herstockart/iStock via Getty Images

The market may be undergoing a change in leadership, or perhaps it that will not happen. In either case, the Vanguard Total Stock Market ETF (NYSEARCA:VTI) should remain a core holding in long-term equity portfolios. VTI’s broad exposure to all market sectors and company sizes, as well as its highly competitive management fee combines to make it a keeper that can be accumulated through dollar cost averaging, as well as during periods of market weakness or uncertainty.

VTI is the exchange-traded fund (“ETF”) version of the largest equity mutual fund in terms of assets under management, the Vanguard Total Stock Market Index Fund Admiral Shares Inst (VTSAX). VTI is also the fourth-largest equity ETF. The fund tracks the performance of the CRSP U.S. Total Market Index that essentially represents all public companies traded on both the New York Stock Exchange and the Nasdaq Stock Market. VTI is composed of over 3,600 companies.

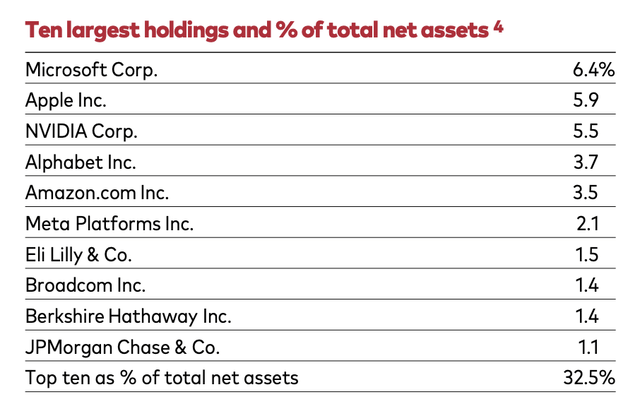

Despite VTI’s significant number of holdings, it is market weighted and about 80% of VTI’s weighting is within the S&P 500, and the top ten holdings make up about one-third of the ETF. Similarly, VTI’s to holdings are usually the same as the S&P 500, due to both being market weighted. Sometimes a company can make it into VTI’s top holdings without being a member of the S&P 500, such as in 2020 when Tesla (TSLA) reached the top holdings of VTI before being added to the S&P 500.

VTI’s top 10 holdings (VTI fact sheet [Vanguard website])

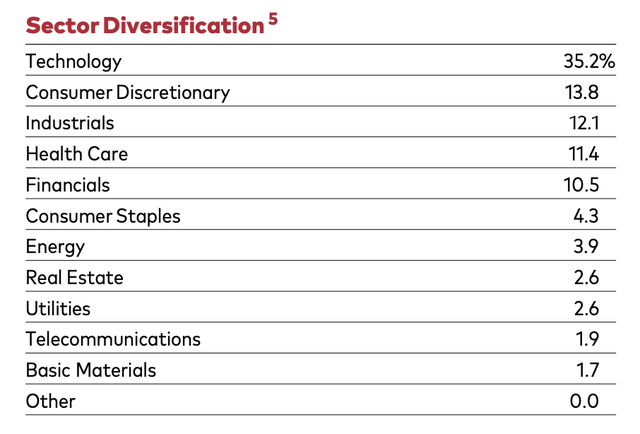

While VTI may suffer from the same excessive concentration risks that the broader market presents, VTI’s risk profile remains in proportion to the market itself, and not a manager’s preference. VTI is currently heavily concentrated in the technology sector, which makes up over 35% of the fund. Several other sectors make up over ten percent each, including Consumer Discretionary (13.8%), Industrials (12.1%), Health Care (11.4%), and (Financials 10.5%).

VTI’s sector weighting (VTI fact sheet [Vanguard website])

By including access to all sectors, VTI provides the potential to include whatever sector or industry might benefit from a shift in momentum. Of course, that also means VTI must include those equities whose momentum is diminishing. To that end, VTI is essentially guaranteed to not beat the market, but rather to be the market. As a result, VTI allocators are not seeking market outperformance, but instead to make sure they have exposure to the market’s actual performance.

VTI allocation is primarily premised upon the presumption that equities as an asset class are likely to appreciate over time, and that a fund like VTI will closely track that appreciation. As a result, VTI is almost always not the best performer, but it is similarly almost certain to not be the worst. Further, over broad periods of time, VTI’s market performance tends to generate higher returns for its long-term investors.

Some of VTI’s historical long-term outperformance is due to it rarely being the case that active management can maintain a streak of above-average returns, and few can maintain an average return that beats the market over a decade or several decades. Further, VTI’s fees tend to be considerably lower than competing funds, and especially active management, and those lower fees also contribute to significant differences over the long-term. VTI’s expense ratio is 0.03 percent.

Current market conditions include heightened expectations that a rate cut cycle may soon begin. This includes the incredibly strong indicator that in mid-August, Jerome Powell, Chair of the Federal Reserve, gave a speech where he indicated that the time has come to begin cutting interest rates, largely due to lower levels of inflation and higher rates of unemployment.

A series of rate cuts has the potential to benefit many of the smaller companies that are more leveraged and which lack large cash positions on their balance sheets. If this premise turns out to be the case, having some exposure to small and mid-sized equities would likely be beneficial. VTI provides some reasonable exposure to those companies, while primarily maintaining more sizable positions in the existing market leaders.

Unlike many ETFs and companies that could be good picks for the short term, VTI is one to accumulate over the years. I would be hesitant to acquire a sizable stake at current market valuations, given we are near market highs and there is the potential for increased volatility due to factors including, the rate cut cycle, a U.S. presidential election, and the potential for increased geopolitical conflict. Nonetheless, I consider VTI a sensible ETF for adding exposure to any market weakness that may occur in the coming months.

Conclusion

VTI is among the most reasonable funds for accumulating diversified equity exposure within a single ETF. VTI’s all-weather construction, including an extremely low management fee, makes it a sensible long-term holding. VTI and the broader market may undergo a period of enhanced volatility over the next several months due to the uncertainty around the election, as well as the Federal Reserve getting active on initiating a rate cut cycle. Any such weakness brought about by this uncertainty is likely to be a buying opportunity. Similarly, these factors could create a change in market leadership, as well as the performance of small and mid-cap equities, with VTI providing reasonable exposure to these asset classes for a below-average cost of management.