olaser

Like any company, REITs evolve over time. Some of the oldest and most established REITs have changed the most, reshaping themselves as the times change. These changes can include new management teams, new mission statements, or new investment focuses. By and large, change is for the better, bringing forth new opportunities and growth.

For example, we recently published an article celebrating my tenth year as a shareholder of Realty Income (O), the king of the net lease sector. In the article, we discussed the massive changes to the company’s business over the past ten years. Some changes include new business units, acquisitions of large competitors, and new property types around the world. The emphasis being that today, O looks almost completely different than just ten years ago.

Many REITs reshape themselves over time, mostly on account of maturation and long-term growth cycles. The corporate life cycle dictates many of these changes which will coincide with the growth, maturation, and eventual decay of a corporation. Sometimes, changes happen at an accelerated pace, spurred by external factors. An ideal example of this flavor of change is Veris Residential (NYSE:VRE).

As one of many players in an extraordinarily competitive landscape, VRE owns, manages, and develops multifamily real estate across the United States. The company differentiates itself through a socially conscious business model that emphasizes a forward-thinking lifestyle. However, for shareholders, VRE is competing against some of the largest and most established landlords.

On July 24th, VRE reported Q2 earnings. Today, we will explore the recent history of VRE, focusing on Q2 earnings and the outlook of the company. We’ll examine earnings against the company’s changing strategy.

Who Is Veris Residential?

VRE is a multifamily REIT that builds and owns large, luxury apartment properties around the East Coast. The company differentiates itself by putting forth a socially conscious business model. The company provides the following description of their business:

Veris Residential, Inc. is a forward-thinking, environmentally and socially conscious real estate investment trust (REIT) that primarily owns, operates, acquires and develops holistically inspired, Class A multifamily properties that meet the sustainability-conscious lifestyle needs of today’s residents while seeking to positively impact the communities it serves and the planet at large. The Company is guided by an experienced management team and Board of Directors and is underpinned by leading corporate governance principles; a best-in-class, sustainable approach to operations; and an inclusive culture based on equality and meritocratic empowerment.

Today, VRE is a small, niche multifamily REIT, however the company has a much more complex history. Just several years ago, VRE was a diversified REIT with a portfolio of urban and suburban office properties. So what happened?

Put simply, VRE ran into trouble following the pandemic. The diversified portfolio was insufficient to meet challenges in the business, forcing management to halt dividend payments and embark on a major turnaround. At this point, nearly everything related to VRE began to change, including the portfolio, management, and mission.

VRE

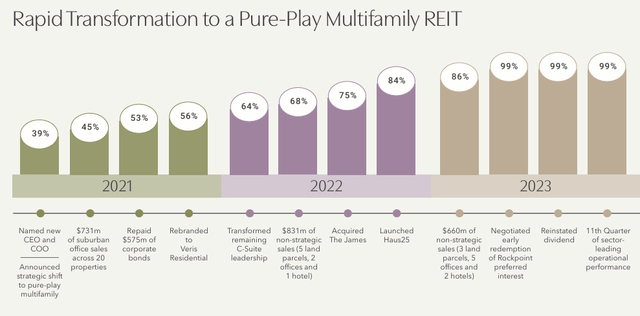

In 2021, a new management team took over VRE and embarked on a journey to reshape the company. This included the disposition of their suburban office portfolio, repayment of debt, and rebranding to the Veris Residential banner. The following year saw the remainder of the C-suite turnover and additional strategic dispositions of land parcels, offices, and one hotel. Last year, the company completed more asset sales, furthering the company’s transformation to a multifamily landlord.

VRE

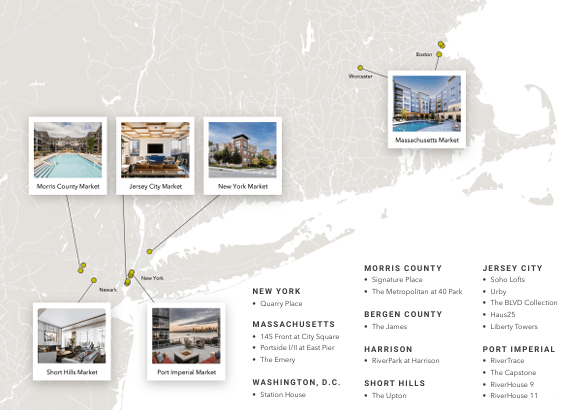

Today, VRE is a different REIT entirely. As of May 31st, VRE owned 7,621 apartment units across 22 assets in the Northeast, focusing on markets such as Boston, New York, Newark, and Washington D.C. VRE emphasizes quality in their assets, focusing on Class A properties which are marketed specifically towards young, wealthy renters.

VRE touts that their average renter’s median income is more than double the national average at $187,102 and $74,755, respectively. Additionally, the company’s relentless emphasis on social governance creates a bias towards a younger clientele. The emphasis on wealthy young renters provides a greater opportunity for future rent growth given housing is a smaller portion of their overall income. VRE also provides tech-oriented amenities to attract renters, including a mobile app and AI property assistant with a >90% adoption rate by tenants. These amenities drive a higher retention rate amongst tenancy, reducing long-term vacancy averages.

VRE’s monthly rental rates are high, currently averaging nearly $4,000 per unit per month. These rents are significantly higher than multifamily competitors including Essex property Trust (ESS) which commands just $2,631 per unit. Again, this data point emphasizes VRE’s focus on high earners.

Development is also a large component of VRE’s business model. The company has a land bank worth around $187 million, zoned to build over 4,000 future units. VRE can decide whether to build on the land or sell that land at a considerable profit, unlocking capital to further delever.

Performance

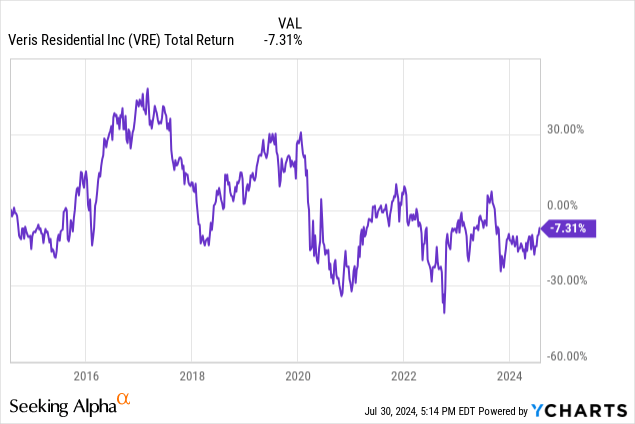

VRE is clearly a case of “that was then and this is now”. It is unfair to look at history before their transition as an estimate of forward performance. With a different portfolio, different focus, and different management team, there is almost no consistency. With that in mind, let’s explore how VRE has performed over the past several years.

The major transformation for VRE begin in 2020 following the cessation of dividend payments. Management was cleared out and current CEO, Mahbod Nia, took helm.

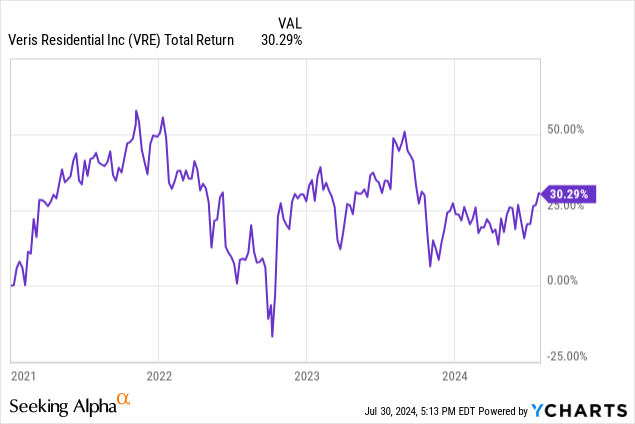

Since the beginning of 2021, VRE has begun to recover. The company improved greatly following the announcement of their strategic shifts and initial property dispositions. Share prices have improved considerably, but remain well below their pre-pandemic averages, and have continued their long term decline.

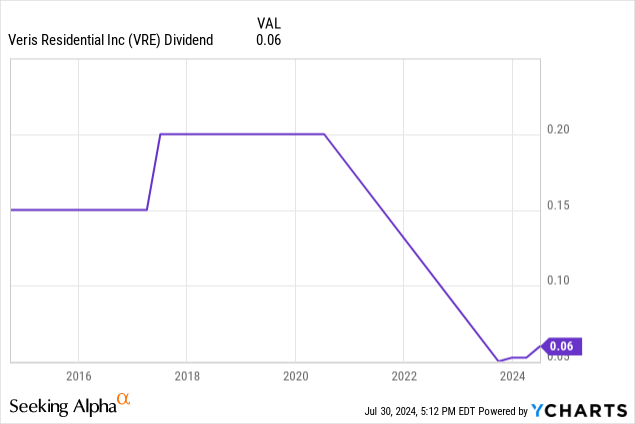

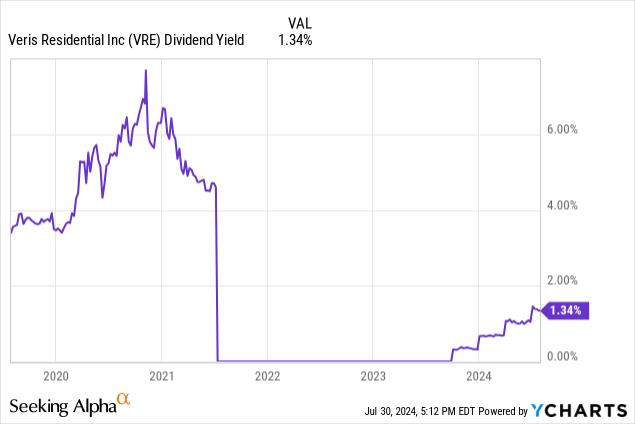

Last year, VRE recommenced dividend payments. In the fourth quarter, VRE paid a dividend of $0.05 per share. The following quarter, the dividend was increased to $0.0525 per share and subsequently increased again to $0.060 per share. Despite increases to the dividend, VRE’s yield is still rock bottom as the company gets its footing back into cash distributions. Currently, the yield is around 1.5%, but expect healthy dividend growth as the company reestablishes itself.

Veris Residential Q2 Earnings

On July 24th, VRE reported Q2 earnings which were strong across top and bottom lines. This year will mark the company’s first stable year under the full rebrand with new dividend payments. This means investors will be focusing on earnings to set baseline expectations for future quarters.

VRE reported impressive rental growth rates on a same store and blended basis. Same store NOI growth for the quarter was 3.1% compared to the previous quarter and 7.9% compared to the same quarter of the prior year. VRE records same store data against their 7,621 core units. For the quarter, occupancy increased by 100 basis points and average unit rent climbed to $3.923 from $3,899.

Additionally, VRE continued to dispose of non-core assets during the quarter with the sale of three assets for $82 million. This brings the year’s disposition proceeds to over $200 million. The assets include 107 Morgan which sold for $54 million and two land parcels from the land bank for a total of $28 million. Disposition proceeds are being used to reduce debt and reorganize VRE’s capital stack.

Management provided commentary on the quarter’s financing activities on their earnings release.

In April we secured a new $500 million credit facility and term loan, signaling a renewed, strategic approach to managing our balance sheet and providing us with substantial liquidity and financial flexibility going forward. We also reduced our overall debt by a further $168 million, primarily utilizing proceeds from nonstrategic asset sales…

The quarter also saw significant capital market activity as VRE announced the issuance of a large chunk of equity. On June 17th, the company announced the issuance of over 10 million shares of common stock. Proceeds will fund the acquisition of 55 Riverwalk Place, a 348-unit multifamily asset outside of New York City.

The Company intends to use the net proceeds from the offering to fund its pending acquisition of 55 Riverwalk Place, a 348 unit residential asset with 48,000 square feet of retail space located in the Port Imperial waterfront in West New York, New Jersey. If the Company is unable to consummate this acquisition, it may use the proceeds for general corporate purposes and working capital, including contributing to the repayment of approximately $157 million in outstanding mortgage debt that is secured by its Soho Lofts property in Jersey City, New Jersey, a 377 unit multifamily residential property.

However, shortly thereafter, the offering was withdrawn, and the company announced it would not acquire the asset. Per the earnings transcript:

I’d like to address our decision to withdraw the company’s recent public offering of common stock and proposed acquisition of 55 Riverwalk Place. While this strategic and accretive transaction would have strengthened our position in one of our core markets, Port Imperial and further delevered our balance sheet, we decided not to proceed given the unintended signaling that the Board and management team may seek to prioritize external growth at the expense of rather than parallel with a comprehensive spectrum of strategic and organic value-creation opportunities.

Interestingly, the emphasis was on the appearance of the management team’s intentions. Despite the quality of the transaction, management was afraid of looking like they are seeking external growth opportunities. Instead, the company wants to appear hard at work on their existing assets. This aligns strongly with their emphasis on social responsibility.

That’s An Issue….

In my opinion, this is a significant conflict of interest for a management team. I expect a management team to be hard at work identifying any opportunities to add shareholder value, especially accretive transactions aligned with management’s core competencies. There are two possibilities of what could be at play.

First, it’s possible that management is truly concerned that acquisitions could tarnish the VRE brand from the public’s perspective. However, hesitancy to act in the financial interest of shareholders due to public appearance is an unorthodox strategy at the very best. Most developers would pounce on the opportunity to take down a trophy asset in an infill east coast market.

Second, it’s also possible that the transaction deteriorated for a variety of reasons and VRE was simply unable to get over the finish line. However, this presents another layer of risk, showing VRE may not be able to compete in a crowded marketplace. East Coast multifamily is a highly competitive segment with some of the largest investors competing over a limited number of assets. Execution risk is larger in these markets. The work to align capital to close the deal means the transaction was very close to closing.

Either scenario marks a large downside for VRE. Failing to execute on large transactions is viewed negatively regardless of the driving force. After all, it is a waste of time and energy on the part of VRE’s employees.

Conclusion

VRE is embarking on a new journey as a rebranded, socially conscious landlord. It is simply unfair to punish VRE based on anything that happened prior to 2021 given the comprehensive changes to the company. Today, VRE is almost an entirely different company than just several years ago.

However, this means VRE is essentially a new, unproven REIT. Their differentiated business model attracts a unique set of investors, clients, and stakeholders who may place an overweight emphasis on corporate governance and social responsibility. However, this also adds additional complexity and consideration to a business model which operates around making money. For shareholders, this area of focus places too much emphasis on perspectives other than financial productivity, which could become evident in long term financial performance.