JHVEPhoto

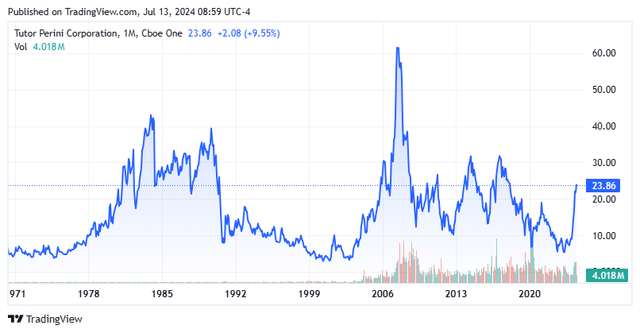

I have money on construction giant Tutor Perini (NYSE:TPC) several times over the past years by establishing a position in the stock via covered call orders whenever the equity has a significant dip, which has happened a few times over that the past half decade. I am not currently in the shares as my previous holdings have expired in the money. In recent months, the stock has had a huge up move after blowout Q1 results. Several insiders have used the rally to substantially reduce their holdings in the equity. Has the stock become overbought? An analysis follows below.

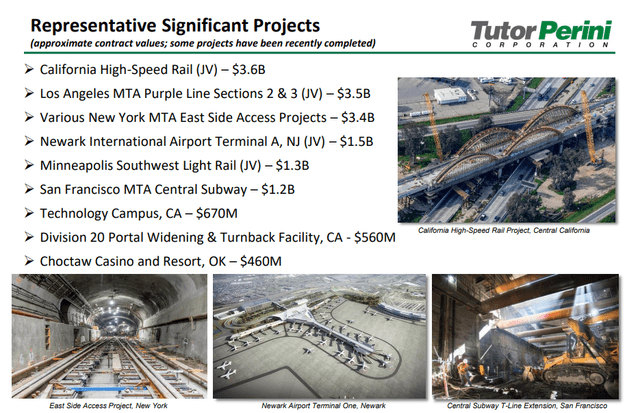

May 2024 Company Presentation

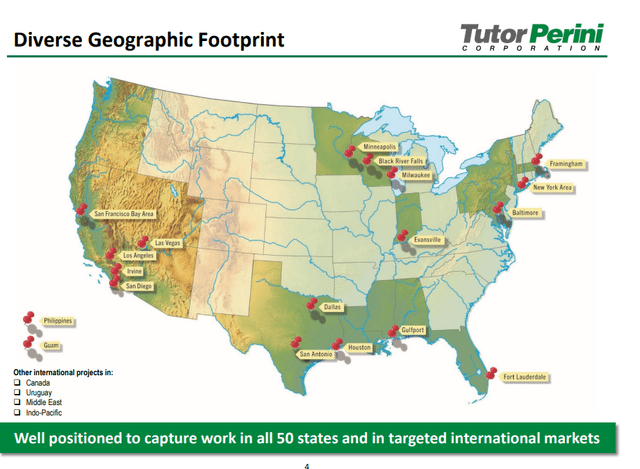

Tutor Perini is headquartered in California and operates out of three primary business segments: Civil, Building, and Specialty Contractors. Tutor Perini provides diversified general contracting, construction management, and design-build services. It serves both private and governmental agencies and has benefited from all the infrastructure largess Congress has bestowed in the last few years via legislation. The stock trades around $24.00 a share and sports an approximate market capitalization of $1.25 billion.

May 2024 Company Presentation

Recent Results:

Tutor Perini posted its Q1 numbers on April 25th. It was one of Tutor Perini’s best quarters in recent memory. The company posted a GAAP profit of 30 cents a share, when the consensus was expected a bit over 15 cent a share loss. The company posted net income of $15.8 million for the quarter, compared to a net loss of $49.2 million in 1Q2023.

Revenues rose just over 35% on a year-over-year basis to $1.05 billion, besting expectations by some $175 million. Revenues were boosted nicely by two mass-transit projects in California.

As mentioned previously, the company is benefiting from increased governmental spending on infrastructure, and its order backlog increased 26% from the same period a year ago to some $10 billion. Here is how annual revenue and current backlog breaks down across the company’s three business segments.

May 2024 Company Presentation

Analyst Commentary & Balance Sheet:

Despite a decent market capitalization, only two analyst firms have offered up commentary on the shares in 2024. B. Riley Financial maintained its Buy rating on TPC on June 5th and significantly raised its price target on the stock from $17 to $26 a share. On June 14th, UBS upgraded the shares from a Neutral to a Buy and pushed its price target sharply higher from $14 to $27 a share.

Insiders sold just under $1.5 million worth of shares collectively in the first four months of the year, in the low teens. However, once the stock moved up to the $19 to $21 a share range following first quarter results, they have sold nearly $10 million worth of equity in total. Two officers and a director have disposed of the majority of their stakes in the company. Tutor Perini listed nearly $360 million in cash and marketable securities on first quarter 10-Q. It also noted $780 million of long-term debt.

In the first quarter, the company generated $98.3 million worth of operating cash flow, a huge increase from the just over $21 million in operating cash flow. Cash flow was helped by $50 million of collections that were associated with certain recently concluded settlement negotiations or dispute resolutions in the quarter. This surge in cash flow helped the company successfully completed a debt refinancing in April of this year. Tutor Perini retired all $500 million of its 6.875% senior notes due in 2025. To do this, the company issued $400 million of debt due in 2029 with nearly a 12% coupon. AKA, interest costs will be much higher on the current debt than the old debt. Management also extended its current credit facility to 2027 as part of this effort.

Conclusion:

Tutor Perini lost $3.30 a share on $3.88 billion in revenues in FY2023. The current analyst consensus has the construction concern swinging to profit of $1.15 a share in FY2024 on sales of $4.55 billion in revenues. They project $1.70 a share in earnings in FY2025 on sales growth in the high single digits.

Seeking Alpha

As I noted in my opening narrative, I have traded in and out of TPC via covered call orders successfully for years. This simply is a company that can’t stand prosperity. Every time things seem to be going well, the company has an overrun on a major project, finds itself locked in litigation or the economy hits a recession. As you see from the chart above, the stock basically trades at the same levels as it was in 2005 and management has created no long-term shareholder value.

Therefore, historically, it has paid to buy the dips and sell the rips. With this cyclical concern trading north of 20 times forward earnings after a 70% post Q1 results rally, and insiders selling, I doubt it will any different this time around.