Daniel_Kay

Summary

UiPath’s (NYSE:PATH) sales execution challenges have amplified a multitude of issues both specific to the company and macro-economic. While the market was right to punish the stock for performance issues, we think it’s a bit overdone. However, considering the macroenvironment we would not enter the stock at this point but would also not be sellers.

Business

UiPath started out as an automation solutions and computer vision solution provider. The company has gradually expanded into providing an integrated business automation platform. UiPath sells its offerings through cloud and on premise, along with associated professional services.

What spooked the markets

UiPath’s Q1 2025 results had three key takeaways:

- Revenue outlook had weakened materially due to the overall macro-economic backdrop and the erstwhile management having taken an austere view of the sales compensation for longer deals.

- The traction in products such as IDP (or intelligent document processing) and investments towards growth had not performed per expectations.

- The erstwhile CEO had stepped down and was being replaced by the founder.

It is anyone’s guess if the CEO’s ouster was an outcome of the lack of results or was it truly a ‘personal decision’.

We think that the markets like consistency and lack of surprises. All the points above were about inconsistency and surprises.

While the slew of negative news will put immense pressure of delivery on the new management for Q2 2025, we like what we read.

Why do we like UiPath?

[Q]: You talked about some deals getting pushed out of the quarter, particularly for large contract customers. Have you started to see some of those deals close in 2Q? And are they also closing smaller than maybe originally anticipated like you saw in 1Q? Or have some of them been lost completely? Are they still in the pipeline?

[A]: The only thing is we don’t really see losses.

Source: UiPath Inc. Q1 2025 Earnings Call Transcript on Seeking Alpha

This one-line answer tells us that the sales execution was a person issue and that seems to have been addressed. The founder, who grew the business from 0 to 1 is back and wants to revamp the organizational culture of centrality etc.

We think the company’s operational elements went off-track; however, the product is still brilliant.

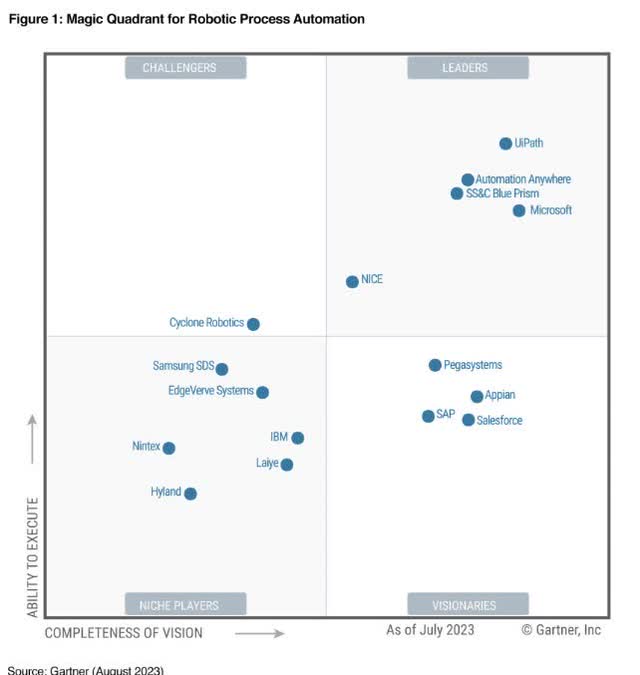

In addition to being a leader in the Gartner Magic Quadrant, the business cases that UiPath serves are quite compelling.

Source: UiPath 10K – 2024

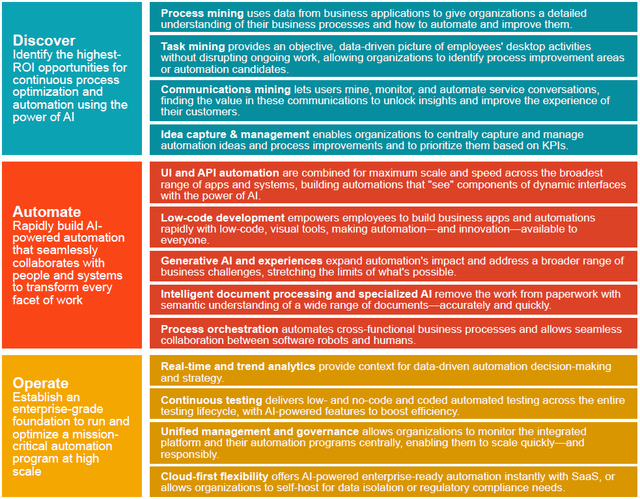

All these use cases benefit from the increased focus on AI. As the founder-CEO puts it:

I want to start by saying that the AI and Gen AI is a tailwind for us. And we have invested significantly over the years and in particular, over last year in Gen AI. In June, we are going to launch our first cities of autopilots in GA.

This being said, I think that AI is creating a little bit of confusion with our customers. And they are evaluating what kind of tasks are better suitable to automate the AI, which task are better with using our platform. But what I hear from many of our customers. It’s actually the combination between Gen AI and automation, it’s something that makes a lot of sense to them. We said it before, but it’s like the human body, and it’s — AI is the brain and our platform is the arms and the legs.

Source: UiPath Inc. Q1 2025 Earnings Call Transcript on Seeking Alpha

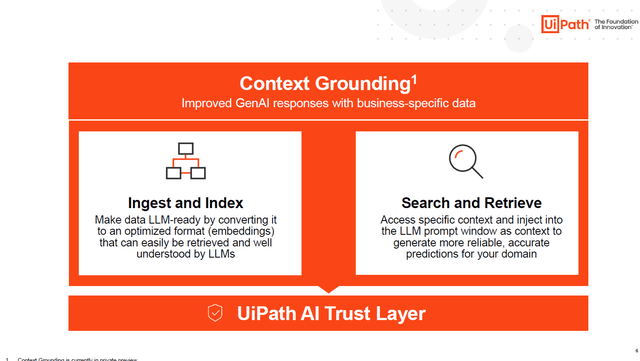

The ability to find and then automate manual processes is of immense value, which become more valuable when such processes can be used to feed LLMs (or large language models).

UiPath Q1 2025 Earnings Presentation

The distinction between AI (artificial intelligence) and automation is an important one. Furthermore, Gen AI (or generative AI) as the application of AI and automation running atop Gen AI makes UiPath’s business model more relevant.

AI is like we said, has always been infused within our platform. So when you look back computer vision, as I talked about, that was embedded deeply within our platform. Task mining. You really need to understand and analyze data at scale and use AI to give the appropriate suggestions and inferences that are there. The advent of Generative AI has given us really an open source set of LLMs to build more efficiently specialized models.

So where does that help us? We’re not building our own general LLMs. We’re really specializing on top of the LLMs that are there. And so what that allows us to do is if you look at Autopilot. Autopilot, we have almost — which is our version of Copilot, generates expressions for our developers to be able to code faster, lowering total cost of ownership and reducing the barriers of entry for automations — for harder and tougher automations. There is a 70% acceptance rate on the expressions that our Autopilot is generating in the hands of our test — of our pilot group.

Source: UiPath Inc. William Blair 44th Annual Growth Stock Conference Transcript on Seeking Alpha

In addition to the AI headwinds, we think the management has build itself a reasonable partner ecosystem to evangelize its product offering. Some of UiPath’s large partners include Microsoft, Accenture, and SAP.

It is notable that much of the business these partners drive is from digital transformation, which feeds a flywheel for UiPath. Processes continue to evolve in response to market demand and companies continuously need to re-invent (read: transform) themselves to stay relevant. Hence, in a manner of speaking, UiPath’s fortunes are increasingly getting tied to the need for digital transformation – and digital transformation is not just moving from paper to computer but continual enhancement of processes.

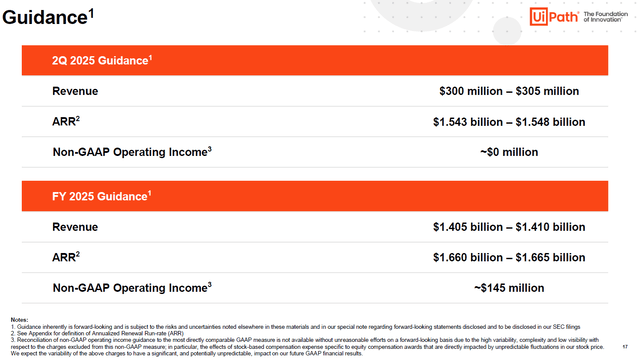

Another interesting element of the business model is the clean balance sheet and strong cash generation. Despite the sales execution challenges, the company has been firm of its guidance of $300 million in FCF for fiscal 2025.

UiPath Q1 2025 Earnings Presentation

We would also want to touch upon the topic of revenue vs FCF. While large deals were affected and some of them are even closing smaller, the company maintained its FCF projection of $300 million.

The first is I want to remind everybody that we follow ASC 606 accounting. And so that — when you have multiyear deals that are impacted, that has a more or an outsized impact to revenue. And you can see that even the differential between our revenue growth rate and our ARR growth rate, right? Within our guidance, we’re talking about a 14% ARR growth rate, which is significantly better than the revenue growth rate for the reasons that the complexities of 606, both deployment as well as duration impacts our accounting.

Source: UiPath Inc. Q1 2025 Earnings Call Transcript on Seeking Alpha

This is a curious observation – while ratable recognition of revenue is well known in ASC 606, the money must come through at the income statement and cash flow level, albeit at different times. If revenue is getting hit, so should the cash collected be hit.

The other way to think about it is from an ARR standpoint: UiPath possibly has annual or multi-year contracts with a floor in place and that ensures collections are stable. (The lack of short-term debt would support the stability in the collections.) However, this school of thought would imply that the added revenue that was coming in previously was FCF neutral – either the margin on it was going to be 0 or the collections would have been questionable. In both the cases, which was possibly bad revenue and getting rid of it, UiPath may have saved itself from a much bigger challenge than just lowering its current guidance.

Valuation

UiPath is not inexpensive at 23-24x 2025E FCF of $300 million (or sub 5% yield). We think that the growth prospects of the company are good and hence we would not be sellers of the stock. It is also worth mentioning that with the macro-economic setup changing there could be potentially better entry points in the stock. We think this is an asset for the long-term and we would hold the stock.

Risks to our thesis

Sales execution issues: If the change in sales compensation is not able to bring about the desired impact to the H2 outlook, the stock could see pressure.

Revenue recognition: If the management is unable to maintain its FCF targets, it would be a major red flag. Furthermore, clarity around how the revenue translates into FCF would be greatly appreciated.

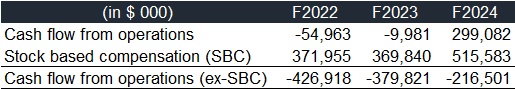

Stock based compensation or SBC: The SBC impact to the cashflow is still significant.

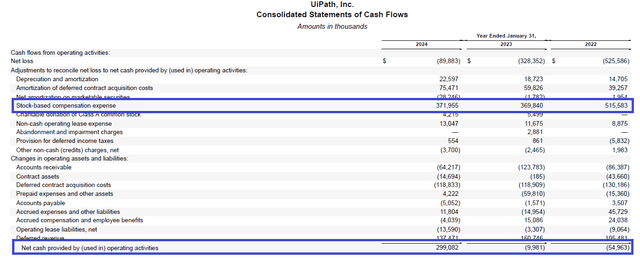

UiPath 10K – 2024 UiPath 10K – 2024, Author’s analysis

The cash flow of the company is highly dependent on deferring the stock grants. While a growth company can afford this for a while fine, continuation of such elevated levels of SBC is risky. As the company matures it will significantly dilute existing shareholders and will also push out GAAP profitability. We draw some comfort from the management commentary around reducing S&M and G&A expenses, which should possibly lead to reduction in SBC going forward.

Conclusion

We think the fundamentals of the business remain intact, as shown by the growth, which experienced a hiccup due to the change in organizational setup. The execution issues around sales appear to have been fixed but the impact of those will really come through in the outlook for H2 and beyond. Furthermore, we think the acknowledgement around inertia having crept in the organization due to bureaucracy was quite credible and was another reason for the ouster of the CEO. Founders are typically quite passionate and in UiPath’s case the founder has also helped grow the company significantly. Hence, we would be quite bullish on him returning to the helm.