Thomas Barwick

Investment overview

I give a buy rating for Viking Holdings (NYSE:VIK) as the Q2 2024 performance and forward booking metrics point to very solid demand, which suggests near-term performance is going to be outstanding. In particular, this performance is very impressive when we consider the demand weakness that other verticals within the industry are seeing. With a better growth outlook, I expect VIK to trade at a premium vs. peers.

Business description

VIK is a travel and leisure company that currently operates 85 vessels (as of Q2 2024). The unique aspect of VIK is that it provides unique cruise journeys on the world’s great rivers (mainly in Europe), including its new Mississippi River itineraries, along with ocean and expedition voyages around the globe. VIK also has a strong brand reputation in the industry, with multiple notable awards. The primary business units (segments) are Cruise and land revenue (93%) and onboard & other (7%).

VIK reported Q2 2024 earnings last week with revenue of $1.587 billion, driven by Cruise and Land revenue of $1.481 billion and Onboard & Other revenue of $107 million. While revenue underperformed consensus expectations, adj. gross profit did better at $1.038 billion vs. $944 million. Because of this, adj. EBITDA margin came in better than expected by a big margin (47.5% vs. 43.6%).

Outstanding performance in this macro climate

As I look across various verticals within the travel and leisure space, VIK stands out as an outstanding performer, as it is apparently not showing signs of weakness in this macro environment but also has strong visibility into near-term growth. I believe these are very attractive attributes that will continue to support the stock’s valuation.

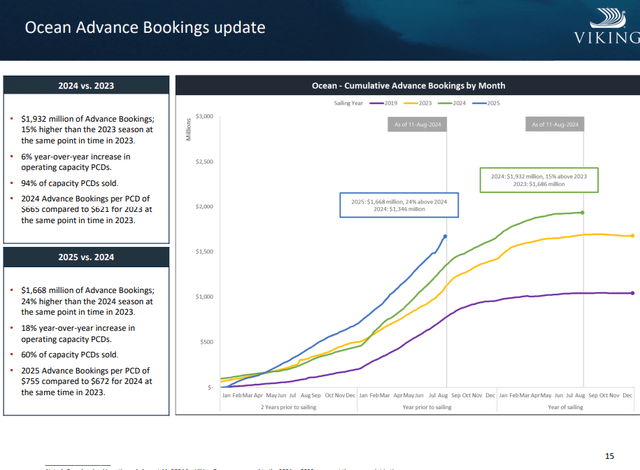

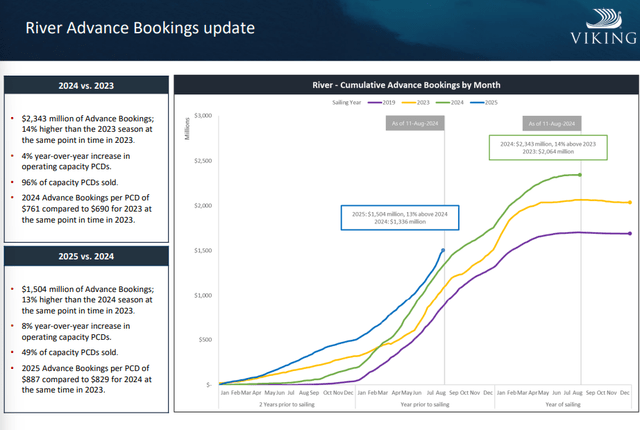

Starting with the demand strength, it was very impressive as it was driven by both capacity expansion and pricing (which also means demand outstrips supply by a sizeable margin). Specifically, Q2 2024 9.1% y/y revenue growth was driven by 6.6% growth in net yields (net cruise revenue per passenger cruise days [PCD]) and an occupancy rate of 94.3% (in line with the past 4 quarters of ~94%). These are achieved despite available PCD growing by 3.1% in Q2 2024 (note this is already 23% higher than pre-covid FY19 levels). Considering the macro impact on the travel & leisure industry today, this is a very strong set of performances that defies the notion that consumer discretionary spending is hurting the cruise industry. Even better, the forward-looking metrics for VIK are extremely positive and indicate this demand strength will continue to translate into robust P&L performance in the foreseeable future.

For readers who are not aware of how the booking cadence works for VIK: VO typically operates year-round, with the selling season starting earlier; hence, current booking metrics for VO will be higher for VR. As for VR, booking season mainly starts in March and April, with early bookings mainly for the high season and higher cabins. In other words, pricing growth will gradually decelerate as VIK sells the lower cabin and non-peak season categories. Based on the current booking trends, they point to very strong pricing growth, which means underlying demand has not weakened at all.

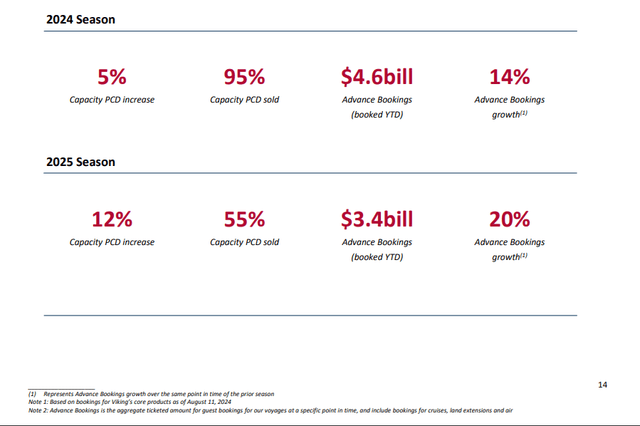

To better illustrate this, consider that for the FY24 season (as of the latest report), VIK sold 95% of its capacity (despite 5% capacity growth), and advance booking saw 14% y/y growth to a total of $4.6 billion. However, for the FY25 season (note that we have not even finished FY24 yet), VIK has already sold 55% of its capacity despite a 12% capacity increase, and advance booking growth is up 20% (already covers 73% of FY24 year-to-date bookings). If you look at the bookings curve (as shown below), performance from past years suggests that this curve will very likely track above FY24 levels.

A few other indicators also point to very strong underlying demand. For instance, management even specifically called out that momentum was strong throughout Q2 2024, and VIK even hit two sales milestones in the last week of July, when it was the business highest grossing and saw the highest-grossing day of sales in history. They also noted that August was also very strong, which I take as an indication that they are not seeing any sign of weakness so far. With these data points, we basically know that two-thirds of Q3 2024 is strong, and given this momentum, I think it is very likely that Q3 2024 will be another strong quarter.

Additionally, we continue to experience robust demand for our core products with 95% and 55% of our 2024 and 2025 capacity already sold as of August 11th. Our momentum was strong throughout the second quarter, culminating with two sales milestones at the end of July. Company Q2 2024 earnings

What management is saying is in line with what JP Morgan research is saying too. To be specific, the research points to a positive demand backdrop and that bookings to date (for FY25) are already ahead of historical levels. Importantly, the cruise industry is expected to capture a larger share of the global vacation market in the next few years (a major tailwind for VIK). Additionally, key players in the cruise industry are all seeing robust demand as well:

“We are witnessing robust demand with strong pricing and booking volumes, leading to record breaking advanced ticket sales. This demand, coupled with our onboard offering and high-quality service has led to strong guest satisfaction scores while we continue to effectively control costs. “ Norwegian Cruise Line Holdings (NCLH) Q2 2024 earnings

“The strong demand environment is also translating into higher revenue and earnings expectations for the balance of the year. We are increasing full-year yield growth expectations by 115 basis points compared to our prior guidance.” Royal Caribbean Cruises Ltd (RCL) Q2 2024 earnings

“Our current booking trends are a testament to that. We are hitting records on top of previous records, which clearly tells us the strength in demand we have been building is continuing into next year and beyond. “ Carnival PLC (CCL) Q2 2024 earnings

Solid balance sheet to support growth

VIK has managed to drive down its net leverage ratio from 3.4x in Q1 2024 to 3x in Q2 2024, and this is really good considering that they expanded capacity by 12%. Given the strength of demand, this also eases concern that VIK needs to raise capital to fund any major growth in CAPEX. Based on the CAPEX outlook, I don’t see any immediate balance sheet risk either. According to the guide, F24 expected CAPEX is around $830 million, and FY25 is around $710 million. With the current cash balance of $1.8 billion and the expected FCF of $1 billion in FY25 (consensus estimate), VIK should easily fund these CAPEX (note that the that the capex net of financing for FY24 is just $450 million and FY25 is $90 million).

Valuation

Given the robust underlying demand and strong visibility into FY24/25 growth, I expect VIK to continue to see strong support for its share price and valuation. From a relative valuation standpoint, VIK should continue to trade at a premium to its peers (NCLH, RCL, and CCL), given that it is expected to grow faster. For comparison, over the next 24 months, RCL is expected to grow at ~11%; NCLH is expected to grow at ~9%; CCL is expected to grow at ~7%; and VIK is expected to grow at ~14%. As such, I think it is reasonable to believe that VIK will continue trading at the current premium against peers (10.6x vs. peers at 8.9x forward EBITDA).

Risk

While historical performance (booking trends) is a good precedent for actual performance so far, I note that this may not be the case this time around. With other travel and leisure companies noting a softening demand environment, VIK may be impacted as well if the situation gets worse.

Conclusion

I give a buy rating for VIK as it demonstrated robust performance despite a challenging macro environment, and its strong booking suggests this level of robustness to continue through FY25. The business has also improved its balance sheet strength, which gives comfort that it will be able to fund any related growth CAPEX without raising capital. Given the better expected growth vs. peers, I believe it should trade at a premium to peers, and hence, I recommend a buy rating.