ilkercelik

Investment Thesis

Historically we’ve had cycles of small-caps overperforming large-caps and vice versa. Currently, we come from a cycle of more than a decade of large-caps performing better and I believe that there’re signs to think that the next years may be good for small-caps, not only because of their valuation in relation to large-caps, but also because of its valuation with respect to its own historical average and the macroeconomic moment in which we live.

Although exposing yourself to a leveraged ETF is highly risky, this (NYSEARCA:NYSEARCA:TNA) would serve to benefit from a hypothetical start of a rally with the 3x leverage.

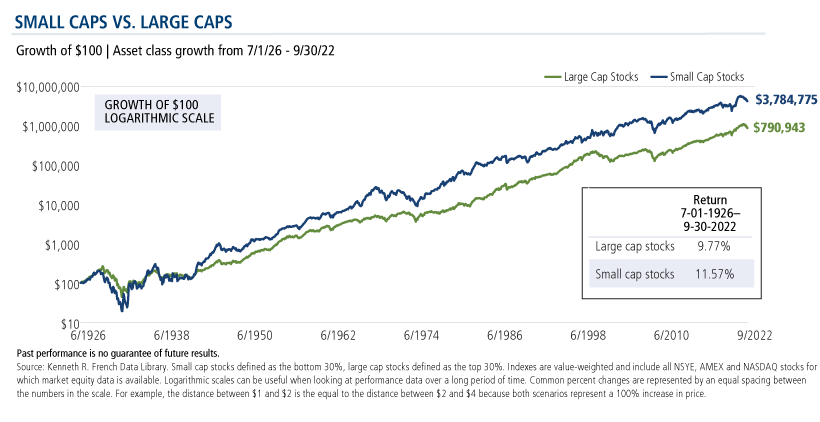

Small-Caps Overperform Over Time

In recent years it seems that the norm has been to invest in the largest companies in the US market to have better returns than average, investing in the once called FAANG, now known as rhe Magnificent 7 (Microsoft, Apple, Nvidia, Tesla, Google, Meta, Amazon). But, if we analyze history, this hadn’t always been the case and the capitalizations that usually have the best performance are the small ones.

This makes sense and is somewhat intuitive. Usually a small company has more possibilities to grow its sales than a large one, going from $10M to $100M isn’t the same as going from $10B to $100B in revenue.It’s also usually easier to expand margins over time because the company start from a smaller base and once the company performs well over time, it ends up being discovered by more investors, increasing the valuation multiple due to demand for its stocks.

Small-caps vs Large-caps (Calamos Investments)

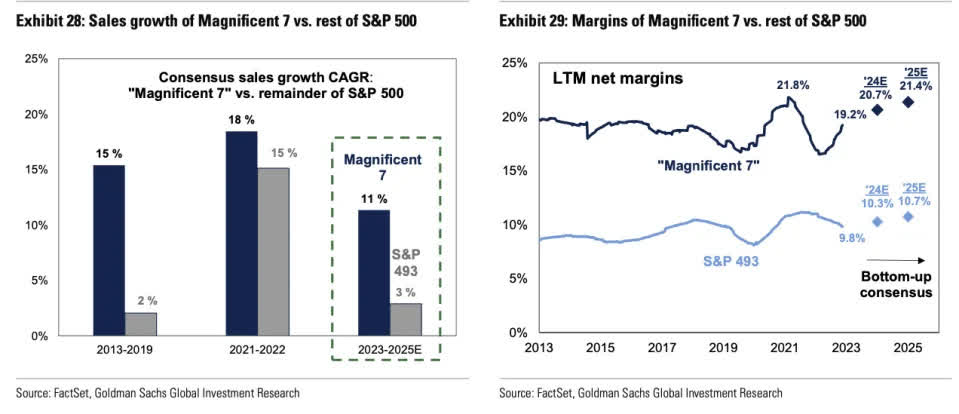

However, we come from a period where small caps have underperformed large companies (represented by the S&P500). And this seems normal, after all, the Magnificent 7 that represent more than 30% of the index have had extraordinary growth with wider margins, compared to the remaining 493 companies that make up the S&P500, and consequently have had better performance. This superior performance attracts more capital flows, supported by the popularization of passive investment through indices such as the S&P500, and creates a cycle that is difficult to break.

Magnificent 7 Growth (Goldman Sachs, Factset)

And speaking of cycles, like everything in the economy, there’re cycles of performance. There’re those cycles where large companies have done better during and others where small companies dominate. In the following image you can see that these periods range from 6 years to 15 years the longest one.

The current period of large caps has been going on for more than 13 years, starting in 2011, so it’s a good time to ask if there’s any sign of cycle reversal or if the this could be lengthened.

Large vs Small-caps Cycles (Wellington Management)

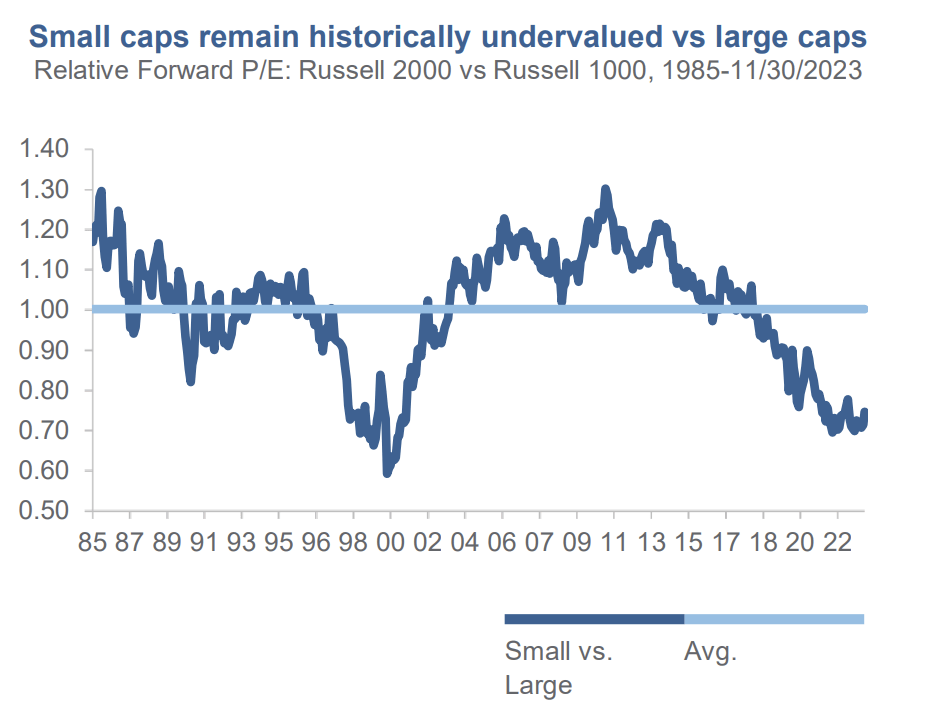

Small-Caps Are Cheap

We’re currently at a fairly low point of relative valuation between small and large-caps. The last time there was such a P/E difference was in 1999/2000, which coincides with the beginning of the last 12-year cycle of small caps overperforming.

This would be a great first indicator that would support the idea of the cycle change.

Small-Caps Valuation vs Large-Caps (Westwood Insights)

Relying solely on the small/large ratio would be quite dangerous, since the S&P500 has changed top holdings radically in recent years. In the 2000s, the largest companies were banks (BofA and Citi), oil companies (Exxon), electronics manufacturers (General Electric), most cyclical, capital-intensive businesses with few competitive advantages. That has changed and we now have mostly asset-light businesses with high product scalability and recurring revenue. Perhaps the higher valuation is justified.

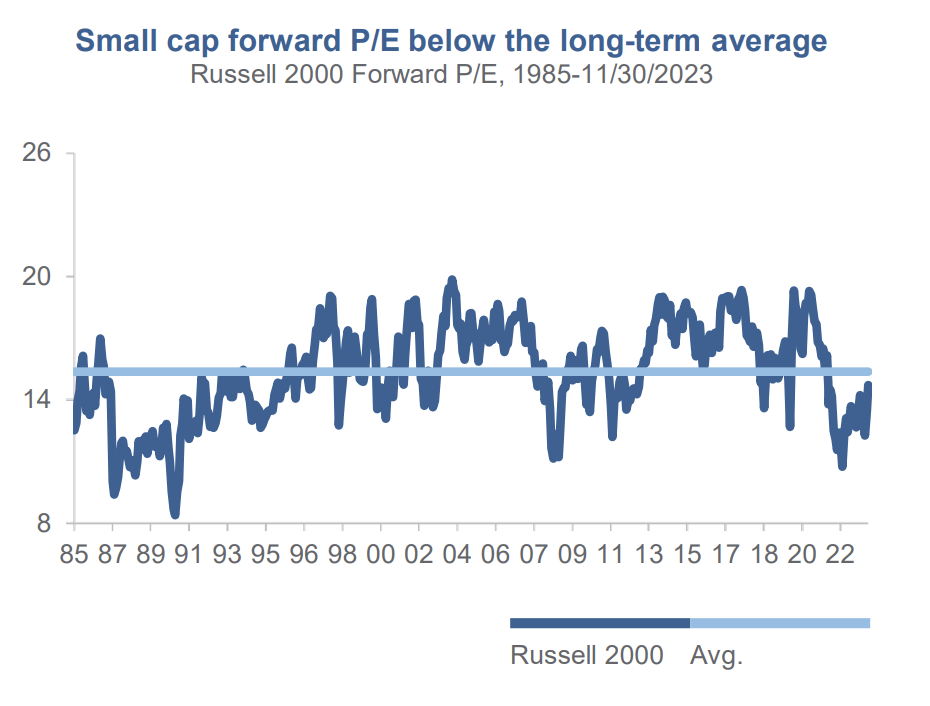

But, currently small-caps are also cheap in relation to their own historical average. While we’re not at levels as low as in 2022, we can think that we would be buying at a certain discount and we don’t depend solely on the market valuing them better than the large-caps.

Small-Caps valuation (Westwood Insights)

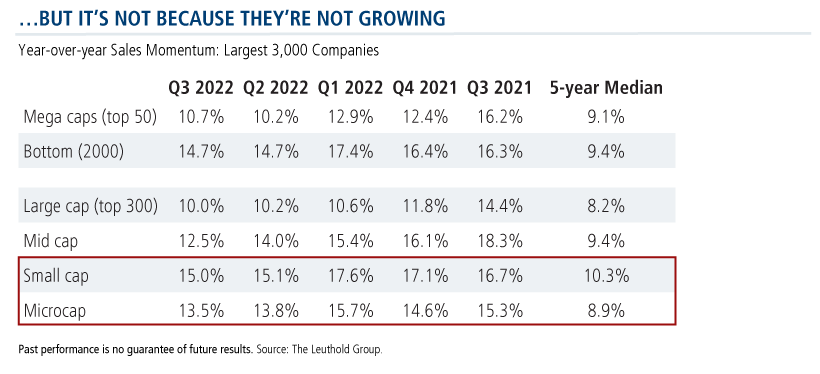

Another relevant point is that small companies aren’t cheaper because they have structural problems or lower growth. In the last five years they have grown on average 10% and until Q3 2022 their sales were still growing 15%. That is, we’re not seeing a clear reason why they should not be trading at their average (or above) beyond the fact that capital flows aren’t coming in because there’s more interest in large companies.

We must remember how important capital flows are in the short/medium term. If there’re no investors wanting to buy, the stock won’t move even if it has not fundamentally gotten worse.

Small-Caps Growth (Calamos Investments)

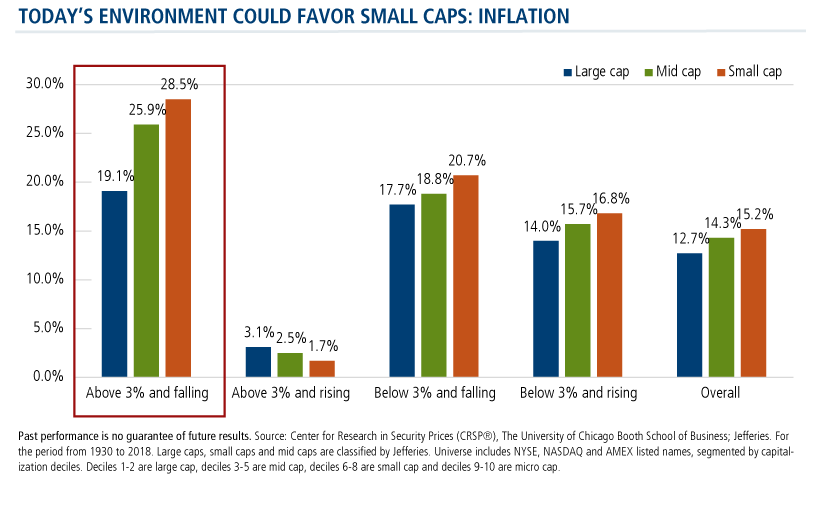

Finally, if we analyze the periods between 1930 and 2018 (a good sample), we’re come from the only period where small-caps perform worse than mid- and large-caps: Inflation above 3% and rising.

However, we currently have strong indications that inflation will continue to decline from the 3% we’re currently at. In this scenario, small caps tend to have exceptional returns, so the macroeconomy and stock valuations would support a change in cycle or at least a positive cycle for small-caps even if large companies also do well.

Small-Caps and Inflation (Calamos Investments)

Why TNA?

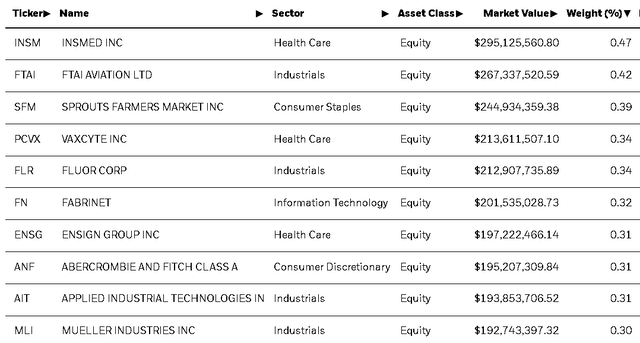

TNA is 3x leveraged to the IWM ETF managed by BlackRock, so it’s worth taking a look at its top holdings.

The top holding is a biopharmaceutical company called Insmed Incorporated, but it only has a 0.47% weight of the total index, so in this aspect we could consider a highly diversified ETF where the main positions will not have as much impact on the performance, as happens in the S&P500. There’re other interesting companies with good businesses, such as Sprouts, an organic food supermarket, Ensign Group, which operates assisted-help centers, or Fabrinet, which makes fiber optic components and communication systems, among others. Therefore, I like the main holdings of the ETF and the diversification factor considerably reduces the risk

IWM Holdings (BlackRock)

Investing in a 2 or 3x ETF is a simple way to access leverage without having to borrow money from your broker or someone else, since this has the danger that at some point you’ll have to return that money and if they make a margin call you’ll practically lose everything. On the other hand, a leveraged ETF, especially a bullish one, can be held at a loss for years with the expectation of a hypothetical recovery. And if purchased at a suitable time, as I consider to be the current one, you could increase your returns considerably.

This ETF has an expense ratio of 1.08%, which, it’s not as low as like what one can find in an ETF of the S&P500. However, we must consider that with a leveraged ETF your returns can be much higher than those of a normal ETF, therefore paying a higher expense ratio can be highly compensated. For example, between July 9 and 16, TNA returned 37%, compared to 1.6% for the S&P500 or 0.27 for the Nasdaq-100. And if you’re looking for another small-cap leveraged ETF, the reality is that there aren’t as many options, except for (NYSEARCA:UWM) which is 2x leveraged and has an expense ratio of 0.95%, although it’s much more illiquid (average volume of $1M per day vs $60 M from TNA).

The Bottom Line

It’s risky to expose yourself to a leveraged ETF and I’d never recommend using it as the base of your portfolio or allocating a large percentage to it. That said, I think that at the moment the risk/reward is very inclined for small-caps (and the general market) to have a rally in the next twelve months. Inflation continues to slow down, the probabilities of the first rate cut in September are very high and so far we haven’t yet had a recession.

It must be mentioned that TNA it’s made to benefit in the short-term at specific moments, like the current one, that is, less than a couple of years. Therefore, it’s not advisable to hold it for the long term because bearish cycles can be very painful. But, if used carefully and market conditions are adequate as it currently is, this ETF can provide extra alpha to your returns.