DNY59

We previously covered UiPath (NYSE:PATH) in July 2024, discussing its inability to ride the first wave of generative AI monetization, as observed in the sudden management change and the drastically lowered FY2025 guidance.

Despite near-term challenges, the decelerating ARR growth, and moderating dollar-based net retention rate, the SaaS company had reported growing customer base and healthy balance sheet. Even so, we had preferred to initiate a Hold rating then, attributed to the elevated short interest and the higher insider selling over the LTM.

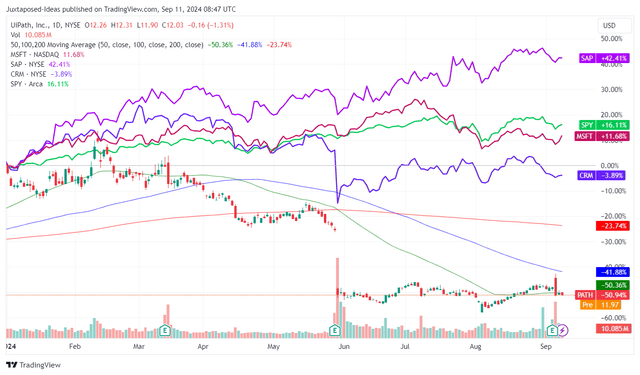

Since then, PATH has underperformed at -6.8% compared to the wider market at -0.7%. This is despite the double beat FQ2’25 earnings call, raised FY2025 guidance, and the growing profitability metrics.

Even so, opportunistic investors may consider adding here indeed, attributed to its cheap PEG non-GAAP ratio, the bullish support observed in its stock prices at $10s, and the recently announced Autopilot partnership.

We shall discuss further.

PATH’s Investment Thesis Is Showing Signs Of Promise, Albeit With A Slower Than Expected Reversal

PATH YTD Stock Price

Trading View

PATH has had a painful YTD performance indeed, as observed in the drastic pullback by end May 2024 as the market overreacted to the mixed FQ1’25 earnings call.

Sentiments remain mixed after the double beat FQ2’25 earnings call and the raised FY2025 guidance as well, attributed to the management’s laser focus on “getting back to a better growth trajectory.”

While the management has highlighted its “go-forward priority will be balancing these investments while expanding non-GAAP operating margin and delivering sustainable investments and delivering sustainable non-GAAP adjusted free cash flow,” the FQ2’25 results remain mixed indeed.

For reference, PATH reported FQ2’25 revenues of $316.25M (-5.6% QoQ/ +10% YoY) and deteriorating adj operating margins of 7.7% (-7.2 points QoQ/ -2.7 YoY).

Much of the top-line tailwinds are attributed to the growing Annual Recurring Revenue [ARR] of $1.551B (+2.8% QoQ/ +18.5% YoY) and net new ARR of $43M (-2.2% QoQ/ -27.1% YoY), with it implying the management’s ability to drive new adoption.

The enterprises’ robust demand has also been observed in PATH’s increasing customers at over $100K ARR of 2,163 (+3.3% QoQ/ +12% YoY) and customers at over $1M ARR of 293 (+1.7% QoQ/ +20% YoY) in the latest quarter.

This development well balances the moderating Dollar-based Net Retention [DNR] rate of 115% (-3 points QoQ/ -6 YoY), attributed to the intensifying robotic process automation [RPA] and AI-powered automation market competition from numerous legacy competitors and startups.

Even so, with a growing multi-year remaining performance obligation of $1.08B by FQ2’25 (-1.8% QoQ/ +20% YoY), we believe that PATH’s near-term prospects remain secure.

If anything, the management has raised their FY2025 guidance to revenues of $1.4425B (+10.2% YoY), adj operating margins of 11.7% (-6.1 points YoY), and adj Free Cash Flow to $325M (+5.1% YoY).

This is up from the lowered numbers of $1.4B (+7.6% YoY), 10.3% (-7.5 points YoY), and $300M (-2.9% YoY) offered in the FQ1’25 earnings call, respectively, thanks to the ongoing restructuring /streamlining efforts.

Assuming that PATH is able to tamp down on its burgeoning expenses while operating at scale, we believe that the SaaS company may be able to achieve the long-term adj operating margin target of 20% indeed.

This may be significantly aided by the SaaS company’s July product releases, which included the integration of Autopilot and LLM capabilities into the automation platform across “the entire testing life cycle from creating user stories to generating test cases and to reporting” while reducing manual work by up to -50%.

With PATH already looking to hard launch Autopilot in Q3’24, we may see the management offer a relatively promising FQ4’25 guidance in the upcoming earnings call – thanks to the new AI monetization opportunities.

The Consensus Forward Estimates

Tikr Terminal

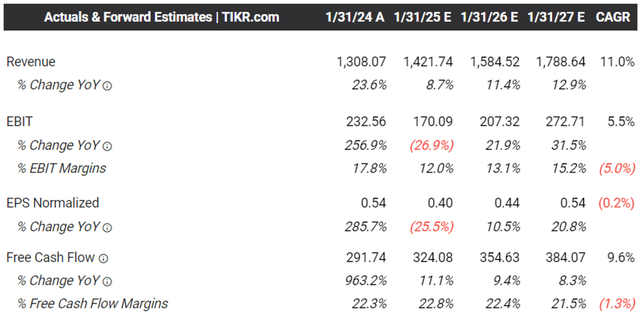

Perhaps this is why the consensus forward estimates appear to be rather promising, with PATH expected to generate an accelerated top/ bottom-line growth after the trough and painful FY2025.

Most importantly, the SaaS company is expected to remain profitable on a Free Cash Flow basis, allowing it to weather the near-term growth deceleration.

This is significantly aided by PATH’s still rich balance sheet at a net cash position of $1.74B (-9.3% QoQ/ -4.3% YoY), with the QoQ/ YoY moderation merely attributed to the $218.75M or the equivalent 2.6% of its float retired in H1’24.

This development naturally “underscoring our confidence in the business, our conviction and the long-term opportunities ahead and our commitment to delivering shareholder value,” with another $500M expansion in its share repurchase program during the FQ2’25 earnings call.

PATH Valuations

Seeking Alpha

Based on the FWD P/E non-GAAP valuations of 30.28x and the adj EPS expansion at a CAGR of +26% between H1’25 annualized adj EPS of $0.34 to the consensus FY2027 adj EPS estimates of $0.54, we believe that PATH’s FWD PEG non-GAAP ratio of 1.16x remains reasonable here.

This is especially when compared to its automation/ AI SaaS peers, such as Microsoft (MSFT) at FWD PEG non-GAAP ratio of 2.31x, SAP SE (SAP) at 3.02x, and Salesforce, Inc. (CRM) at 1.36x, with it implying an excellent margin of safety for those looking to add PATH.

So, Is PATH Stock A Buy, Sell, or Hold?

PATH 2Y Stock Price

Trading View

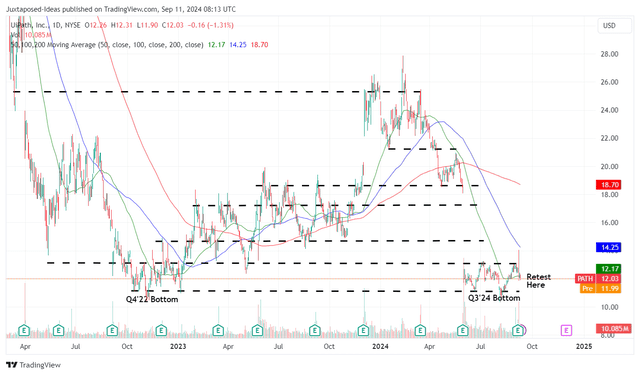

For now, it is apparent that the bulls continue to defend the $10s bottom during the recent market rotation in early August 2024, with PATH currently retesting the intermediate support levels of $12s at the time of writing.

Based on the moderated FWD P/E non-GAAP valuations of 30.28x (down from 37.61x) and the consensus lowered FY2025 adj EPS estimates of $0.54 (down from $0.56), we are looking at an updated (and lower) long-term price target from $21 to $16.30 – with it implying a decent upside potential of +35.4% from current levels.

Even so, while we are cautiously upgrading the PATH stock as a Buy, readers may want to take note of a few caveats to its investment thesis.

Risk Warning

One, PATH’s short interest has been growing to 7.4% by the time of writing, up from the 5.9% reported in early 2024, with it implying further near-term volatility as the CBOE Volatility Index remains elevated.

Two, with the headcount reduction only expected to be completed by FQ1’26 (April 2025), readers may want to temper their near-term expectations on its margin expansion as well, with FY2025 likely to remain a trough and painful year.

Lastly, we believe that PATH’s reversal is likely to be prolonged, attributed to the slower (but steady) AI monetization.

While Autopilot may potentially drive new growth opportunities, we believe that the impact on the second half FY2025 performance is likely to be muted with any material contribution likely only by FY2026, with readers well advised to monitor the management’s guidance in the upcoming earnings call.

As a result, it goes without saying that PATH is only suitable for investors with longer investing trajectory, since the stock is likely to trade sideways in the near-term.