yujie chen

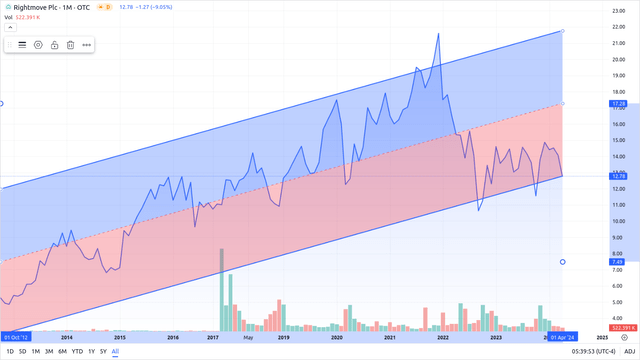

It has been more than a year since we started covering Rightmove plc (OTCPK:RTMVF)(OTCPK:RTMVY), the UK’s leading property portal. We thought shares were fairly valued, but started with a “Buy” rating given the quality of the business and its strong pricing power. The total return has been quite decent, with the shares outperforming the iShares MSCI United Kingdom ETF (EWU), although they have significantly underperformed the S&P 500 index (SPY). The company recently shared its financial results for fiscal year 2023, and we are analyzing them to update our rating, if appropriate.

Seeking Alpha

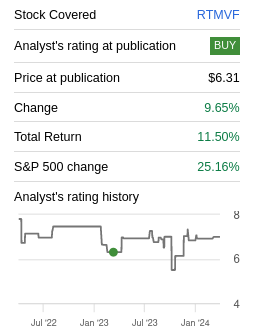

While UK stocks have continued to underperform the main U.S. stock market indices, there is a case to be made that this trend could soon reverse. According to World PE Ratio, shares are trading at almost twice the Price/Earnings multiple in the U.S. compared to the UK. Part of the difference can be attributed to sector weightings, with the U.S. having more exposure to high growth sectors like technology (XLK).

Still, even compared to their own historic multiples, the U.S. appears expensive and the UK appears more fairly valued. This is one of the reasons we have been paying more attention to international stocks recently, and we believe Rightmove plc in particular is one of the highest quality franchises available in the UK stock market.

worldperatio.com

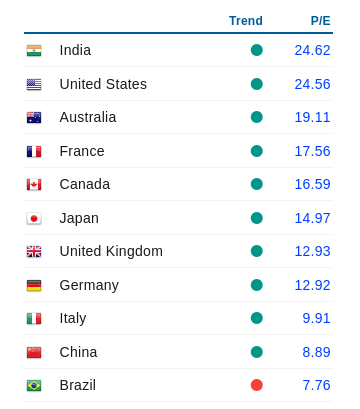

If we look at the share price regression for Rightmove, it is clear that it is currently trading significantly below trend.

This could be an indication that the share price presents an opportunity, but we will analyze the fundamentals to make sure the company’s competitive moat remains strong.

FY23 Financial Results

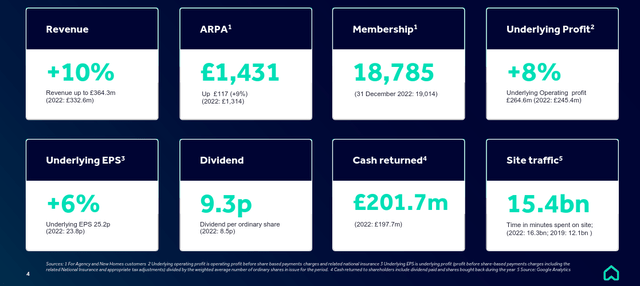

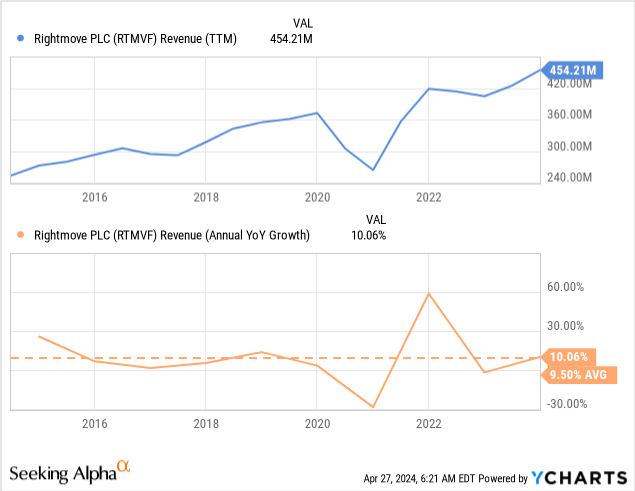

Despite multiple headwinds in the UK residential sector, and weakness in the economy, Rightmove was still able to deliver 10% revenue growth. It had an Agency retention rate of 89% as the company remains indispensable for most of these customers.

The company generated cash from operations of £268 million, a slight increase compared to the £244 million generated in 2022. Rightmove continued with its progressive dividend policy by increasing the dividend 10%.

Rightmove Investor Presentation

Competitive Moat

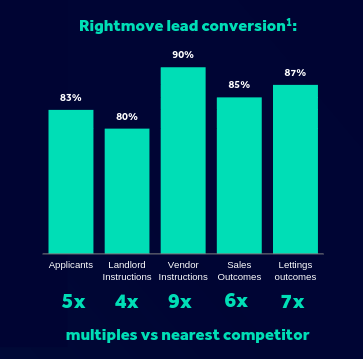

Rightmove has strong pricing power thanks to its network effects derived from being the dominant property platform in the UK. Its market share remains high at 86%, and most web traffic is from consumers who are seeking the Rightmove brand. The mobile app now generates more than 40% of the leads, and lead conversion is multiples higher compared to its competitors.

Rightmove Investor Presentation

Innovation and R&D

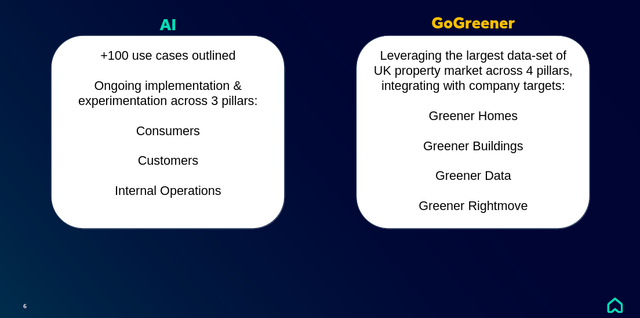

Despite its significant lead versus local competitors, Rightmove has not stopped innovating or developing new functionality. It is currently focused on two areas, finding how to use artificial intelligence to improve and automate its platforms, and making it easier for customers to evaluate the sustainability of a house or building.

Rightmove Investor Presentation

Peer Comparison

Property platforms that are dominant in their country or region are very attractive businesses, something that professional investors have not missed. For example, private equity giant Silver Lake bought Zoopla, a Rightmove competitor, for $3 billion in 2018. Similarly, Swedish private equity group EQT acquired Spanish real estate platform idealista for €1.3 billion in the middle of the pandemic. The company is the leading property platform in Spain, and it has a strong presence in Portugal and Italy as well. Despite making the purchase at a time of high uncertainty, the price was not cheap as EQT paid roughly 25 times the €50 million in earnings the company delivered in 2019.

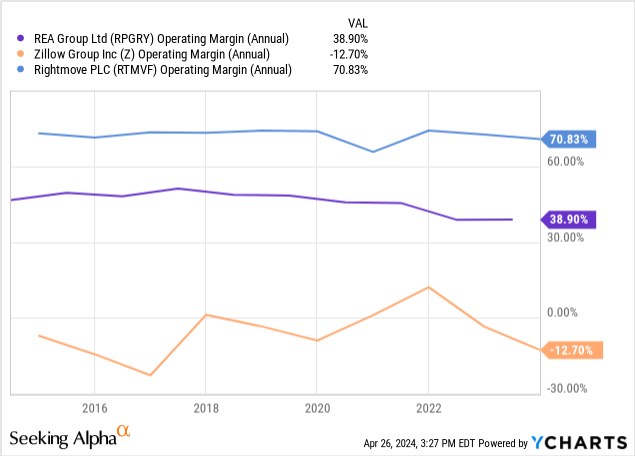

This has left relatively few public peers for Rightmove, most notably REA Group (OTCPK:RPGRY) which has well-known property platforms in Australia, and Zillow Group (Z) which is probably the closest U.S. competitor. There is, however, a significant difference in the operating margins they have been able to deliver, with Rightmove offering much higher profit margins compared to these two alternatives.

Revenue Growth

Rightmove has such a strong competitive moat that it has managed to deliver growth despite significant headwinds. It was significantly impacted by the Covid pandemic, but it recovered quite quickly, and it has been reaching record revenue numbers. This is despite the UK’s housing market being in disarray, delivering few new homes at very high prices and in some cases low quality levels. This has kept volumes down, and has meant that most revenue growth for Rightmove has come from pricing actions, either from new products and functionality, or traditional price increases.

While it is good to see the company has such strong pricing power, we do worry that it is not healthy when customer numbers are stagnant. At some point, the company will have to refocus on growing the number of subscribers, as price increases above inflation are less sustainable. In any case, despite numerous headwinds during the past decade, the company managed to deliver ~10% average annual revenue year-over-year growth.

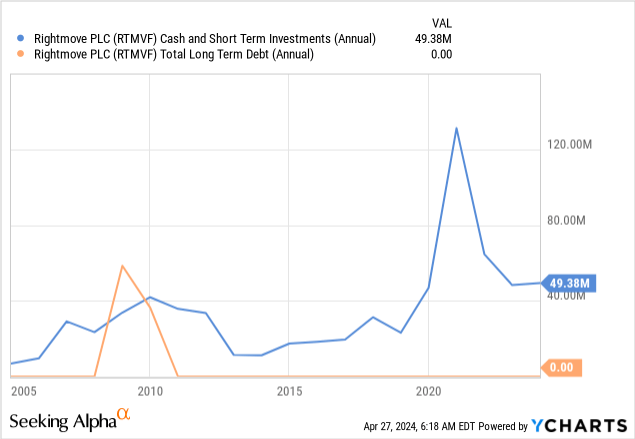

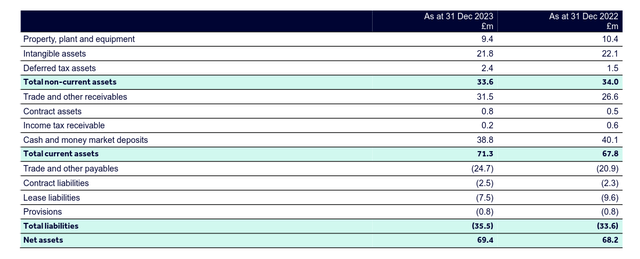

Balance Sheet

Rightmove has an asset-light business model which has allowed the company to keep a very clean balance sheet with basically no long-term debt, and a good amount of cash and short-term investments.

As can be seen in the table below, most liabilities are things like “lease liabilities” and certain types of trade payables. While the company has a positive book value, the real worth of the business is significantly higher and mostly comprised of intangible assets including its valuable brand, platform, and business relations.

Rightmove Investor Presentation

Shareholder Returns

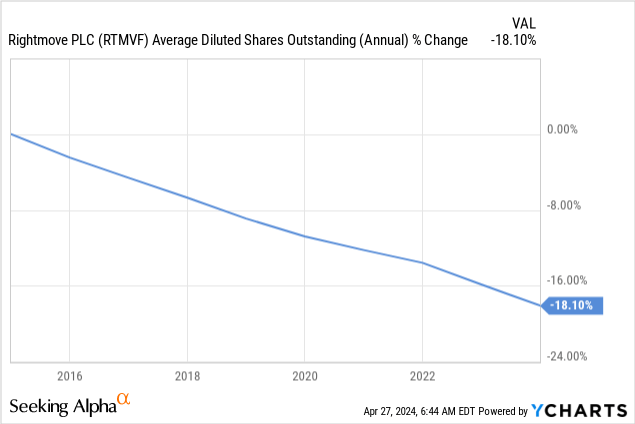

While the dividend yield is modest at ~1.8%, the shareholder yield which includes stock buybacks is close 5%. The dividend yield is close to the maximum it has been in about a year, just a little lower compared to last October and November when there was a general stock market pullback. The company typically returns most of its earnings to shareholders through the dividend and share repurchases.

Contrary to some U.S. technology companies that spend enormous amounts just to offset stock option dilution, we can see that Rightmove has actually very significantly decreased the number of average diluted shares outstanding over the past decade.

Outlook

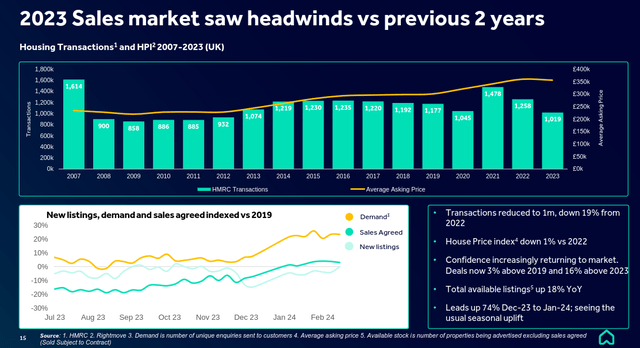

The future outlook for the company is mixed, with both headwinds and tailwinds expected. Rightmove expects that the expected reduction in interest rates in 2024 and 2025 should help stabilize property prices, which should help improve transaction levels.

The company shared its financial guidance for 2024, which includes expected revenue growth of between 7% and 9%, average revenue per agency (ARPA) growth between £100 and £110, with a slight drop in customer numbers. The underlying operating margin is expected to remain close to 70%. In terms of capital allocations, the company will prioritize organic investments, followed by bolt-on acquisitions. It plans to continue its progressive dividend policy, and return all surplus cash to shareholders.

Looking further ahead, the rental market remains challenging for both tenants and landlords due to low supply growth, and landlords facing increased regulatory and financing headwinds. This has resulted in an increase in large and professional landlord companies that are better positioned to handle these challenges, often by acquiring smaller competitors. Rental demand continues to be considerably above historic levels, with the company generating several times more leads per property compared to pre-pandemic numbers, but demand has started to cool down.

Rightmove Investor Presentation

Valuation

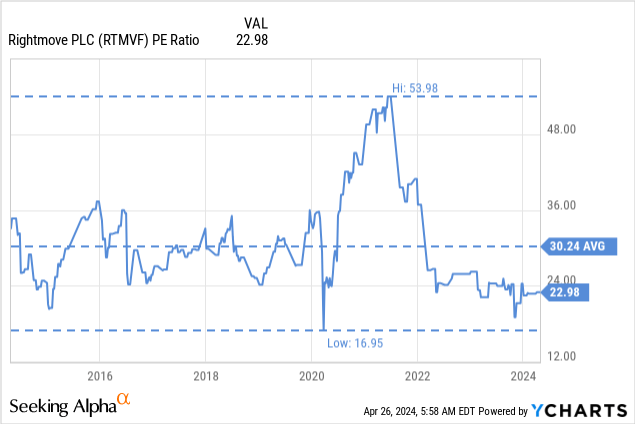

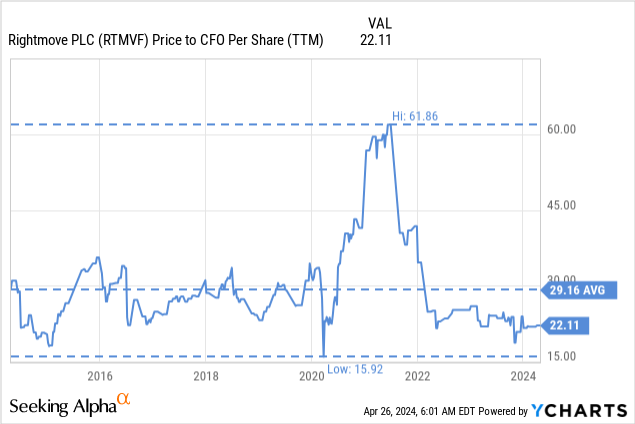

Despite a mixed outlook, we believe this is a good time to buy shares of Rightmove plc. The company is currently trading at a significant discount to its historical Price/Earnings multiple, and it is a cheaper multiple than what EQT paid for idealista at a time of high uncertainty during the pandemic.

It is true that revenue growth prospects are not very high, but investors should also consider that the company has to reinvest very little in order to increase revenue and earnings. This has allowed the company to grow while returning most earnings to investors in the form of dividends and share repurchases.

Looking at the Price to Cash-flow from Operations, we see something similar, with shares currently trading with a meaningful discount to their ten-year average.

Risks

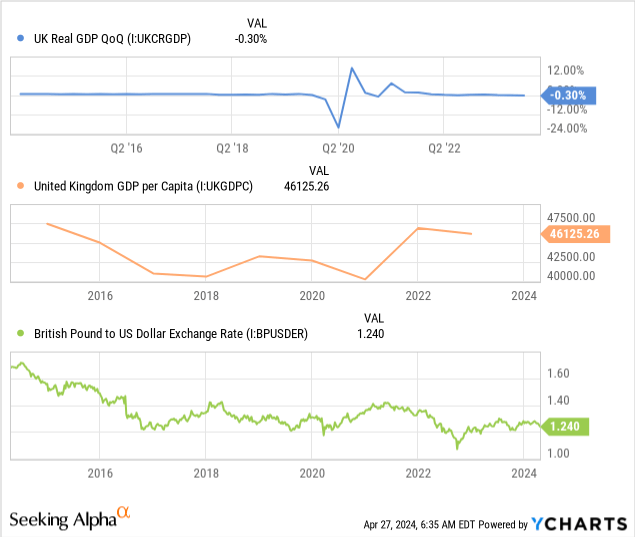

Probably the biggest risk with Rightmove is the over reliance on the UK market, which has had a very bad performance over the past decade. In fact, it recently posted negative GDP growth, and GDP per capital has gone down over the past decade, when measured in dollars. Part of the reason is that the British Pound (FXB) has lost significant value over the past decade against the dollar and several other major currencies.

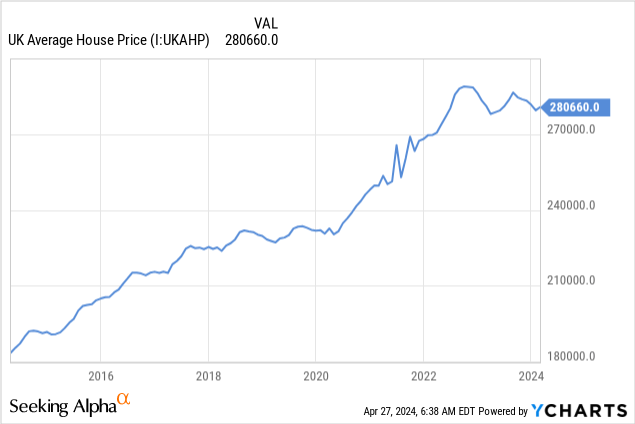

Despite low economic growth, house prices have risen dramatically, making housing affordability a significant issue in the country. There is little new supply being added to the market, despite robust demand. This has constrained transaction volumes, and is also a headwind for companies like Rightmove.

Conclusion

After reviewing Rightmove’s financial results for fiscal year 2023, we continue to find shares attractive. In fact, we believe they are more attractive now given that they are trading at a lower Price/Earnings multiple compared to our previous article, and expectations are that interest rates will start to be reduced relatively soon. We remain impressed by the company’s pricing power, but find it concerning that revenue growth has been accomplished mostly through price increases. There are several risks to consider, including issues with the UK’s economy and housing sector in particular. Still, we believe the valuation is currently very attractive given the quality of the business.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.