alacatr

When choosing an investment, I aim to purchase high-quality companies that are trading with a reasonable margin of safety and offer a healthy dividend growth track record.

One high-quality company that has a lot of what I am looking for in an investment is Snap-on Incorporated (NYSE:SNA). Snap-on has a strong business moat and strong dividend growth, but doesn’t appear to offer much in the way of value at the moment.

This article will examine Snap-on in depth to see why I think the company would be an excellent addition to a portfolio, but at a lower price.

Recent Earnings Results

Snap-on reported first quarter earnings results on April 18th, 2024. Revenue was essentially unchanged at $1.18 billion, but this was $20 million less than expected. The company performed much better on the bottom-line as earnings-per-share of $4.75 improved from $4.60 in the prior year and topped analysts’ estimates by $0.09.

Results were negatively impacted by a 0.8% decrease in organic sales. Revenue for Snap-on Tools Group, the largest segment within the company, fell almost 7% to $500 million, mostly due weakness in the U.S. business. Commercial & Industrial was down slightly to $359.9 million, as acquisition related sales only partially offset a decrease in organic sales.

Repair Systems & Information Group was the one business to demonstrate growth as revenue grew close to 4% to $463.8 million, primarily due to organic growth and higher activity with OEM dealerships and undercar equipment.

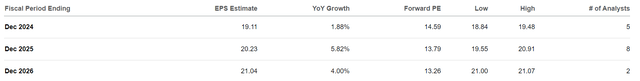

Snap-on is projected to earn $19.11 in 2024, which would represent growth of just under 2% compared to 2023.

Earnings Takeaways & Long-Term Analysis

Snap-on reported mixed first quarter results, with revenue unchanged, but earnings-per-share improving. Longer-term, the company has generated solid numbers.

Revenue for the 2014 to 2023 period had a compound annual growth rate of just 4.3%, but earnings-per-share have improved at a much more impressive rate of 11.3%. Part of this is a reduction of ~5 million shares, or 8.6% of the share count at the beginning of the period.

While a bit of financing engineering did aid earnings growth, it does not tell the whole story. Net profit grew at more than 10% annually over the last decade. This was helped in large part to a greatly improving net profit margin rate that went from 12.1% in 2014 to 19.8% last year. The other margins have improved too, but not to this degree. For example, the gross margin only expanded 170 basis points, not the nearly 800 point improvement that net profit margin experienced.

Much of the growth in net profit over the last decade is due to a much more efficient business operation. This has, in turn, greatly benefited shareholders over the long-term and explains the double-digit growth for earnings-per-share since 2014.

That being the case, earnings growth in the near-term does not appear to approach the historical rate. The company’s guidance for 2024 calls for a small improvement. The analyst community also sees lower growth ahead.

Snap-on has an excellent track record, but investors buying today aren’t likely to see that level of earnings growth if the company’s guidance and analyst predictions are close to accurate.

Dividend and Valuation Analysis

When it comes to dividend growth, there is much to like about Snap-on.

Snap-on has raised for 14 consecutive years and distributed a dividend for 34 years, this compares extremely well to the average of 2.3 years and 12.1 years, respectively, for the Industrials sector.

The company raised its dividend by 14.8% in late 2024. This is just above the five-year average growth rate of 14.4% and below the 10-year average growth rate of 15.4%. Many companies begin to slow down the pace of growth as the dividend becomes larger, but this has not been the case for Snap-on. The company has consistently raised its dividend at a mid-teens growth rate.

At the same time, the payout ratio has remained well within a healthy range. Shareholders are likely to see at least $7.44 of dividends per share in 2024 (though this will surely be higher as the company typically raises its dividend for the last payment of the calendar year). Using analysts’ estimates for the year, this equates to a payout ratio of 39%. This is just slight above the five-year average payout ratio of 33%, but well ahead of the 26% average payout ratio since 2014.

The free cash flow payout ratio shows the dividend to be well-covered as well as this average is 34% since 2020.

Therefore, it appears that investors can expect that the company will continue to raise its dividend, though the level of growth could be less robust if earnings growth does not return to past levels. The rising payout ratio could also lead to a deacceleration of dividend growth if middling earnings growth becomes the new norm.

Shares yield 2.7% today, which compares favorably to Snap-on’s average yield of 2.3% over the last decade. The current yield is also more than twice the average yield of the S&P 500 Index. Snap-on is providing a higher level of income relative to its own history and to that of the market. That yield should be safe as well given the low payout ratios.

Snap-on is trading at 14.6 times expected earnings for the year. For context, this matches the stock’s price-to-earnings ratio of 14.6 over the last five years, but is lower than the 10-year average of 18.3. While the stock’s long-term average multiple is well above where shares reside today, the average valuation has settled below that more recently.

I find the business to be attractive and the dividend growth is exactly what I want in a company. However, the market is not paying up for these qualities at the moment, making me hesitant to assign an aggressive valuation range. I believe fair value belongs in a range of 13 to 15 times earnings.

Using estimates for this year, this results in a target price range of $248 to $287. At the current price of $279, shareholders could see as much as an 11% decline while the upside would be just ~3%. As much as I like the company, that is not enough margin of safety to entice a purchase of the stock.

Closer to the lower end of that price range and I would be a buyer of Snap-on, as that level would provide considerably more safety. Snap-on last traded near this level in late October 2023, but reached the low mid-$250 as recently as the beginning of July. It not unusual for the stock to trade at this level, so that would be my entry point.

Final Thoughts

Snap-on has an appealing business model that has generated solid revenue growth and earnings-per-share at a high rate for a very long time. The company also pays a nice dividend yield that appears to be very safe. The dividend also has an impressive growth rate.

The issue that I find with the stock is that Snap-on’s earnings growth rate over the next few years is forecasted to be in the low- to mid-single-digits, which saps some of my enthusiasm for the name. The market has not bid shares up to the decade-long average multiple despite the historical performance, likely because future growth is projected to be on the low side.

The present valuation is near the top end of my target range, which would make Snap-on slightly overvalued at the current time.

Closer to 13 times earnings-per-share, I would feel much more comfortable adding the stock. Until then, I rate shares of Snap-on as a hold.