Robert Way

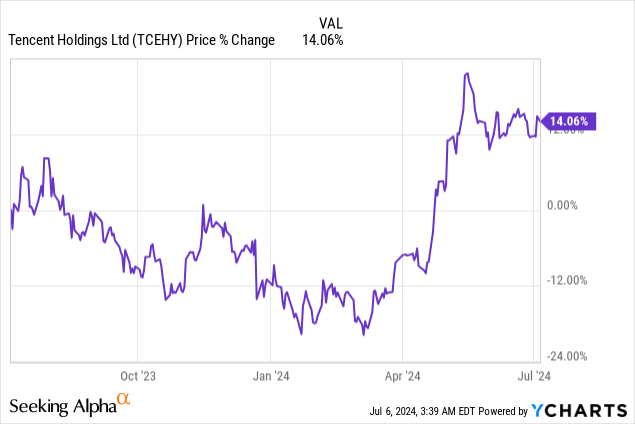

Shares of Tencent Holdings Limited (OTCPK:TCEHY) keep trading at an undeservedly low price-to-earnings ratio despite the Chinese technology company reporting decent Q1’24 results. Tencent represents good value, in my opinion, because the communications firm is growing, especially in online advertising. The company’s focus on controlling costs is paying off in the form of surging gross profits and Tencent continues to generate a ton of free cash flow. In my opinion, an investment in Tencent reflects a high safety margin and U.S investors are too hesitant to buy into promising Chinese large-cap!

Previous rating

I rated Tencent a strong buy in April 2024 due to a fast-growing online advertising business as well as strong core business profitability. While I also referenced Tencent’s low valuation at the time, shares of the tech firm are still widely undervalued given the company’s favorable business trends. With Tencent also seeing strong free cash flow in the last quarter and posting free cash flow margins in excess of 30%, I believe Tencent is attractive as a capital return play going forward.

Solid growth in Q1’24, surging gross profits

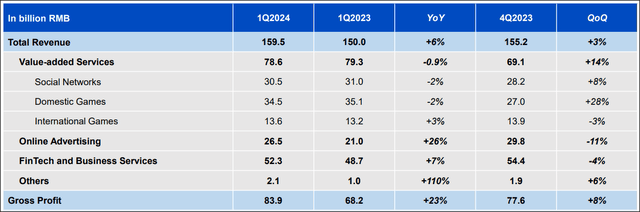

In the first fiscal quarter, Tencent saw a 6% increase in the top line and quarterly revenues of 159.5B Chinese Yuan ($22.5B). Tencent is one of the top three Chinese large caps and owns a number of online and social media businesses. Tencent is doing especially well in online advertising right now, with the Q1’24 earnings card showing a 26% year over year growth rate in this critical business. While Tencent’s top line growth has moderated in the last couple of years due to slowing growth in China’s economy, partly due to COVID-19, the trajectory in gross profits looks promising.

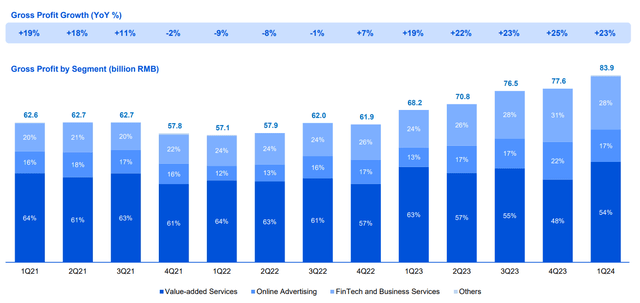

Tencent’s gross profits are in an upsurge (+23% Y/Y) and hit 83.9B Chinese Yuan ($11.8B) in the March quarter. Driving this growth is a stricter focus on costs and a revisit of strategic priorities. As an example, to focus more on profitability, Tencent just decided to shut down its online education platform which has about 400M users.

The decision to shut down the online education business is driven by a desire to refocus attention on the company’s core businesses, such as communications. Tencent, which is often called China’s FaceBook, is the owner of Weixin, also known as WeChat, which is the largest communications app in China with 1.4B monthly active users.

Tencent’s ‘Value-Added Services’ which includes the firm’s social networking business is responsible for more than half (54%) of the company’s gross profits… with another 17% contributed by online advertising. The online advertising business, which I mentioned in April as underpinning my bullish outlook for Tencent, is by far the fastest-growing core business for the Chinese company.

Capital return potential

Besides gross profit momentum, a refocus on core business activities, such as social media and online advertising, Tencent could potentially become attractive as a capital return play for investors.

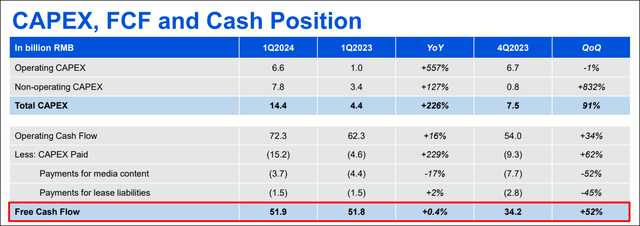

The reason behind this is that Tencent is generating quite a bit in free cash flow and the rebounding online advertising business paired with strategic cost cuts has led to significant free cash flow tailwinds in the last quarter. In the most recent quarter, Tencent generated 51.9B Chinese Yuan ($7.3B), showing 52% quarter over quarter growth.

The free cash flow margin expanded as well and was an impressive 33% in Q1’24 compared to 22% in Q4’23. A large part of this free cash flow could get returned to shareholders in the future and Tencent could therefore become much more attractive for investors from a stock buyback point of view. For the current fiscal year, Tencent has announced plans to buy back 100B Hong Kong Dollar ($12.8B) worth of its shares. In Q1, Tencent repurchased 51M shares in Hong Kong for a total consideration of 14.8B Hong Kong Dollar ($1.9B).

Tencent’s valuation

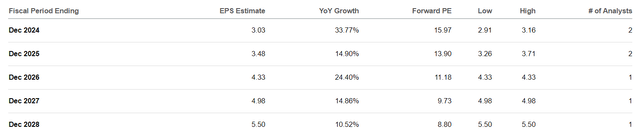

Like Alibaba (BABA) and Baidu (BIDU), Tencent is trading for an unreasonably low price-to-earnings ratio. Tencent is valued at a 13.9X P/E ratio, based off of FY 2025 earnings estimates, compared to 8.1X for Alibaba and 7.6X for Baidu. All three Chinese large-caps are cheap based off of earnings, in my opinion, and Alibaba and Baidu obviously represent even deeper earnings value than Tencent does. Especially Alibaba can be considered a capital return play as well as the e-Commerce firm recently announced a special dividend and is set to buy back more shares going forward.

Tencent has deep earnings value because its earnings per-share are growing faster, however: both Alibaba and Baidu are expected to generate negative EPS growth this year while Tencent is projected to see 34% earnings per-share growth, due to a comprehensive cost restructuring and continual momentum in online advertising.

Given the strength of Tencent’s free cash flow and gross profits, stronger EPS growth and momentum in online advertising, I am raising my fair value P/E ratio from 15X to 15-16X which implies a fair value range of $52-56. This is a dynamic number and may decrease or increase based off of Tencent’s core business momentum, free cash flow margins and progress in terms of buying back discounted shares in the market.

Risks with Tencent

The biggest risk for Tencent is that the company could see slowing growth in its online ads business… which is where all the action is right now for the company. As I said in the past, a potential Taiwan invasion could be a risk factor for Chinese equities in general. What would change my mind about the tech company is if it saw moderating top line growth in its social media businesses or a deterioration of its free cash flow (margins).

Final thoughts

Tencent has a lot to offer and possibly much more than investors are willing to admit. While Tencent has been widely out of favor with U.S. investors — as have Alibaba and Baidu — the company is growing its gross profits quickly, seeing strong underlying free cash flow and shares are cheap. Alibaba also recently stepped up its stock buybacks and paid a special dividend… strategic decisions that were at least partially directed at making shares more attractive to investors outside of China. Tencent’s core business is doing well, especially online advertising which together with a more serious focus on cost controls has led to improved profitability. Shares are still cheap and the valuation, in my opinion, reflects a high safety margin!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.