uschools

This is an update of my macroeconomic analysis on the interest rates and a possible recession ahead. Most analysts agree that US GDP growth is slowing down. The labor market is not as strong as it used to be, the inflation data are not as worrying as they once were, while the Fed is now more dovish. As Nobel winner Joseph Stiglitz says, the Fed raised rates ‘too far, too fast‘—and now needs to cut big. In other words, in order to enable the soft landing, the Fed has to cut the interest rates very fast. Otherwise, it might be too late to prevent the coming recession. In this article, I will cover the recent macroeconomic statistics, present the different scenarios under the current economic conditions, and also provide a few tips for investors on the best course of action.

My previous article about US interest rates

When I wrote my previous analysis about the Fed’s cuts, the Fed was expected to cut interest rates only once in the fourth quarter of 2024. Now, the Fed is expected to cut the rates on Wednesday this week. Wednesday will still be September and only the third quarter of 2024. Moreover, more rate cuts will likely follow because right now, the rates are at their multi-year highs and everyone is worried about the coming recession. Like a couple of months ago, when my previous article was published, US macroeconomic statistics show decreasing inflation. Like before, the unemployment rate is reasonably low but gradually increasing. I would personally recommend investors grow more cautious and conservative, while staying away from overvalued companies. But let me explain this later in this article.

US macroeconomic statistics

Let me discuss the actual macroeconomic statistics.

First, I would like to talk about inflation numbers, the most closely watched for data.

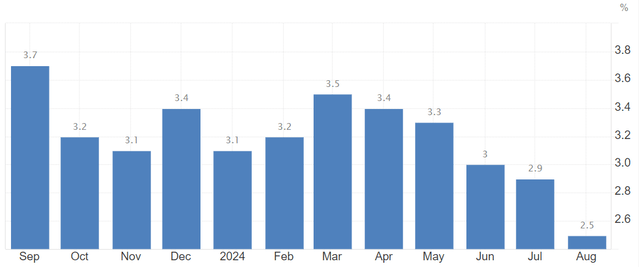

General US inflation rate—annual inflation rate

The general inflation rate is near this year’s lows. The Fed’s inflation target is 2%. The number of 2.5% is very close to this ideal number.

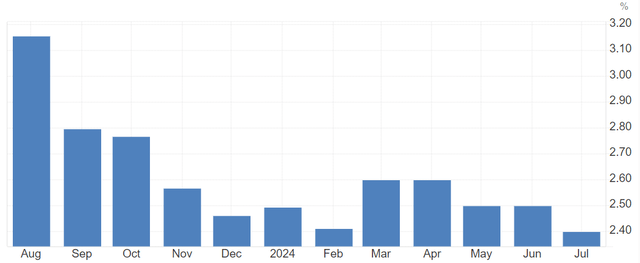

As concerns the consumer price index year-on-year changes (CPI inflation, in other words, one of investors’ most closely watched macroeconomic indicators), its growth has clearly slowed down.

CPI Core (YoY)

Also, the core PCE index is the Fed’s favorite inflation measure. It excludes the two most volatile indicators, namely food and energy and allows seeing the general inflation trend.

Core PCE Index

We can clearly see that the index is hardly rising, meaning that PCE inflation has also decreased.

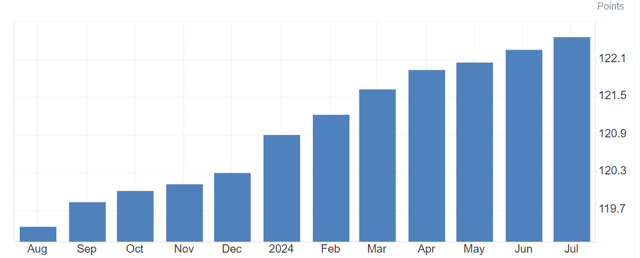

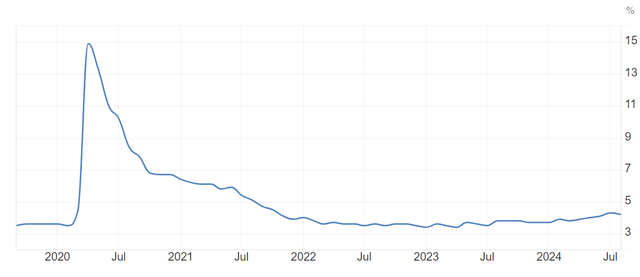

US unemployment rate

The US unemployment rate is still reasonably low, albeit not as low as it used to be in November or December last year. On the 5-year graph, we can see that the unemployment rate is just slightly rising.

US unemployment rate

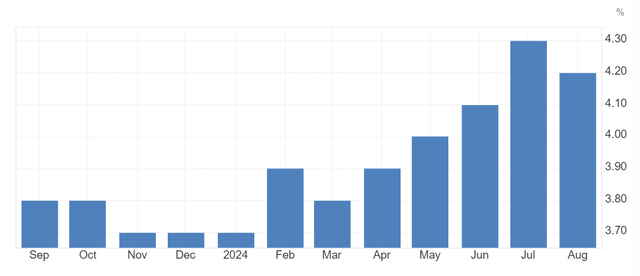

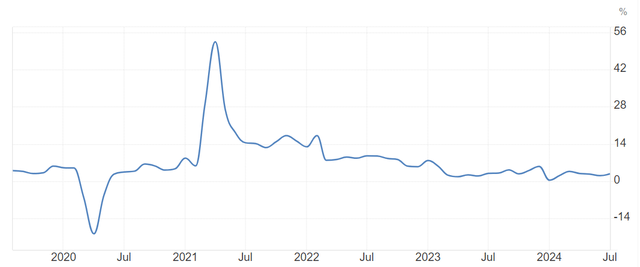

The retail sales, however, present the most worrying picture. These are really low compared to the ones recorded in the years 2021 and 2022.

US retail sales YoY

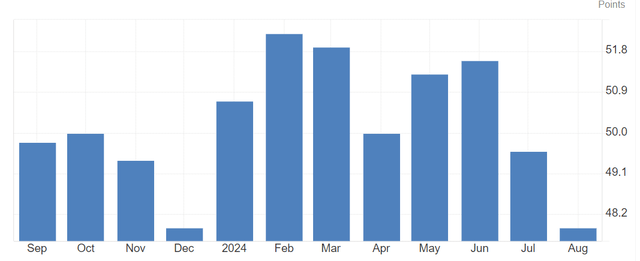

The US manufacturing PMI index showing manufacturing activities is pointing towards contraction, currently standing at about 48.

US Manufacturing PMI

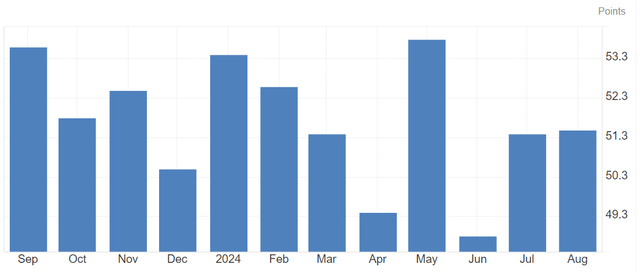

The US Non-Manufacturing PMI showing services activities is currently standing at 51.3. Although it is expanding, it is doing so at a very slow pace.

US Non-Manufacturing PMI

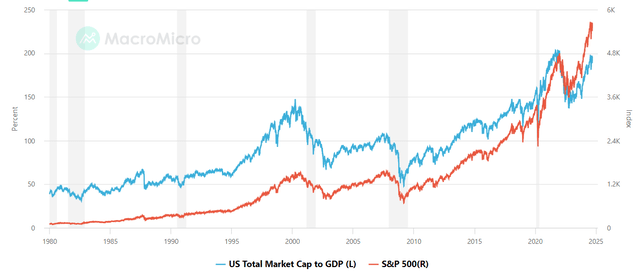

It is also important to judge how overheated the US stock market is. Normally, if there are asset bubbles, it is a sign of an economic boom, the stage of the economic cycle just preceding a recession. One of the ways to judge if the stock market is overvalued is by using the so-called Buffett indicator, which compares the total market capitalization of all US stocks with the quarterly output of the US economy. The stock market is fairly valued if the total value of the Wilshire 5000 index (which measures the total market) is about on par with the latest quarterly GDP estimate. If shares trade at about 70% of GDP, they are considered to be undervalued. If the market cap is at about twice the size of the economy, this is considered a major threat.

Right now, the indicator is near all-time highs. Only in 2021 was the Buffett indicator higher.

Soft landing

Soft landing is still in the cards, of course. This is well possible if the Fed eases very fast. After all, economic cycles tend to last longer than 4 years. The last recession we had was in 2020 during the Covid-19 pandemic.

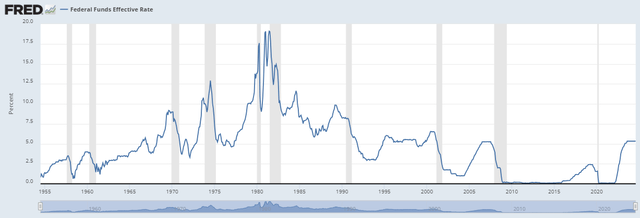

As can be seen from the graph below (recessions are shaded areas on the diagram), in most of the instances, economic cycles—periods between recessions—tend to last about ten years. In the past, however, economic cycles were somewhat shorter. But then, after the 1980s, the cycles got longer, meaning we have been enjoying longer periods of stability for a while. Let us hope that something similar might actually happen now.

As can be also seen from this graph above, recessions mostly happen when the interest rates are near record highs. If the Fed eases in a timely manner, no recession will happen, it seems.

After the monetary conditions get tighter, they soon ease, something which is about to happen right now.

For the first time, the Fed can cut the interest rates by 0.50%, something that JPMorgan Chase (JPM) and Joseph Stiglitz suggest is reasonable. Rather, slowing job growth and reasonable inflation numbers demand a rate cut, it seems. However, easing too fast can dramatically raise the money mass in the US economy, thus making inflation numbers increase dramatically. This is another extreme that should be avoided.

Hard landing

“Hard landing,” also known as an economic crisis, is another possible scenario. This can happen if the Fed does not ease fast enough, in my opinion. Apart from certain macroeconomic factors, tight monetary conditions can also be a sign that a recession is near. But there could also be external, unexpected “black swan” events, including a possible inflation surge (like the 1970s oil price surge), market volatility due to elections, wars and any additional political tensions, such as the worsening of a trade war between the US and China or the US and Russia. Add to that the fact that there are asset bubbles. In other words, the stock market is highly overvalued despite the worsening macroeconomic conditions. Overheated asset markets and tight monetary conditions usually lead to recessions. In some cases, there could be a combination of factors. For example, the US economy can slow down due to geopolitical tensions, but the Fed might cut the interest rates too slowly, thus making the stock market panic, which can harm most investors’ portfolios.

Where to invest now?

The key question here is what to do about that. Choosing where to invest depends on how conservative you are. Most investors expect lower interest rates ahead, and some predict a recession is near. In this case, it is worthwhile to consider buying precious metals. These are already appreciated, especially gold, but they have much further room to run. I wrote many times in my previous articles that gold was cheap relative to the liquidity that was available on the market. Silver is now much cheaper than gold. But for those investors unwilling to buy precious metals but wishing to avoid portfolio losses, it is a very good idea to cut stakes in overvalued companies and bank stocks. Overvalued growth stars tend to plunge in value when the economy is slowing down, but the most significant stock market crash happens when there is an economic crisis.

Conclusion

In conclusion, I would say that a soft landing of the US economy is a likely scenario. But in this case, the interest rates would have to be decreasing at quite a fast pace. If there is no soft landing of the economy, meaning a likely recession ahead, then the Fed would probably have to decrease the rates dramatically the way it did during the 2020 crisis. In either case, investors should brace for lower interest rates ahead. However, I would not personally invest too much money in growth stocks because these do not do well during crises. But I would instead opt to buy precious metals, even though these have already appreciated significantly. Yet, these still have substantial growth potential.