JHVEPhoto

Investment thesis

My previous bullish thesis about Super Micro Computer’s stock (NASDAQ:SMCI) was destroyed by the stock market as the stock nosedived by 49% since early June. As I have emphasized in most of my articles about SMCI, the stock is extremely volatile. I still do not recommend investing in SMCI for investors who are not ready to tolerate massive volatility.

I am a long-term investor and prefer to allocate my capital to stocks with vast potential. I am ready to hold it for decades, meaning that dips like the recent ones create more buying opportunities. I prefer to look at businesses from a secular perspective, and SMCI definitely has strong potential. Moreover, the stock became dirt cheap once again after the recent dip. All in all, I reiterate my “Strong buy” rating for SMCI.

Recent developments

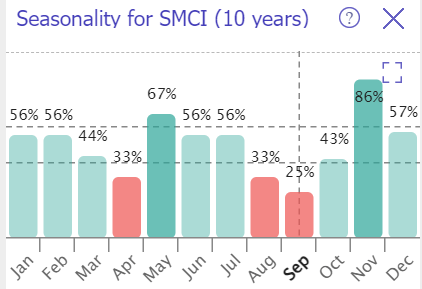

SMCI peaked at above $1,200 in March 2024. The current price is around $413, which is almost three times lower. The stock is extremely volatile with the past 52-week range spanning from $227 to $1,229. The stock started experiencing a massive sell-off since mid-July, mostly due to the broader market’s factors. This approximately aligns with the stock’s historical seasonality patterns. The below bar chart suggests that the share price decline is likely to continue in September.

TrendSpider

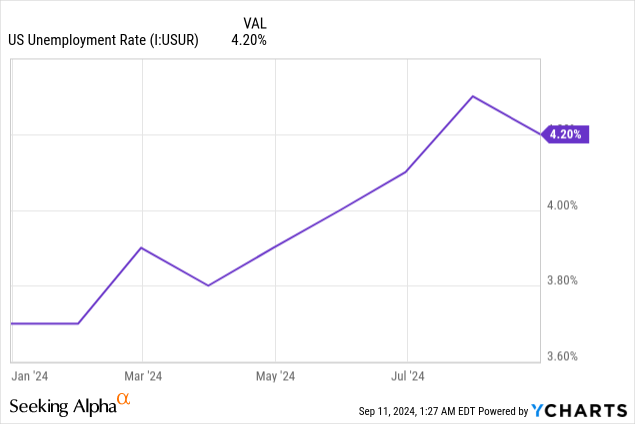

The broader market’s sentiment around growth stocks started deteriorating in mid-July when there was an outage of Microsoft’s (MSFT) services due to CrowdStrike (CRWD) updating its cybersecurity software. Fears around growth stocks were also fueled by U.S. unemployment rate breaking through a psychological 4% level during Summer 2024.

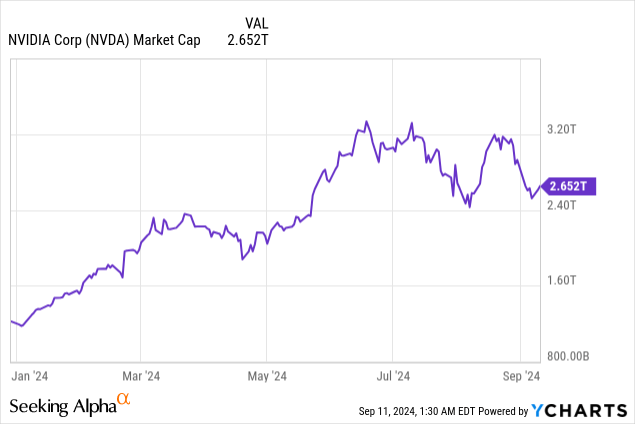

The market is a voting machine over the short term. Sentiment around further AI winners growth prospects has apparently cooled down after Nvidia’s (NVDA) market cap surpassed $3 trillion. This is a massive psychological level for the entire market because none of the stocks ever rallied far above $3 trillion market cap. Therefore, it is not surprising that NVDA investors are taking profits when the company’s market cap hits $3 trillion. Even the recent stellar quarterly earnings release did not help much. I think that the market needs to get used to the new reality where companies’ market caps can go closer to $4 trillion before the rally resumes. Moreover, September is historically the weakest month for stocks.

Therefore, SMCI’s price might continue to stagnate over the next few months. As a long-term investor, I prefer to ignore the noise and short-term share price fluctuations. Let me better explain why I firmly believe that SMCI is still a strong investment opportunity based on fundamental factors.

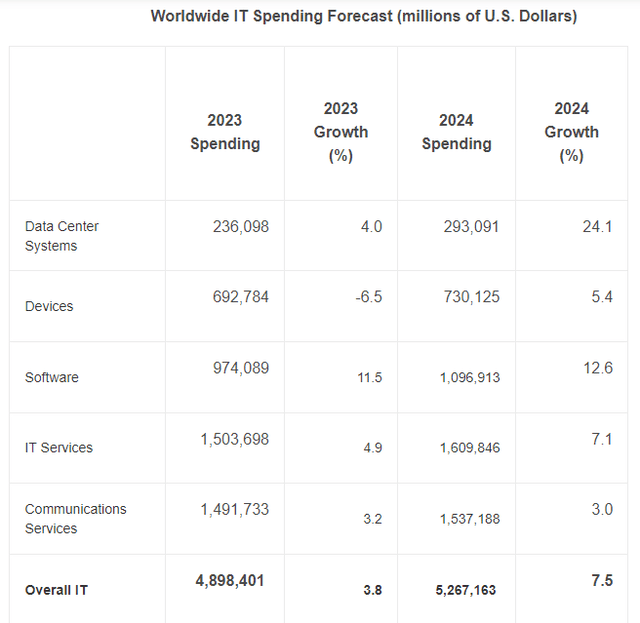

The industry of hardware for generative AI is still thriving. In July, Gartner has significantly upgraded its worldwide technology spending forecast. According to the report, generative AI is the primary reason for such a bullish outlook. Spending on data center systems is expected to grow by 24.1% in 2024 compared to 2023.

Gartner’s bullish outlook aligns with recent development around the industry. Amazon’s (AMZN) AWS continues expanding its data centers network and yesterday shared information that the company will invest around 8 billion GBP in the United Kingdom. Asset management giants are also active pouring billions into data centers. For example, a consortium led by Blackstone (BX) will acquire Australia-based data center group AirTrunk in a deal worth over A$24 billion. Blue Owl Capital (OWL) also plans to invest billions in a JV that will develop data centers. Therefore, it is very early to think that investments in data centers is losing momentum.

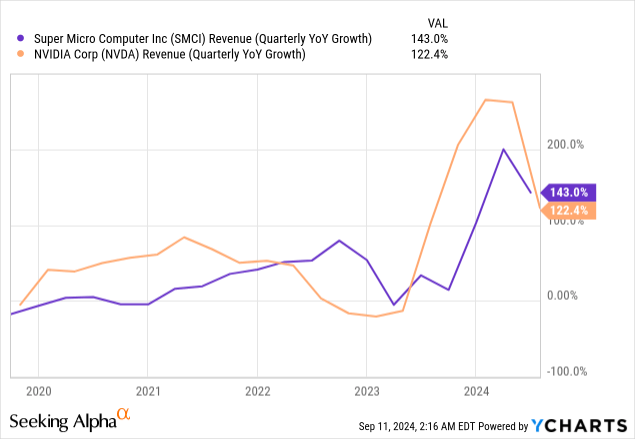

As a company with a strong technological partnership with Nvidia, the major AI winner, SMCI is poised to continue enjoying massive industry momentum. The company’s revenue is soaring and has grown by around five times over the last five years. Consensus expects Nvidia’s revenue to triple over the next decade. This bullish outlook is crucial for investors as there is an extremely strong correlation between NVDA’s and SMCI’s revenue growth. I became even more convinced that the strong correlation of the two companies’ revenues’ will persist after Jensen Huang described himself as Liang’s [SMCI’s CEO] long-time partner and Supermicro’s “best sales guy”.

It is also very important that SMCI does not only concentrate on building strong relationships with NVDA. Super Micro Computer also promptly reacts on new chips releases from AMD (AMD) by introducing servers that are compatible with AMD’s. SMCI also works closely with Intel (INTC) to ensure that its offerings are compatible with Intel’s as well. Therefore, I think that SMCI is protected from the concentration risk related to Nvidia. With strong partnerships with all three leading AI chips companies, SMCI is well-positioned to capitalize on soaring investments in data centers.

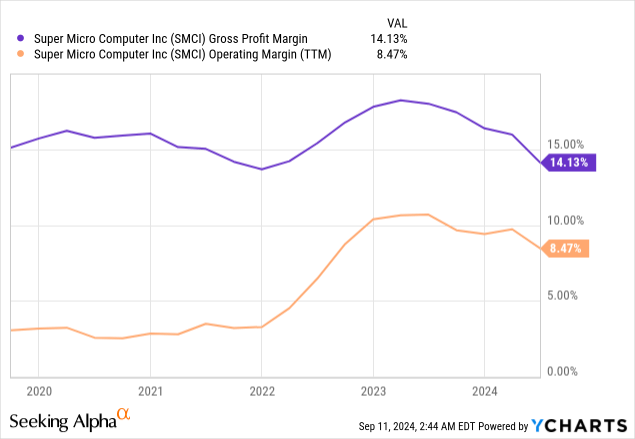

Some analysts became less optimistic about SMCI due to its gross and operating margins dropping in recent quarters. In my analysis, I also consistently emphasize that it is crucial for investors to check whether a company’s profitability is moving in line with revenue. When profitability stagnates while revenue is growing, it might indicate that the business model is unsustainable.

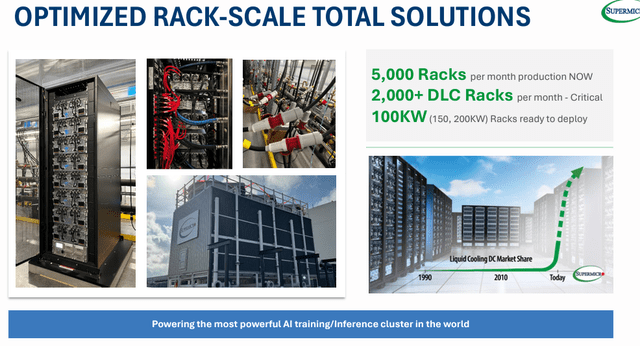

SMCI’s latest earnings presentation

I believe that it is not the case for SMCI. First, the company is not a startup, and it has rich history of strong financial performance, meaning that the management is able to manage growth efficiently over the long term. Second, SMCI faced a sharp spike in demand for racks and the environment is rapidly evolving as Nvidia and AMD are in the fierce battle of releasing the most powerful AI chip of all time. Therefore, SMCI invested heavily in its infrastructure and capacity, R&D, and talent acquisition to address the rapidly evolving environment. I think that these investments are highly likely to pay off as the company is now well-equipped to capitalize on the AI strong momentum.

Valuation update

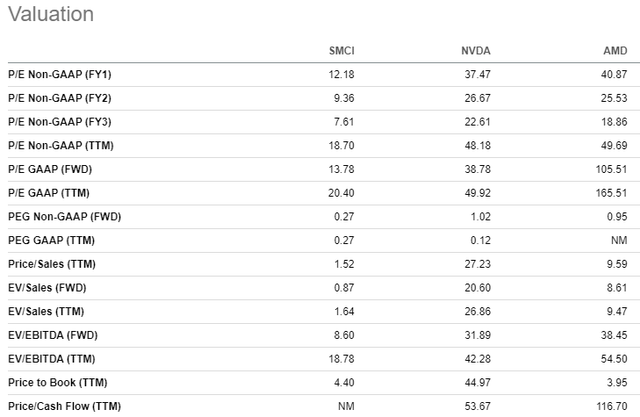

SMCI rallied by 49% over the last twelve months and by 45% YTD. Valuation ratios are high compared to historical averages and the sector median. On the other hand, SMCI has strong AI exposure, which is not incorporated in historical averages. Moreover, not all sector companies have the same exposure to AI. Therefore, comparing SMCI’s multiples to the sector median and historical averages appears to be unfair in current circumstances. Therefore, let me compare SMCI’s valuation ratios to other hot AI stocks like NVDA and AMD. They are not peers or competitors, but all three are perceived as the major AI darlings.

SMCI is not only cheaper than NVDA but also substantially cheaper compared to AMD, a company with revenue growth nowhere near SMCI’s. Therefore, from valuation ratios, SMCI looks dirt cheap to me.

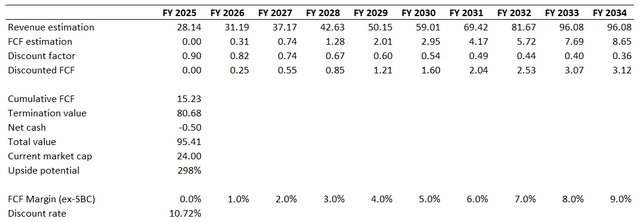

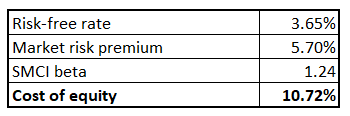

I consider the discounted cash flow [DCF] approach to be the most reliable for aggressive growth stocks. SMCI’s total debt is insignificant compared to its market cap. Therefore, I use the cost of equity as a discount rate. Cost of equity is calculated below using the CAPM formula. All assumptions for my CAPM calculations are publicly available on the Internet.

Author’s calculations

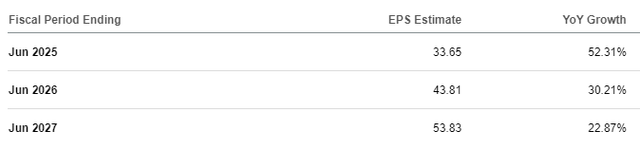

Thus, the model will be discounted using a 10.72% discount rate. I rely on consensus revenue estimates, which are available for the entire next decade, projecting a 14.6% CAGR. On a TTM basis, SMCI’s FCF margin was negative due to heavy investments in inventory to meet surging demand. Therefore, for the base year, I incorporate a zero FCF margin. The adjusted EPS is expected by consensus to jump by 52.3% in FY2025 and by 30.2% in FY2026. Therefore, I think that incorporating at least 100 basis points yearly expansion for FCF margin is conservative enough.

With all these assumptions, my DCF model suggests that the business’s fair value is $95 billion. This is almost four times higher than the current market capitalization, meaning that the stock is dirt cheap once again as it was in December 2023.

Risks update

My readers should be aware that SMCI’s reputation is not perfect. In August 2020, the company paid $17.5 million SEC fine over alleged accounting violations. The recent report from Hindenburg Research included allegations of new cases of accounting manipulations, among other issues. The market’s sentiment significantly deteriorated, especially after SMCI announced that it would not be able to file its annual 10-K report on time the next day after Hindenburg’s report.

Despite SMCI there was no official reaction from the company to Hindenburg’s publication, I am quite skeptical about the report. Short sellers like Hindenburg are recording profits when stock prices plunge. Therefore, there is an apparent conflict of interests when such a company releases its bearish report. Another reason why I consider Hindenburg’s report as noise is that JPMorgan Chase (JPM) noted that it saw “limited evidence of accounting mistreatments beyond revisiting the 2020 charges from the SEC, and limited new information relative to the existing and already known business relationship with related companies owned by the siblings of the founder of SMCI”. I tend to believe more to official comments from the U.S. the largest bank that to the report from a company with a certain conflict of interests.

Once again, I do not recommend investing in SMCI if an investor is not ready to hold the stock for several years and is likely to panic if temporary drawdowns occur. I have already mentioned that the SMCI’s price range over the last year has been extremely wide, and not everyone is able to stomach such a roller-coaster.

Bottom line

To conclude, SMCI is still a “Strong Buy” for long-term investors who are okay with substantial valuation. The company is firmly positioned and well-equipped to ride the AI wave, and the valuation is extremely attractive after the recent nosedive.