SusanneB

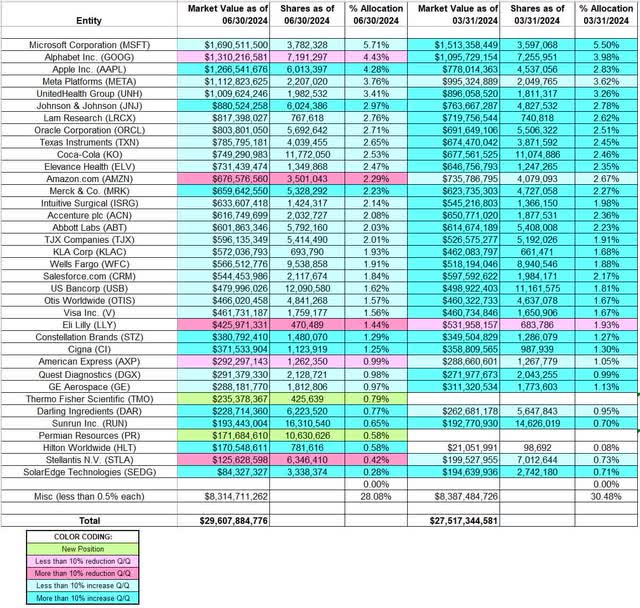

This article is part of a series that provides an ongoing analysis of the changes made to GMO’s 13F stock portfolio on a quarterly basis. It is based on GMO’s regulatory 13F Form filed on 08/13/2024. Jeremy Grantham’s 13F portfolio value increased from $27.52B to $29.61B this quarter. The portfolio is diversified with recent 13F reports showing well over 500 different positions although most of them are very small. There are 36 securities that are significantly large (more than 0.5% of the portfolio each) and they are the focus of this article. The largest five stakes are Microsoft Corporation, Alphabet, Apple, Meta Platforms, and UnitedHealth. They add up to ~21% of the portfolio. Please visit our Tracking Jeremy Grantham’s GMO Portfolio series to get an idea of their investment philosophy and our last report for the fund’s moves during Q1 2024.

As of June 30 2024, GMO’s 7-year asset class real return forecast is for US Large Cap asset class to have a negative 4.9% annualized return on one end and Emerging Value asset class to have a positive 3.9% annualized return at the other extreme. The firm currently has ~$85B under management, a far cry from ~$120B that they had at the peak. The assets are distributed among separately managed, institutional, and mutual fund accounts. Their flag ship mutual fund is GMO Benchmark-Free Allocation Fund (MUTF:GBMFX) which was incepted in 2003. They also offer an ETF that track “quality” stocks – GMO U.S. Quality ETF (NYSEARCA:QLTY).

Note 1: It was reported in December 2020 that Jeremy Grantham has a ~4.8M share stake in QuantumScape (QS). The ~$12.5M investment was made around 2012 as part of a series of bets on early-stage “green technology” companies.

Note 2: Jeremy Grantham has repeatedly said the US stock market is in a bubble since June 2020.

New Stakes:

Thermo Fisher Scientific (TMO): TMO is a 0.79% of the portfolio position purchased this quarter at prices between ~$541 and ~$599. The stock currently trades just above that range at ~$604.

Permian Resources (PR): The 0.58% PR stake was established this quarter at prices between $15.04 and $17.86 and the stock is now below that range at $14.17.

Stake Increases:

Microsoft Corporation (MSFT): MSFT is currently the top position in the portfolio at 5.71%. It is a very long-term stake. The 2007-2008 period saw the stake build from ~5.6M shares to over 59M shares at prices between $19 and $35. The position size peaked in 2011 at ~68M shares. The next four years saw the stake sold down by ~80% at prices between $28 and $56. Recent activity follows: the three years through Q3 2020 saw a ~70% selling at prices between ~$88 and ~$232. The position was increased by 20% in the last quarter at prices between ~$366 and ~$429. The stock currently trades at ~$416. This quarter also saw a ~5% increase.

Apple Inc. (AAPL): AAPL is now a top three 4.28% long-term position. It was a large stake in 2005 but was sold down in the next year. The position was rebuilt in 2007 but was again sold down the next year. Similar trading pattern continued over the next several years. The four years through 2019 saw a ~75% reduction at prices between ~$23 and ~$82. Q3 2020 saw another ~30% selling at prices between ~$91 and ~$134. That was followed with a ~20% reduction during Q3 2022 at prices between ~$137 and ~$175. The position was increased by 42% in the last quarter at prices between ~$169 and ~$195. There was a one-third further increase this quarter at prices between ~$165 and ~$216. The stock is now at ~$225.

Meta Platforms (META): META is a top three 3.76% of the portfolio position purchased in Q1 2018 at prices between ~$160 and ~$190. The stake had seen incremental buying since. The three quarters through Q4 2022 saw a ~125% stake increase at prices between ~$90 and ~$235. The next three quarters saw a ~40% selling at prices between ~$127 and ~$326. The stock is now at ~$532. There was marginal trimming during Q4 2023 while in the last quarter there was a ~10% increase. This quarter also saw a ~8% increase.

UnitedHealth Group (UNH): The top five 3.41% of the portfolio stake in UNH was already a very large ~18M share position in 2005. The position size peaked in 2007 at over 20.5M shares. The five years through 2019 had seen a ~75% selling at prices between $102 and $296. That was followed with a ~25% reduction in Q2 2022 at prices between ~$452 and ~$546. Q2 2023 saw a ~20% stake increase at prices between ~$458 and ~$526. The next quarter also saw a ~13% stake increase and that was followed by a minor ~4% increase during Q4 2023. The position was increased by 14% in the last quarter at prices between ~$471 and ~$543. That was followed by a ~10% further increase this quarter at prices between ~$437 and ~$522. The stock is now at ~$579.

Johnson & Johnson (JNJ): JNJ is a very long-term stake. In their first 13F filing in 2005, the position was at ~170K shares. The sizing peaked at around 26M shares in 2009. The stake was sold down by ~40% in 2014 at prices between $88 and $109. 2016 saw another ~50% selling at prices between $97 and $125. Recent activity follows. There was a one-third increase in Q3 2022 at prices between ~$161 and ~$180. That was followed by a ~25% further increase during the two quarters through Q3 2023 at prices between ~$154 and ~$175. The position was increased by 21% in the last quarter at prices between ~$155 and ~$163. This quarter saw a ~25% further increase at prices between ~$143 and ~$157. The stock currently trades at ~$162 and the stake is at ~3% of the portfolio.

Lam Research (LRCX): The 2.76% LRCX stake was built in Q3 2020 at prices between ~$294 and ~$385 and the stock is now at ~$836. There was a ~15% selling during Q4 2023 while in the last quarter there was a similar increase. There was a minor ~4% further increase this quarter.

Oracle Corporation (ORCL): The 2.71% ORCL position is a very long-term stake. The position was already at around 14M shares in 2007. The next two years saw the stake built to a much larger 62M share position at prices between $15.50 and $24.50. Next few years saw selling at higher prices and by 2017 the stake was back at 14M shares. Recent activity follows. The three quarters through Q2 2022 saw a ~30% selling at prices between ~$64 and ~$104. The position was increased by 20% in the last quarter at prices between ~$102 and ~$129. The stock is currently at ~$138. There was a minor ~3% increase this quarter.

Texas Instruments (TXN): TXN is a 2.65% of the portfolio position. The majority of the stake was purchased in Q3 & Q4 2016 at prices between $63 and $75. There was a ~20% stake increase in Q1 2022 at prices between ~$163 and ~$191. Q3 2023 saw a ~15% stake increase at prices between ~$157 and $183. That was followed by a ~25% increase in the next quarter at prices between ~$141 and ~$172. The last quarter saw another ~21% increase at prices between ~$156 and ~$174. The stock currently trades at ~$204. There was a minor ~4% further increase this quarter.

Coca-Cola (KO): KO is a 2.53% of the portfolio stake. The position was already a large 7M share stake in 2005. That original stake was built to 23.7M shares during the 2007-2008 timeframe at price between $20 and $32. The sizing peaked at almost 39M shares in 2012. The next five years saw the position sold down by ~90% to a ~3.7M share stake at prices between $37 and $47. Recent activity follows. Q2 2022 saw a ~40% reduction at prices between ~$59 and ~$66. There was a ~18% stake increase during Q3 2023 at prices between ~$56 and ~$63. That was followed by a ~20% increase in the next quarter at prices between ~$52 and ~$60. The last quarter saw another one-third increase at prices between $58.44 and $61.18. The stock is now at $69.33. This quarter also saw a ~6% stake increase.

Elevance Health (ELV): ELV position was first purchased in 2014. The bulk of the current 2.47% portfolio stake was established in 2017 at prices between $144 and $232. There was a roughly one-third selling in H1 2022 at prices between ~$428 and ~$530. Q2 2023 saw a ~16% stake increase at prices between ~$436 and ~$496. The position was increased by 36% in the last quarter at prices between ~$463 and ~$520. The stock currently trades at ~$543. There was a ~8% further increase this quarter.

Merck & Co. (MRK): MRK is a very long-term stake. In 2014, it was sold down to a very small position at prices between $50 and $62. The stake was rebuilt in H1 2018 at prices between $53 and $63. Recent activity follows. Q2 2023 saw a ~20% increase at prices between ~$106 and ~$118. That was followed by a ~11% increase in the next quarter. The position was increased by 17% in the last quarter at prices between ~$113 and ~$132. That was followed by a ~13% increase this quarter at prices between ~$124 and ~$133. The stock currently trades at ~$117, and the stake is at 2.23% of the portfolio.

Intuitive Surgical (ISRG): ISRG is a 2.14% of the portfolio position purchased in Q2 2022 at prices between ~$191 and ~$306. There was a ~50% stake increase during Q2 2023 at prices between ~$254 and ~$342. That was followed by a ~25% increase during Q4 2023 at prices between ~$259 and ~$338. The position was increased again by 20% in the last quarter at prices between ~$322 and ~$401. The stock currently trades at ~$490. This quarter saw a minor ~4% further increase.

Accenture plc (ACN): ACN became a significant part of the portfolio during the 2013-2014 timeframe when around 3.8M shares were purchased at prices between $69 and $85. The next five years saw a combined ~50% reduction through minor selling most quarters. The two quarters through Q3 2021 saw another ~24% reduction at prices between ~$295 and ~$415. H1 2023 saw a ~27% increase at prices between ~$246 and ~$324. The position was increased by 18% in the last quarter at prices between ~$333 and ~$385. The stock currently trades at ~$331 and the stake is at ~2% of the portfolio. There was a ~8% increase this quarter.

Abbott Labs (ABT): The ABT stake saw a ~28% increase during Q3 2023 at prices between ~$95 and ~$114. That was followed by a ~20% increase in the next quarter at prices between ~$90 and ~$110. The position was increased by 24% in the last quarter at prices between ~$109 and ~$120. The stock is now at ~$112. There was a ~7% further increase this quarter.

TJX Companies (TJX): TJX is a ~2% of the portfolio position that has been in the portfolio for well over fifteen years. The position has wavered. H1 2020 saw a ~25% stake increase at prices between ~$37 and ~$63. The last quarter saw another ~20% increase at prices between ~$91 and ~$101. The stock is now at ~$119. There was a minor ~4% further increase this quarter.

Wells Fargo (WFC): The ~2% WFC position was purchased in Q3 2017 at prices between $49.50 and $56. Q1 2020 saw a ~25% stake increase at prices between ~$25 and ~$49. That was followed with a ~30% stake increase in Q4 2020 at prices between ~$21 and ~$30. There was a ~18% selling over the next two quarters at prices between ~$30 and ~$48. Q4 2022 saw another ~27% reduction at prices between ~$40 and ~$48. The position was increased by 21% in the last quarter at prices between $45.85 and $57.63. The stock is now at ~$56. There was a ~7% further increase this quarter.

Salesforce.com (CRM): The 1.84% CRM stake was increased by ~30% over the last two quarters at prices between ~$197 and ~$317. The stock currently trades at ~$259. This quarter also saw a ~7% increase.

U.S. Bancorp (USB): USB stake was purchased in 2017 at prices between $50 and $56. Q1 2020 saw a ~50% stake increase at prices between ~$29 and ~$55. There was a ~30% selling during Q1 2023 at prices between ~$33 and ~$50. The next quarter saw a ~17% increase at prices between ~$29 and ~$36. That was followed by a ~12% increase during Q3 2023 at prices between ~$32 and ~$40. The position was increased by 40% in the last quarter at prices between $39.46 and $44.70. The stock is now at $44.19, and the stake is at 1.62% of the portfolio. This quarter also saw a ~8% increase.

Constellation Brands (STZ), Cigna (CI), Darling Ingredients (DAR), GE Aerospace (GE), Hilton Worldwide (HLT), KLA Corp (KLAC), Otis Worldwide (OTIS), Quest Diagnostics (DGX), Sunrun Inc. (RUN), SolarEdge Technologies (SEDG), and Visa Inc. (V): These stakes (less than ~2% of the portfolio each) were increased this quarter.

Note: they have a significant ownership stake in Sunrun.

Stake Decreases:

Alphabet Inc. (GOOG): GOOG is a top three 4.43% position. The long-term stake was built during the 2007-2014 timeframe at low prices. The position size peaked in 2014. Since then, the stake was reduced at prices between ~$25 and ~$150. There was a ~25% stake increase during Q1 2023 at prices between ~$87 and ~$109. That was followed by a ~13% increase during Q4 2023. The position was increased by 28% in the last quarter at prices between ~$133 and ~$155. The stock currently trades at ~$166. There was marginal trimming this quarter.

Amazon.com (AMZN): The 2.29% AMZN stake saw a huge ~130% stake increase during Q4 2022 at prices between ~$82 and ~$121. That was followed by a ~25% increase in the next quarter at prices between ~$83 and ~$113. The three quarters through Q4 2023 saw minor trimming while in the last quarter there was a ~4% increase. There was a ~14% selling this quarter at prices between ~$174 and ~$198. The stock currently trades at ~$176.

Eli Lilly (LLY): The 1.44% LLY stake was sold down by ~30% this quarter at prices between ~$724 and ~$909. The stock currently trades at $954.

American Express (AXP), and Stellantis N.V. (STLA): These positions (less than ~1% of the portfolio each) were reduced during the quarter.

Note: GMO has significant ownership stakes in the following businesses: Ameresco (AMSC), Aemetis (AMTX), Adecoagro (AGRO), Clean Energy Fuels (CLNE), Green Plains (GPRE), GrafTech (EAF), and Kosmos Energy (KOS).

Below is a spreadsheet that shows the changes to Jeremy Grantham’s GMO Capital 13F portfolio holdings as of Q2 2024:

Jeremy Grantham – GMO Capital – Q2 2024 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from GMO Capital’s 13F filings for Q1 2024 and Q2 2024.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.