RunPhoto

Valero Energy Corporation (NYSE:VLO) refines petroleum into oil products, including gasoline and distillate fuels. The company also refines agricultural products into ethanol and biofuel. VLO’s company profile states:

VLO Company Profile (Seeking Alpha)

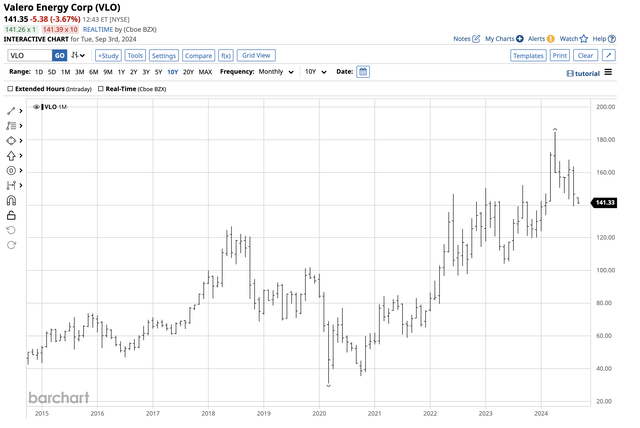

At $141.35 per share, VLO had a $47.01 billion market cap. VLO trades an average of over 2.245 million shares daily and pays shareholders a $4.28 or 3.02% dividend.

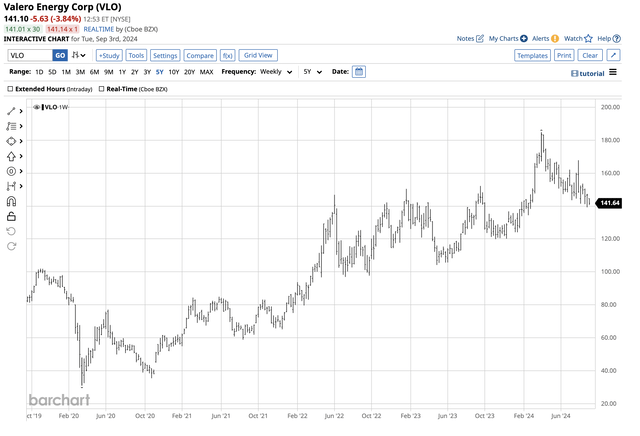

VLO remains in a bullish trend, but it has run out of some upside steam over the past months.

VLO share peaked in April 2024 after a parabolic rally from the 2020 low

VLO shares fell to a pandemic-inspired $31 low in March 2020 as crude oil and oil products were heading for a bearish abyss.

The ten-year chart highlights the explosive rally that took VLO shares nearly 500% higher to a record $184.79 high in April 2024.

Since April, VLO shares have returned to earth, falling 24.7% to a $139.22 low in August and trading below the $142 level in early September.

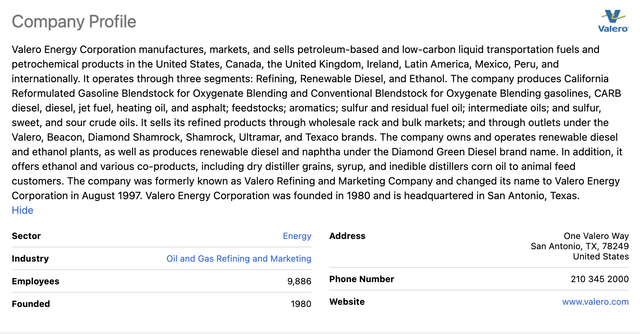

Crack spreads have moved lower-VLO follows the refining spreads

Crack spreads reflect the economics of processing crude oil into gasoline and distillate fuels, which is VLO’s primary business. Refiners like VLO do not speculate on the price of crude oil they purchase or gasoline, heating oil, jet, diesel fuels, or agricultural products that are inputs in biofuel production. However, the risk is in the refining spread for processing the raw materials into fuels. In petroleum, Crack spreads are a real-time indicator of refining profits or losses in the petroleum processing market. As crack spreads rise, profits tend to increase and vice versa.

Over the past months, gasoline and heating oil (which is a proxy for distillate fuels) crack spreads have made lower highs and lower lows.

Weekly Chart of the Gasoline Refining Spread (CQG)

The weekly chart shows a 62.7% decline in the gasoline crack spread from $34.17 in mid-March 2024 to $12.76 per barrel in early September 2024.

Six-Month VLO Chart (Barchart)

VLO shares peaked in April 2024, but declining refining spreads have weighed on revenues and earning potential over the past months.

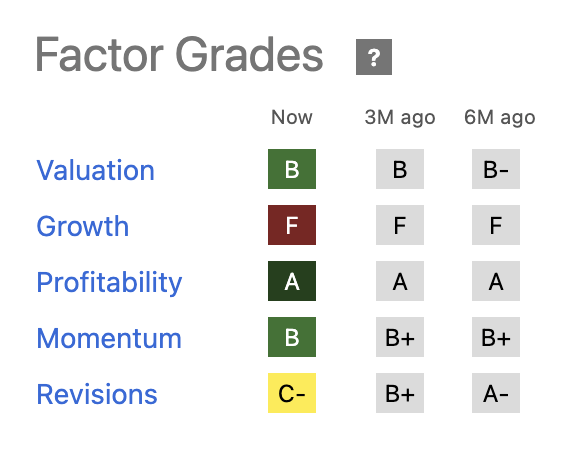

The dividend remains attractive-Reasonable Factor Grades

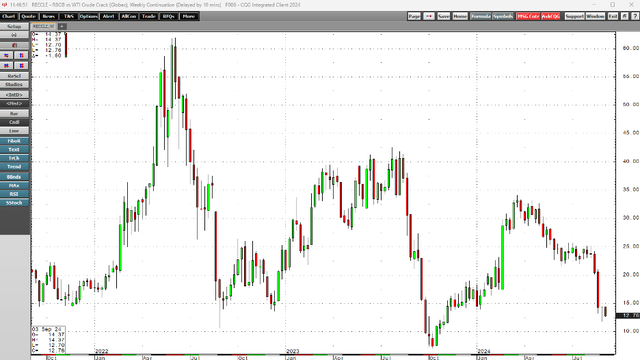

Seeking Alpha’s VLO Factor Grades have been mostly stable over the past six months.

VLO Seeking Alpha Factor Grades (Seeking Alpha)

The chart shows a steady valuation at a B and profitability at an A. A C- in revisions reflects declining consensus ETF forecasts, while the B in momentum demonstrates the decline in VLO shares’ price since the April high. An F in growth also reflects the forecasts for lower earnings over the coming years.

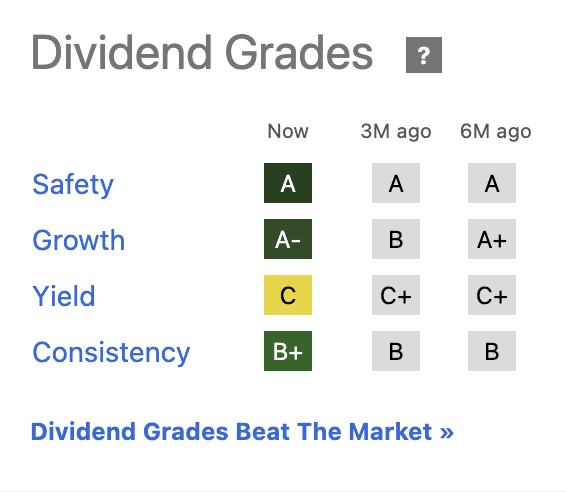

Meanwhile, VLO receives high marks for its dividend policy.

VLO Seeking Alpha Dividend Grades (Seeking Alpha)

As the chart illustrates, VLO receives high dividend safety, growth, and consistency grades. The decline in yield grade to a passing C level reflects the 3% yield, which has declined as the stock rallied from the 2020 low to the 2024 high.

Earnings beat on EPS but missed on revenues- A bearish trend going into the off season for gasoline demand

VLO reported quarterly earnings on July 25. Normalized actual EPS at $2.71 per share beat consensus estimates by 11 cents, while EPS GAAP Actual results were 13 cents better than the market’s forecasts. Revenue at $34.49 billion came in $3.14 million lower than estimates, an insignificant miss. However, the decline in crack spreads has weighed on the shares since the April 2024 high.

VLO shares could continue to decline as the crude oil product markets are heading into the off season for gasoline, the most ubiquitous oil product. A recent Seeking Alpha article on gasoline and the UGA ETF product highlights the seasonal weakness during the fall and winter. That is when drivers put fewer miles on their automobiles and gasoline demand declines after the peak spring and summer vacation season. Declining gasoline demand leads to lower crack spreads and earnings for VLO and other refining companies. Therefore, the bearish trend could continue over the coming months until the market shifts its attention to the peak demand period in 2025 in the spring.

The U.S. election could impact VLO shares

While seasonality could significantly impact the path of least resistance of VLO shares, 2024 is no ordinary year. The November election will determine the course of U.S. energy and tax policies that will impact VLO’s future.

The race for the U.S. White House is close as we head into the final two months of the contest. With the conventions in the rearview mirror, the next significant events will be debates. The bottom line is that Democrats support climate change initiatives that inhibit fossil fuel production and consumption, encouraging alternative and renewable fuel sources. Moreover, rising corporate taxes could impact most companies. Another term for Democrats at 1600 Pennsylvania Avenue would likely support oil and gas prices, as supplies could decline under a heavier regulatory hand and a more restrictive tax environment.

Meanwhile, a second term for former President Trump could send prices lower as he advocates a “drill-baby-drill” and “frack-baby-frack” policy and lower corporate taxes. Achieving any policy initiatives depends on majorities in the House of Representatives and the Senate. Therefore, the odds favor a continuation of gridlock that will not change the current environment. When it comes to the path of least resistance of VLO shares, the off season for gasoline demand will likely weigh on crack spreads and the company’s earnings. However, the lower the stock falls, the higher the dividend yield will rise, and the more attractive it will be for the next peak driving season when gasoline demand increases. The bottom line is that I favor buying VLO on a significant price correction.

Five-Year VLO Chart (Barchart)

The five-year chart illustrates significant technical support at the $120 and $100 per share levels. If the price gets to these levels, I am a buyer of VLO shares, leaving plenty of room to add on further declines.

We could see lots of volatility in the refining company’s shares over the coming weeks due to uncertainty caused by the U.S. election and U.S. energy and tax policy for the coming years. The bottom line is that the oil products processed by VLO will continue to power the U.S. and the world.