Samuel Corum

The FOMC meeting in May may prove to be a pivot point yet again for a Fed that has struggled to find its way over the last few months and, for a time, appeared to lose control of the market and its battle against inflation. However, with three hot CPI prints in a row to start 2024 and a fourth hot print expected to be on the way for April, the Fed now finds itself in a position where it finally must push against the easing of financial conditions in an attempt to get the disinflation trend back in place.

Powell will need to make a hawkish pivot at this May meeting, perhaps one that the equity market is not expecting. Consider that there are still calls from bulge bracket firms such as Citigroup and Goldman Sachs looking for rate cuts as early as July.

No One To Blame, But Itself

The Fed can blame all of this on itself by showing its hand much too early in the process. It decided to signal in November that rate hikes were basically finished, and then in December, it chose to show in the Summary of Economic Projections it planned to cut rates three times in 2024.

The market, of course, took the projection of three rate cuts and turned into seven rate cuts. This allowed financial conditions to ease dramatically at a pace typically seen in a rate-cutting cycle. In essence, the market went ahead and cut rates for the Fed, and now the Fed needs to get the market to take those rate “cuts” back and get financial conditions to tighten.

The most effective thing the Fed can do on Wednesday is to indicate at the press conference that the number of rate cuts in 2024 is likely to be less than indicated at the March FOMC meeting. Additionally, it must convey that the disinflation process has stalled and that they expect inflation to run hotter than previously thought. It also needs to be noted that financial conditions have eased too much and that if financial conditions remain too loose, they will be forced to act to tighten those conditions, implying rate hikes could be back on the table if necessary.

Inflation Expected To Run Hotter

It’s easy to see that market inflation expectations will not return to a 2% target anytime soon. Thus, monetary policy is not as restrictive, especially if inflation expectations continue to rise as they have over the past few months.

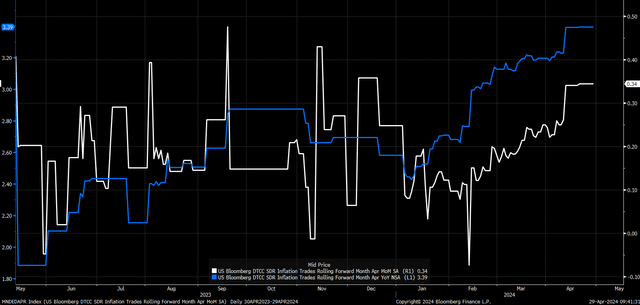

Currently, CPI swaps are pricing inflation to rise by 0.34% month-over-month in April, which is a push between 0.3% and 0.4% m/m at this point, while rising by 3.4% year-over-year. This would be the fourth hot CPI print month-over-month in a row and is not what disinflation looks like.

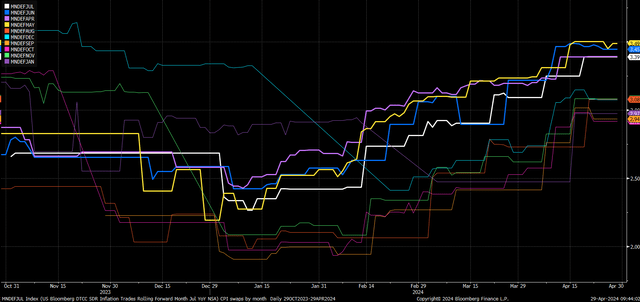

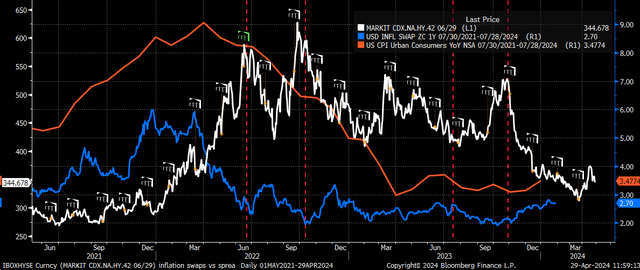

CPI inflation swaps have also risen dramatically since the middle of January and are now seen around 3% or higher until January 2025. Because CPI is an index, as the data comes in, should the data be hotter, these values shall only build upon each other and go higher.

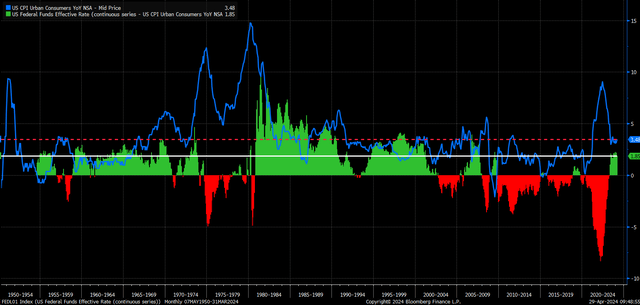

Not As Restrictive

Additionally, due to these hotter CPI readings, monetary policy has eased over the last few months in real terms as the spread between the Fed Funds Rate and CPI falls to a real yield of about 1.85% vs. the roughly 2.25% it stood at in January. Since CPI swaps give us a sense of where the market sees inflation in the future, if swaps are correct and CPI in January 2025 is 3%, the policy would be back to that 2.25% to 2.3% range. Historically, it doesn’t seem that restrictive when going back to the 1950s, considering a 3% CPI.

Additionally, if this outlook should worsen because the Fed fails to get financial conditions to tighten, the risk for rate hikes will only increase as time goes on. Because policy restrictiveness will decline as inflation increases. For example, if CPI should rise to 4%, it would imply that policy would drop to a range of 1.25% to 1.3% in real terms. So, at that point, raising the Fed Funds rate would be the only way to get the real rate higher.

A True Pivot Point

This makes this meeting crucial for the Fed to push back against the easing of financial conditions that have taken place. The Fed can’t afford to wait until the June meeting. The Fed needs conditions to start tightening because the impact of the tightening isn’t likely to be felt for months to come.

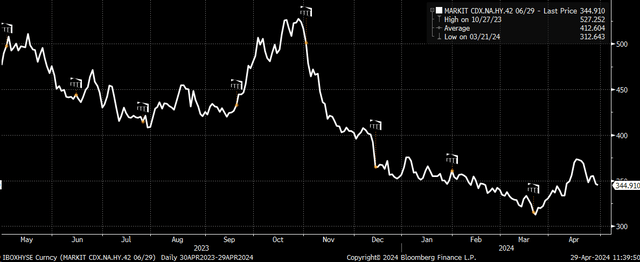

Credit spreads started contracting in November and completely collapsed following the December FOMC meeting. High yields credit spread finally only reached a low point following the March FOMC meeting. The Fed needs credit spreads to widen much more to get financial conditions to tighten.

Credit spreads appear to lead to one-year inflation swaps by around 90 days, which means that if the Fed can keep the process that appears to have started following the March FOMC meeting going or can even get the pace to speed up, then perhaps the Fed can get inflation expectations to start falling again by some time early this summer.

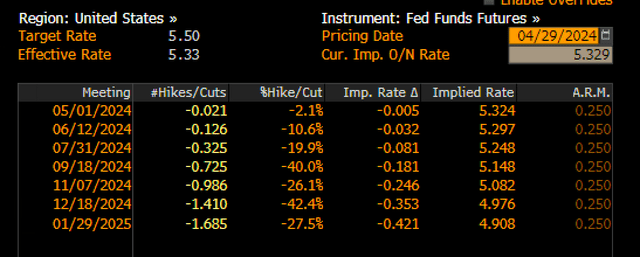

Unfortunately, the equity market is not positioned correctly for wider credit spreads. Based on some estimates mentioned above, expectations for rate cuts still exist for as soon as July, even though the Fed Fund futures now see the first rate cut happening in December.

This remains a significant disconnect, and perhaps the only reason equities have held on to this point is that credit spreads remain near their lows. However, once credit spreads widen, the stock market party will be over.

If the Fed is serious about getting inflation back to target, then the time for them to get hawkish is now.