fatido/iStock via Getty Images

Introduction

In May 2023 I analyzed Osisko Gold Royalties Ltd (NYSE:OR) with the view to making an acquisition. However, I came to the conclusion that Osisko had ran “Too Far Too Fast” and so I decided to keep it on the Watch List. At the time of publication Osisko was priced at $17.38 and since then it has been a roller coaster ride for this royalty company. The stock price is also down by 3.16% since May 2023 so no progress to speak of

Today we are some sixteen months further on so we will take another look to see how it is doing in order to establish if it’s a buy, a sell, or a hold?

Osisko Gold Royalties Ltd: Brief Description

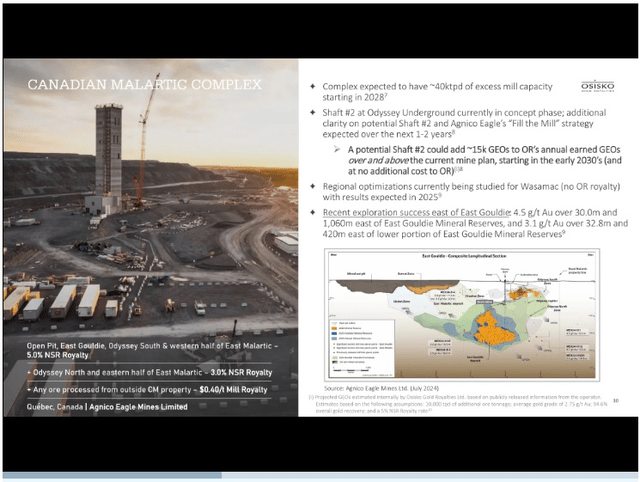

Osisko is a $3.07 Billion precious metal royalty company that has been in existence for ten years and now has a portfolio of over 185 royalties, streams, and precious metal offtakes. The jewel in the crown is the 5% net smelter return royalty that they have on the Canadian Malartic mine, the biggest gold mine in Canada, shown below.

Canadian Malartic Mine Osisko Royalty (Osisko Presentation)

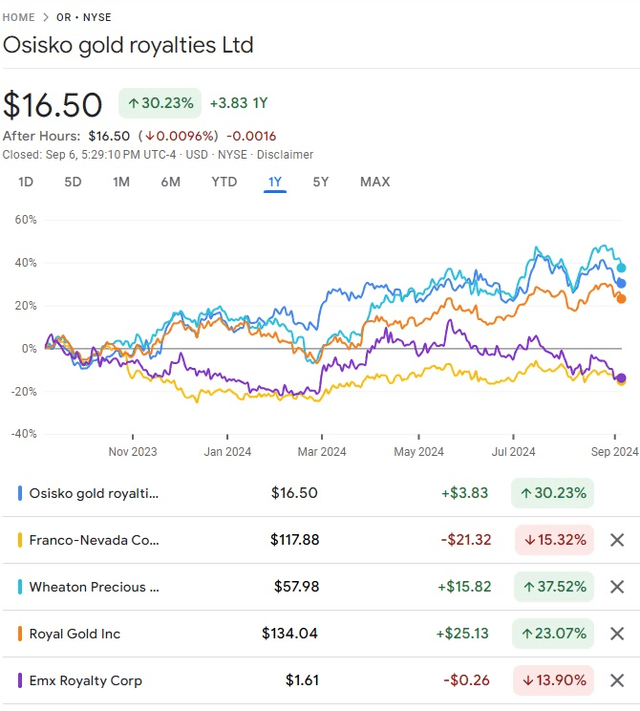

To get a feel for how they have performed over the last 12 months the chart below compares them with some of their peers.

Osisko Gold Royalties Ltd Compared With Its Peers (Google finance)

The chart shows that Osisko has gained 30.23%, so it is holding up quite well. In general the royalty business model is gaining in popularity and there are around 20 or so such business models operating in this field. This means that the competition for investors’ investment funds is a lot more competitive than it was just a few years ago and the ability to outperform their peers is of the utmost importance.

Financial Highlights for Q2 2024

I will start with a comment from Jason Attew, President & CEO of Osisko which is as follows:

“Osisko’s second quarter of 2024 was a markedly busy one, thanks to the Company’s robust corporate development pipeline and its ever-evolving portfolio of assets. Increased commodity prices resulted in strong revenues and record operating cash flows that allowed Osisko to continue to rapidly pay down its revolving credit facility. As such, Osisko’s balance sheet remains well-positioned for the future deployment of capital towards new accretive growth opportunities.”

A perfect example of this was the recent announcement of the acquisition of the Cascabel gold stream by Osisko Bermuda, a transaction that was completed subsequent to quarter-end and one that provides the Company with an additional long-term growth lever on a tier-1 copper-gold asset.

It is good to see that this company is making deals and not allowing the grass to grow under their feet as they say.

Other key metrics are as follows:

20,068 gold equivalent ounces1 (“GEOs”) earned (24,645 GEOs in Q2 2023); lower than same period last year, which is a tad disappointing.

Revenues from royalties and streams of $64.8 million ($60.5 million in Q2 2023);

Record cash flows generated by operating activities of $52.3 million ($47.4 million in Q2 2023);

Of note here is that they have achieved a record cash flow compared to Q2 2023, along with record adjusted earnings of $33.2 million, $0.18 per basic share ($27.2 million, $0.15 per basic share in Q2 2023) which suggests a better time ahead.

However on the negative side there is a Net loss of $21.1 million, $0.11 per basic share (net earnings of $18.0 million, $0.10 per basic share in Q2 2023), as a result of a non-cash impairment loss of $67.8 million on the Eagle gold royalty, so it’s not all blue-sky sailing

Also of note is a repayment of $44.2 million was made under the revolving credit facility and they reported a cash balance of $65.7 million and debt outstanding of $109.0 million as at June 30, 2024.

Another standout for me is that they announced another dividend payment of C$0.065 per common share, an increase of 8%, and that this is the 40th consecutive quarterly dividend. Consistent dividend payments are attractive to investors who require a return of their investments on a regular basis. Personally, I do not place too much importance on dividends as it is the capital growth that I am interested in and that takes priority over the return from dividends. However, each investor is unique in their requirements for any acquisition that they are considering, so please do your own due diligence as it is your hard-earned cash that is on the line.

Osisko Gold Royalties Ltd has a market capitalization of $3.134B, an EPS of -$0.37 and pays regular dividends. The average volume of shares traded on a daily basis is 714,674 so the liquidity is good for those speculators wishing to trade in and out of this stock on a regular basis. The 52-week trading range has been from a low of $11.24 to a high of $18.34 so volatility in the stock price should be taken into consideration before making an acquisition.

For forward looking projections, a visit Seeking Alpha’s Quants figures is always worthwhile, and they have forward projections of P/E (FWD) 32.87 and an EPS (FWD) of 0.19, and they give this stock a “Hold” rating.

As for Seeking Alpha’s Quant Ranking, Osisko is ranked in Industry at 30 out of 44 with a score of 2.94 which places Osisko well down the list when compared with other Royalty companies. Wall Street scores Osisko at 4.30 with a “Buy” rating.

All in all I think the future is reasonably bright for Osisko and if I owned its shares I would probably continue to hold them. As I don’t own any shares in Osisko I am reluctant to make a purchase just yet and so Osisko will remain on the Watch List for now.

Osisko Gold Royalties Ltd trades on the New York Stock Exchange under the symbol (NYSE:OR) and on the Toronto Stock Exchange under the symbol (TSX:OR:CA)

A Quick Look At The Chart Of Osisko Gold Royalties Ltd

Since May 2023, the stock price has fallen from $17.50 to $11.00 and bounced up to $18.00 or so before closing at $16.50, a bumpy ride indeed.

A One Year Chart Of Osisko Gold Royalties Ltd (StockCharts)

Also note that both the 50dma and the 200dma are moving up in parallel, which is usually a positive indication of steady progress.

The technical indicators suggest that this stock is slightly oversold at the moment and so there is plenty of headroom for Osisko to trade at higher price levels in the short term.

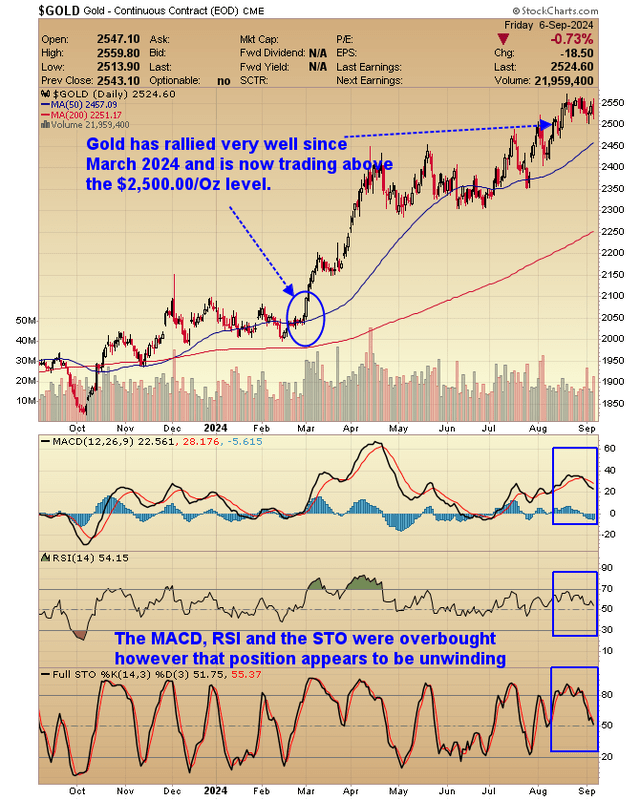

A Quick Look At The Chart Of Gold

Gold has rallied very well since March 2024 and is now trading above the $2,500.00/Oz level as the chart below indicates:

A One Year Chart Of Golds Progress (StockCharts)

The MACD, RSI and the STO were overbought however that position appears to be unwinding. Gold’s fortunes in the immediate future are rather dependent on next week’s meeting of the FOMC when we will be informed of any changes to monetary policy. It is widely expected that an interest rate cut is on the cards and that this could be the long-awaited Pivot Point in monetary policy.

Conclusion

Osisko’s share price has improved considerably over the last 12 months having been at a low point last October.

This company continues to make deals enhancing its growth profile for future returns on its investments

Osisko is not a ‘Buy’ for me right now but it could be in the near future and will therefore remain on my Watch List as a possible acquisition.

Go gently.

My readers are aware that I have been Long both physical silver and gold for many moons and that I own a portfolio of gold, silver and uranium mining stocks and Royalty companies in the precious metals space, including but not limited:

Mega Uranium Limited (MGA)

Laramide Resources (LAM)

Wheaton Precious Metals Corp. (WPM)

Agnico Eagle Mines Limited (AEM)

Fortuna Silver Mines Inc (FSM)

First Majestic Silver Corp. (AG)

IMPACT Silver Corp. (IPT:CA)

Pan American Silver Corp. (PAAS)

If you can spare the time your opinion and comments are very much appreciated by our readers and me as they add some semblance of balance to these publications,

thanks, Bob K