Erik Isakson

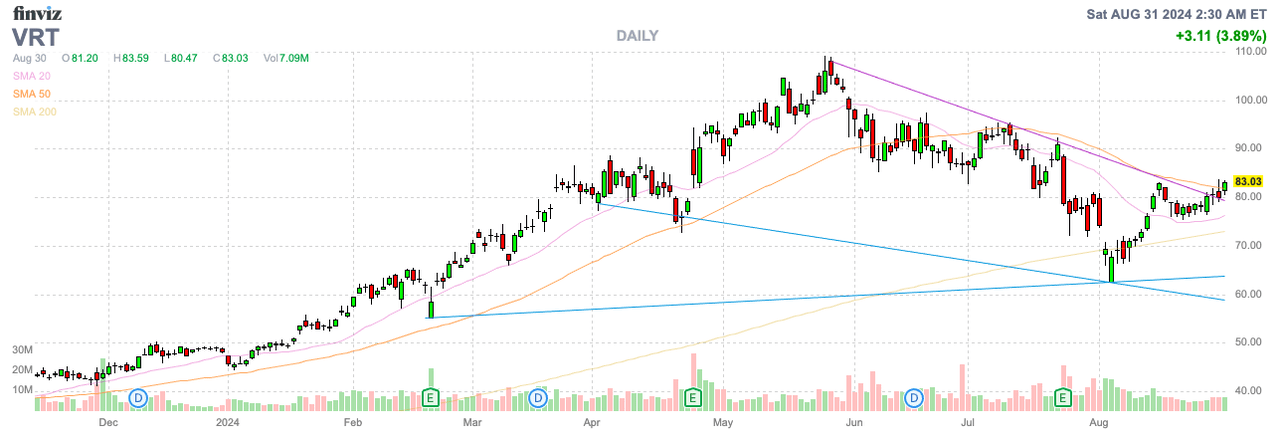

Vertiv Holdings, Inc. (NYSE:VRT) remains one of the big AI winners that hasn’t really seen huge benefits to the business. The AI infrastructure company has reported massive order growth, but the top line isn’t seeing a huge benefit. My investment thesis remains Bearish on the stock after the recent large rebound.

Source: Finviz

Booming Orders

Vertiv has surged from $10 back in 2022 to over $80 now due to surging orders. The company reported a massive 57% boost in organic Q2 orders, with total orders up 37% on a trailing 12-month basis.

AI data center demand is surging, but Vertiv was only able to hike revenues guidance for the year by a minimal $50 million. A big reason for this is that orders have elongated and will now start declining in the upcoming quarters

The company reported Q2’24 sales grew 14% to $1.95 billion, but the big order growth was for multiple years. On the Q2’24 earnings call, the CFO summarized the order growth as follows:

As a consequence, a lot of the orders are for future years, and we feel good about how 2025 is shaping. Pipeline, orders, backlog, all three are positive in the same direction, and we like what we are seeing.

Vertiv forecasts a decline in the sequential orders in Q3, with the 12-month orders growth remaining in the 30s range. The real key is the lengthening of the order book timeline, which the company hasn’t confirmed via any metrics outside of not hiking any revenue growth targets.

The data center infrastructure company benefits more from building of the new data centers related to power and cooling solutions, especially the big focus on liquid cooling technology. While Nvidia (NVDA) reported 122% sales growth due to surging GPU data center demand and Super Micro (SMCI) forecasts a roughly doubling of sales in the current FY despite the issue with filing the 10-K on time, Vertiv doesn’t benefit in the same way with power and cooling sales demand growing, but not at the same ratio as the GPUs and servers.

The stock has surged due to the AI excitement and to the increased sales boosting margins. Vertiv reported operating margins jumped 510 basis points to 19.6%. The company won’t see the same step-up margin growth going forward.

Vertiv guided to Q3 adjusted operating margins in the same 19.6% range and annual margins at just 18.7%. The company might have a hard time pushing much above 20% margins in the future, with only low double-digit sales growth rates.

Too Much AI Hype

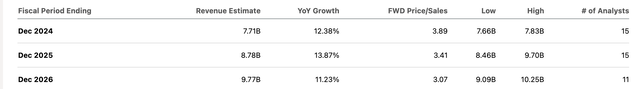

The consensus analyst estimates only have sales growing ~14% in 2025 following growth topping 12% in 2024. The targets are only for 11% growth in 2026 in a sign of how the big order growth and surging AI GPU chip demand isn’t leading to massive growth for other AI infrastructure supplied by Vertiv.

Source: Seeking Alpha

The company is forecast to earn $2.50 per share this year, with a big EPS jump next year to reach $3.23. The stock trades at about 26x EPS targets for 2025, while the big jump doesn’t appear warranted based on the minimal growth rates.

Vertiv will need to generate operating margins of 20% in 2025 to generate the net income to produce the $3.23 EPS. The market needs the company to hit this target in order to warrant the current stock price, much less warrant further upside.

The company has seen the market cap soar to over $31 billion, while the company is only forecast to produce free cash flow this year in the $900 million range. The company definitely benefits from surging AI demand, especially with the issues tied to power consumption and the needs to use cooling technology to lower the power demands, but actual sales growth isn’t that impressive.

Takeaway

The key investor takeaway is that Vertiv just isn’t the best way to play the AI boom. The company doesn’t appear to have the capacity for substantial upside, with low double-digit growth rates expected despite the orders and booming demand.

Investors should use the recent rally to unload the stock, as the market appears to have again got too excited about large growth in orders without any clear understanding that these orders are for multiple years and not a sign of accelerated growth rates.