designer491

Introduction

I analyzed Vanguard Long-Term Corporate Bond ETF (NASDAQ:VCLT) back in October 2023. At that time, I highlighted VCLT’s attractive yield and that inflation rate will eventually cool down, albeit at a slow pace. Since the current macroeconomic environment is quite different from last year. It is time for me to provide another update.

ETF Overview

VCLT has a portfolio of long duration investment grade U.S. corporate bonds. While inflation has improved dramatically from the peak reached in mid-2022, it is still a distance from the long-term Federal Reserve target. Therefore, the Federal may need to keep the rate elevated for longer and the risk of an economic recession will increase. Meanwhile, credit spread between corporate bond and U.S. treasury has narrowed to only 1%, making corporate bonds less attractive. These suggests that it is likely not be the best time to invest in corporate bond funds such as VCLT. This is certainly true for short-term income investors. However, long-term income investors should definitely still hold on to this fund as this fund has a good chance to continue to outperform U.S. treasuries in the long run.

YCharts

Fund Analysis

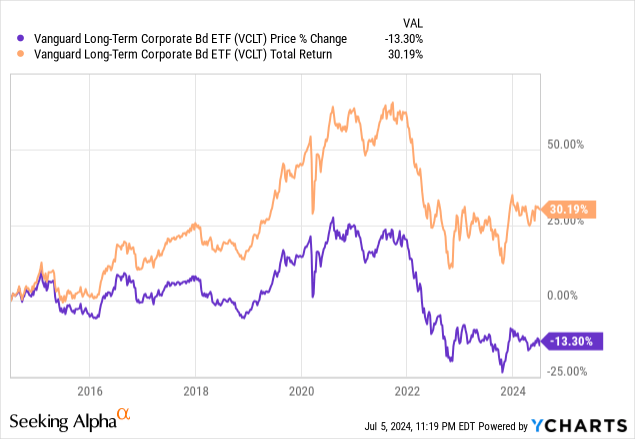

VCLT delivered solid return since October 2023

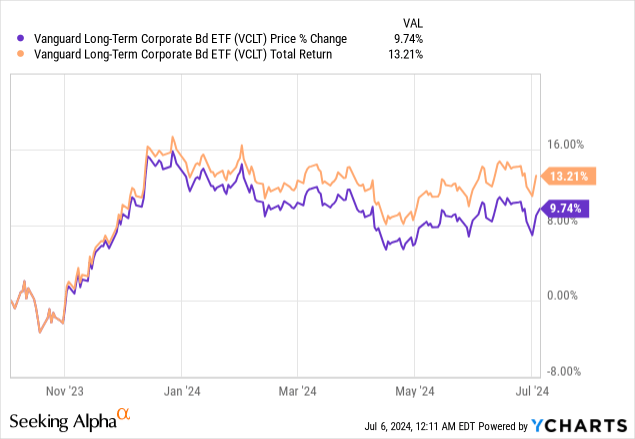

VCLT has performed well since October 2023. This was primarily due to its fund price surge towards the end of 2023. As can be seen from the chart below, the fund has surged as much as 16% in the last two months of 2023. Meanwhile, the fund’s attractive 30-day SEC yield of 5.8% helped it to maintain this solid return in the first half of 2024. Together, VCLT’s total return was about 13.2% since October last year.

YCharts

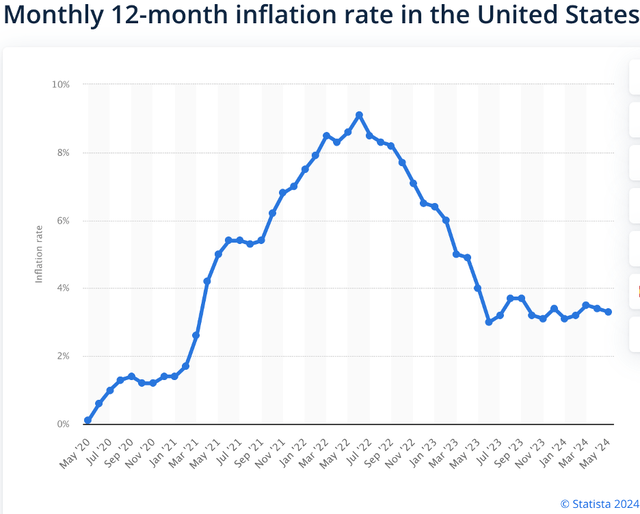

Inflation declining, but still not good enough

If we look at the macroeconomic environment, inflation has clearly passed the peak reached in mid-2022. However, it is still in rangebound between 3~3.5% for more than a year. It is still far from the Federal Reserve’s long-term target of 2%. Therefore, the Federal Reserve has opted to keep its rate elevated in the past year.

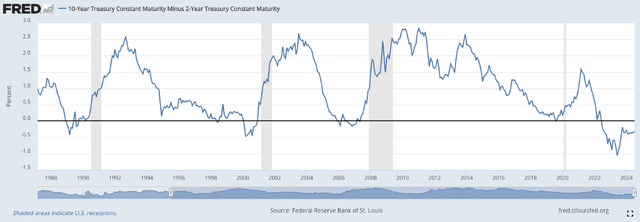

A soft-landing may not happen

The problem in this scenario is that the longer the Federal Reserve continue to keep its rate elevated, the risk of the economy going into a recession increases. We are currently in an environment where the yield curve is inverted. In other words, the long-term treasury rate is lower than short-term treasury rate. In fact, the 10-year treasury rate minus 2-year treasury rate is currently at negative 0.32%. As can be seen from the chart below, this inverted yield curve typically occurs before economic recessions (shaded areas). We have observed this trend in the past 4 recessions: in the recession in 1991, 2001, 2008/2009, and 2020. Therefore, an inverted yield curve appears to be a very accurate forward economic indicator. If this forward indicator is accurate, an economic recession may not be too far from now.

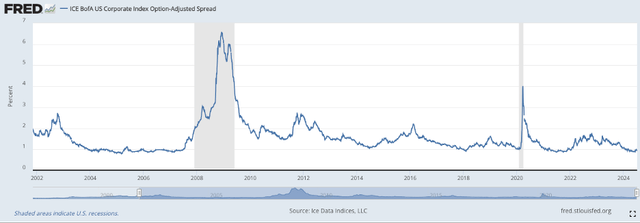

Credit spread at its lowest level, and this may soon reverse

Another trend we have observed is the credit spread between corporate bonds and U.S. treasuries has now narrowed down to 1 percentage points. As can be seen from the chart below, an economic recession typically occurs after the credit spread narrowed to 1% or below. Therefore, we may be at a point where an economic recession may soon occur.

Is it better to buy U.S. treasury funds than corporate bond funds in this environment?

In this scenario, is it better to buy corporate bond funds such as VCLT or own U.S. treasury funds? Let us first compare the yields of VCLT and Vanguard Long-Term Treasury ETF (VGLT). As we have mentioned earlier, VCLT’s 30-day SEC yield is about 5.8%. In contrast, VGLT’s 30-day SEC yield is 4.7%. Therefore, there is a 1.1% difference between the two. An investment in VCLT will have better yield than VGLT for sure. But, we also know that VGLT has no credit risk as U.S. treasury is considered by the market as a risk-free asset. In contrast, VCLT’s credit risk is higher despite it only include investment grade corporate bonds. About 44.5% of the portfolio belong to BBB bonds, the lowest grade investment grade bonds. Some of these BBB bonds may be downgraded if the broader economy is going through turmoil. Therefore, there is certainly some credit risk.

However, if your goal is to own the fund in the long run, VCLT may still be better

Given the narrow credit spread between corporate bonds and U.S. treasury, one may think that it may not be worth the effort to opt for corporate bond funds such as VCLT right now. This is certainly true if one’s goal is to only park the capital in the short run. It may be wise to wait till an economic recession before opting for VCLT. The better choice for short-term investors is to opt for U.S. treasury funds instead.

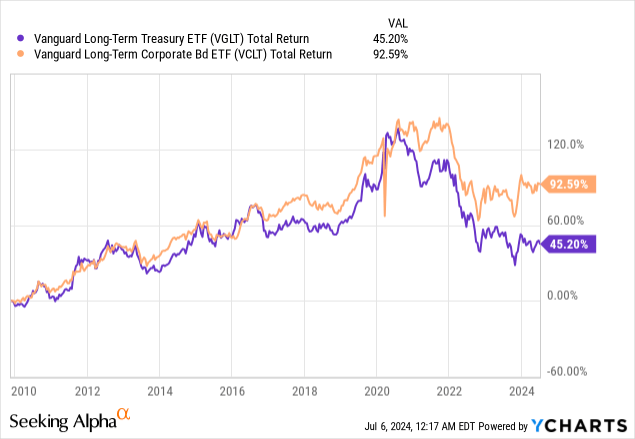

However, if one’s goal is to own the fund in the long run and earn bond interests, it is a different story. As can be seen from the chart below, VCLT delivered a total return of 92.6% since the beginning of 2010. In contrast, VGLT’s total return in the same period was only 45.2%. This is less than half of the total return of VCLT.

YCharts

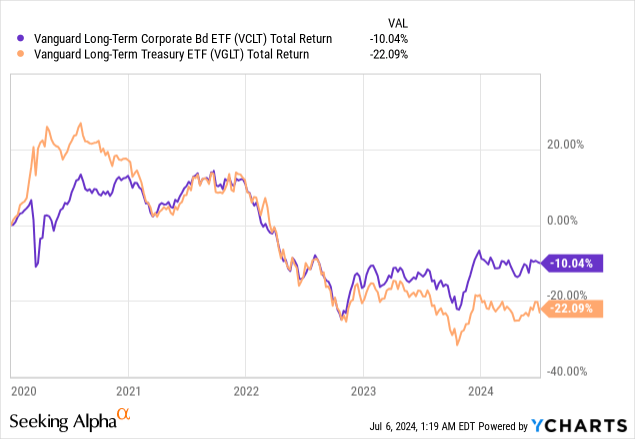

Even if buying the fund during the time when the credit spread is only about 1%, such as in the beginning of 2020, VCLT’s total return was still much better than VGLT as demonstrated in the chart below.

YCharts

Investor Takeaway

For income investors seeking only to park the money in the short-term, VCLT will not be the best choice given macroeconomic uncertainties. However, as this article has suggested, VCLT will still be the better choice than U.S. treasuries in the long run. Therefore, long-term income investors should continue to own this fund.

Additional Disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.