MarsBars

Written by Nick Ackerman, co-produced by Stanford Chemist

Looking for high-yield opportunities can be a focus for many income-hungry investors in the closed-end fund space. However, just trying to buy whatever the highest-yielding investment out there is often not a great strategy. It can end up costing investors more in the long run if the investment isn’t truly earning its underlying distribution. It can cause net asset value to erode over time, which makes it harder and harder to support those higher payouts. Eventually, it can lead to distribution cuts, which most people tend to want to avoid—as much as they can anyway.

Since CEFs often pay out high distributions, there generally isn’t a lot of margin for error. They aren’t like a corporation that can strengthen their balance sheets for turbulent times by retaining cash. So, most CEFs will eventually cut their distributions at some point.

That said, today, I wanted to take a look at two interesting options in the closed-end fund space that are fully covering their high-yield payouts. That is PIMCO Dynamic Income Opportunities Fund (NYSE:PDO) and ArrowMark Financial Corp. (BANX).

PIMCO Dynamic Income Opportunities Fund

- 1-Year Z-score: 0.53

- Discount/Premium: 3.50%

- Distribution Yield: 11.49%

- Expense Ratio: 2.06%

- Leverage: 41.02%

- Managed Assets: $2.483 billion

- Structure: Term (anticipated term date January 27, 2033)

PDO is designed to provide “current income as a primary objective and capital appreciation as a secondary objective.” This is pretty standard for the PIMCO funds and most CEFs. They go on to mention how they will attempt to achieve this:

The fund will normally invest at least 25% of its total assets in mortgage-related assets issued by government agencies or other governmental entities or by private originators or issuers. The fund may invest up to 30% of its total assets in securities and instruments that are economically tied to “emerging markets” and countries; however, the fund may invest without limitation in short-term investment-grade sovereign debt issued by emerging market issuers. The fund may normally invest up to 40% of its total assets in bank loans (including, among others, senior loans, delayed funding loans, covenant-lite obligations, revolving credit facilities, and loan participations and assignments). It is expected that the fund normally will have a short to intermediate average portfolio duration (i.e., within a zero to eight-year range), although it may be shorter or longer at any time depending on market conditions and other factors.

The fund is what some could call the usual PIMCO type of closed-end fund. It takes a multi-sector approach, investing in just about any fixed-income related securities. PDO has its highest allocation currently tilted toward high-yield credit, but non-agency mortgages aren’t too far behind. Those two categories combine to make up around 50% of the fund.

Currently, the fund trades at a slight premium, but that isn’t unusual for a PIMCO CEF. At a fairly low premium, we still view this fund as a ‘Hold’ with our buy target being at a discount of 0% or price relative to its NAV per share.

This fund is highly leveraged, so that’s something to consider before jumping in. However, with rate cuts expected to be next from the Fed, and as soon as September, that can start to see some of those borrowing costs ease. Further, rate increases weren’t necessarily the most harmful in terms of being hedged through various derivatives. Those derivatives could help support the fund’s distribution, even if net investment income was taking a hit. Where PDO got hit the worst was that it is a multi-sector fixed-income CEF, which all fixed-income saw meaningful declines when the risk-free rate was climbing.

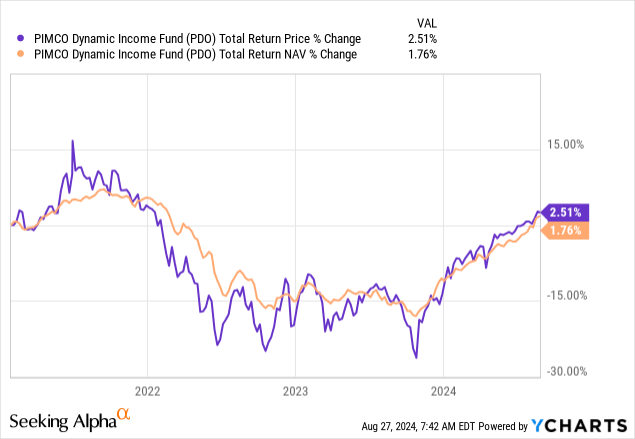

PDO came to market at the beginning of 2021, and initially, it saw some success. However, we can clearly see heading through 2022 there was significant downside pressure. It was mostly level throughout 2023 before hitting its lows (along with most other fixed-income related investments) in October 2023 and then rallied from there. As risk-free rates eased, that caused the fund to appreciate.

The high-yield spread remains fairly low historically, but it has been widening back out more recently. Despite that, we haven’t seen PDO take too much of a hit. That would remain a risk, and the fund’s leverage adds more volatility and risk as that compounds the downside moves. On the other hand, the positive of leverage is that it can help to support an even higher distribution.

With a current distribution yield of 11.49%, this is an attractive option for those seeking a high-yield choice.

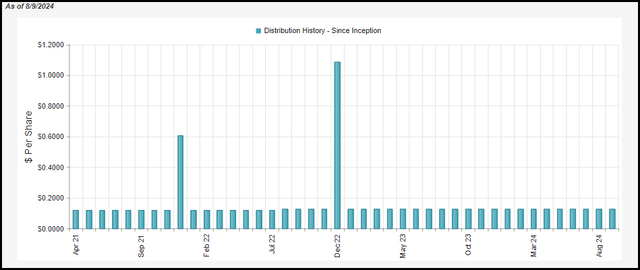

PDO Distribution History (CEFConnect)

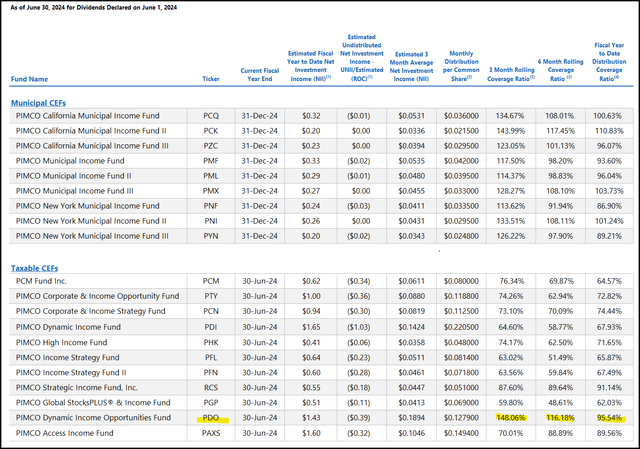

Even better, the fund has seen its distribution coverage have been strong over the last 3 and 6-month rolling periods. In fact, it is seeing the strongest coverage by a fairly wide margin against the rest of the taxable income CEFs in the PIMCO suite.

June PIMCO UNII Report (PIMCO)

The fiscal year-end for PDO is June 30—so what the UNII Report above should be showing us for fiscal year-to-date distribution coverage is the entirety of the fiscal year 2024 for the fund. Meaning that coverage had been weaker earlier in the year, but it started to ramp up in the second half and final quarter, as reflected by the increasing coverage ratios in these periods.

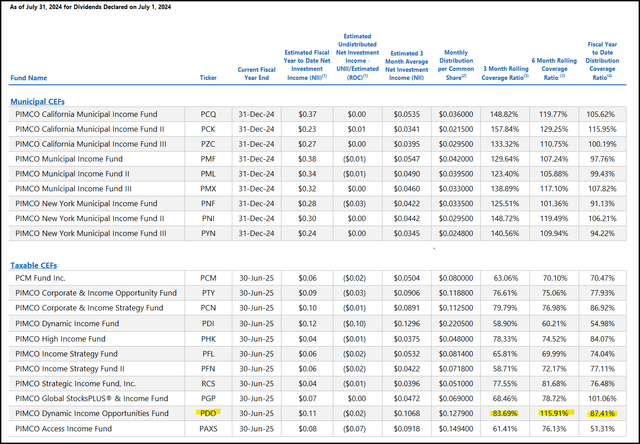

However, that has turned lower once again with the latest July UNII report from PIMCO. The dramatic increases and decreases in the 3-month rolling periods seem to happen with the PIMCO funds fairly often. So, sticking with using a longer-term measurement period for NII coverage could be more appropriate. That includes the 6-month period and the above fiscal YTD distribution coverage coming in rather strong.

July PIMCO UNII Report (PIMCO)

The UNII reports also don’t capture what is going on with the underlying portfolio. More specifically, with the number of derivative instruments that PIMCO utilizes in managing their suite of funds.

As we noted above, they can be utilized to help hedge against higher interest rates. Just as the fund can position itself to be hedged against rising rates, they can hedge themselves for lower rates as well. The funds can also use future contracts, forward foreign currency contracts, total return swaps and credit default swaps, all in attempts to hedge or position the fund for various outcomes. Those potential gains can be used to help support the monthly payouts.

ArrowMark Financial Corp. Basics

- 1-Year Z-score: 1.48

- Discount/Premium: -6.62% (based on 07/31/2024 estimated NAV)

- Distribution Yield: 8.87%

- Expense Ratio: 4.31%

- Leverage: 22.67%

- Managed Assets: $198.5 million

- Structure: Perpetual

BANX’s investment objective is “to provide shareholders with current income.” To achieve these investment objectives, they will invest primarily in “regulatory capital securities of financial institutions.”

BANX is a unique investment choice in the CEF space. They invest primarily in regulatory capital relief securities. This is an area where there aren’t a lot of ways to get exposure for most retail investors, except through BANX. We previously discussed these more in-depth in a prior article. Here is the general idea:

The general concept of these securities is they help provide support to banks and other financial institutions to meet their regulatory requirements, essentially providing “capital relief” to these institutions as their name would imply. For BANX they are investing in mostly credit-linked notes.

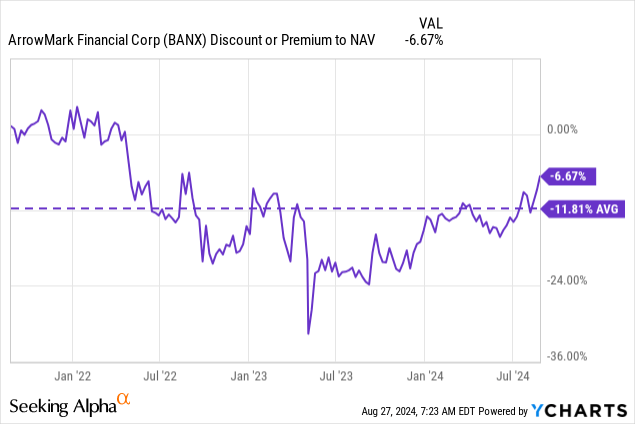

The fund provides a monthly estimated NAV per share, with the latest July 31, 2024, NAV estimate coming in at $21.75. That is where we end up seeing the current discount coming in at around 6.6%. The discount has been narrowing over the last year and, even more, very recently, coming off a double-digit level. Since just our last update a couple of months ago, the fund’s discount has narrowed from the -13.40% level. We view BANX as a ‘Buy’ with a 10%+ discount, so ideally, we’d like to see it widen from here before accumulating more aggressively. For a long-term income-focused investor, one could pursue a dollar-cost averaging approach.

One of the possible risks currently for BANX is, they recently filed an N-2. That’s a filing to offer new shares to investors, often through a rights offering. It can be for an at-the-market offering as well, but those can only be done at a premium to NAV. This is also filed if they intend to offer preferred shares or debt securities as well.

This prospectus is part of a registration statement that the Company has filed with the U.S. Securities and Exchange Commission (the “SEC”), using the “shelf” registration process. Under the shelf registration process, the Company may offer, from time to time, in one or more offerings, up to $150,000,000 of common stock, preferred stock, subscription rights or debt securities, which we refer to, collectively, as the “securities,” on terms to be determined at the time of the offering.

During rights offerings, the discount usually widens, and the price comes under pressure. Historically, it is often best to sidestep the RO by selling out of the fund when it is announced and then revisiting after the offering is over.

Unfortunately, N-2 filings are generally too generic and unless they come right out and say exactly what they intend, it leaves the door open for ambiguity. If an RO is announced, though, we could easily get to our 10% discount buy target.

The NAV is up slightly from the beginning of the year when it finished off on December 31, 2023, at a NAV of $21.43. Of course, this is while the fund also delivered $0.90 with its two quarterly distributions since then.

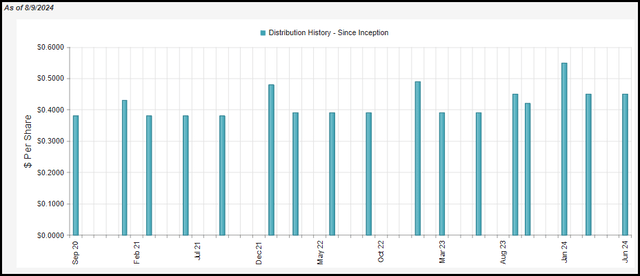

BANX Distribution History (CEFConnect)

Thanks to strong coverage, they’ve been able to also pay out a number of special distributions. This is because the underlying securities are primarily floating-rate securities; they’ve benefited from the rise in the Fed’s short-term target rates. When rates are cut, we would expect to see that coverage face some pressure. However, with $0.70 in NII reported in Q1, that was good for coverage of 156%. For fiscal 2023, the period ending December 31, 2024, NII came to $2.63. That was good for coverage of 146% of its regular distribution. With that being the case, I believe that unless we go back to a zero-rate environment, BANX can continue to support its distribution.

Conclusion

PDO and BANX provide investors with attractive, high yields. They are leveraged closed-end funds, which adds additional risks for investors to consider. PDO invests in a multi-sector fixed-income approach, with exposure to a number of generally below-investment-grade securities.

BANX offers a unique exposure to regulatory capital relief securities comprising nearly its entire portfolio, which helped it due to its floating rate nature. The fund’s discount has been narrowing, and we’ve seen them file an N-2. An N-2 could mean a rights offering is coming, though it can’t be certain, as these filings leave it pretty open-ended to be a number of different things. It is still worth watching for an RO, as that could cause some short-term disruptions in terms of pressure on the share price.