RichLegg/E+ via Getty Images

The following segment was excerpted from this fund letter.

PAR Technology (PAR)

Let’s start with the acknowledgement that anything with the word “technology” in the name is not 100% inevitable. With that said, PAR has several “ways to win” and I think the next five years will see a compelling transformation resulting in this caterpillar coming out of the cocoon and being valued like a butterfly. PAR’s core business is POS (point of sale) for chain restaurants, which has the benefit of being a very low churn business. Losing less than 5% of locations per year, PAR’s high retention rate means that new customers and new products can drive growth. They are not just spinning their wheels to refill a leaky bucket. Stable base + new customers + new products = Good Business.

In the interest of space, I will not go through all of PAR’s tailwinds. I suggest you check out a write-up by Voss Capital (a fund we are invested in through the Partners Fund, our fund of funds), called “PAR’s Path to $80 Redux: Godot Finally Arrives”

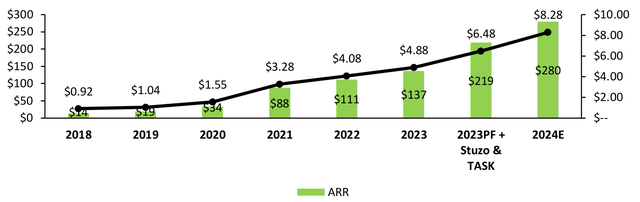

As discussed in our Q3 2023 letter, PAR has been growing their recurring revenue dramatically over the last five years through acquisitions and organic growth. The best way to measure their progress is on a per-share basis. Below is the chart from Q3.

As the last column alludes to, Burger King growth is coming. PAR’s systems will start rolling out in U.S. BK stores this quarter (Q2) and, over the next year and a half (absent an unforeseen event), PAR will add 7,000 new locations generating more than $20M per year in high margin recurring revenue from a single customer. As shareholders, we wait. The team works. It is contractual, the revenue should be is coming.

There is reason to believe that the new customer wins do not end with Burger King. Our Q3 letter, linked above, outlined a path to the rest of the Restaurant Brands (Burger King owner) portfolio. On the topic, PAR’s CEO has said,

“What makes us even more positive, is that we believe we’re just at the beginning of a tidal wave of large deals coming to market, which should provide for long-term sustainable growth….”

To buttress this statement, PAR this month announced Wendy’s (WEN) as a customer for their Punchh loyalty product, likely contributing another $6M per year in recurring revenue starting this year.

Over the next several years, new products will contribute to growth. In 2024, we will begin to see the contribution of Table Service, a POS for table service restaurants. PAR already announced that Hooters, a 300-unit chain, is a customer, and I believe that the company is deep in the running to win a 1,200+ unit table service chain that is named after a city in upstate New York. PAR will also get growth from their recently launched online ordering offering (MENU) that almost every new customer is taking. They also continue to sell their payments solution into their base of customers. Again, there are a lot of irons in the fire and a lot of ways to win.

PAR has been our largest position for a while now for all the reasons laid out above, but the beauty of good teams is that they can surprise to the upside. In March, PAR announced two acquisitions, Stuzo and TASK. Both accretive and both EBITDA positive, the acquisitions provide additional scale for PAR, accelerate profitability, add new markets, and add new customers. Each one of those factors – scale, profitability, new markets, and new customers – matters individually, but together they can create a lollapalooza. The market’s reaction so far has been a big fat yawn. It is a lot to process. Let me just provide the elevator pitch for each acquisition.

Stuzo is the leading loyalty app for convenience stores. They have had zero customer churn historically, are profitable, and have been growing quickly. In the very near term, PAR can improve the Stuzo business by layering in payments functionality. PAR’s Punchh loyalty offering formerly competed with Stuzo. By combining forces, the pricing environment can only get better. In the longer term, there is a real opportunity for PAR to build/adapt their POS for convenience stores. They are growing their opportunity while accelerating profitability by purchasing this Rule of 40 company.

Their second announced acquisition, TASK, is an Australia-based company that similarly sells POS and loyalty. TASK will be PAR’s foothold internationally. As you may remember, while PAR won all of Burger King domestic, they did not win international, which has more units, because PAR did not havean international product. This TASK acquisition is a major step in the direction of being able to compete in those markets and serve existing customers. TASK also comes with two very interesting customers, Starbucks (SBUX) and McDonald’s (MCD). McDonald’s, an international loyalty program customer, also invested in TASK, owning 16%. Task was largely bootstrapped by its current CEO, Daniel Houden, who is rolling his equity into PAR and staying on. TASK is a product-led company that did not have a dedicated salesperson until two years ago. They did not win McDonald’s or Starbucks through an advanced go-to-market strategy, they won on product and support. It will be interesting to see what happens when you layer in PAR’s hardware and sales resources. TASK is a fastgrowing, EBITDA-positive company with a stellar customer list that massively advances PAR’s international presence, which PAR’s customers (Burger King and others) have been begging for. Does TASK show up in PAR’s last quarter numbers? No. Unfortunately, because of Australian laws, the acquisition will not even close until the third quarter this year and it will not show up in sell side projections for months. PAR’s share price is down since the deal was announced. On some level I get it, the deal has not closed yet. but I believe that this has the potential to be a monster when it is fully reflected in the share price.

We started discussing PAR with a pretty chart of ARR per share that ended in 2023. Looking forward and layering in the two acquisitions, the portion of Burger King that will come online in 2024, plus Wendy’s loyalty purchase, and other expected growth, I expect year-end ARR per share to be approximately $8.30 or over 8X larger than when CEO Savneet Singh took over just over 5 years ago. PAR will be entering 2025 with a lot of momentum, including $10M+ of contracted but not yet installed Burger King recurring revenue, a growing online ordering business, table service business, international business, and that tidal wave of RFPs that could yield some new customers. I expect 2025 ARR/Share to be $10+.

ARR/Share Growth

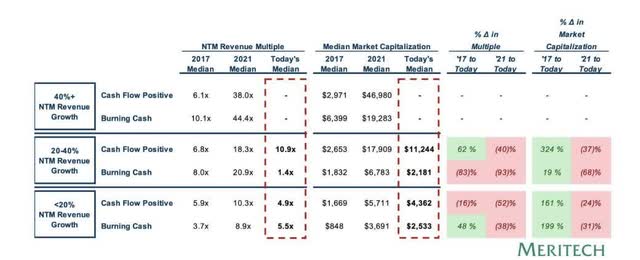

All of this business progress is great and exactly what we want to see from the companies we are invested in, but if the multiple continues to contract, we may lose money. The market has treated cash-generating software companies very differently than cash-burning software companies. I believe PAR completes the transition this year to becoming cash-flow positive. Below is a chart comparing cash-flow-positive software companies to cash-burning companies (first red dotted column).

Will PAR really get the full 10.9X revenue multiple implied by the chart above? Probably not. PAR will also not screen well to computers until it divests of its legacy government business, but it is highly likely that PAR looks very different both operationally and financially entering 2025 than it did entering 2023 or 2024.

This is a business getting stronger with every passing day. Its momentum is showing up in the ARR/share, customer wins, and product launches. PAR will end the year with nearly $300M in recurring revenue, opportunities in new markets, new customers, new products, and a non-zero chance of “running the table.” But to benefit, Mr. Market is saying that we have to wait. The future is bright and the PAR team is busting their ass for us.

|

Disclaimer: This document, which is being provided on a confidential basis, shall not constitute an offer to sell or the solicitation of any offer to buy which may only be made at the time a qualified offeree receives a confidential private placement memorandum (“PPM”), which contains important information (including investment objective, policies, risk factors, fees, tax implications, and relevant qualifications), and only in those jurisdictions where permitted by law. In the case of any inconsistency between the descriptions or terms in this document and the PPM, the PPM shall control. These securities shall not be offered or sold in any jurisdiction in which such offer, solicitation or sale would be unlawful until the requirements of the laws of such jurisdiction have been satisfied. This document is not intended for public use or distribution. While all the information prepared in this document is believed to be accurate, MVM Funds LLC (“MVM”), Greenhaven Road Capital Partners Fund GP LLC (“Partners GP”), and Greenhaven Road Special Opportunities GP LLC (“Opportunities GP”) (each a “relevant GP” and together, the “GPs”) make no express warranty as to the completeness or accuracy, nor can it accept responsibility for errors, appearing in the document. An investment in the Fund/Partnership is speculative and involves a high degree of risk. Opportunities for withdrawal/redemption and transferability of interests are restricted, so investors may not have access to capital when it is needed. There is no secondary market for the interests, and none is expected to develop. The portfolio is under the sole investment authority of the general partner/investment manager. A portion of the underlying trades executed may take place on non-U.S. exchanges. Leverage may be employed in the portfolio, which can make investment performance volatile. An investor should not make an investment unless they are prepared to lose all or a substantial portion of their investment. The fees and expenses charged in connection with this investment may be higher than the fees and expenses of other investment alternatives and may offset profits. There is no guarantee that the investment objective will be achieved. Moreover, the past performance of the investment team should not be construed as an indicator of future performance. Any projections, market outlooks or estimates in this document are forward-looking statements and are based upon certain assumptions. Other events which were not taken into account may occur and may significantly affect the returns or performance of the Fund/Partnership. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. The enclosed material is confidential and not to be reproduced or redistributed in whole or in part without the prior written consent of the relevant GP. The information in this material is only current as of the date indicated, and may be superseded by subsequent market events or for other reasons. Statements concerning financial market trends are based on current market conditions, which will fluctuate. Any statements of opinion constitute only current opinions of the GPs, which are subject to change and which the GPs do not undertake to update. Due to, among other things, the volatile nature of the markets, and an investment in the Fund/Partnership may only be suitable for certain investors. Parties should independently investigate any investment strategy or manager, and should consult with qualified investment, legal, and tax professionals before making any investment. The Fund/Partnership are not registered under the Investment Company Act of 1940, as amended, in reliance on exemption(s) thereunder. Interests in each Fund/Partnership have not been registered under the U.S. Securities Act of 1933, as amended, or the securities laws of any state, and are being offered and sold in reliance on exemptions from the registration requirements of said Act and laws. The references to our largest positions and any positions listed in the Appendix are not based on performance. All of our positions will be available upon a reasonable request. All hyperlinks contained herein are not endorsements and we are not responsible for such links or the content therein. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.