Editor’s note: Seeking Alpha is proud to welcome Bryant Trombly as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

Editor’s note: Seeking Alpha is proud to welcome Bryant Trombly as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

G0d4ather

Vanguard Short-Term Treasury ETF (NASDAQ:VGSH) is currently an excellent buy with a strong yield and an attractive price appreciation target, as it stands to benefit the most from the normalization of the yield curve and the anticipated Federal Reserve rate cuts.

With short-term Treasuries out-yielding their intermediate-term counterparts, and future yield reductions looking more likely in the short-term part of the curve compared to the intermediate term, VGSH offers a compelling opportunity to earn a higher current yield and capture future price appreciation while maintaining a lower risk profile.

VGSH is a low-cost, high-quality bond fund that focuses on U.S. government debt with maturities between one and three years, making it an attractive choice for conservative investors seeking stability and income. The ETF tracks the Bloomberg U.S. Treasury 1-3 Year Index, providing exposure to short-term U.S. Treasuries. With an expense ratio of just 0.04%, it is the most efficient option for cost-conscious investors in the 1-3 year treasury ETF space.

The fund’s risk/reward profile is characterized by lower volatility compared to intermediate or long-term bond funds and as a pure-play treasury fund exposes investors to minimal credit risk. This makes it an ideal core bond holding for investors looking to preserve capital while earning a steady income.

VGSH manages over $25 billion in assets under management (AUM), with a dividend yield of around 4.7%. Over the past year, the ETF has delivered a 1-year performance of approximately -0.2% and a year-to-date (YTD) return of 2.5%, which reflects its conservative positioning in a rising interest rate environment. VGSH’s holdings, primarily U.S. Treasury securities, provide a reliable income stream while offering protection against interest rate risks, making it a solid addition to a diversified portfolio.

VGSH’s Short Duration A Better Holding For The Coming Normalization Of The Yield Curve

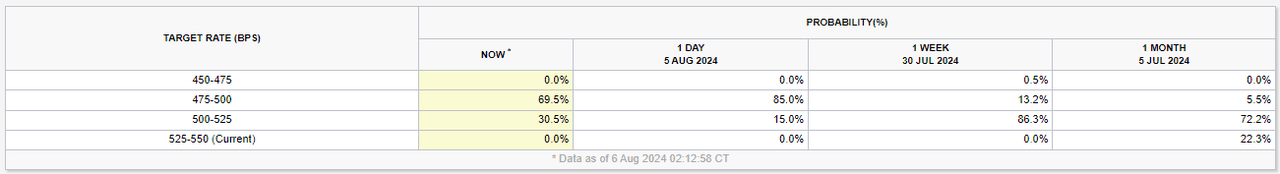

It’s evident that Federal Funds rate cuts are on the horizon. We saw a huge shift in market expectations for a rate cut during the upcoming September FOMC meeting. There’s now a 75% expectation of a 25-bps cut, with still a 25% chance of 50 bps. This compares to the 13.2% expectation of a larger cut that we saw two weeks prior.

Target Rate Probabilities for 18 SEP 2024 Fed Meeting (CMEGroup.com)

Ultimately, if we take the Fed at its word and examine the most recent “dot plot” we can factor in a 2.75% Fed Funds target rate in the long term.

FRB “Dot Plot” June 2024 (FRB Summary of Economic Projections June 2024)

This leads us to an important question on duration. Where is the optimal positioning to take advantage of rates moving lower (and conversely bond prices moving higher)?

It’s tempting to believe that Fed Funds cuts will broadly impact fixed income, but there’s reason to believe that it’s more likely we’ll see a return to normalization of the yield curve rather than falling rates across all durations.

To get a sense of where the intermediate-term rates may likely settle in a normalized environment, we can look back at the 54 monthly periods where the Fed Funds sat between 2.5 and 3% and gauge where the 10-year fell during that time.

St. Louis FRED

Putting aside the cluster in the upper right-hand corner when the Fed was aggressively cutting an already normalized yield curve during the 1992/93 time period, it’s easy to spot here that a 10-Year of about 4% can be expected with long run rates of 2.5-3%. This means that at current 10-Year rates, we’re likely played out in appreciation potential from falling rates alone.

However, after hitting a low of 3.664%, the 2-yr settled in at 3.883% to close out Monday and seems primed for a further downward move in yield as the Fed moves toward their long-term rate target.

Going back to the start of the 2-Year data in 1978, during the 11 prior periods of a normalized 10-Year/2-Year yield curve we noted the 2-Year trading on average 140 bps below that of the 10-Year. This would imply a 2.6% long-term 2-year target.

This is a much more attractive amount of potential yield reduction compared to the intermediate-term space. When coupled with the fact that the 2-Year is also currently out-yielding the 10-Year, this makes a much more attractive positioning for fixed-income allocations.

VGSH Exhibiting An Attractive Risk/Reward

VGSH is exhibiting an attractive risk/reward profile at the movement, especially when compared to its intermediate-term counterpart VGIT (Vanguard Intermediate-Term Treasury ETF).

With a current yield of 4.41% and a 1.9-year duration, VGSH has the potential to pick up meaningful price gains as rates normalize to our 2.6% target. The higher yield and lower duration than VGIT also insulate its total return outlook better from any short-term backup in rates. The near-term outlook is bright for this ETF.