D-Keine

One company that will always have a special place in my heart is Service Corporation International (NYSE:SCI). Even though it may seem odd for a funeral home and cemetery owner/operator to strike an emotional chord with someone, the company was not only one of the first five firms that I ever bought shares in, it was also the subject of a major research report that I wrote in graduate school. The last article that I wrote about the company was published approximately one year ago, in July of 2023. At that time, I acknowledged that the business had experienced some weak points over the prior few months. But because of how shares were priced and the long term outlook for the company, I ended up keeping the firm rated a ‘buy’.

Sadly, things have not gone exactly according to plan. With revenue mixed and issues on its bottom line continuing, shares have actually underperformed the broader market. While the S&P 500 is up 20.7% since I last wrote about the business, its shares are up slightly less at 17.4%. Even with this underperformance, however, I remain confident in how shares are priced, both on an absolute basis and relative to similar firms. I also think that the long term the picture for the company is positive, though it may not be as positive very far out as what I previously anticipated. Ultimately, I think the company still warrants a soft ‘buy’ rating at this time.

This picture could, of course, change. And it just so happens that new data, covering the second quarter of the 2024 fiscal year for the firm, is expected to come out after the market closes on July 31st. Leading up to that point, analysts expect sales to inch up modestly, while earnings per share should remain flat. Investors should absolutely pay attention to the results that do come out, because they could have an impact on the company’s picture moving forward.

A mixed bag

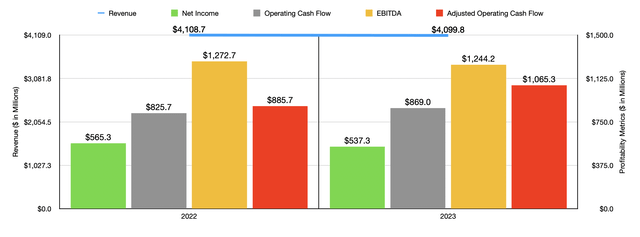

A lot has transpired since I last wrote about Service Corporation International a year ago. We have seen financial results covering not only the 2023 fiscal year come out, but also covering the first quarter of 2024. For 2023, revenue for the business came in at $4.10 billion. That’s a hair below the $4.11 billion reported one year earlier. This modest decline was driven entirely by the company’s funeral home operations.

Revenue dropped from $2.33 billion to $2.30 billion. This was in spite of the fact that the company benefited to the tune of $26.6 million from increased sales involving newly constructed properties and properties that were acquired. On a comparable basis, however, sales dropped by 54.9%. And this was essentially all because of an irregularly high death toll caused by the COVID-19 pandemic that extended into 2022. The picture would have been worse had it not been for the fact that average revenue per funeral grew by 2.8% thanks not only to increased trust fund income, but also the willingness of consumers to spend a bit more.

One part of the company that did perform well was its cemetery operations. Revenue managed to rise by 1.1% from $1.78 billion to just shy of $1.80 billion. This was partially the result of acquisitions and new construction that collectively added $4.8 million to the firm’s top line. Actual comparable cemetery revenue, meanwhile, rose by 0.9% from $1.77 billion to $1.79 billion. Even though at need revenue dropped $16.2 million year over year, this was more than offset by a $31.2 million rise in pre-need revenue. Considering the elevated death rate in 2022, and the return to normalcy that would see consumers start to plan for the future instead of dying from a once-in-a-century contagion, this shift makes a lot of sense to me.

On the bottom line, the firm took a larger hit. Net income dropped from $565.3 million to $537.7 million. A good portion of this drop was driven by a decline in funeral gross profit from $545.7 million to $497.1 million. Management attributed this to the drop in sales, combined with higher selling costs on higher pre-need insurance sales production in 2023 compared to 2022. The firm benefited from some cost reductions, such as a drop in corporate general and administrative expenses from $237.2 million to $157.4 million. But one thing that weighed on the company was a surge in interest expense from $172.1 million to $239.4 million. Higher interest rates proved to be a problem here, but so did the increase in net debt from $4.15 billion to $4.49 billion.

At first glance, you might think that other profitability metrics would have declined as well. But the picture was not quite that simple. Operating cash flow actually managed to grow from $825.7 million to $869 million. If we adjust for changes in working capital, we would actually get an even larger increase from $885.7 million to $1.07 billion. Meanwhile, EBITDA for the company managed to drop slightly from $1.27 billion to $1.24 billion.

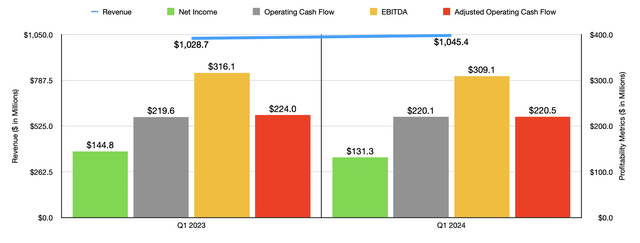

Moving into the 2024 fiscal year, the picture was mostly negative from a profitability and cash flow perspective. However, this was in spite of the fact that revenue rose from $1.03 billion in the first quarter of 2023 to nearly $1.05 billion the same time this year. Once again, the cemetery side of things was where the company benefited most. Revenue there jumped from $419 million to $440.6 million. This was mostly because of a 5% improvement in comparable revenue that management attributed to hire recognized pre-need sales as pre-need sales production grew year over year. This was offset to some extent by a decline in funeral revenue that was attributable in part to a fall in the number of pre-need contracts produced from 35,212 to 34,132.

From a profitability perspective, the picture was largely worse. Net income fell from $144.8 million to $131.3 million. This was in part driven by funeral gross profits contracting from $149.5 million to $131.9 million. This, according to management, was driven not only by a rise in annual incentive compensation, but also because of the higher costs associated with pre-need activities. Add on top of this a continued rise in interest expense from $53.9 million to $64.4 million, and this worsening certainly is logical. It is true that operating cash flow ticked up modestly from $219.6 million to $220.1 million. But on an adjusted basis, it fell from $224 million to $220.5 million, while EBITDA contracted from $316.1 million to $309.1 million.

For the rest of this year, management seems slightly optimistic. With earnings per share expected to come in at between $3.50 and $3.80, this is guiding, at the midpoint, to net income of $539.9 million. That is slightly above the $537.3 million generated last year. Operating cash flow is expected to be between $900 million and $960 million. At the midpoint, that would be a comfortable improvement over the $869 million reported for 2023. That would likely translate to adjusted operating cash flow of about $1.14 billion. No estimates were given when it came to EBITDA. But if we assume that it will increase at the same rate that adjusted operating cash flow should, then a reading of $1.33 billion is not unrealistic.

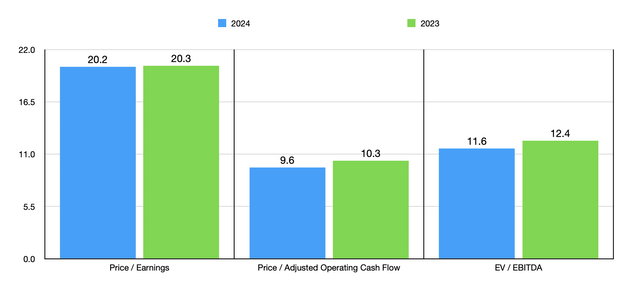

With these figures in mind, I was able to value the company as shown in the chart above. It includes historical results from last year and forecasts as already outlined for this year. On a cash flow basis specifically, shares do look attractively priced in my book. But for the most part, they also look attractive compared to similar firms. In the table below, I compared Service Corporation International to two other players that have exposure to this space. On a price to earnings basis, our candidate was in the middle of the two. The same holds true on a price to operating cash flow basis. Only when we look at the picture through the lens of the EV to EBITDA multiple does Service Corporation International look a bit pricey, coming in as the most expensive of the three businesses.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Service Corporation International | 20.3 | 10.3 | 12.4 |

| Carriage Services (CSV) | 15.5 | 7.0 | 9.8 |

| Matthews International (MATW) | 26.6 | 13.6 | 9.9 |

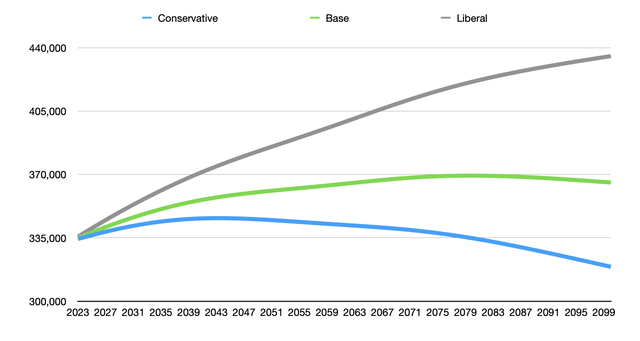

In addition to being fairly attractively priced, Service Corporation International is practically guaranteed to see demand for its services grow for the foreseeable future. According to the most recent data available by the US Census Bureau, if we use the base scenario for immigration in this country, the US population should peak at around 369.4 million by the year 2080. That’s up from the 336.8 million today. Of course, this data can vary based on a number of factors. The most significant would be our behavior as a country toward immigration. If we adopt a stricter stance on immigration, forecasts suggest the population peaking at 345.9 million by the year 2043. Meanwhile, if we go with a policy that prioritizes high levels of immigration, the population should hit around 435.3 million by the year 2100.

Author – US Census Bureau Data

This is not to say the demand will grow forever. In the base case where immigration peaks in the year 2080, we will start to see a decline. That decline will take the population down to 366 million by the year 2100. And if we adopt a stricter stance on immigration, population decline will eventually take us to 319 million by the end of the century. Only in the aggressive immigration scenario do we see no signs of population growth ending by the end of the century. So at the end of the day, politics will play a big role in how long things are good for Service Corporation International from an industry perspective. After all, the larger the population is, the more demand there will be for funeral and cemetery services. But even in the more conservative scenario, we are still looking at population growth of 9.2 million over the next 19 years.

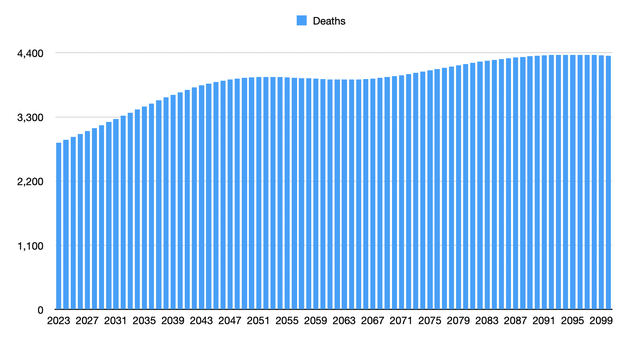

Author – US Census Bureau Data

With an increase in population will come an increase in deaths. Data is not available for the conservative or liberal scenarios, but the US Census Bureau did provide estimates for the base scenario. In this case, the number of deaths in the US came in at 2.86 million last year. This year, that number should climb to 2.91 million while by the end of the decade we should see 3.21 million people dying annually. Even though the base scenario has the population beginning to decline after the year 2080, deaths will continue to grow until hitting a peak of 4.37 million in the year 2094. That is particularly bullish for Service Corporation International.

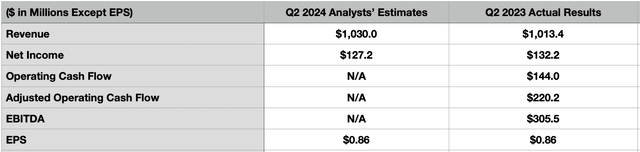

Despite how I feel about the company, there is no denying that the fundamental picture could change. These changes are most likely to become apparent when companies announce financial results covering their latest fiscal quarters. And it just so happens that, after the market closes on July 31st, the management team at Service Corporation International is expected to announce financial results for the second quarter of the company’s 2024 fiscal year. Leading up to that point, analysts are forecasting revenue of $1.03 billion. This would represent a 1.6% increase over the $1.01 billion generated the same time last year.

On the bottom line, the expectation is for $0.86 per share in profits. This would match with the company achieved last year. But because of the change in share count, it would translate to a decline in net income from $132.2 million to $127.2 million. In the table above, you can see some other profitability metrics from the second quarter of last year. Investors should be paying attention to these metrics as they come out, even though analysts have not provided any guidance for them.

Takeaway

Even though things aren’t going great for Service Corporation International at this point in time, they certainly aren’t going poorly. It is true that some of the top and bottom line figures of the company have worsened since I last wrote about the business. But a lot of this appears to be related to a return to normalcy following the COVID-19 pandemic. Relative to earnings, I would say that shares are a bit pricey. But this is not the case involving the other two profitability metrics. Add on top of this growth prospects that should last decades, and I think that the company deserves a soft ‘buy’ rating at this time. In the event that shares rise another 15% without a corresponding improvement in fundamentals, I would likely downgrade it to a ‘hold’. That upside would imply a price of around $89, though for investors who want to be more conservative, cashing out at around $85 would seem reasonable.