Alexandros Michailidis

In the last few years, I covered several pharmaceutical companies – including Gilead Sciences, Inc. (GILD), Novo Nordisk A/S (NVO) or Eli Lilly and Company (LLY) – and wrote in one way or another about many different pharmaceutical companies. But one major pharmaceutical company I never wrote about is Pfizer Inc. (NYSE:PFE). The company is one of the oldest and major pharmaceutical companies in the world and among the top 10 pharmaceutical companies (according to market capitalization).

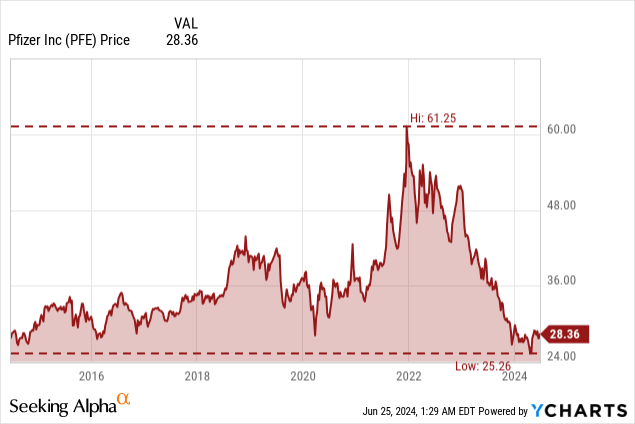

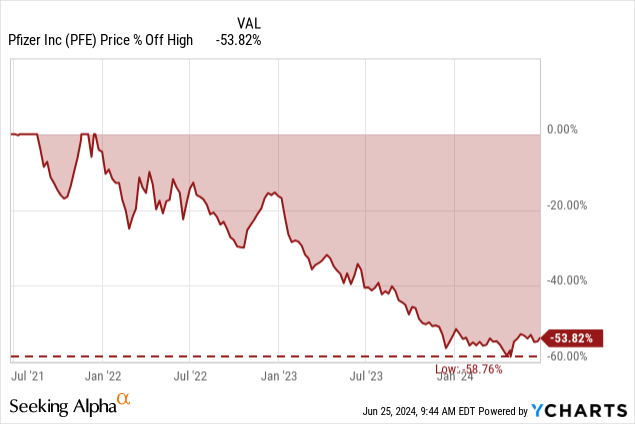

In the following article, I will look at Pfizer and try to answer the question if the stock could be a good investment after declining 54% from its previous all-time high.

Business Description

Pfizer is a company that probably needs no introduction, as most people (and investors) are familiar with the pharmaceutical company. Nevertheless, I will offer a short description anyway. Pfizer was founded in 1849 in New York by two Germans – Charles Pfizer and Charles F. Erhart. In the last 175 years, the company developed into one of the major pharmaceutical companies in the world, with about 88,000 employees and $60 billion in annual revenue. Pfizer is developing medicines and vaccines. In the last few years, Pfizer was especially known for its COVID-19 vaccines, but it is also offering pharmaceuticals for immunology, oncology, cardiology and neurology.

Quarterly Results

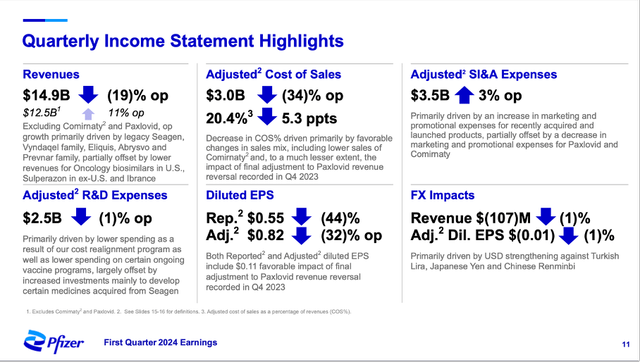

When looking at the last quarterly results, we see a company that doesn’t seem to be in great shape. Total revenue declined from $18,846 million in Q1/23 to $14,879 million in Q1/24 – resulting in a 21.0% year-over-year decline. Income from operations also declined 43.7% YoY from $5,555 million in the same quarter last year to $3,128 million this quarter. And finally, diluted earnings per share declined from $0.97 in Q1/23 to $0.55 in Q1/24 – also resulting in a 43.3% YoY decline.

At first, the results seem horrible, and Pfizer seems to be in big trouble. However, there is a rather simple explanation for the results. In the last three years, Pfizer generated a lot of revenue with pharmaceuticals related to COVID-19 and with COVID-19 not being a major issue anymore, revenue from these products is declining.

When looking at the three different segments – Primary Care, Specialty Care and Oncology – it is especially Primary Care that got hit hard. Revenue declined 38% year-over-year to only $7,211 million in revenue, but as mentioned above, this was due to the pharmaceuticals used for COVID-19 treatment and vaccination. Comirnaty sales declined steeply from $3,064 million in the same quarter last year to only $354 million this quarter (88% YoY decline) and Paxlovid sales declined from $4,069 million in Q1/23 to $2,035 million in Q1/24 (50.0% YoY decline). When excluding these two, revenue for the Primary Care segment increased 8.9% year-over-year from $4,427 million to $4,822 million. Especially, Eliquis is a major contributor and generated $2,040 million in revenue and grew 8.9% year-over-year. The second major contributor is the Prevnar family, which generated $1,691 million in revenue and grew 5.6% year-over-year.

The second major segment is Specialty Care, which generated $3,843 million in total revenue and compared to the same quarter last year grew 6.3% YoY. Here we have a very diversified portfolio with only one blockbuster drug and several other drugs generating revenue in the hundreds of millions. Only the Vyndaqel family generated $1,137 million in quarterly revenue and was also the major driver of growth with a 66% YoY increase.

The third segment is Oncology, and this might be one of the most promising segments for Pfizer right now. In Q1/24, it generated $3,549 million in revenue and grew 18.4% year-over-year. The major blockbuster is Ibrance, which generated $1,054 million in revenue. However, year-over year, revenue declined 7.9%. Other major contributors to revenue were Xtandi generating $418 million in revenue (23.3% YoY growth), Padvec generating $341 million in revenue (has not been approved in Q1/23) and the portfolio of oncology biosimilars generating $264 million in revenue.

Growth

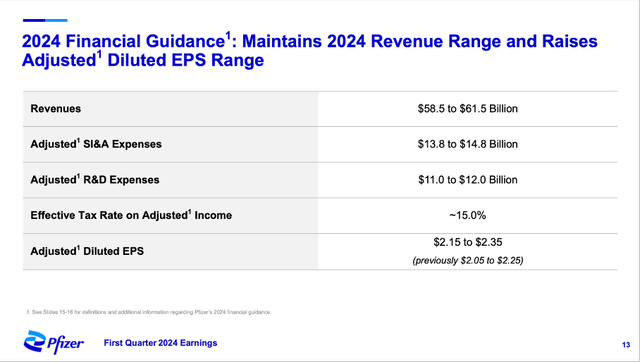

When looking at Pfizer’s guidance for fiscal 2024, management is expecting revenue to be between $58.5 billion and $61.5 billion. Compared to fiscal 2023 results, this would result in 0% to 5% growth for the top line. Adjusted diluted earnings per share are expected to be between $2.15 and $2.35. And not only raised Pfizer its guidance from previously $2.05 to $2.25 in earnings per share, but this would also result in 17% to 28% bottom-line growth.

And when looking at the guidance we must take into account that Comirnaty generated $11,220 million in revenue in fiscal 2023 and Paxlovid generated $1,279 million in revenue. For fiscal 2024, Pfizer is expecting these two pharmaceuticals to generate only about $8 billion in revenue and the company therefore also must set off $4.5 billion in losses.

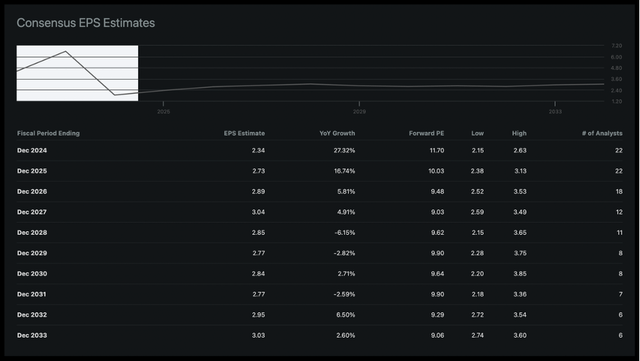

Pfizer Earnings Estimates (Seeking Alpha)

When looking not only and the current fiscal year but also the bigger picture, analysts are expecting earnings per share to grow in coming years, but in a few years from now, stagnation is expected again. Of course, it is extremely difficult to estimate revenue for a pharmaceutical company in 5 or 10 years from now due to patent losses and not knowing how the pipeline will turn out. And as a result, analysts are rather cautious about pharmaceutical companies in 5 or 10 years into the future.

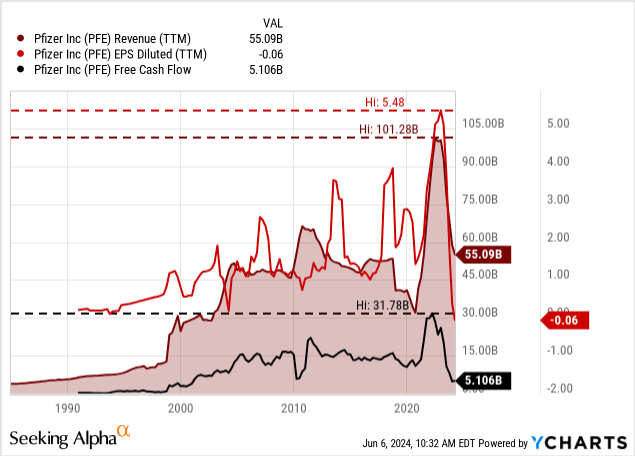

The past is also showing us a rather messy picture. Of course, Pfizer grew with a high pace in the last few years and generated huge amounts of revenue and free cash flow. But that was due to COVID-19 and won’t most likely not be repeated. In the years before, the business rather stagnated.

Nevertheless, we can be optimistic for the years to come and when asking the question of where future growth for Pfizer might come from, the answer could be the oncology segment and acquisitions. Different studies are expecting high growth rates for the oncology market and are expecting at least high single digit growth rates in the years to come (some studies are even expecting double-digit growth).

And recently, Pfizer completed a major acquisition. In mid-December, the company announced the completion of the $43 billion acquisition of Seagen. As part of this acquisition, Pfizer acquired four approved medications (and of course several other pipeline candidates). Seagen is especially focused on transformative cancer medicines. Pfizer acquired all outstanding common stock of Seagen for $229 in cash per share.

Balance Sheet

And of course, such a major acquisition also had an impact on the balance sheet. As a consequence of the acquisition, Pfizer has now (on March 31, 2024) only $719 million in cash and cash equivalents as well as $11,209 million in short-term investments on the balance sheet. This is still enough to operate and face no liquidity issues. But before the acquisition, Pfizer had as much as $41 billion in short-term investments on the balance sheet.

On March 31, 2024, Pfizer also had $8,232 million in short-term borrowing on the balance sheet as well as $61,307 million in long-term debt. This might seem like a high amount of debt, but we also have to take into account $92,558 million in shareholder’s equity and this leads to an acceptable debt-equity-ratio of 0.75

Aside from comparing the total debt to total shareholder’s equity, it is more important to compare the total debt to either the operating income or free cash flow, as those metrics will tell us how long it will take the company to pay off the debt. Usually, we take the operating income of the last four quarters, but in the case of Pfizer this was only $3,100 million – a number that is not really representative of the business. In the previous years, Pfizer also generated amounts close to $40 billion, but that is also not representative (as already mentioned above). A realistic amount would be $15 billion annually and when subtracting cash and short-term investments from the total debt, it would take Pfizer less than 4 years to repay the outstanding debt. This is not great, but acceptable, and Seagen will also contribute to operating income (not reflected in the numbers so far).

Risks

Despite all optimism about high potential growth rates for the oncology business, we should not ignore that Pfizer is generating the biggest part of revenue not from oncology. And when only oncology is growing with a high pace, this is not enough for the overall business to achieve meaningful growth rates. The primary care and specialty care business also must contribute to growth, otherwise Pfizer will not be able to grow overall revenue and earnings.

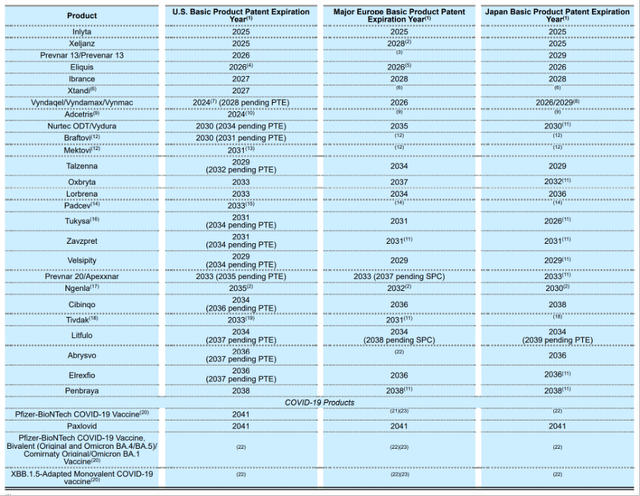

And of course, Pfizer is also facing the risk of biosimilars and other competitor’s products once patent protection is lost. In the next two years, Pfizer will lose patent protection for Inylta, Xeljanz, Prevnar 13 and Eliquis. And all four are blockbusters generating at least $1 billion in annual revenue. Especially, Eliquis is generating $6.7 billion in annual revenue, and losing this kind of revenue would certainly be a major hit to Pfizer. And while more than $10 billion in annual revenue could be at risk here, scenarios are different. When a company loses patent protection for its products, it could lead to steeply declining revenues. But sometimes competitors are just not able to bring a similar product to the market that is also accepted by medical personnel and patients in a similar way.

Dividend

Pfizer could certainly be interesting for its dividend and a stock a dividend investor might buy. Right now, Pfizer is paying a quarterly dividend of $0.42, resulting in an annual dividend of $1.68 and is resulting in a dividend yield of 6.1%. And although bonds are paying a high yield, investing in Pfizer could make sense for investors seeking passive quarterly income. Pfizer is not a dividend king or dividend aristocrat but increased the dividend for 13 years in a row.

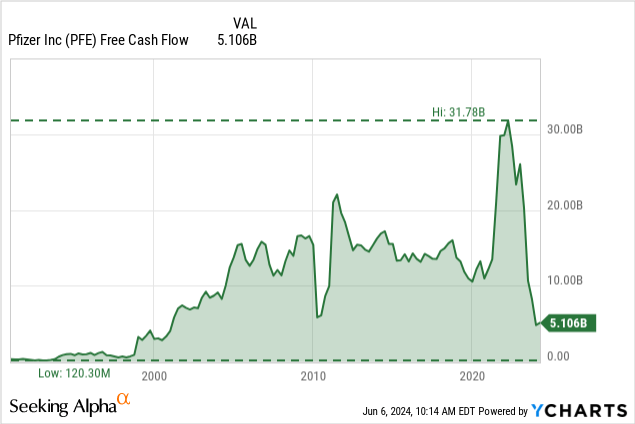

Of course, treasury bonds yield 4.3% right now (10-year treasury bond), but Pfizer not only has a higher dividend yield, but investors might also profit from a rising stock price. On the other hand, treasury bonds are extremely safe and in case of Pfizer we at least must add a question mark to the dividend safety. For fiscal 2024, earnings per share are expected to be $2.34 and this would result in a payout ratio of 72%, which is rather high and should make us cautious. In the last four quarters, the company paid $9,316 million in dividends but the generated free cash flow was only $5,106 million. This means that Pfizer is paying out much more in dividends than it generated in free cash flow.

Here we must look at the free cash flow in the last few years (or decades) to get a feeling what free cash flow might be realistic. Of course, we can’t take the extremely high free cash flow of the last three years, Pfizer generated due to COVID-19 and offering a successful vaccine (in collaboration with BioNTech SE (BNTX)). However, when looking at free cash flow of the last 10 to 15 years, it seems reasonable to assume Pfizer can generate at least $10 billion in free cash flow, which would be enough to cover the dividend. We could be even a little more optimistic. In the last ten years, the company generated $15.5 billion in free cash flow on average, and we can assume that Pfizer can generate a similar free cash flow in the next few years.

Intrinsic Value Calculation

A final step in every analysis is the calculation of an intrinsic value for a stock to determine if we are also dealing with a great investment (a company can be a great business, but a stock does not automatically have to be a great investment).

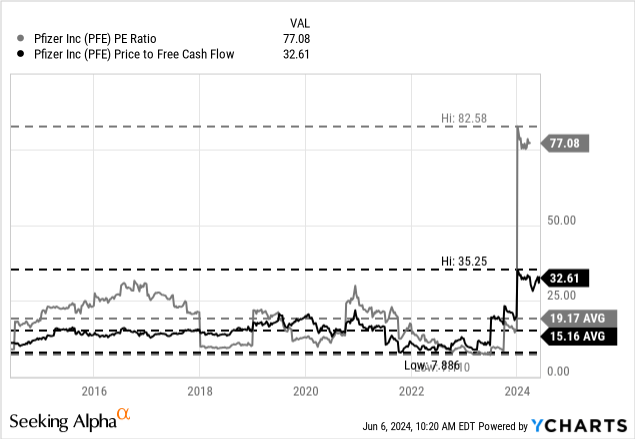

We can start by looking at simple valuation multiples, but when looking at the price-earnings ratio we see that the company is not reporting a P/E ratio right now as the trailing twelve months EPS is negative. Instead, we can look at the price-free-cash-flow ratio. But as free cash flow declined constantly in the last few quarters (see section about the dividend), the P/FCF got higher and higher (despite a declining stock price). At the time of writing, Pfizer is trading for 33 times free cash flow.

In the last ten years, this is the highest price-free-cash-flow ratio Pfizer has been trading for. In the meantime, Pfizer is trading close to the lowest stock price in the last ten years. And here we already see that it is not so easy to reach a conclusion just based on simple valuation metrics.

Instead, we should rather use a discount cash flow calculation to determine an intrinsic value for the stock. Here we must make several assumptions. As always, we use the last reported diluted number of shares outstanding (5,697 million at the point of writing) and a 10% discount rate (as this is the annual return on our investment we like to achieve at least). I often take the free cash flow of the last four quarters as the basis for the calculation, but as already mentioned above, the numbers reported in the last few quarters might not be representative of the business.

In such a case, we can take the average free cash flow of the last 10 years as a realistic basis (of course, this is including the very successful years 2021, 2022 and 2023 during the COVID crisis). But I still think this is a realistic assumption to use in our calculation. Let’s calculate with $15 billion in free cash flow. On the other hand, let’s be rather cautious about the growth potential, as it seems very unlikely that Pfizer will suddenly grow at a high pace again. But assuming about 2-3% growth annually (in line with GDP) seems reasonable for Pfizer. This would lead to an intrinsic value of $37.61 for Pfizer, and the stock is undervalued at this point and might even consider a bargain.

Conclusion

Pfizer is certainly not a high growth business, but with its high dividend yield and cheap stock price, it seems like a mistake to ignore Pfizer at this point. We should expect Pfizer to grow only in the low to mid-single digits over the long run, as it also had troubles growing in the past, and we don’t know if the growth stemming from acquisitions and the oncology business is enough. Nevertheless, Pfizer’s stock seems to be undervalued at this point and maybe a good long-term investment and a rather recession-resilient business.