ALFSnaiper

Investment Thesis

In our first article, we gave a buy rating on Sphere (NYSE:SPHR) when it was trading at $27.52 merely a year ago. We discussed the project in length, explaining why we are treating it as a deep value play and how it’s extremely undervalued.

We wrote our second article when Sphere had risen by 75% since our initial position and 35.5% since our first article. We explained how sphere’s story was finished as a deep value play, and in a good way for us. We explained why we are taking profits and waiting for more clarity to decide on the story further.

Since then, Sphere Entertainment has released two earnings reports, providing clarity on various issues, including the performance of the sphere venue, future on new sphere projects and CEO Dolan’s strategic intentions for MSGN. We believe the downside risk is limited to current levels, supported by the asset value and multiple catalysts such as new sponsorship deals, naming rights, and CEO Dolan’s increased stake. Additionally, the potential expansion of the sphere through a franchise model, rather than solely building new venues, further mitigates risk. Coupled with the Sphere’s rising popularity, robust growth prospects, and potential for profitability, we find sphere presents an attractive risk/reward profile.

Third Quarter Highlights

Sphere Entertainment reported its financial results for the quarter ending March 31, 2024. This was the second quarter covering the full sphere performance.

The quarter saw several significant highlights. U2 concluded with a sold out 40 shows run in March. This was followed by Phish’s sold out 4-night run in April. Sphere experience featuring “Postcard from earth” generated over $1 million in average daily ticket sales. Due to high ticket demand, Dead & Co. extended their upcoming residence from 18 to 24 shows. Additionally, Sphere’s exosphere featured campaigns from several global brands and achieved a record setting week of advertising revenue around the Super Bowl in February. Sphere also announced it will host its first corporate keynote event with Hewlett Packard (HPE) in June as well as this year’s NHL draft.

MSGN concluded regular season telecasts for its five professional sports teams. They telecasted first round playoff games for the New York Knicks, New York Rangers, and New York Islanders. Currently, they are providing comprehensive pre/post games coverage for the second round of post season for both the Knicks and the Rangers.

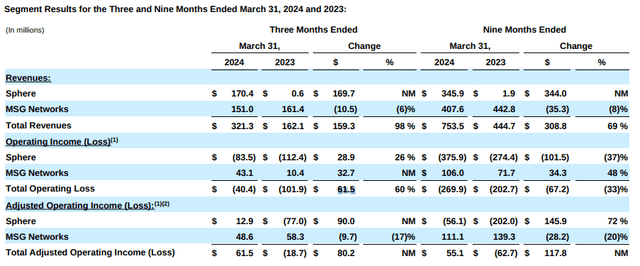

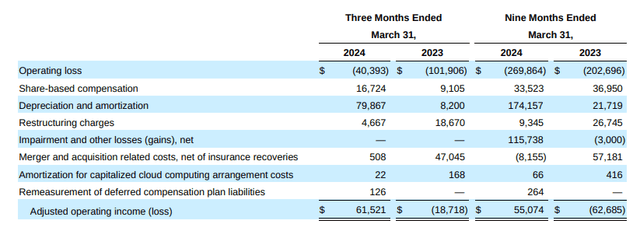

On a consolidated basis, the company reported $321.3 million in revenues. The company also reported an operating loss of $40.4 million, an improvement of $61.5 million. Adjusted Operating Income of $61.5 million was reported as compared to an adjusted operating loss of $18.7 million in the previous year quarter.

CEO James Dolan commented that the second consecutive quarter of robust revenues and positive adjusted operating income in sphere segment highlights the sphere potential to disrupt the traditional venue model.

Sphere reported revenues of $170.4 million. Sphere experience contributed $100.5 million across 257 performances. Event related revenues from concerts held at sphere in Las Vegas amounted to $34.3 million. Additionally, revenues from sponsorships, exosphere advertising and suite licensing fees totaled $32.9 million, primarily due to advertising campaigns on the exosphere discussed above.

Sphere direct operating expenses for the third quarter were $62.3 million. These included $29.8 million form sphere experience, $13.4 million form venue operating cost, $8.6 million from the event related costs and $3.1 million from others.

SG&A was $109 million, a 31% increase from last year. Sphere’s operating loss was $83.5 million, an improvement of $28.9 million compared to the last year, mainly due to increased revenues and less restructuring charges. Adjusted Operating Income (AOI) was $12.9 million.

MSGN reported total revenue of $151 million, a decline of $10.5 million or 6% compared to last year. Advertising revenue fell by $1.5 million, mainly due to lower pregame advertising sales for live sports telecasts on linear networks and reduced branded content revenue, partially offset by higher advertising revenue from MSG+. Distribution revenue fell by $8.4 million, primarily due to a 12% decrease in subscribers.

Direct operating expenses increased by $2.5 million to $91.7 million, driven by higher programming and production costs related to MSG+, partially offset by other net cost decreases. Rights fees expense rose by $0.3 million due to annual contractual rate decreases.

Operating Income for the third quarter was $43.1 million, thanks to lower administrative expenses, despite reduced revenues and higher operating costs. AOI fell by $9.7 million or 17% to $48.6 million, reflecting decreased revenues and increased operating expenses, offset by lower administrative costs.

Current Position on Sphere

This report serves as a follow-up so we will not delve into the project intricacies and trivial details as these were covered in our two earlier reports and a video on our YouTube Chanel.

Reports

- Sphere Entertainment Spinoff Creating A Value Opportunity

- Sphere Entertainment: An Update On Our Initial Report (Rating Downgrade)

Video

After the initial surge in the stock, we preferred to have a hold rating on the stock as, among other reasons, the performance of sphere as an entertainment venue was unclear. Since it was such a unique project, the gross margin estimates in the market ranged from 50% to all the way up to 80%. The company had not yet filed as a standalone remain co. with sphere operations up and running.

Other reasons had to do with the uncertainty surrounding MSGN and history of the Dolan family. MSGN’s debt was although non-recourse but looking at the history of Dolan family’s restructuring to protect their legacy companies we feared that sphere’s cash might be used to pay off MSGN’s debt. The Dolan family’s history of prioritizing their own interest over the interest of minority shareholders is well documented in our first report under the risks section.

Since then, we have had significant updates on sphere, it has reported two quarterly earnings covering sphere’s performance, and we have seen the growth potential and potential of it becoming positive EBITDA sooner than initially estimated. The sphere segment, as mentioned earlier, has already posted a positive AOI of $12.8 million.

On the expansion side of the story, they had land in London on which they were planning to build a new sphere, but unfortunately or fortunately the plan was not approved. We were always skeptical of the London project and the company’s push to build the new spheres by themselves. Management seems to have come around to this point as well, since the new expansion model they are pursuing is a franchise-based model. The company is in discussion with several markets and expects to conclude at least one deal soon.

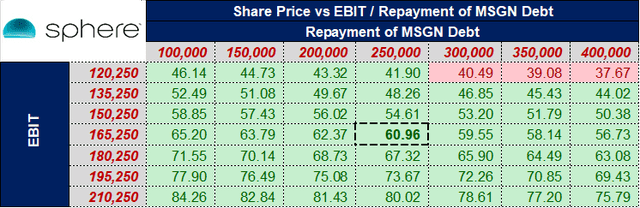

MSGN’s has a net non-recourse loan of $767 million, Since this legacy network was going down in revenues and operating margins, we always assumed it to have no value to us when valuing the company, but we had a fear that parent’s cash might be used to keep MSGN afloat. This fear was turned true when Dolan announced that there would be some contribution from the parent to pay back MSGN’s debt. Although this was a huge hit to investors sentiment but when looked closely this onetime payment might actually be a blessing in disguise as the CEO is finally coming to terms with evaluating strategic decisions for MSGN’s future. Management is targeting to pay some of the debt and refinance the remaining for one year to have some flexibility to evaluate the long-term future of MSGN. In our analysis, we will assume that there will be a $250 million payment in this regard from the parent. CEO Dolan also confirmed that any new deal on refinancing will continue to remain recourse only to MSGN, so we’ll continue to assign no value to MSGN.

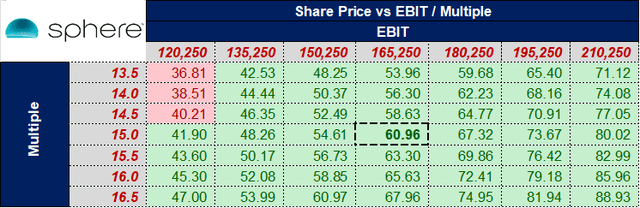

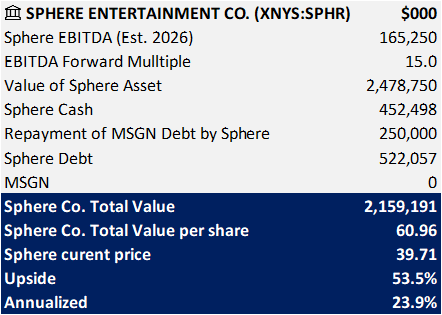

We will keep the same simple approach to valuing sphere in contrast to our usual approach of EPV & DCF. Instead of trying to come up with the Est. 2026 EBITDA number ourselves, we’ll rely on the mean industry consensus of $165.25 million. Looking at the current trajectory of sphere to profitability, we are comfortable with this EBITDA figure. Sphere is a first of its kind in both technology and business model, making it difficult to compare to other companies in terms of margins or multiples. No one has ever invested this much in a performance theater designed primarily for hosting propriety content. Given the uniqueness of this premium venue and its high growth potential, I have used a conservative 15x multiple. This provides us with a value of $2.15 billion or $60.96 per share. This provides us with an annualized return of 24%.

Moat Investing

Scenario Analysis

As with any investment, there are certain risks as well, so we need to tread carefully. The risks involve sphere not growing and turning profitable as soon as expected, failure to reach a strategic alternative for MSGN, parent company paying more to pay down MSGN’s debt, any restructuring from the CEO Dolan will potentially hurt the minority shareholders.

To account for all of these risks, we have performed a scenario analysis on the main value driver affecting our valuation.

The table below helps us in understanding how SPHR’s asset value per share perform under different Repayment scenarios vs the EBIT.

This table highlights the sensitivity of SPHR’s stock price when analyzed between different assumptions of EBIT and EV/EBIT multiple.

Conclusion

Although this calculated return is not a very meaningful one, but this provides us with enough margin of safety. Since our assumptions are already conservative and there is a factor of support from the tangible asset value as well, we believe the downside risk is limited. Given this low downside risk and margin of safety from the proposed valuation, we rate it as a buy. With the additional catalysts in the form of new sponsorship announcements which we believe will eventually start flowing, the stock can re rate very quickly.