Klaus Vedfelt

Sometimes I look at an ETF and am forced to think about in 2 very different ways:

1. Do I like the industry, its long-term potential, and the way the ETF is constructed to tap into that over time?

2. Is it currently in a position where I’d invest in it. That requires that I believe its reward potential over the next 6-12 months or longer is well in excess of the risk of major loss from holding it. Sure, I can always change my mind if I am quickly off-target (and I do, as a tactical investor, and since I am frequently off-target).

But since I prioritize avoiding big loss and have a short fuse for ETFs that go south on me, if something looks like a high reward/high risk situation, I’ll pass. Or I’ll take a very small position to start.

When it comes to the First Trust Cloud Computing ETF (NASDAQ:SKYY), my answer yes to #1, no #2. That is, while I track this one since I suspect it will become more buy-able to me at some point, it is neither. And it does amount to being attractive enough to me at this stage of the market cycle to prompt me to want to own it. And I’ll assign a sell rating, simply because I think it is too far from buy consideration to classify it as a hold.

For those not familiar with my own approach to “ratings” on ETFs, I think people often take them out of context. I strongly believe investing is about position sizing more than “in or out,” and this trains investors to limit their flexibility as investors. That’s bad long-term training.

SKYY: a prominent cloud computing ETF

Cloud computing is still a rather new industry altogether. Tech investors, millennials, and generation Z are likely most familiar with this space, but by and large the “cloud” is not very familiar to many consumers and investors.

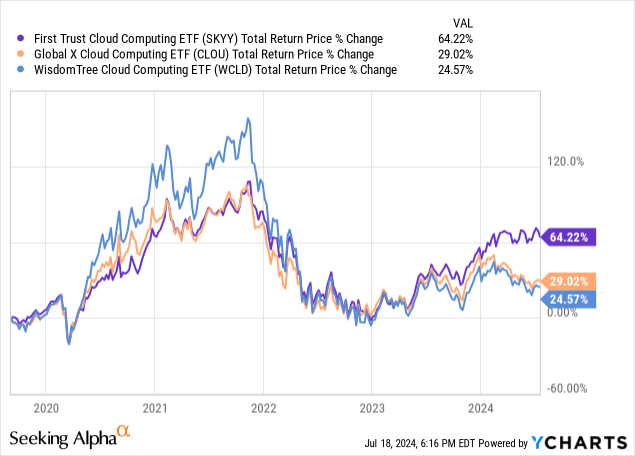

From an investment perspective, the cloud computing industry saw a decent size dip from late 2021 to early 2023. Many of these stocks and ETF’s have had recent gains but are still looking to get back to those peak highs seen about a year and a half ago.

First Trust Cloud Computing ETF is the biggest cloud ETF in the market. Up 65% over 5 years makes for a decent 13% annual return. But all things considered, this really seems like an underperformance, as it trails the S&P 500 return and widely trails the return of many tech industries. But that’s the past, which is only of limited use to my analysis. What about going forward?

When I analyze SKYY from that standpoint, I see what I have seen in past technology stock cycles. They spike higher for an extended period, longer than most expect. Then, they appear invincible, “one-decision stocks” as they used to say. That is, you buy them and never have to think about selling them. That’s about the worst risk management approach I could imagine! But that’s what past performance does to investors whose experience and study of market history only goes back 10 or 15 years.

Ultimately, tech stock cycles end poorly, where the tickers, fundamentals, and business outlooks just do not matter. This is especially the case this time around, since indexation of the market and investor complacency has added tons of risk to the tech investing equation. So, while there is always potential for more gains, they come with extremely high risk in my view.

Holdings analysis

The ETF has about 60 holdings and is heavily allocated in the technology sector. 3 of the most prominent cloud computing services are Amazon Web Services, Microsoft Azure, and Google Cloud Platform. SKYY has all three of these companies in its top few holdings. With the Nasdaq 100 so top-heavy with these names, SKYY will not be able to escape a severe follow through the downside in the Invesco QQQ Trust ETF (QQQ). It is bound to correlate highly to that index ETF, as do many of this year’s top performers. And while they have led SKYY to peer-beating results in recent years, that party may be simmering down.

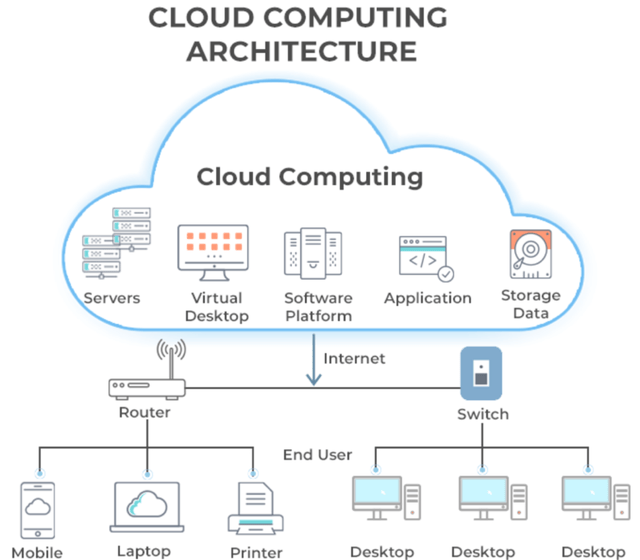

Cloud computing explained

Cloud computing refers to the use of hosted services, such as data storage, servers, databases, networking, and software over the internet. The data is stored on physical servers, which are maintained by a cloud service provider. Computer system resources, especially data storage and computing power, are available on-demand, without direct management by the user in cloud computing. Instead of storing files on a storage device or hard drive, a user can save them on cloud, making it possible to access the files from anywhere, as long as they have access to the web.

Cloud computing is growing rapidly because of the forward-looking benefits it offers. It saves businesses the time and resources required to set up actual physical IT infrastructure. By using cloud-based services, businesses avoid the need to purchase expensive infrastructure, greatly reducing their costs. Cloud allows organizations to grow their users from merely a few to thousands in a very short time.

The world has shifted toward a “work from home” environment since the pandemic hit in 2020. Cloud provides the freedom to set up a virtual office anywhere. It also allows teams to work on a project across several locations by giving them access to the same files. Worldwide, spending by businesses on cloud computing infrastructure is forecast to top $1 Trillion for the first time in 2024.

Risks in the cloud computing business

It’s not all sunshine and rainbows here. Challenges include security concerns associated with the technology. Although cloud service providers assure customers of using the best security standards and industry certifications, there’s always a risk while storing data in the cloud.

With tech and cloud adoption on the rise, so too is the number and sophistication of hackers, who constantly targeting these services. Of course, using the cloud is very internet-dependent. Without a good internet connection at home or without strong public wi-fi, data on the cloud may be inaccessible.

Valuation

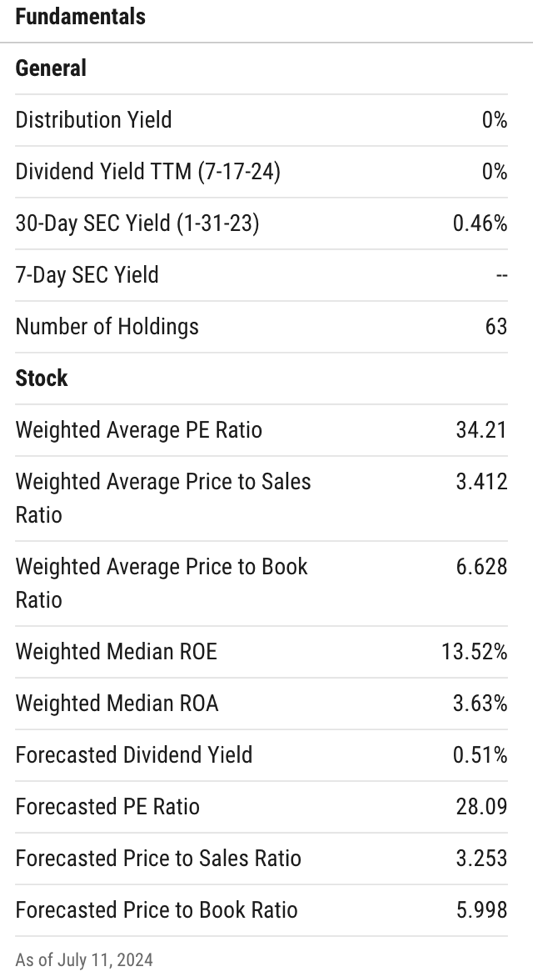

There are market environments where I would not sweat owning a basket of stocks via an ETF with a trailing P/E ratio of 34x. This is not one of those environments. And 3x forward sales is the opposite of what I’m hunting for, especially with the market potentially and finally waking up to the values outside of the technology sector.

Ycharts.com

With AUM just shy of $3 billion, SKYY is far and away the largest cloud computing ETF. Though compared to other well-known technology ETF’s, SKYY is relatively small. Dividends are almost nonexistent in this industry, and SKYY does not currently have one. A weighted P/E ratio around 34 is higher than market average but not unusual at all in the information technology sector.

Allocating heavy weight in the technology sector has been and will likely continue to reap benefits for investors over very long-term time horizons. I am a long-term investor, but included in my definition is to do all I can to manage risk to prevent having to dig out of deep financial holes in my portfolio. So, while SKYY will look to lean on some up-and-coming cloud computing companies along with the big 3 in Amazon, Microsoft, and Google, the valuation and euphoric support assigned to the broader tech sector is the biggest risk here.

Conclusion

There will likely come a point where I look to “own” tech instead of “renting” it, and SKYY will be among the tech subsegments I consider. But for now, this ETF gets a sell rating from me. It is on my watchlist, but essentially playing for my A-ball baseball squad, a few rungs on the ladder away from the major league roster.