SDI Productions

Back in late December of 2023, one financial institution that I dug into for the first time was First Financial Bankshares (NASDAQ:FFIN). In the article that I published about it, I talked about how the firm was struggling with declining deposits. Uninsured deposit exposure was high and both revenue and profits were dropping. These factors, combined with how the stock was priced, led me to rate it a ‘hold.’ That rating signifies a scenario where I think the stock is unlikely to perform materially different than what the broader market should see for the foreseeable future.

So far, I would call that assessment correct. While shares of First Financial Bankshares are up 19.1% since then, the S&P 500 is up 18%. Considering the time that has passed, that is not a significant disparity. Looking at the picture again, I am happy to say that there have been some improvements. Deposits are now rising again, and loans are following suit. Management is also proving to be successful in growing both the company’s top and bottom lines. Relative to earnings, shares have gotten cheaper. But on a price to book basis, the stock is a bit more expensive. Truth be told, in my original article about the company, I was even tempted to rate the business a ‘sell.’ And coming into it again, I thought that there was a chance that such a downgrade would occur. The changes the company has experienced are not enough for me to upgrade it. But at least they are enough to justify keeping it where it’s at.

The picture is improving

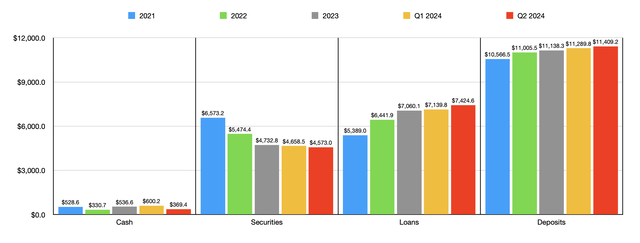

The most recent data that we have regarding First Financial Bankshares covers the first half of the 2024 fiscal year. To start with, we might want to talk about the balance sheet. This is where much of the improvement has been seen as of late. Deposits in the most recent quarter, the second quarter of 2024, came in at $11.41 billion. That’s an improvement over the $11.14 billion that the company had at the end of 2023. And it’s higher than the $10.72 billion that the company had for the third quarter of 2023. The third quarter of last year was the most up-to-date data that I had on the firm when I wrote my prior article on it. Unfortunately, while deposits have grown, uninsured deposit exposure has remained high. It’s not as high as it was back then at 48.2%. But it is still quite lofty at 46.1%. Generally speaking, I’d like to see this number at 30% or lower. So we are quite a bit above that mark.

Deposits weren’t the only things that improved during this time. At the end of last year, the company had $7.06 billion worth of loans on its books. This was up from the $6.99 billion that the company had in the third quarter of last year. But today, loans stand at a hefty $7.42 billion. We have seen some weakness. Take securities as an example. These have actually dropped this year from $4.73 billion at the end of 2023 to $4.57 billion in the most recent quarter. But when weighed against the value of loans, and how that has changed, this is only a small inconvenience. Cash and cash equivalents have, unfortunately, dropped during this time. They fell from $536.6 million at the end of 2023 to $363.4 million today.

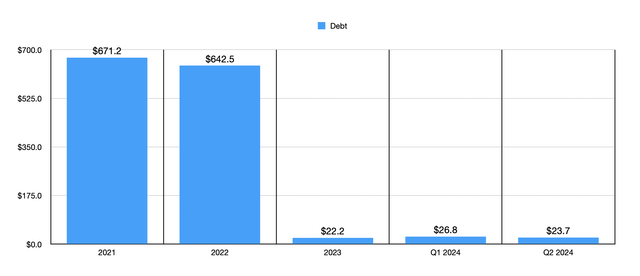

Debt, meanwhile, remains very low, hitting $23.7 million in the most recent quarter. This is one of the company’s strongest data points in my opinion. While the uninsured deposit exposure could prove problematic if there ever is a bank run, at least the institution doesn’t have a material amount of debt to have to repay. That on its own reduces the probability of having to engage in asset sales. It also increases the company’s capacity to borrow if need be. For context, when I last wrote about the company, debt was quite a bit higher at $751.5 million. So it is great to see a big improvement on that front.

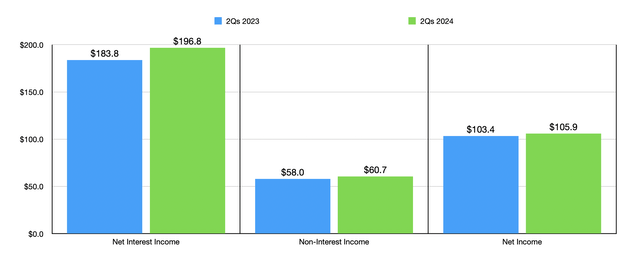

Moving on to the income statement, management has done well to grow the firm. Thanks to the growth and loans and the decrease in debt, net interest income for the institution hit $196.8 million for the first half of 2024. That’s up from $183.8 million reported one year earlier. It is absolutely the case that a rise in interest earning assets helped the business. However, it’s also the case that the company benefited from an improvement in its net interest margin from 3.32% to 3.41%. At first glance, this might not seem like much of a change. But when applied to the total earning assets that the company had at the end of the most recent quarter, this translates to an extra $5.5 million in net interest income on a year-over-year basis. That is nearly half of the improvement that the company saw from last year to this year.

Net interest income wasn’t the only area for improvement. Non-interest income also grew, climbing from $58 million last year to $60.7 million this year. This was in spite of the fact that the company saw a drop in debit card fees from $11.7 million to $10 million. Most of the increase came from trust fees expanding from $19.7 million to $23.1 million. But there were other improvements as well. This, combined with the growth in net interest income helped to push net profits up from $103.4 million for the first half of 2023 to $105.9 million the same time this year. The picture would have been better had it not been for non-interest expense growing. This was mostly the result of the company having to increase salaries, commissions, and employee benefits costs from $63.2 million to $74.2 million.

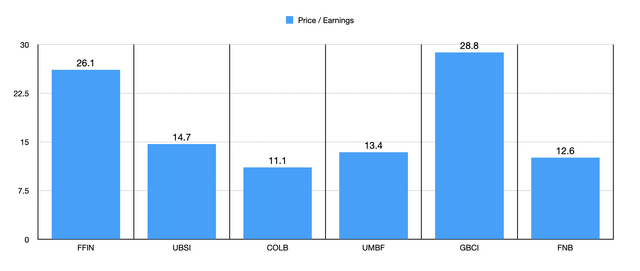

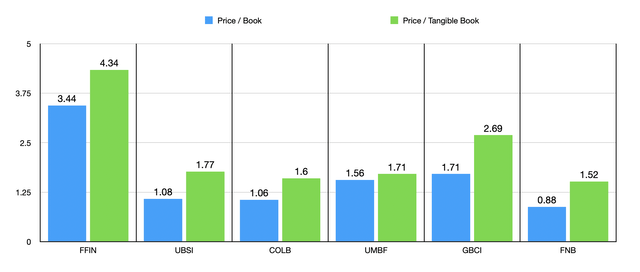

When it comes to valuing the business, I would like to first look at how shares are priced relative to earnings. In the chart above, you can see this in action, with a price to earnings multiple of 26.1. That chart also compares the institution to five similar firms on that basis. Even in a vacuum, the price to earnings multiple of the company is very high. And relative to similar firms, that becomes apparent. Only one of the five companies that I compared it to had a price to earnings multiple higher than what it did. Another way to value the company is relative to both book value and tangible book value. In the chart below, I compared both of these metrics for First Financial Bankshares to the same metrics for five comparable firms. And in both cases, unfortunately, our candidate ended up being the most expensive of the group.

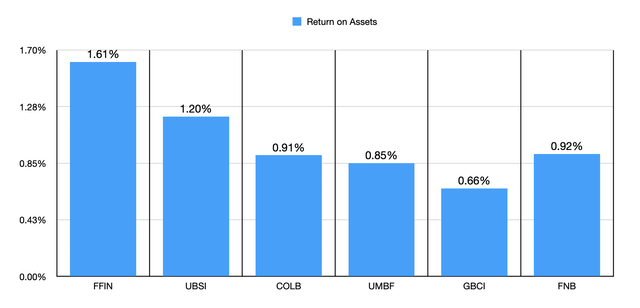

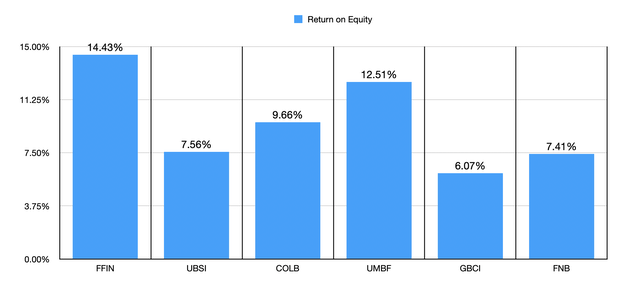

A high trading multiple can be justified if asset quality is high. In this case, First Financial Bankshares do come in strong. But in my opinion, it’s not strong enough to justify such a lofty premium. The first chart below looks at the return on assets for our candidate and the five companies I’ve already compared it to. On this basis, First Financial Bankshares ended up being the best of the group. In the subsequent chart, you can see the same thing for return on equity. And once again, First Financial Bankshares ended up coming out on top with a reading of 14.43%.

Author – SEC EDGAR Data Author – SEC EDGAR Data

Takeaway

There’s no doubt in my mind that First Financial Bankshares is a high-quality business. But just because it is a high-quality player does not mean That it justifies a lofty trading multiple. I could accept some premium, but this premium is far too high to be fine for a ‘buy’ candidate. It is nice to see improvements when it comes to the income statement and the balance sheet. I hope this trend will continue. If it doesn’t, it could eventually necessitate a downgrade of the stock. But for as long as this continues, I think that keeping the firm rated a ‘hold’ makes sense.