richcano

In April, I raised my recommendation on the iShares 0-3 Month Treasury Bond ETF (NYSEARCA:SGOV) and the WisdomTree Floating Rate Treasury Fund ETF (USFR) to a buy, as the Fed was likely on hold while inflation remained elevated and the economy continued to grow briskly. However, I noted that one downside risk to these treasury bill-related investment funds is a deterioration in the economy, as the Federal Reserve has stated it stands ready to cut policy rates if economic growth or the labor market were to falter.

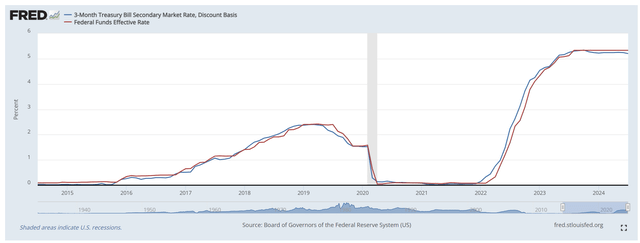

Since treasury bill yields closely follow the Fed’s policy rates, if the Federal Reserve were to cut Fed Fund rates, treasury bill yields would decline, and SGOV and USFR investors would see a reduction in their distribution income (Figure 1).

Figure 1 – Treasury bill yields closely follow Fed Funds rates (St. Louis Fed)

Although the Fed remained on hold in the recent July FOMC meeting, deteriorating economic data suggest the Fed may join the rest of the world’s central banks in cutting policy rates in September. With diminishing yields on the horizon, I am downgrading my recommendation on SGOV and USFR to a hold.

Brief Fund Overviews

For those not familiar with these products, the iShares 0-3 month Treasury Bond ETF and the WisdomTree Floating Rate Treasury Fund ETF provide investors with easy access to the performance of owning short-term treasury bills (“T-Bills”) in a brokerage account. These securities are effectively ‘risk-free’ funds, as they do not have credit or duration risk.

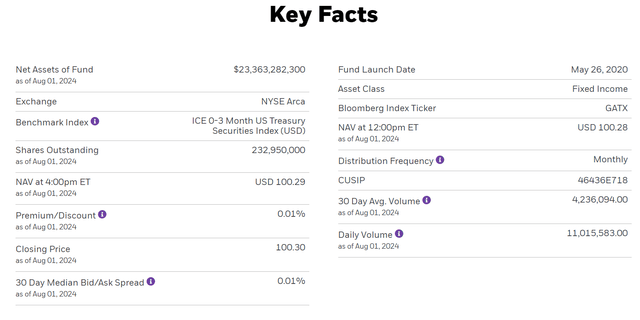

SGOV has $23 billion in assets and charges a 0.09% expense ratio (Figure 2) while the USFR ETF has $17 billion in assets while charging 0.15% (Figure 3).

Figure 2 – SGOV overview (iShares) Figure 3 – USFR overview (WisdomTree)

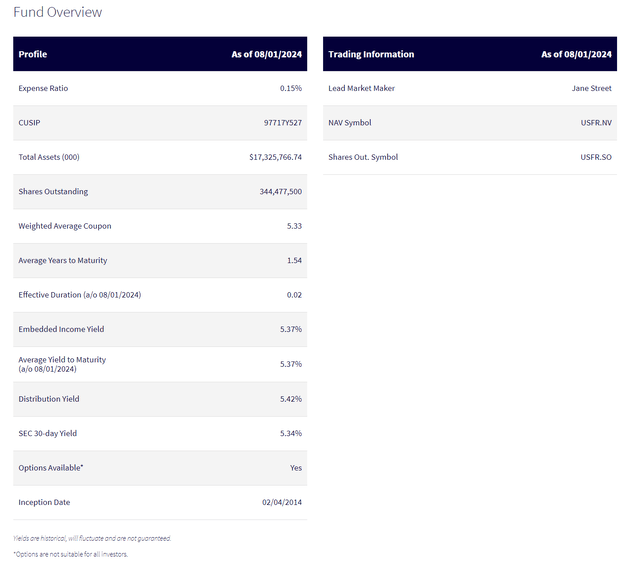

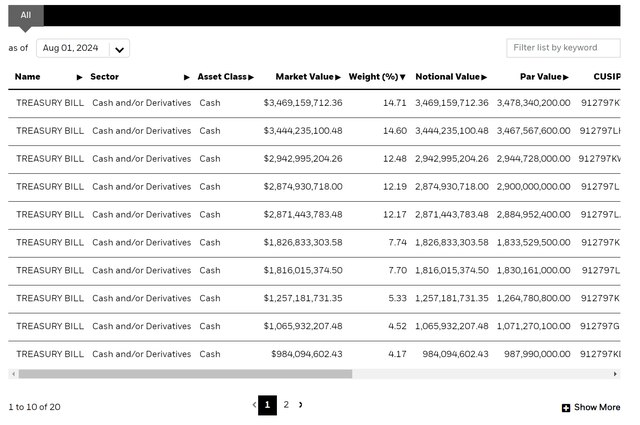

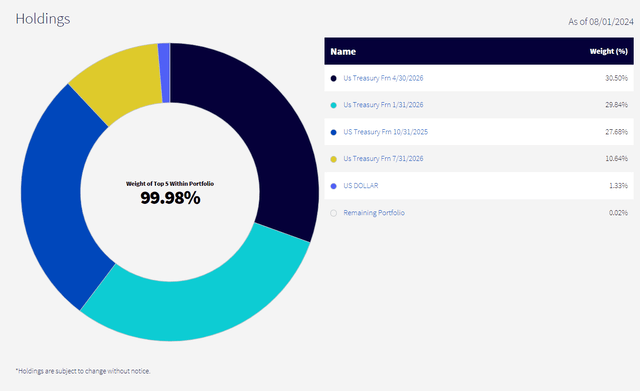

The main difference between these two funds is that SGOV owns and rolls treasury bills (Figure 4) while the USFR ETF owns floating-rate treasury notes (Figure 5), so SGOV may experience slightly more transaction costs and slippage.

Figure 4 – SGOV portfolio holdings (iShares) Figure 5 – USFR portfolio holdings (WisdomTree)

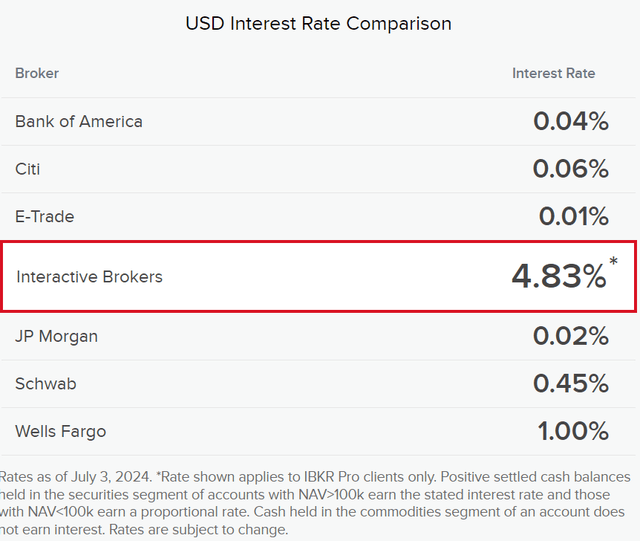

Compared to the interest rate paid on idle cash in brokerage accounts, SGOV and USFR, with forward yields of 5.2% and 5.4% respectively, are a great way to earn some risk-free interest income for many investors (Figure 6).

Figure 6 – Many brokerage accounts pay next to nothing on idle cash (Interactive Brokers)

Readers interested in learning more about the mechanics of these products can refer to my initiation articles here and here.

Fed Remains On Hold But Rate Cuts Approaching

While the Federal Reserve remained on hold at the most recent July FOMC meeting, Chairman Jerome Powell opened the door to September rate cuts by noting that should inflation remain subdued, and the labor market weakens, the Federal Reserve will be open to cutting interest rates at its upcoming September meeting: (Author highlight key passage from the July FOMC press conference transcript)

CHAIR POWELL. Well assuming that the totality of the data supports such an outcome. No question, that is the case that as I mentioned, we think that the time is, it’s approaching and if we do get the data that we hope we get, then a reduction in our policy rate could be on the table at the September meeting.

In fact, many journalists pushed back against Mr. Powell and wondered whether the Fed may be behind the curve once again in waiting too long to cut interest rates:

MICHAEL MCKEE. Well you have event risk basically, with the jobs report on Friday and another one before you meet again. Are you certain that you won’t fall behind the curve and lead to unnecessary unemployment if you wait until September?

Mr. Powell’s response is that the Fed is data-dependent and will base their September policy rate decision on incoming economic data between the July and September FOMC meeting to make up their minds.

Weak Data Spurs Recession Fears

Unfortunately for the Fed, recent economic data such as the July ISM Survey and the July Non-Farm Payrolls report, released on August 1st and August 2nd respectively, seem to support the notion that the Fed is once again behind the curve.

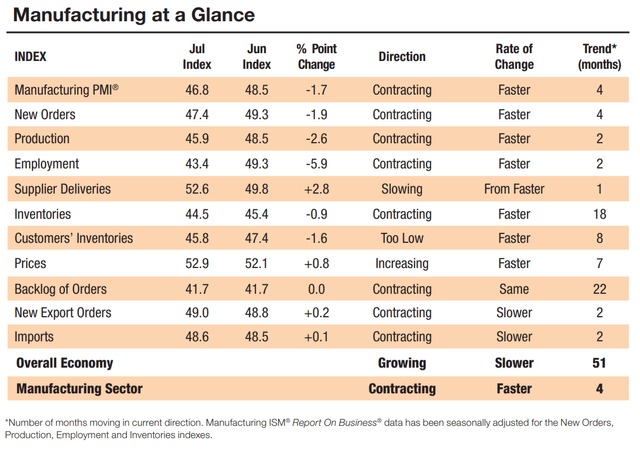

Concerning the ISM Survey, the July manufacturing PMI printed 46.8, a 1.7 pt MoM decrease and missing analyst estimates for 48.8 (Figure 7).

Figure 7 – July ISM Manufacturing Survey showed contraction across the board (Institute for Supply Management)

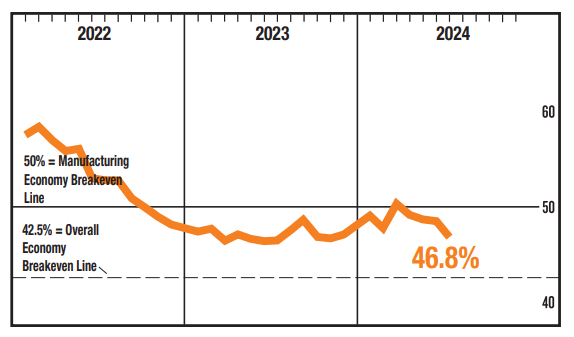

Importantly, every sub-category except prices seemed to show contraction. Since the pandemic re-opening surge in 2022, the ISM Manufacturing PMI has been in contraction for 21 of the past 22 months, with the March pop to 50.3 looking increasingly like an aberration (Figure 8).

Figure 8 – ISM Manufacturing mired in contraction for almost 2 years (Institute for Supply Management)

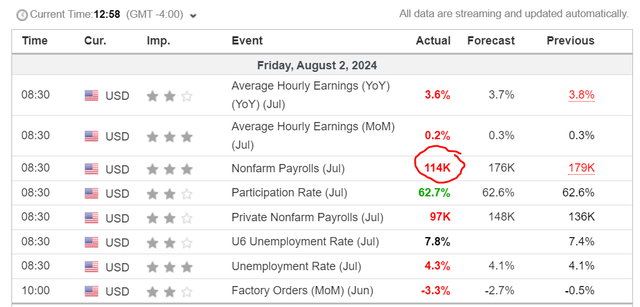

Moving on to the labor market, July non-farm payrolls printed a 114k gain, far weaker than the consensus forecast of 176k (Figure 9).

Figure 9 – Nonfarm Payrolls report missed expectations (Investing.com)

More importantly, the US unemployment rate spiked 0.2% to 4.3% in July, or 0.9% above the cycle lows achieved in April 2023 (Figure 9).

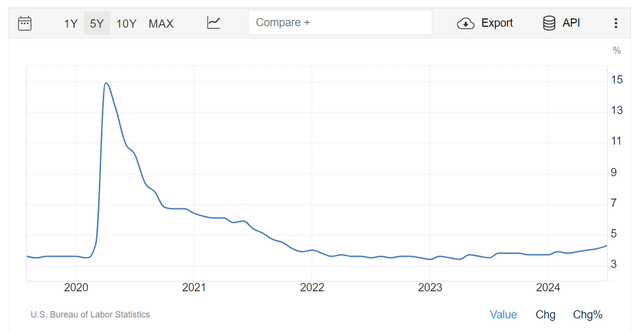

Figure 10 – Unemployment spiked 0.2% to 4.3% (Trading Economics)

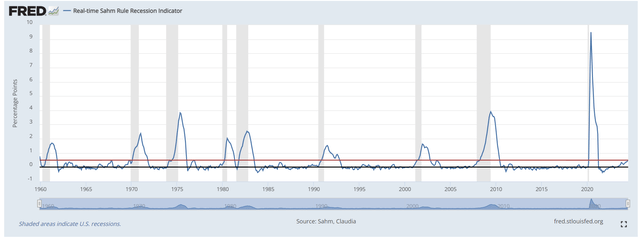

Historically, there is an empirical rule called Sahm Rule that says when the three-month moving average of the unemployment rate rises by half a percentage point from the cycle low, that signals the beginning of a recession. The Sahm Rule was just triggered with the July jobs report (Figure 11).

Figure 11 – Sahm Rule triggered on July payrolls report (St. Louis Fed)

Although the creator of the Sahm Rule, Claudia Sham, has pushed back against reading too much into her empirical rule, the rapid increase in unemployment in the last few months does highlight a deterioration in the labor market and a weakening U.S. economy.

September Rate Cut Increasingly Likely

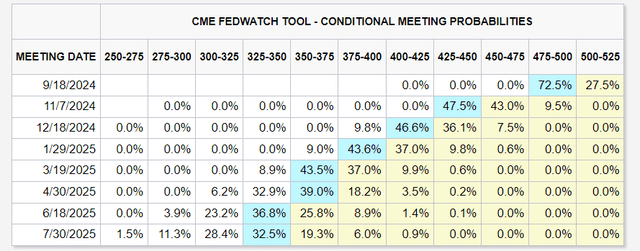

What this means for SGOV and USFR investors is that barring any large economic surprises in the coming weeks, the Federal Reserve is increasingly likely to cut interest rates at the September FOMC meeting. Bond investors are currently assigning a 72.5% probability to a September rate cut, and expect almost 3 rate cuts by year-end (Figure 12).

Figure 12 – Investors now expect 3 rate cuts in 2024 (CME)

In fact, following the weak jobs report, many sell-side analysts are now forecasting the Fed to cut 50 bps at the September meeting.

Conclusion

With downside economic risks rising with the release of July economic data, investors in the SGOV and USFR ETFs need to be mentally prepared for a decline in distribution yields over the coming months. Outside of Japan (which is beating to its own drum), central banks around the world have begun an easing cycle, and the Fed appears likely to join in September.

I am downgrading SGOV and USFR to hold recommendations. While both funds should remain safe-haven assets as the economy weakens, a potential decrease in income means their attractiveness is diminished.