Eoneren/E+ via Getty Images

I assigned a ‘Hold’ rating to Steris (NYSE:STE) in my article published in February 2024, highlighting their strong growth in Healthcare products alongside the weakness in Applied Sterilization Technologies (AST) business. I believe the company has made the right move by divesting their dental business and acquiring the surgical instrumentation business. As I believe the stock price is overvalued, I reiterate a ‘Hold’ rating with a fair value of $220 per share.

Dental Business Divestiture and Surgical Instrumentation Acquisition

In June 2023, Steris announced to acquire the surgical instrumentation, laparoscopic instrumentation and sterilization container assets from Becton, Dickinson and Company (BDX) for $540 million.

In April 2024, Steris announced to divest their Dental Business to Peak Rock Capital for $787.5 million. The proceeds will be used for debt repayment and investment in healthcare, life science and AST businesses.

I think the acquisition and divestiture could benefit the shareholders for the following reasons:

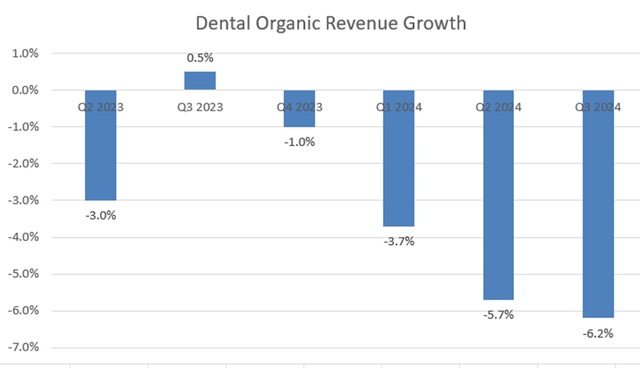

- As illustrated in the chart below, Dental business has become a growth burden for Steris in recent quarters. Steris’s Dental business originated from their acquisition of Cantel Medical in 2021. As discussed in my previous article, dental business is a highly competitive, with several large, established players including Dentsply Sirona (XRAY) and Henry Schein (HSIC). As a small player, Steris lacks strong relationship with dentists in the dental supplier market; making it difficult for the company to scale their dental business.

- The divestiture of dental could allow Steris to focus on their core healthcare products, AST and life science business. As the dental customers have a different customer profile, there are limited synergies between the sales forces of the various business units.

- The Surgical business acquisition could extend Steris’s presence in the operating room and sterile processing markets. As the Surgical business shares a similar customer profile, Steris can more easily leverage its sales force, leading to potential revenue synergies.

Recent Result and Outlook

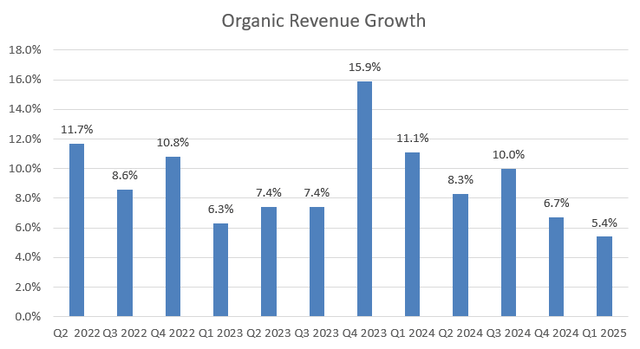

Steris released its Q1 FY25 result on August 6th, reporting 5.4% organic revenue growth and 7% adjusted EPS growth. Due to the divestiture, Steris has classified their Dental business into discontinued operations.

My biggest takeaway from the quarter is the solid growth of AST business, which increased by 7.2% organically. As indicated in my previous article, Steris has built up a large scale of applied sterilization facilities in recent years, enabling to sterilize products near their end-customers’ manufacturing facilities. Over the earnings call, the management expressed strong confidence in a recovery in the bioprocessing marketing in the second half of this year.

For FY25, Steris is guiding for 6.5-7.5% growth in reported revenue from continuing operations. I am considering the followings for their near-term growth:

- Healthcare: Without the Dental business, Healthcare business will account for 70% of total revenue. The segment offers products for hospitals, surgery centers and endoscopy centers, with 70% exposure to services and consumables. The segment growth will be driven by increased healthcare procedure volume and market share gains. I estimate the segment will grow by 7%, assuming 5% volume growth and 2% share gains.

- Life Sciences: Consumables and services account for nearly 75% of total segment revenue. I estimate the segment will grow by 6%, aligned with their historical average growth rate.

- AST: I anticipate AST will be a primary growth driver for Steris in the coming years. Steris provides contract sterilization and testing services of single-use products for pharma and medical companies, and the network of Steris’s sterilization facilities provide the company tremendous competitive advantage over small players. I estimate the business will grow by 12% annually.

Overall, the total revenue is estimated to grow by 8% organically. Additionally, I assume the company will allocate 7% of total revenue towards acquisitions, contributing an additional 2.3% to the total growth.

Valuation

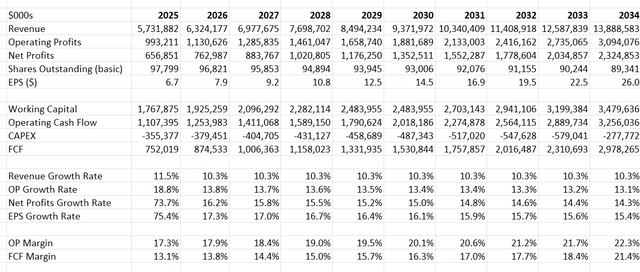

As analyzed previously, I estimate Steris will grow their revenue by 10.3% annually. I model 50bps margin expansion driven by 20bps from pricing and gross profits and 30bps from SG&A optimization. With these parameters, the DCF can be summarized as follows:

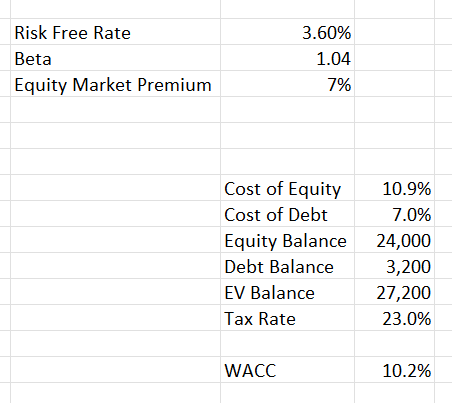

The WACC is calculated to be 10.2%, as follows:

Steris DCF -WACC Calculation

I discount all the future free cash flow and adjust their net cash position, and the fair value is calculated to be $220 per share.

Key Risks

Over the earnings call, the management indicated that Healthcare capital equipment revenue declined during the quarter as hospitals tightened their spending on capital equipment. Steris is guiding for low-single-digit revenue growth in their capital equipment business for FY25, reflecting a cautious outlook on the overall healthcare capital equipment spending. I think the current spending pattern is largely driven by the high-interest rate environment, and it is more likely to recover once the Fed starts to reduce the interest rate.

Conclusion

I think Steris has made a right strategic decision to optimize their business portfolio and the dental divestiture could potentially accelerate their overall organic growth. Due to the high valuation, I reiterate a ‘Hold’ rating with a fair value of $220 per share.