LukaTDB

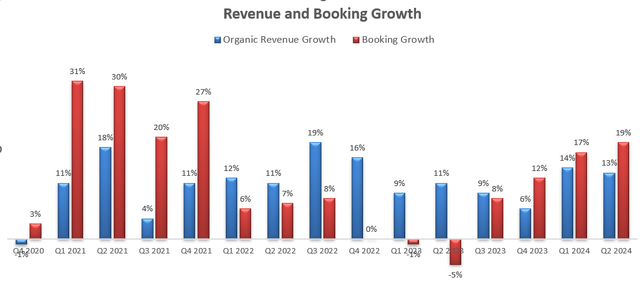

Since I presented my ‘Strong Buy’ thesis on Trane Technologies (NYSE:TT) in March 2024, the stock price has surged by more than 14%, significantly outperforming the S&P 500 index (SPX). I highlighted Trane’s strong commercial HVAC growth driven by energy efficiency. The company released its Q2 result on July 31st with 19% growth in orders and 13% growth in revenue. As I think the economy is more likely to enter an interest rate downcycle in FY25, I argue Trane Technologies’ new residential business will benefit from a lower interest rate environment. I reiterate a ‘Strong Buy’ rating with a one-year price target of $380 per share.

Strong Backlog Supporting Near-term Growth

Trane Technologies achieved a record backlog of $7.5 billion, growing at 19% organically during the quarter, as depicted in the chart below. My biggest takeaway during the quarter is their strong backlog will support the growth through both FY24 and FY25.

Trane Technologies Quarterly Earnings

The strong backlog growth was driven by the following factors:

- Over the past three years, Trane Technologies has been investing in their commercial HVAC business, focusing on some high-growth verticals such as data centers and semiconductor fabs. Over the earnings call, the management expressed strong confidence in the growth momentum within these verticals. The company has been tracking 14 different verticals in their commercial HVAC market, and Trane Technologies has experienced growth across all of them.

- Trane Technologies has been promoting their applied technology for commercial customers. They disclose that the applied HVAC business grew by 90% on a three-year stack basis, and the management estimates that applied HVAC can generate 8-10x more equipment and service revenue over the lifetime. As such, the fast growth in applied HVAC can boost both equipment and aftermarket revenues.

- Trane Technologies has actively launched new products to shorten HVAC replacement cycle. For instance, on March 26th, 2024, the company announced a completely new residential HVAC and heat pump portfolio, offering better energy efficiencies. These new products are expected to drive demand for replacement, and come with higher gross margin.

Residential business

As mentioned in my previous article, Trane Technologies’ new residential business in the U.S. market faced growth challenges due to the high interest rates and weak housing starts.

Despite these headwinds, Trane Technologies delivered a stronger than expected result in the U.S. residential market, and expects the revenue will grow by mid-single-digit for the full year. While the management remains cautiously optimistic about the U.S. new residential market, Trane Technologies has been benefiting from moderating channel inventories and a strong start to the cooling seasons, as noted over the earnings call.

I think the Fed is more likely to reduce the interest rate this September, bringing the economy into an interest-rate downcycle in 2025. The housing market might gradually recover when the interest rate moves down, which will stimulate the demand for residential HVAC and heat pump market. In this context, I view Trane Technologies as a potential beneficiary of the interest rate cut.

Outlook and Valuation

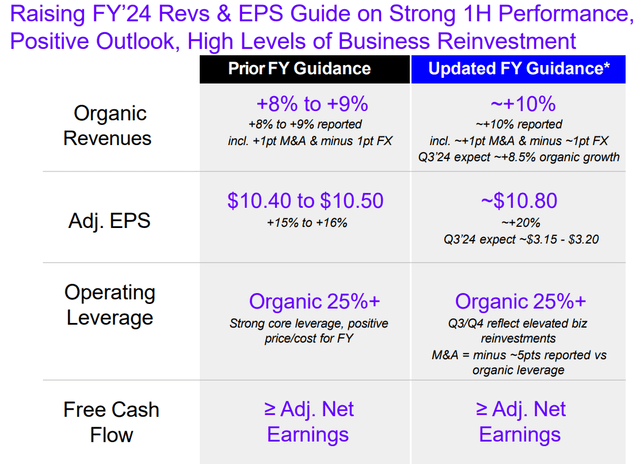

Due to strong revenue and backlog growth, the company raised guidance for both topline and EPS for FY24, as detailed in the slide below.

Trane Technologies Investor Presentation

My considerations for their near-term growth can be summarized as follows:

- Trane Technologies has 2.8 billion in backlogs booked for 2025, and I estimate the new bookings will account for more than 13% of total revenue in FY25. It’s worth noting that the backlog only contains equipment and does not include any services. Historically, Trane Technologies has maintained a high service attach rate, especially among commercial customers.

- Trane Technologies achieved 2% growth from pricing during the quarter, which aligns with historical averages. Trane Technologies has significant pricing power over both residential and commercial customers due to their leading technology, better energy efficiency, brand strength as well as extensive service networks. I anticipate the company will continue to achieve 2%-3% pricing growth in the near future.

- Grand View Research predicts that the U.S. HVAC market will grow at a CAGR of 7.4% from 2024 to 2030. I trust Trane Technologies can outpace overall market growth, driven by their applied technology, pricing power and strong service capabilities.

- I assume Trane Technologies will allocate 4% of total revenue towards acquisitions, contributing 2% to the overall topline growth.

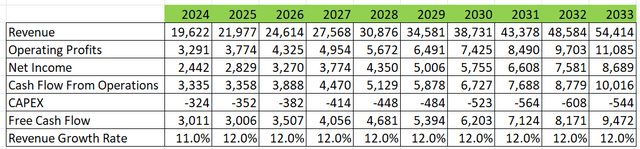

Taking into account all these considerations, I estimate Trane Technologies’ revenue will grow by 12% annually. I model 40bps annual margin expansion, driven by:

- 20bps gross margin improvement due to price increase, service business growth and applied HVAC penetration growth.

- 10bps operating leverage from SG&A.

- 10bps from the cost-optimization initiatives, including back-office consolidation and supply chain optimizations.

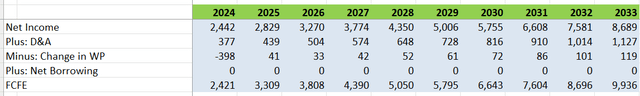

The DCF can be summarized as follows:

I calculate the free cash flow from equity (FCFE) as follows:

The cost of equity is estimated to be 12% assuming: risk free rate 3.7%; beta 1.19; equity risk premium 7%. Discounting all the FCFE at 12%, the one-year target price is calculated to be $380 per share, according to my DCF model.

Key Risks

Trane Technologies has some HVAC business in China, with exposure to the local property market. They disclosed that China represents around 5% of total revenues, and the growth rate has been quite bumpy in the past. The management expressed a very cautious outlook on the Chinese property market, noting that they don’t think the end-market has bottomed out yet. As such, they don’t anticipate any market recovery in the second half of the year.

In addition, Trane Technologies’ transport revenue declined by high teens during the quarter, due to a tough comparable last year. The transport business has been very volatile in the past, as it is driven by capital expenditure cycles. Investors should be prepared for earning volatilities in this segment going forward.

Closing Thoughts

Trane Technologies’ strong backlog growth provides a solid foundation for their revenue growth in FY24 and FY25, and I favor the company’s pricing power, applied technology as well as strong service/aftermarket business. I reiterate a ‘Strong Buy’ rating with a one-year price target of $380 per share.