Jetlinerimages

I have been following Cathay Pacific (OTCPK:CPCAF, OTCPK:CPCAY) for nearly two years and while I have been seeing fundamentally driven upside for the stock, the reality is that the stock is not performing anywhere near where it should trade based on historic EV/EBITDA multiples. Perhaps with higher costs in the industry and softening of yields driven by macroeconomic concerns, higher capacity in the market and global conflicts it is not that odd that airline stocks are underperforming.

In this report, I will be discussing the most recent results for Cathay Pacific and review my rating and price target for the stock.

Cathay Pacific Earnings Decline Despite Revenue Growth

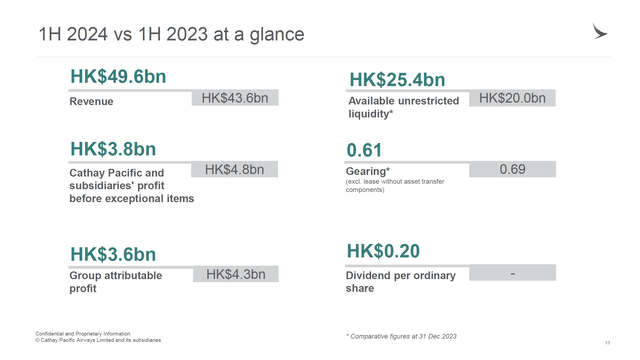

A first look at the results shows that the revenues increased 13.8% to HK$49.6 billion and while that might look impressive it is not. The revenue increased was driven by a 22.8% increase in capacity, and it did not translate to higher profits. In fact, the profit attributable to the Cathay Pacific Group decreased by 15.3% to HK$3.6 billion. For an airline, that is not a bad margin to be operating at, but we do see continued normalization of yields as a significant threat to the margins. Unit revenues for passengers declined 15.9% while cargo unit revenues declined 8.5%.

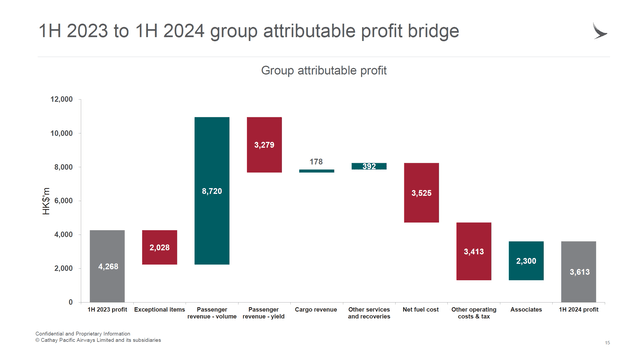

The earnings bridge quite clearly demonstrates that passenger revenue increases were fully offset by lower passenger yield, higher net fuel costs and other operating costs. In other words, the capacity increase did not translate to the bottom line at all.

Cathay Pacific saw passenger revenues increase 20% to HK$30 billion, but that was driven by a 42.7% increase in capacity for the airline, pointing to a 11% decline in passenger yields. The cargo business grew revenues by 1.5% while capacity grew 11.4%, so also in that business segment we are seeing yields and unit revenues moderate.

HK Express, which is Cathay’s low-cost arm, increased revenues by 22.1% to $HK3.175 billion, but that was on a capacity expansion of 57.1% while the company saw its after-tax swing from a HK$333 million profit to a HK$73 million loss. Ex-fuel unit costs declined by 9.4% for the airline group and if we keep the significant increase in capacity in mind, it shows quite clearly how hard it is to bring those unit costs down significantly and Cathay Pacific is already seeing its yield drop. So, what is really happening here is that Cathay Pacific has been able to significantly increase capacity at a time when competitors already have done so, and it is doing that at the expense of unit revenues while costs are elevated. While its cargo business has done well during the pandemic, the company, due to pandemic restrictions was simply not able to scale up as fast to strongly benefit from the uptick in travel demand seen globally in the past two years or so.

Cathay Pacific Stock Is Significantly Undervalued

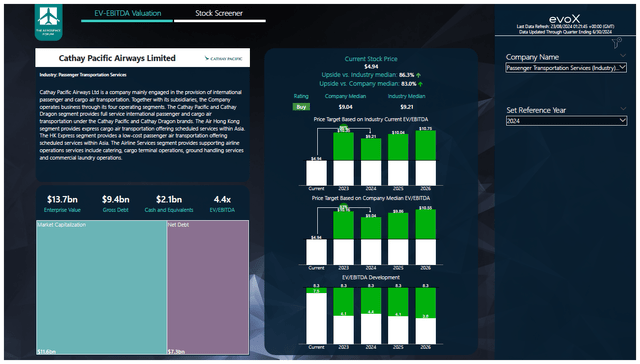

To determine multi-year price targets The Aerospace Forum has developed a stock screener which uses a combination of analyst estimates on EBITDA, CapEx and free cash flow along with the most recent balance sheet data, cash flow statements and my assumptions on debt repayment, share repurchases and dividends. Each quarter, we revisit those assumptions and update accordingly.

EBITDA for 2023 came in significantly lower than expected. Free cash flow, however, came in much stronger and for the years ahead, EBITDA is expected to be lower in 2024 but stable from there on with significant free cash flow. That would imply a $9.04 price target, or 83% upside. However, at this point there are also a lot of pressures such as the yield on pressure driven by either macroeconomic or geopolitical turbulence globally. As a result, while the upside is significant, I am putting my price target at $6 per share or $1.19 per ordinary share.

How To Buy Cathay Pacific Stock?

If you are still interested in buying Cathay Pacific stock, there are three ways. You can buy CPCAY which is traded OTC, which represents 5 ordinary shares, and that ticker has a decent volume but still relatively low at 1,100. The other way is buying CPCAF, which represents one ordinary share but lacks any significant volume and that might give investors a hard time buying and selling at desired prices and in desired quantities. If you want to buy the ticker with the highest volume, the best option is to buy Cathay Pacific stock via the Hong Kong Stock exchange, where it has a 10-day average volume of 6.72 million pieces according to CNBC.

Conclusion: Cathay Pacific Is Recovering Slowly But Has Upside

The recovery at Cathay Pacific is gaining traction. However, if we look at how peers have recovered and where yields have been heading, we can only conclude that Cathay Pacific recovered to slowly to benefit from strong yields and sees much of its recovery measured by flights and destinations completed by Q1 2025 at a time where yields will likely have normalized further. In essence, it means that Cathay Pacific largely missed the boat on a strong revival in air travel demand. My buy rating remains, but seeing upside in the stock price actually materialize might be difficult as airline stocks are significantly driven by short-term sentiment and swings in capacity and costs, and those are not in Cathay Pacific’s favor.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.