Abstract Aerial Art/DigitalVision via Getty Images

Dear readers/followers,

I’m very interested in the investment of capital into water businesses. You really only need to look at my publishing history, and my history with companies like Uponor (OTC:UPNRF) in Finland, but also American water companies. This includes dividend monoliths like York Water (YORW). So I like companies that in some way have to do with water, and I’m willing to assign those companies fairly hefty valuations.

Why is that?

Because, as one of my early articles on water companies said – water is life. Water is a fundamental need for our species, not just as human beings in the biological sense, but also for our industries, our businesses, and other processes. Any company that “does” water well is worth my attention. By extension, it could be worth yours if you like the way that I invest and “do things”.

In this article, I’ll be picking up coverage of a new company. That new company is called Primo Water Corp. (NYSE:PRMW). It’s not a “new company” for the market, but a new company for me specifically. I’m always happy when I find a new water company to cover.

Let’s see what we have going for us with this one.

Primo Water – A “Primo” company?

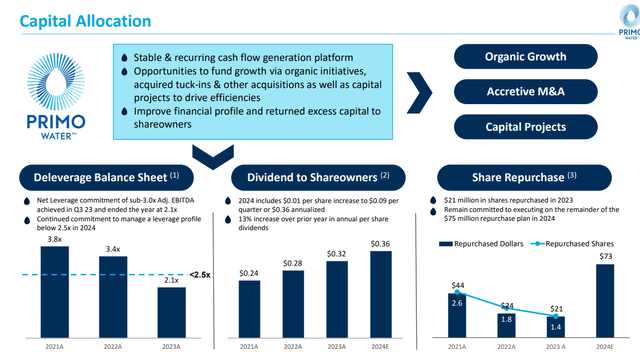

So, why is there a lot to like about Primo? Primo is US-based, a company that also quite recently doubled down on the US focus of its business. The company did this by divesting European operations during the tail-end of last year, closing on the 29th of December. This transaction allowed the company to cut down its revolver to zero in usage, and cut down leverage to below 2.2x net debt/adjusted EBITDA. In other words, plenty to like. The company ended the move with over $500M on its balance sheet, and increased its share repurchasing program to $75M, which should add some support despite the marked difference in earnings potential as a result of this.

Primo Water IR (Primo Water IR)

The company is “American-Canadian” and offers multi-gallon bottled water services. This includes water dispensers and self-service refill machines, as well as water filtration. It’s not a water company with bottled products like Evian, but works on a larger, more commercial scale – which is welcome. The company has headquarters in Tampa, FL, and after the transaction works with customers in the US, Canada, and some customers in Israel. At this point, the company is 72 years old, and works both with organic and inorganic growth, meaning M&A’s as well as more typical earnings growth.

In the latest annual results, we find that the company manages revenues of around $1.77B, and adjusted EBITDA of $380M. This means a double-digit, 21.5% EBITDA margin, which can be viewed as impressive for continued operations. For the combined operations, the revenue is higher at $2.35B, but the EBITDA margin is at 20.3%, with EBITDA adjusted at just north of $475M.

The company’s focus as of late has been a combination of repurchasing of shares and delevering the balance sheet, which I applaud.

Primo IR (Primo IR)

The company is an organically interesting company – because the demand for water has historically only moved up. This is confirmed by solid organic growth trends, a deepening and growing relationship with major retailers, market share growth, and also some connectivity and IT growth. The company sells about 1M water dispensers (the company’s core), and a total of 1B gallons of water. The clear target is also selling the remainder of the international business, and focusing entirely on being an NA player. This has also resulted in an increase in the company’s dividend.

That dividend isn’t all that impressive. As it stands, the dividend has grown, but it’s only a very small one, currently at below 1.7%. The company also lacks any meaningful credit rating, coming in only at a B+, despite a long-term debt/cap that’s now below 49%. I view this as indicative that the ratings agencies haven’t caught on to the changes here just yet, and that there are more moves the company is yet to make. Primo, other than that, is a very attractive business. While it hit some snags in the GFC, since revamping its business model post-GFC, the company has averaged a 10-year EPS growth of 18% and is expected to continue to grow at double-digit rates going forward (Source: Paywalled F.A.S.T Graphs Link).

I said the company isn’t a traditional bottled water or drinks company – but it used to be. Back in 2000, the company sold several brands of products, including Seltzer Water, and coffee delivery services, only to then sell these operations. In -18, the company sold the Refresco business at $1.25B. So for the past 20 years, the company has moved into, and out again of certain areas, and has now ended up with this focus. Primo Water was not in fact part of the company until 2020. Until then, the company was called Cott Corporation. And this, that the company has found, is a focus I like.

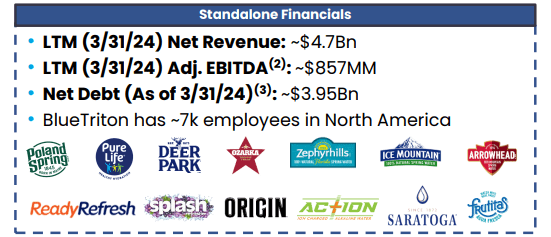

Another set of important news, one that’s very new, is the upcoming merger with BlueTriton.

Primo IR (Primo IR)

This new suggested merger will bring about a company with net revenues of over $6.5B, and a leverage of only about 3x at close (likely one of the reasons for the disposals, if I’m allowed to speculate here), with an LTM EBITDA of over $1.5B at a margin of 23%. This would make it one of the most attractive businesses in this entire field, with an adjusted FCF of over $550M at this time, and a potential for synergies upwards of $200M. Both of these companies are over 70 years old, both of them have a lot of history, a lot of strong brands – and the addition of BlueTriton would bring to Primo’s portfolio the appeal of bottled water with the following brands and financials on a standalone basis.

Primo IR (Primo IR)

The arguments for this fusion are not unique to the case of such an M&A. But with Primo’s track record of successful M&A, at least over the past few years, I see more upside than downside here. Also, the simplification of its segments and operating geographies here that it has gone through is another positive that I see. This is a merger structured as a merger of equals, all-stock. This means that at the time of closing, holders of the equity will own 43% of the fully diluted shares of Newco (Primos) and 57% of NewCo (BlueTriton). This also comes with a special dividend of $0.82, likely to make up for this difference.

This move allows for the retaining of bonds and term loans, with a target of delevering back down 2x as soon as possible. The new company’s annualized dividend is currently expected to be $0.36 per year.

This transaction is currently expected to close in 1h25, so in about half a year to a year at most.

This of course mostly takes over the thesis and potential for the company – because much of the forecasts are already focused on this potential. We’ll see that in the valuation section.

I like water companies – and I like this combination of water companies.

Let’s look at the valuation for the company, and what could be seen from this combined water company in a year or two.

Primo Water – Together with BlueTriton, I believe an upside here could be in the double digits.

The combination of these two companies will, according to my research and the company’s own data, create a leading company in this field. This results in non-trivial market opportunities for the new player, as well as significant synergies and cost savings. The main concern or hurdle for investors seems to be leverage – but I do not consider either 3x or the targeted 2.5-2x to be overleveraged.

The company’s focus for the new business will not only be retail. Retail’s fine, but the real magic happens when you can combine the appeal of Primo’s commercial segment with the retail experience of BlueTriton. It means you can bring the company’s products into the home and to the businesses, such as food services, offices, and other businesses, all of which rely on these products. This is a category with significant upside, and the US bottled water market is a $25B market.

So for these reasons, I actually consider the company to be somewhat fairly valued at this time. When this news broke, the share price actually dropped to around $20/share – that would have been a better time to buy – but I didn’t watch closely enough. I’m rectifying this mistake now. I believe Primo water can easily be considered worth around 25x earnings multiple, which brings to the table 17-20% annualized growth for the next few years. Even forecasting it only at 23x, the company still gives us 15% per year. And 23-25x is the lowest the company has traded for the past 20 years. The more “correct” average valuation comes to around 35x, like other water companies including YORW, and the upside at this valuation is well over 35% per year. But to be clear, I do not view this as a realistic assumption for this company.

So in the end, I believe that Primo, with the M&A taken into account here, is clearly undervalued. I believe the company has room to grow and room to run once (and if) it closes. The main risk here is that the company’s M&A doesn’t go through – but given everything that’s being said here, and this not being a transaction major enough to where I expect regulators to get involved, I do not view this as a risk.

For that reason, I consider Primo Water Corp to be an interesting play here. I’m adding a small stake to my portfolio and would give the company a “Buy” here with the following considerations.

Thesis

- Primo Water is a water company, which in itself is grounds for me to like it, provided it’s qualitatively managed. While the company previously has had some issues, I believe that overall, this company has been solid for the past decade or so – cutting non-core and stray geographical foci, to move into the current market with a solid focus on the core – water and water deliveries.

- With BlueTriton added to the mix, I believe the combination implies an upside, increasing EPS by more than 50-60% initially, and double-digits going forward. I believe the company warrants a premium, albeit not as high as some other water companies.

- For an introductory PT, I go for a somewhat conservative 25x P/E on a forward basis, implying a PT of around $27 for 2025E when this deal closes (not including the extraordinary dividend), and I consider this appealing and with an upside. Therefore, Primo Water is a “Buy” to me here, and I mean to add a small position in the business.

Remember, I’m all about:

-

Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

-

This company is overall qualitative.

-

This company is fundamentally safe/conservative & well-run.

-

This company pays a well-covered dividend.

-

This company is currently cheap.

-

This company has a realistic upside based on earnings growth or multiple expansion/reversion.

I won’t call Primo water “cheap” here because no company at 25x P/E is really cheap, barring some luxury businesses that trade at 40x P/E usually. But it’s attractive enough to where I consider it a “Buy”, fulfilling 4 out 5.