Nandani Bridglal

Investment Thesis

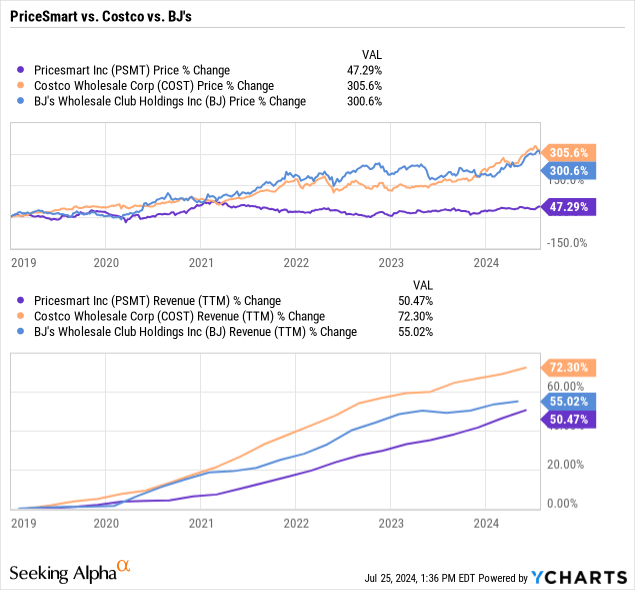

I am long PriceSmart (NASDAQ:PSMT), the leading warehouse club retailer in Central America, as I think this company is undervalued given its strong business model and significant growth prospects. PriceSmart is a well-managed retailer with store and customer metrics all trending in the right direction and remarkably stable margins. Over the past five years, PriceSmart has kept up with (COST) and BJ’s Wholesale Club (BJ) in terms of revenue growth but lagged the two in terms of share price growth. It should only be a matter of time before PriceSmart’s share price catches up.

Company background

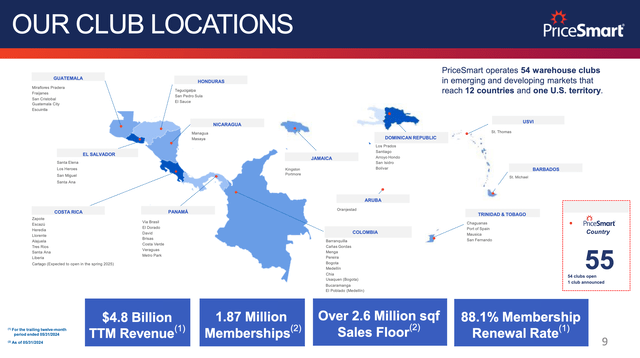

PriceSmart is the “Costco of Central America.” As of May 2024 the company has with 54 well-run, heavily trafficked warehouse clubs serving 1.9 million members. Each member pays a $35 annual fee for the for the right to spend an average of $220 per month on bulk groceries, household products, and pharmaceuticals.

The company was founded and continues to be run by CEO and Chairman Robert Price. Robert’s father Sol Price founded Price Club in 1976 as the first warehouse club retailer in the U.S. Price Club merged with Costco in 1993 and spun out its Central America operations as Price Enterprises, which later became PriceSmart.

Today, PriceSmart operates 54 warehouse clubs primarily in Central America: 10 in Colombia, eight in Costa Rica, seven in Panama, and a handful each in Guatemala, Honduras, El Salvador, Nicaragua, Jamaica, Aruba, the Dominican Republic, Barbados, Trinidad and Tobago, and the U.S. Virgin Islands. These are supported by a network of 16 distribution centers across those same countries.

PriceSmart Q3 2024 Presentation Slides

Stable margins and growing store productivity

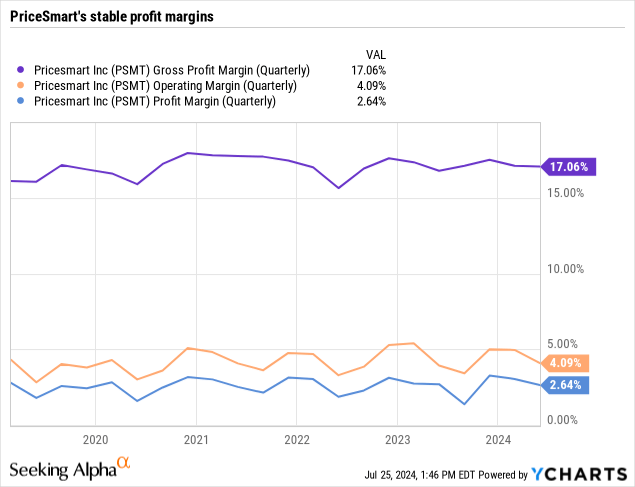

PriceSmart has low but stable margins at 16-18% gross and 2.5-3% net, comparable to other warehouse clubs. Even during the depths of the COVID pandemic, PriceSmart’s USD gross margins never fell below 14.2%. There is some FX exposure as most sales are in local currencies and half of PriceSmart’s imported merchandise is purchased in U.S. Dollars. The company has been lucky that none of its markets have experienced Argentina- or Venezuela-style crises in recent years.

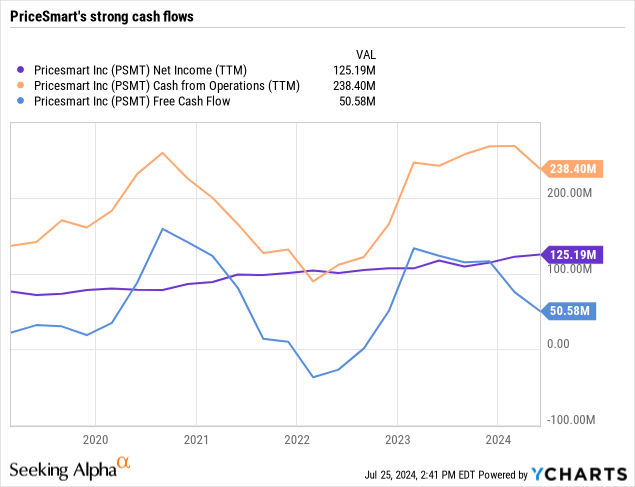

PriceSmart’s lean working capital and cash flows further support the company’s position as a well-run retailer that knows what products its customers want, and how to manage that inventory in an efficient way. The company’s inventory days are consistently in the 45-50 day range, which as a cash-and-carry retailer, means PriceSmart has a near-zero day cash conversion cycle. This translates into exceptionally high earnings quality; between 2019 and 2024, operating cash flow averaged 185% of net income and free cash flow averaged 63% of net income over the same period.

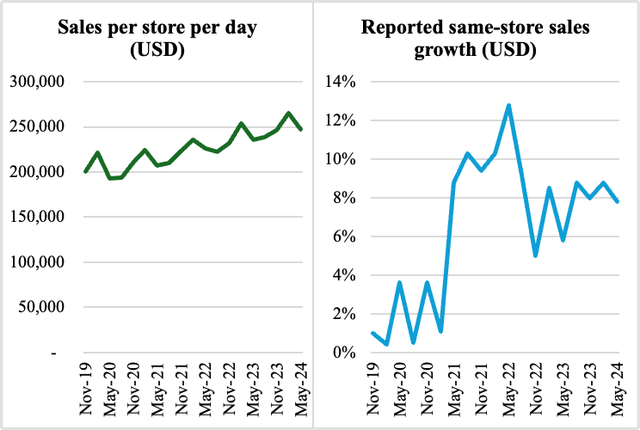

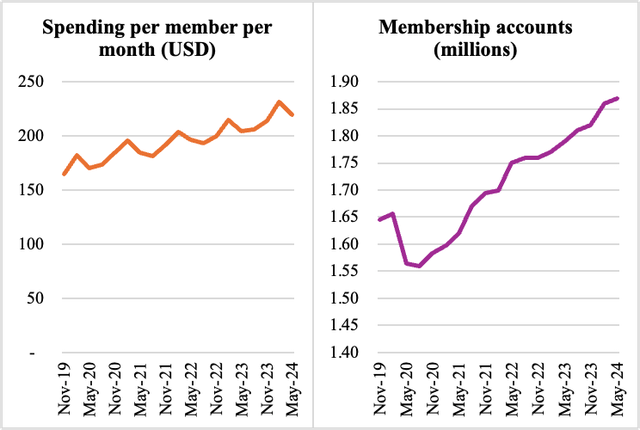

Store and membership metrics have also been consistently moving in the right direction. PriceSmart’s latest financial results ending May 2024 saw:

- Average sales per store per day grow from $200,000 in 2019 to nearly $250,000.

- Same-store sales (reported as “comparable net merchandise sales”) consistently in the positive mid-single digits in USD terms, and mostly positive in constant currency terms except during COVID-era store closures.

- Membership accounts grow from 1.6 million in 2019 to nearly 1.9 million, and renewal rates remaining in the high-80% range. The company has also been successful in encouraging members to upgrade to ‘Platinum Membership,’ which costs double the normal membership.

- Average spending per member steadily increasing from $164 per month in November 2019 to $220 per month in May 2024.

PriceSmart financial statements and press releases; Author analysis PriceSmart financial statements and press releases; Author analysis

Solid returns on new stores

PriceSmart has been conservatively managed over the past several years and opted to only use internally generated cash flows to expand by 1-3 stores per year. New stores have a decent return on capital of around 11%:

- A new store requires an investment of around $25 million = $17 million in capex + $8 million in net working capital.

- After reaching maturity in two years, a store will generate around $90 million in annual merchandise sales, plus another $1.5 million in new membership fees (36,000 members per store x $40 each).

- At a 3% net margin, that represents $2.8 million in net profit per store, or an 11% return on the $25 million investment.

With around $120 million in annual operating cash flow and a 25-30% dividend payout ratio, this means that PriceSmart can internally fund at least 3-4 new stores per year.

Macroeconomic tailwinds

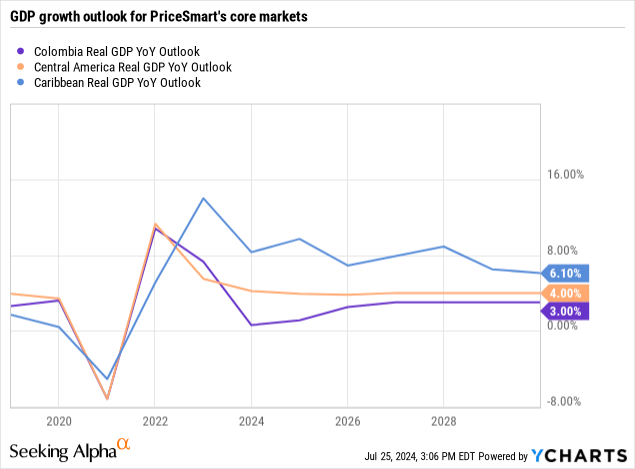

The macroeconomic environments of PriceSmart’s markets should support long-term growth in store expansion, same-store sales, and spending per member. The IMF expects real GDP growth rates of 6.1% for the Caribbean, 4% for Central America, and 3% for Columbia through 2029.

PriceSmart’s core markets are also under-penetrated by wholesale clubs relative to the US. Costco has 604 stores in the U.S. serving a population of 330 million, or one per 550,000 people. PriceSmart has 54 stores serving countries with a population of 100 million, or one per 1.8 million people. There is plenty of room left for PriceSmart to more than double its store footprint in its existing markets.

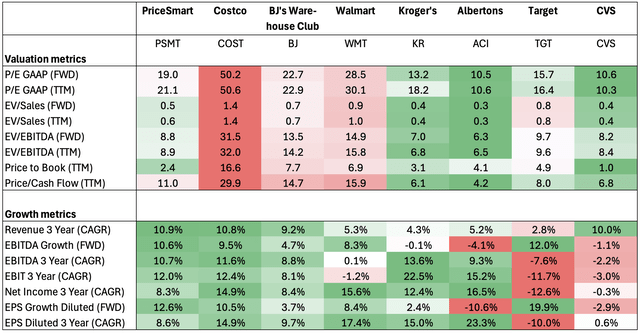

Peer valuations

Despite being well-run and having solid growth prospects, PriceSmart currently trades at a discount to peer wholesale clubs and grocery stores around the world. While some analysts argue that Costco, trading at 50x P/E and 1.4x EV/Sales, is overvalued, PriceSmart is trades at less than 20x P/E and 0.5x EV/Sales. In context of other retailers, PriceSmart is growing almost as fast as Costco but priced at a significant discount to Costco.

Risks

Part of the discount is warranted: PriceSmart operates in emerging markets with more volatile currencies, economies, and political environments than the US. PriceSmart’s customers are also more likely to be more price-sensitive, which leave the company more vulnerable to discount retailer competitors.

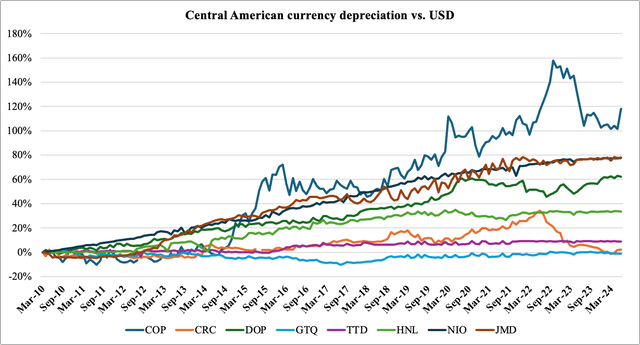

PriceSmart has one foot in and one foot outside the US: it is headquartered in San Diego, trades on the New York Stock Exchange, reports its financial results in US dollars, and procures much of its inventory in US Dollar terms. At the same time, only 20-25% of PriceSmart’s revenues are US dollar-denominated (Panama, El Salvador, and the US Virgin Islands use the USD as their official currency), according to the company’s latest financial report. Since 2010 the currencies of PriceSmart’s core markets have ranged from the Costa Rican colon and Guatemalan quetzal remaining basically unchanged to the Colombian peso depreciating against the US dollar by more than 100%.

A secondary risk is social and political stability, given that PriceSmart operates in less-developed markets with long and recent histories of political and social violence. Political risk goes both ways; improvements like plummeting crime rates in El Salvador can provide a boost to economic growth and to the sales of retailers like PriceSmart.

Conclusion

PriceSmart is a well-run warehouse club dominant in Central America that is trading at substantially lower valuation multiples than its American peers. I think the company is undervalued today given its growth prospects and quality management.