other value-added services such as payment processing.

Unlike using multiple-point solutions, using WEAV is much more productive and efficient. With WEAV, when a patient of record calls, the front desk can immediately see key details such as name, upcoming appointment dates, balance owed, etc. This already makes life easier for the staff, as they do not need to search through the Excel database or flip through physical folders to search for the patient’s file. Linking back to my dental appointment above, staff can leverage WEAV capabilities to find the next best appointment slot. By using just one platform to facilitate this entire process (including payments, which I will discuss more below), the business becomes much more productive. In some instances, I can also imagine these small businesses downsizing their customer-facing team, which saves cost.

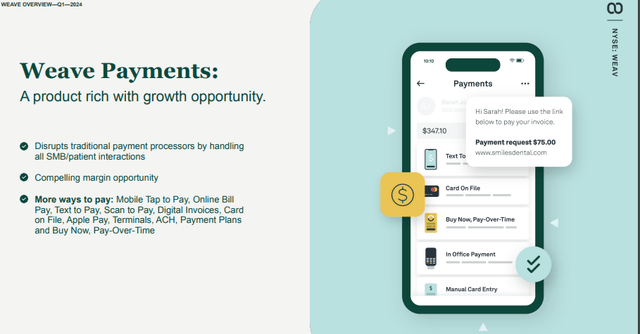

I am positive about the WEAV payment solution given that it will make the lives of small businesses a lot easier and will also improve WEAV retention rate. Cash flow management is a very important aspect for small businesses, as they typically do not have a very strong balance sheet. The traditional method is to note down how much the customer owes and constantly call to remind customers to pay up the next time they come. This is extremely inefficient from an operational standpoint, which leads to poor cash collection.

With a digital payment processor, small businesses can better track balances owed and send notifications to consumers with a few clicks. From the customer point of view, the payment journey has a lot less friction as well, given that it is also a lot easier to just pay via phone (through digital wallets or credit cards) than to head down to the clinic to pay. The end result is less work needed to track payments and faster cash collection.

Given that WEAV is already the main platform that its customers are using to deal with its patients, I believe it is best positioned to offer payment processing services since it integrates seamlessly with the core product (this ensures no hiccups in receiving payments). So far, this is still a small part of the business, at less than 10% of revenue as per 4Q23. However, I expect this to grow at a rapid rate moving forward, as the value proposition is just too strong compared to legacy methods. This aside, it also improves the client retention rate for WEAV as it becomes more integrated into the workflow process of its customers. Let me remind readers that these are small businesses, so once they get used to a product that works well, it is very unlikely that they will spend the effort to rip and replace everything, especially when it impacts their ability to get paid. WEAV net retention rate over the past few years (>90%) really shows how integrated it is, as small businesses typically have higher churn (business fails and closes down) than large corporations.

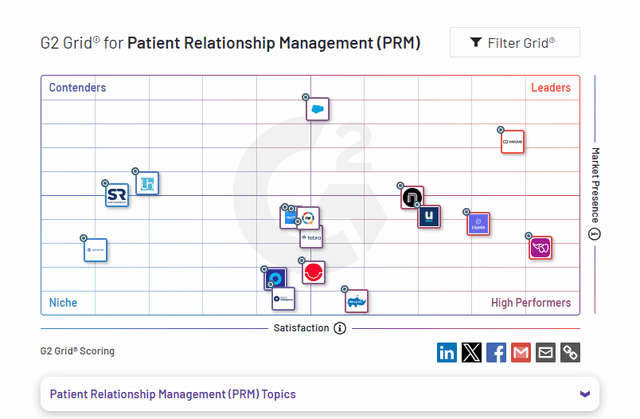

When it comes to competition, WEAV is the leader in the market for its target customer base. The main competition is really all-point solutions that do not integrate well together. I expect WEAV to continue winning share in this market as its solution is built to target small customers.

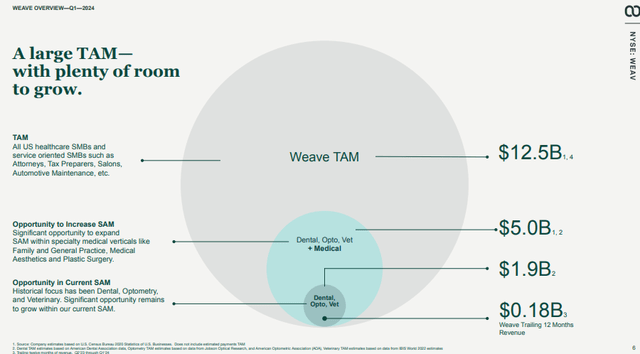

$12.5 billion addressable market

Although the revenue and profits that WEAV can make from each small business are not a lot (given the size of the customers), the TAM is extremely huge because these businesses make up a large portion of the economy. As of 1Q24, based on WEAV’s last 12 months, it has around $180 million in revenue, which is just a small fraction of the addressable market.

The question is, has WEAV been able to execute and grow in this large market? The answer is yes, as WEAV has managed to: (1) grow its number of locations from 13 thousand in FY19 to 31 thousand in FY23; (2) drive strong revenue growth from $45 million in FY20 to ~$180 million on a last 12-month basis, with 1Q24 growth of 19% in line with 1Q23 (showing that it is not heavily impacted by the weak macro economy).

Valuation

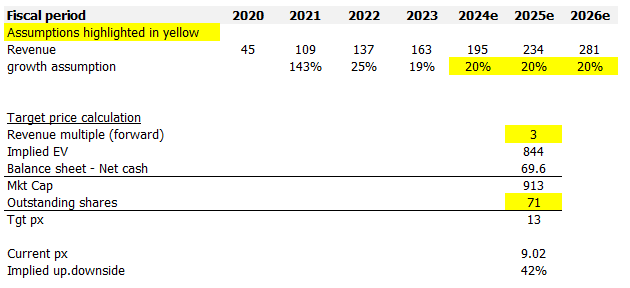

Redfox Capital Ideas

I model WEAV using a forward revenue approach, and using my assumptions, I believe WEAV is worth $13. WEAV’s growth over the past few quarters has basically established a baseline growth rate for the coming years. My view is that even with the worst macro environment in recent history, which should have hurt WEAV greatly given its focus on small businesses, it has continued to grow at 20%. Now that rates are likely to come down, which eases the pressure on small businesses, growth should be minimally sustained at 20%. This should support its current revenue multiple of 3x.

Risks

WEAV solutions may not work as well outside of their current focus market. This could limit the growth runway. In addition, further rate hikes over an extended period of time will certainly put more strain on small businesses, and WEAV will be hurt eventually. WEAV is not profitable as of today, which I think is understandable given the focus on growth. However, if WEAV does not show further signs of margin improvement as it grows, it could put pressure on valuations.

Conclusion

My view for WEAV is a buy rating. WEAV is a market leader in this space, where its all-in-one platform significantly enhances operational efficiency, boosts customer satisfaction, and improves cash flow management for users. Execution has been great, as can be seen from the strong revenue growth and expanding customer base. I am expecting the business to sustain 20% growth in the coming years, and with that, it should support the current 3x forward revenue multiple, leading to a share price target of $13.