ablokhin

Introduction

It’s time to talk about Old Dominion Freight Lines (NASDAQ:ODFL), a company I have given a lot of attention to in recent months. The most recent in-depth article on the less-than-truckload (“LTL”) giant was written on July 2, when I called it “One Of My Favorite Dividend Growth Stocks” in the title.

On top of that, I have mentioned the company in a number of other articles, most of which were focused on undervalued dividend (growth) stocks that make great buys in an environment where market strength broadens.

Moreover, I wasn’t just bullish on the company but put my money where my mouth was, as I added the stock to my portfolio on May 30. The company is one of four major investments I made this year. These four investments emptied my rather large war chest, as Old Dominion Freight Line is now my third-largest investment, accounting for 5.5% of my portfolio.

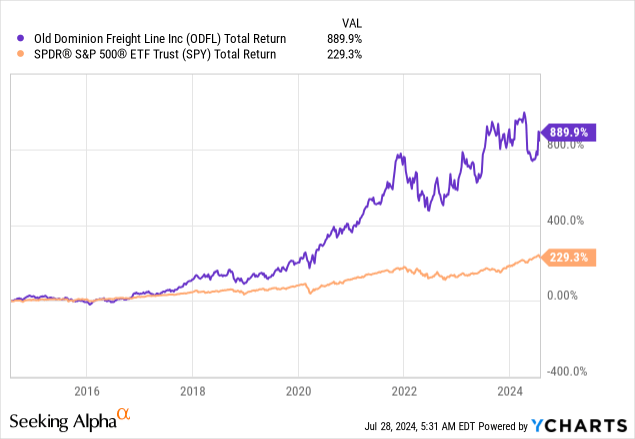

One reason is the stellar start. Since buying, I’m up slightly more than 18%, as the ODFL ticker has started a strong recovery from its lows, which has pushed its ten-year total return to roughly 890%, a performance so high that it makes the S&P 500 look like a boring government bond.

The reason I’m writing this article is to update my thesis. In this case, we can use the company’s just-released 2Q24 earnings, which were absolutely fantastic.

Despite tremendous pressure on cyclical sectors like manufacturing, this industrial-focused LTL giant reported an almost mind-blowing performance. It saw strong pricing power, improving volumes, and continued to lower its already low operating ratio.

I am convinced I bet on the right horse and foresee much higher gains, especially if the company gets some support from recovering cyclical demand in the quarters ahead.

Now, let’s dive into the details!

What Makes ODFL So Special

With the risk of sounding repetitive, I want to briefly spend some time explaining why I bought ODFL. Especially for readers who are new to ODFL, it helps to better understand the numbers we’re about to discuss.

As most readers might know, I (usually) don’t like to buy investments that do not come with a moat. Trucking is one of these industries. It’s competitive, cyclical, and prone to what feels like countless risks.

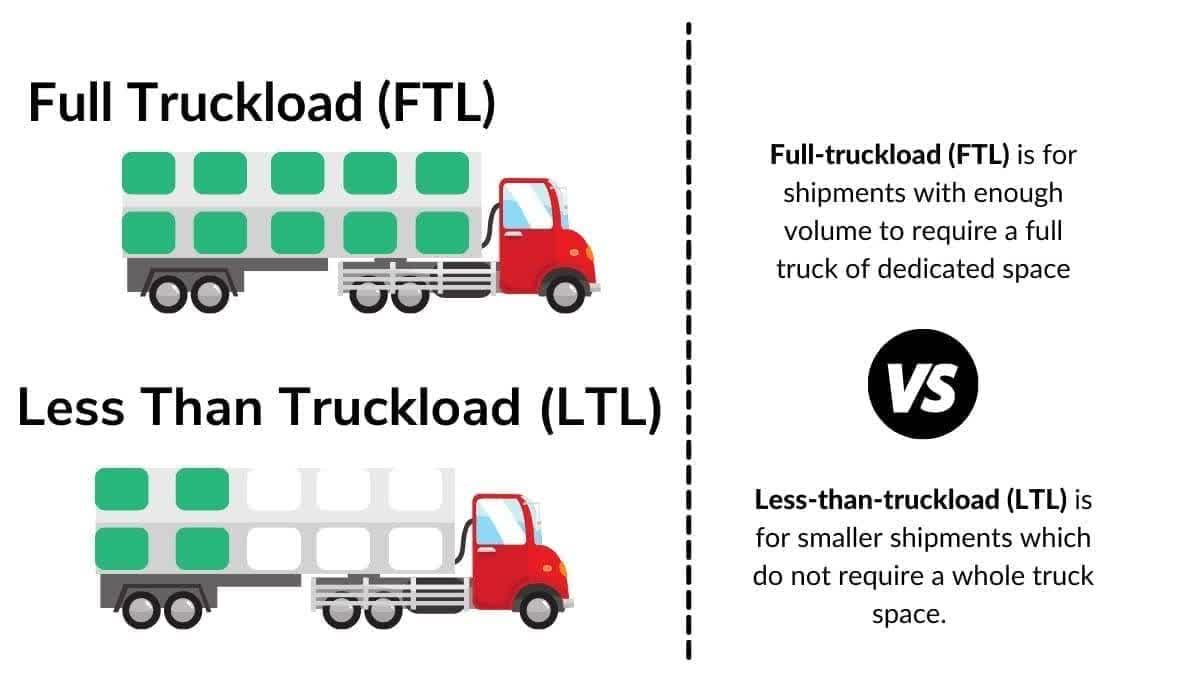

However, ODFL is a less-than-truckload giant. It does not compete with truckload companies who drive for a single customer from point A to point B. LTL operations pick up goods from multiple customers, bring these to service centers, and then ship them to their destination.

As LTL loads usually include goods from multiple customers, efficiency is key.

A2Z Market Research

This is how the company put it in its 2023 10-K:

The trucking industry is comprised principally of two types of motor carriers: LTL and truckload. LTL freight carriers typically pick up multiple shipments from multiple customers on a single truck. The LTL freight is then routed through a network of service centers where the freight may be transferred to other trucks with similar destinations. LTL motor carriers generally require a more expansive network of local pickup and delivery (“P&D”) service centers, as well as larger breakbulk, or hub, facilities. In contrast, truckload carriers generally dedicate an entire truck to one customer from origin to destination. – ODFL 2023 10-K (emphasis added).

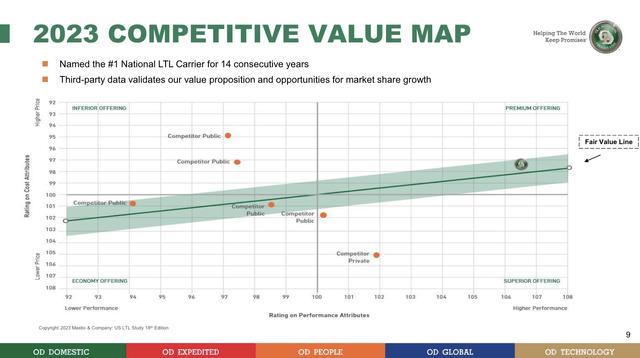

Old Dominion has perfected the art of LTL shipping, having won the Mastio & Company LTL carrier award 14 years in a row and built a business that comes with pricing power due to its superior service (see below).

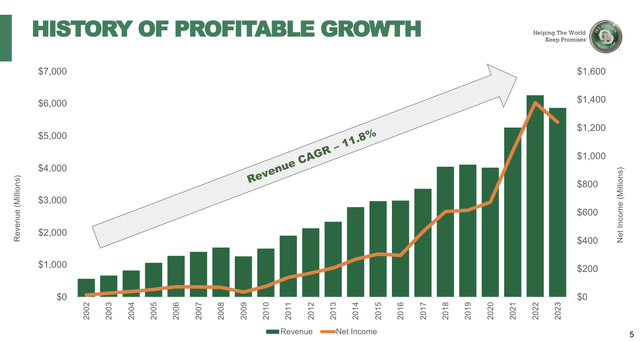

The company, which owns almost all of its service centers (lowering lease costs), has grown its revenue by 11.8% per year between 2002 and 2023, boosting its market share from 3% to 12% during this period – almost entirely organically!

I am fully aware that I’m starting to sound like a cheerleader. However, this achievement and the capability to build a narrow-moat business in a no-moat industry is a fantastic achievement.

Having said that, the just-released earnings were simply fantastic.

ODFL Is Firing On All Cylinders

In the second quarter, ODFL did what it does best: maintaining exceptional service, as it achieved an on-time service level of 99% and a cargo claims ratio of just 0.1%.

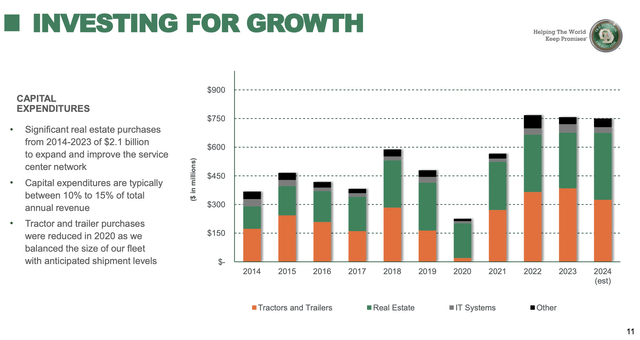

Over the past decade, the company has invested more than $2 billion in its service center network, with an additional $350 million planned for real estate investments this year.

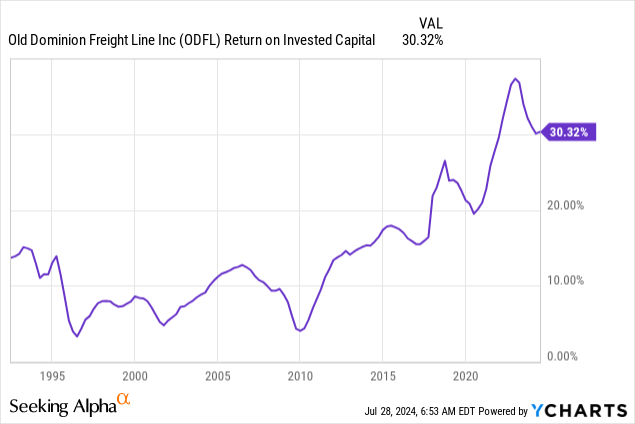

With regard to investments, the company has a return on invested capital of 30%, which is extremely high and a testament to its industry-leading ability to effectively invest money in its business.

As we just saw, these investments have allowed ODFL to almost double its market share over the past ten years, providing the infrastructure necessary to support future growth and exceptional service performance.

Moreover, according to the company, with roughly 30% excess capacity at the end of the second quarter, it believes it is in a great spot to meet increasing demand as the economic environment improves.

This is extremely important to keep in mind, as the company isn’t just doing well in this environment, but it is also able to significantly boost its shipments without having to accelerate capital spending.

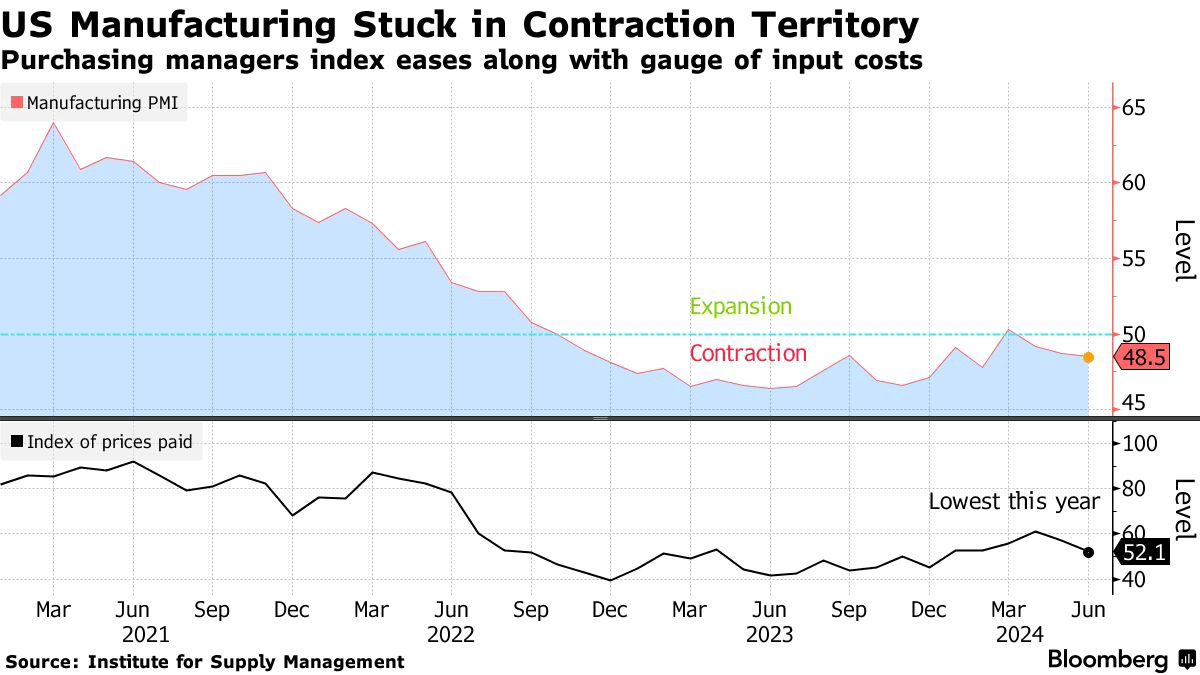

With that in mind, when I talk about challenging economic times, I mean weak demand in cyclical areas. During the Q&A session of its 2Q24 earnings call, the company noted that up to 60% of its volumes are related to industrial operations. The company also noted the persistent sub-50 ISM numbers.

The ISM Manufacturing Index is a forward-looking economic indicator that has been in a downtrend since 2021 and almost nonstop in contraction territory since the end of 2022.

Bloomberg

Generally speaking, this does not bode well for freight demand and explains why the stock prices of so many transportation companies have gone nowhere since 2022.

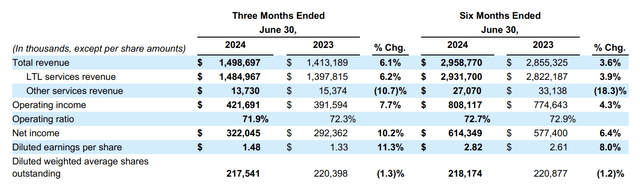

Despite these headwinds, ODFL reported revenue of $1.5 billion, which marks a 6.1% increase from the prior year. This growth was driven by a 4.4% increase in LTL revenue per hundredweight and a 1.9% rise in LTL tons per day.

Furthermore, the already impressive operating ratio improved by 40 basis points to 71.9%, which contributed to an 11.3% increase in earnings per diluted share.

Note that the operating ratio measures what percentage of revenue is used for operating expenses – the lower, the better. An OR in the low 70% range is stunning, as most (highly efficient) railroads have ORs in the 60% range. A lot of trucking companies have operating ratios close to 100%.

Moreover, the fact that ODFL lowered the operating ratio in an inflationary environment is terrific and one of many examples of why it truly stands out.

According to the company, the 40 basis points improvement in its OR was supported by the quality of revenue growth and a sustained focus on operational efficiencies. By effectively managing direct variable costs, the company has succeeded in improving these costs as a percentage of revenue.

Although overhead costs have increased as a percentage of revenue, discretionary spending has been kept minimal. This helped the company when it mattered most, as cyclical growth is usually the biggest driver of higher profitability.

As we have often said before, the two main ingredients to long-term operating ratio improvement are the combination of density and yield, both of which generally require a favorable macroeconomic environment. – ODFL 2Q24 Earnings Call

Going forward, the company aims for a sub-70% operating ratio and sees opportunities for a potential recovery.

This is reflected in its buybacks.

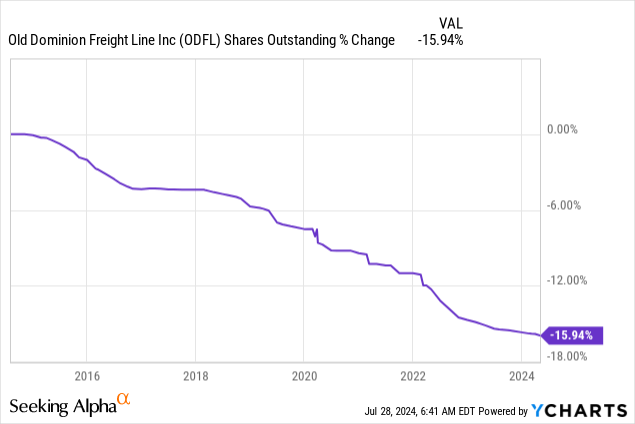

In the second quarter, ODFL stepped up its buybacks, buying back $552 million worth of stock. That’s 1.3% of its total market cap. Over the past ten years, ODFL has bought back 16% of its shares, which significantly contributed to its favorable stock price performance.

Aggressive buybacks make sense, as the company explained that it wanted to use its stock price drop to put money to good use. As its stock price rallies, buybacks will likely normalize again.

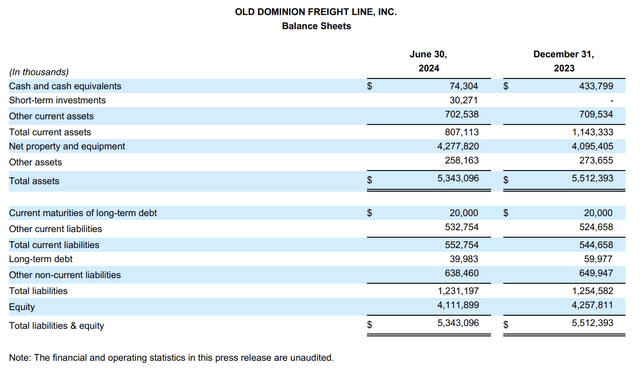

I like this proactive approach of buying back stock when the stock is cheap. This is supported by a healthy balance sheet. Next year, the company is expected to end up with roughly $550 million in net cash, meaning it has more cash than gross debt.

At the end of 2Q24, it had just $40 million in long-term debt and $74 million in cash (excluding short-term investments). This gives it one of the healthiest balance sheets in the entire transportation sector.

ODFL has truly figured out how to grow its business and return cash to shareholders while improving its balance sheet.

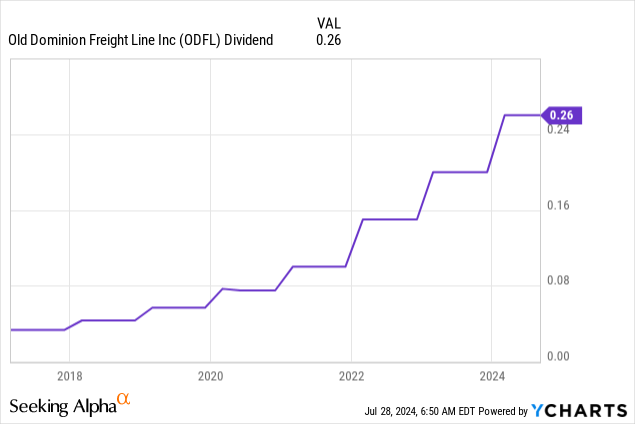

Shareholder distributions also include a dividend. Although its 0.5% yield is nothing to write home about, it comes with a subdued payout ratio of just 16% and a five-year CAGR of 36%!

While I cannot make the case that ODFL is a good stock for income-focused investors, I believe its dividend growth profile and exceptional business model make it a fantastic dividend grower for a wide range of portfolios.

Valuation

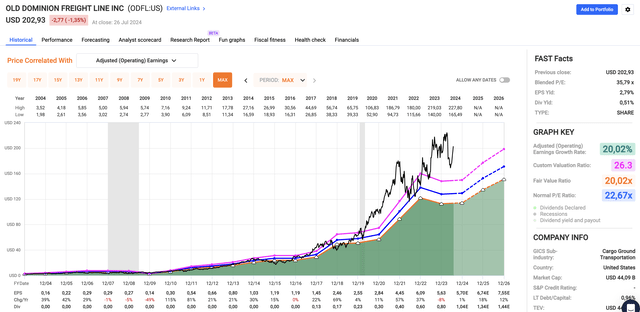

The bad news is that ODFL isn’t cheap anymore. After its most recent surge, the stock is trading at a blended P/E ratio of 35.8x.

Using the FactSet data in the chart below, even if we consider 18% and 12% expected EPS growth in 2025 and 2026, we get a fair stock price of $202, which is where ODFL is currently trading.

Nonetheless, these expectations are based on poor economic growth numbers. Any upswing in expectations could trigger a significant increase in EPS expectations.

As a result, the stock has received higher price targets of roughly $215 after its earnings (TD Cowen and BMO Capital), roughly 8% above the current price.

If 2Q24 earnings were less impressive, I would have gone with a Hold rating. However, due to recent developments, elevated excess capacity, and market share gains, I remain bullish on ODFL, which warrants a long-term Buy rating.

Takeaway

Old Dominion Freight Lines has proven to be a stellar investment, quickly becoming a top holding in my portfolio.

Now, the company’s outstanding 2Q24 earnings reinforce my confidence, showing strong pricing power, efficiency, and a fantastic operating ratio.

Essentially, ODFL’s unique LTL business model and strategic investments have allowed it to grow organically, almost quadrupling its market share.

With a healthy balance sheet and smart buyback strategy, I believe ODFL is poised for elevated long-term growth. This is why I continue to view ODFL as a standout dividend growth stock, especially as we get a rebound in cyclical demand.

Pros & Cons

Pros:

- Strong Growth: ODFL has delivered impressive revenue growth of 11.8% annually since 2002, growing its market share from 3% to 12%.

- Efficient Operations: Its low 70%-range operating ratio and ability to leverage pricing power set it apart in the competitive LTL industry.

- Financial Health: With a pristine balance sheet and net cash position, ODFL is well-positioned for future growth.

- Dividend Potential: Despite a modest yield, the 36% five-year CAGR and a low payout ratio promise significant dividend growth.

Cons:

- High Valuation: ODFL’s current P/E ratio of 35.8x is above its long-term average, suggesting a less favorable valuation. However, in light of growth potential, I think it’s a “good deal.”

- Economic Sensitivity: Depending on industrial output, any prolonged manufacturing slowdown could negatively impact demand.

- Competitive Industry: Despite its strengths, ODFL operates in a highly competitive industry (yet less competitive than truckload transportation).