BJP7images/iStock via Getty Images

Introduction

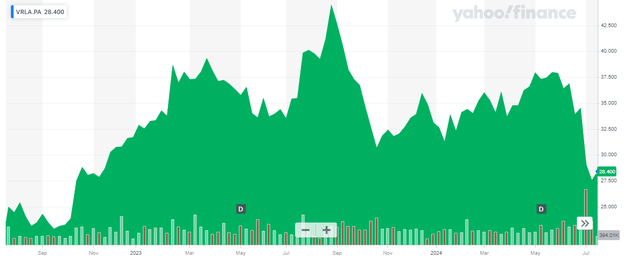

After issuing a severe profit warning earlier in July, Verallia (OTCPK:VRLAF), one of the largest producers of glass bottles in the world, released its detailed financial results for the first half of the year so I wanted to dive right in to see what the damage is. The share price has lost about 20% since my previous article was published in February, and I used the opportunity offered by the profit warning to re-enter the position.

Yahoo Finance

Verallia has its main listing on Euronext Paris where it’s trading with VRLA as its ticker symbol. The average daily volume of approximately 190,000 shares per day makes it the most liquid listing as well. There are currently approximately 117M shares outstanding, for a total market capitalization of 3.3B EUR at Tuesday’s closing price of 28.40 EUR. I will use the Euro as base currency throughout this article. The Paris listing also has options available and the recent volatility spike makes the option premiums interesting for a put writing strategy.

The first half of the year was weaker than initially anticipated

Verallia recently published its H1 results, and the update was a mixed bag.

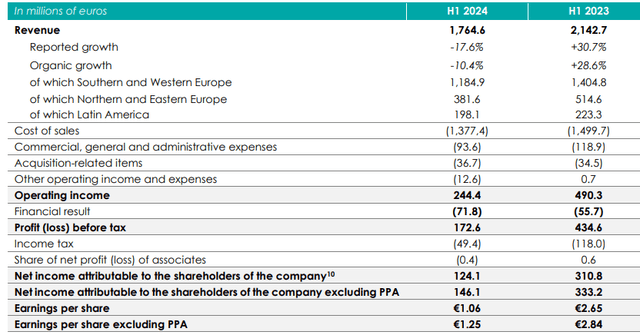

Verallia’s total revenue decreased by almost 18% on a reported basis compared to the first half of 2023 and even if you used constant FX rates, the revenue would still have decreased by in excess of 10%. At the same time, the EBITDA margin decreased to just over 24%, resulting in an adjusted EBITDA of 431M EUR. The lower EBITDA and EBITDA margin were expected as Verallia is contractually required to pass on certain energy-related cost savings to its customers.

Verallia Investor Relations

What does this mean for the bottom line result? As you can see in the income statement above, the operating income fell by approximately 50% while the net income was approximately 124.1M EU, for an EPS of 1.06 EUR. Excluding the specific amortization expense related to customer relationships from a 2015 acquisition, the net attributable income would have been 146M EUR or 1.25 EUR per share.

In all my previous articles, I focused on Verallia’s ability to generate a strong free cash flow result as that ultimately is what funds the company’s growth plans, and the dividend.

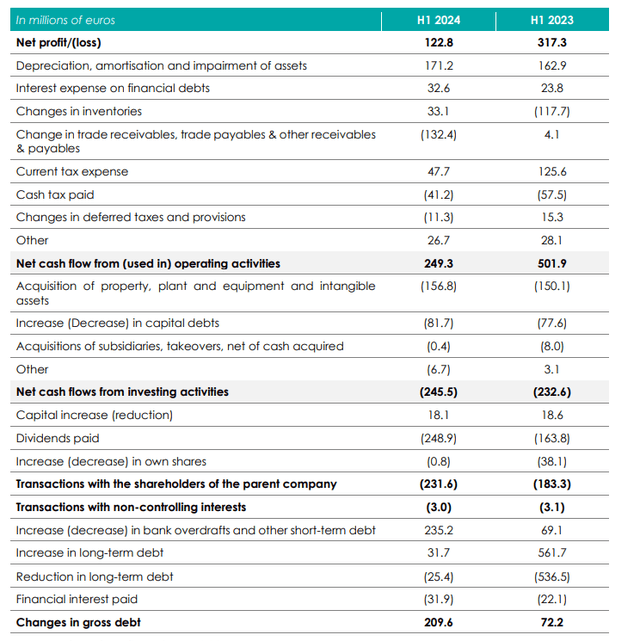

The reported operating cash flow in the first semester was approximately 249M EUR, but as you can see below, there are certain adjustments required. First of all, that operating cash flow includes about 99M EUR in working capital investments, but it also excludes 32M EUR in interest payments and approximately 10M EUR in lease payments.

Verallia Investor Relations

This means the adjusted operating cash flow was approximately 306M EUR. The total capex was approximately 157M EUR, resulting in a net free cash flow of 149M EUR. Divided over 117M shares outstanding, the net free cash flow per share was approximately 1.27 EUR. Keep in mind this includes a total capex and lease payment of 167M EUR although the normal depreciation (excluding the amortization of client relationships which weighed on the net income) was approximately 145M EUR. Also keep in mind the maintenance capex in the previous two years was 250M EUR on average, or 125M EUR per semester. That’s substantially lower than the 157M EUR recorded in the first half of this year.

The lower EBITDA result also had a negative impact on the debt ratio. At the end of H1 2024, the total net debt was 1.65B EUR, which means the debt ratio will come in at around 2x EBITDA, assuming the updated EBITDA guidance with a mid-800M EUR EBITDA result can be maintained. That’s still very manageable, but I am a bit disappointed to see a profit warning relatively soon after the April update wherein the full-year guidance was confirmed.

Verallia has no fixed dividend policy, but it goes without saying last year’s dividend of 2.15 EUR per share likely won’t be maintained this year if the EPS comes in between 2.50 and 3 EUR per share. I think it would be fair to expect a 1.25-1.50 EUR dividend, which would represent a payout ratio of around 50%. That would leave plenty of cash on the table for Verallia to invest in itself.

What does the recent profit warning mean?

The weak performance in the first half of the year wasn’t really a surprise as Verallia had already rattled the market earlier in July with a profit warning. Verallia already mentioned the recovery was going slower than anticipated and it no longer deemed its anticipated 1B EUR in EBITDA feasible. The company mentioned it was now aiming for a similar EBITDA as it generated in 2022 (which is around 866M EUR).

As a reminder, the 866M EUR EBITDA in 2022 resulted in an EPS of 2.92 EUR and a sustaining free cash flow result of around 3 EUR per share (assuming a normalized sustaining capex of around 225-240M EUR versus the 270M EUR sustaining capex in 2022).

As the share price reacted accordingly, I think Verallia is attractively priced again, at just under 10 times its anticipated net profit for this year while the sustaining free cash flow yield should still be a high single digit or even a low double digit percentage.

Investment thesis

I previously sold my position in Verallia when the stock was trading over 40 EUR per share, but I recently re-initiated a long position after the profit warning. I think the market overreacted a little bit due to the uncertainty and the lack of mid-term guidance beyond 2024, but at an earnings multiple of less than 10, I was happy to pick up Verallia stock.

On top of that, I have written put options as well, with strike prices that are currently out of the money.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.