alfexe

The Neuberger Berman High Yield Strategies Fund (NYSE:NHS) is a closed-end fund that investors can purchase as a way to earn a high level of income from the assets in their portfolios. There seems to be a lot of interest in achieving this goal, as the past few years have taught many investors that the market does not always go up. Retirees and others who are trying to live off of the income generated by their assets may not want to have to rely on selling assets and hoping that they appreciate sufficiently to keep their portfolio at a certain level. Instead, the desire is to receive distribution or dividends payments from the portfolio’s assets so that there is no need to sell at inopportune times. The Neuberger Berman High Yield Strategies Fund certainly meets this need for income, as its 13.15% current yield compares very well to its peers:

|

Fund Name |

Morningstar Classification |

Current Yield |

|

Neuberger Berman High Yield Strategies Fund |

Fixed Income-Taxable-High Yield |

13.15% |

|

Allspring Income Opportunities Fund (EAD) |

Fixed Income-Taxable-High Yield |

8.89% |

|

BlackRock Corporate High Yield Fund (HYT) |

Fixed Income-Taxable-High Yield |

9.34% |

|

Credit Suisse High Yield Bond Fund (DHY) |

Fixed Income-Taxable-High Yield |

8.73% |

|

Pioneer High Income Fund (PHT) |

Fixed Income-Taxable-High Yield |

8.37% |

|

Western Asset High Income Fund II (HIX) |

Fixed Income-Taxable-High Yield |

13.30% |

As we can clearly see, the Neuberger Berman High Yield Strategies Fund has a yield well beyond that of most other funds in its category. This is something that will undoubtedly appeal to any investor who is seeking to earn a very high level of income from the assets in their portfolio. However, the fact that the fund has a substantially higher yield than most of its peers poses a potential concern. This is because the market generally only assigns outsized yields to an asset when it expects that the fund will have to cut its distribution in the near future. In a recent article, I pointed out that the distribution paid by the Western Asset High Income Fund II exceeds its investment profits and is destructive to its net asset value. That is the only peer fund that rivals the Neuberger Berman High Yield Strategies Fund in terms of yield, so this concern is not unwarranted. This fund might be suffering from the same problem. After all, it is investing in the same asset type as many of the other funds on this list, so unless it is taking on substantially more leverage or investing in substantially riskier junk bonds it is difficult to see how the fund can generate income that is so far above that of its peers. Thus, we will want to pay very close attention to this fund’s finances going forward, and this article will do exactly that.

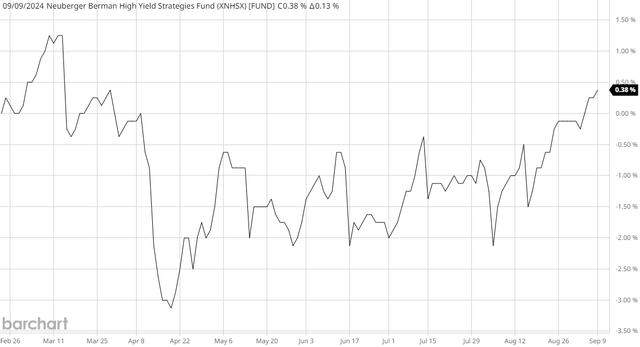

As regular readers might remember, we previously discussed the Neuberger Berman High Yield Strategies Fund in late February. The junk bond market since that time has been fairly stable. Bond prices in general did decline during the first few months of this year as investors began to realize that interest rates would not be dropping as rapidly as they had thought back in December. Thus, bond prices at the start of the year were too high and needed to adjust. However, the decline affected mostly investment-grade bonds and not junk bonds. Junk bonds proved to be much more stable in price during the first half of this year, due mostly to yield-hungry investors wanting to lock in high coupon yields while they still existed. After all, everybody at the time thought that the Federal Reserve would cut interest rates, but they were uncertain about the timing. The Neuberger Berman High Yield Strategies Fund primarily invests in junk bonds, so we can probably expect its performance since our last discussion to exhibit similar stability.

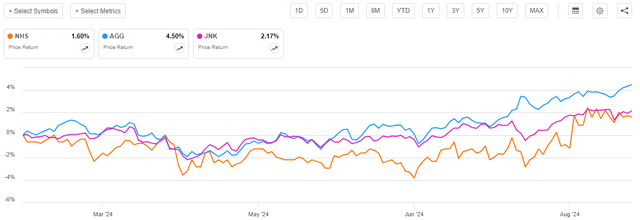

That is indeed the case, as shares of the Neuberger Berman High Yield Strategies Fund have appreciated by 1.60% since our previous discussion:

As we can immediately see, the shares of this fund underperformed both the Bloomberg U.S. Aggregate Bond Index (AGG) and the Bloomberg High Yield Very Liquid Index (JNK) since our previous discussion. This, unfortunately, makes this one of the few closed-end bond funds to underperform the indices over a similar period. We would ordinarily expect that the leverage employed by these funds would result in them outperforming their relevant indices. That would not be the case if the fund is over-distributing, though, so this is yet another sign that we need to be cautious. Overall, it seems likely that many investors would be disappointed with the fund’s performance at this point. In my previous article, I warned about potential problems going forward, and this underperformance suggests that my warning might have been correct.

However, investors in the fund might take some comfort in the fact that they did better than the above chart indicates. As I stated in my previous article:

Closed-end funds typically pay out most to all of their investment profits to their shareholders in the form of distributions. The basic goal is to keep the investment portfolio relatively stable and give the investors all of the investment returns in excess of the amounts needed to cover the fund’s expenses. This is the reason why many funds, including this one, tend to have very high yields. These distributions result in the actual return received by investors being significantly higher than might otherwise be assumed simply by looking at the share price performance. As such, we need to consider the distributions that are paid by the fund in any performance analysis.

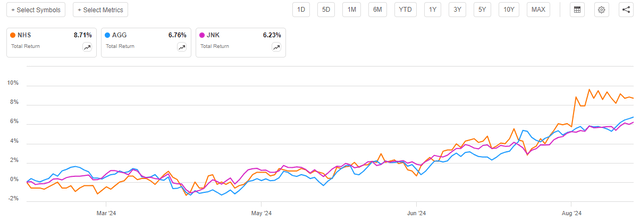

When we include the distributions that were paid by this fund, as well as the coupon payments made by the bonds comprising the two indices, we get this alternative performance chart:

This will likely be more appealing to fans of the Neuberger Berman High Yield Strategies Fund. As we can immediately see, the higher yield boasted by this fund relative to the indices was sufficient to allow it to provide its investors with a substantially higher total return over the seven-and-a-half-month period. That could increase the fund’s appeal among income-seeking investors, but if it is destroying its net asset value making its distribution, then it will be unlikely to sustain all of these returns going forward. Once again, we should have a look at the fund’s finances.

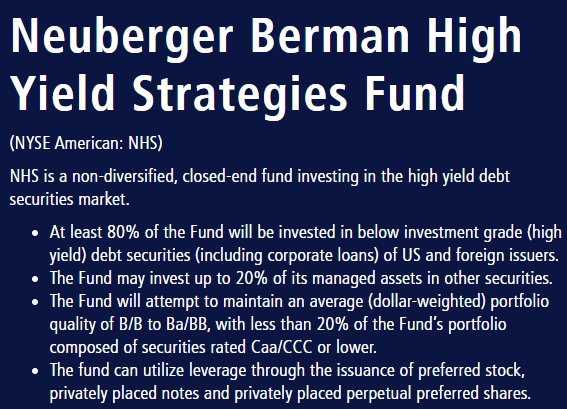

About The Fund

The fund’s website does not specify an objective for the Neuberger Berman High Yield Strategies Fund. The website does provide some information about its overall strategy, though:

Neuberger Berman

As we can see, the website specifically states that the fund invests at least 80% of its assets in junk bonds. That suggests that the fund will have a current income objective because bonds are an income vehicle. As I explained in a previous article:

Bonds by their very nature are income securities, as they do not deliver any net capital gains over their lifetimes. This makes sense, as an investor will purchase a bond at face value and receive face value back when the bond matures. The only investment return for a bond held over its entire lifetime is the coupon payments made to the bond’s owner. Thus, bonds do not deliver capital appreciation over their lifetimes.

However, the fund’s fact sheet states that the Neuberger Berman High Yield Strategies Fund is pursuing a total return objective. Regular readers can likely recall that I have been critical about other bond funds claiming this objective due to bonds not having any net capital appreciation (any temporary gains that they may get from falling interest rates are wiped out at or prior to the bond’s maturity). However, this fund does have two features that may make the total return objective appropriate. Specifically, the following two items:

- The fund can invest in foreign bonds, which allows it to earn capital gains from currency appreciation.

- The fund can invest 20% of its assets into things other than junk bonds, some of which might be securities that can provide long-term capital appreciation.

The potential to profit from investing in foreign currency bonds is something that I discussed in previous articles (see here and here). In short, the bond itself will not generate any net capital gains. However, a U.S. Dollar investor might benefit from gains if the U.S. dollar declines against the foreign currency over the bond’s lifetime. For example, the U.S. dollar and the euro were at parity in mid-2022. At that time, an investor could have purchased a €1,000 euro bond for $1,000. Today, that €1,000 euro bond has a face value of $1,102.55. If that bond matured today, the investor would get back the €1,000 euro, which converts into $1,102.55, so the investor realized a 10.255% gain from the currency. Thus, it is possible to get net capital gains when purchasing a bond denominated in a foreign currency.

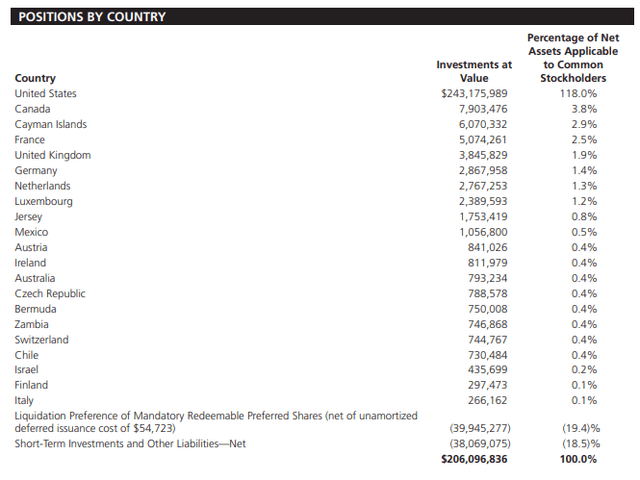

However, it is uncertain to what extent this fund is investing in foreign currency bonds. The fund’s most recent semi-annual report provides the following country allocation as of April 30, 2024:

That states that the overwhelming majority of the debt securities that were held in the fund as of April 30, 2024, were issued by American entities. Almost anything issued by an American entity will be denominated in U.S. dollars, and thus will not benefit from a decline in the U.S. dollar against foreign currencies. However, the remaining countries shown on the list do not use the U.S. dollar as their native currency, so it is possible that bonds issued by those entities are denominated in foreign currency. In particular, the euro, the British pound, the Canadian dollar, and the Swiss franc are considered to be hard currencies that are generally acceptable for international investors. There is no particular reason why an entity in France, Germany, or Switzerland would need to issue U.S. dollar bonds in order to attract interest from investors. Thus, it is possible that the fund could hold bonds denominated in those currencies.

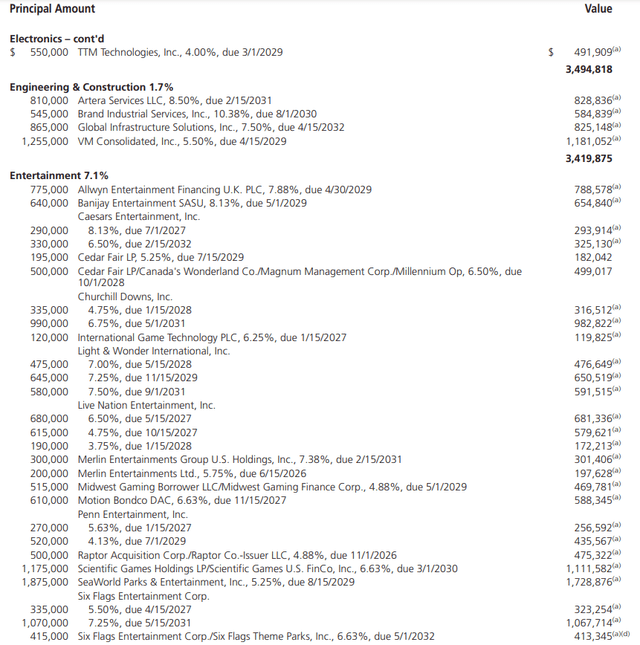

However, there is no hard evidence that it is holding foreign currency bonds, either. The fund lists the principal amount for each of the bonds in its schedule of investments. In all cases, the figure listed is a U.S. dollar amount. It is unlikely that the fund is simply converting the principal into U.S. dollars for reporting purposes, due to the fact that nearly all of the principal amounts are in even thousand-dollar figures. For example, take a look at this page of the schedule of investments:

Some of the companies shown above are foreign entities, but the principal amounts round evenly to thousands of U.S. dollars. That should not be the case if those are foreign currency bonds.

In addition, we have this in the legend section:

NHS Semi-Annual Report

The only currency listed is United States Dollars. If the fund was holding bonds denominated in any other currency, it would be best for its management to simply add more currency abbreviations and list the principal denominations in the foreign currency, rather than converting them back to U.S. dollars. After all, there are some investors who want foreign currency exposure, and providing a full listing of the bonds that it holds along with the currencies that they are denominated in would increase its appeal to those investors. Thus, at the moment, it does not appear that this fund is taking advantage of the opportunity to earn capital gains from the decline of the U.S. dollar against foreign currencies. This is disappointing, as the U.S. Dollar Index (DXY) is down 2.95% over the past year:

Thus, the fund appears to have left some potential gains on the table by not holding foreign currency bonds.

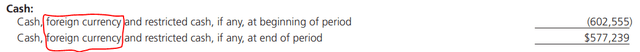

It is important to note though that this does not mean that the fund will never hold foreign currency-denominated bonds. There is nothing in its mandate that forbids such positions, and there is an entry on its balance sheet that suggests that it might sometimes hold foreign currencies:

It would not make mention of foreign currency if it could not hold such positions. There is also no reason at all to have foreign currency unless the fund could invest in foreign currency bonds. Thus, it appears that this may be an option for it even if it is not taking advantage of this option right now. That is something that some investors worried about the long-term future of the U.S. dollar (and recent articles and comments posted on this site suggest that I am not alone in this) might appreciate.

The description of the Neuberger Berman High Yield Strategies Fund posted on its website (and screenshotted above) states that the fund might invest up to 20% of its assets in securities other than junk bonds and leveraged loans. It does not appear that the fund is really taking advantage of this opportunity either. The fund’s most recent semi-annual report states that it had the following asset allocation on April 30, 2024:

|

Asset Type |

% of Net Assets |

|

Commercial Mortgage-Backed Securities |

0.5% |

|

Asset-Backed Securities |

4.2% |

|

Corporate Bonds |

127.2% |

|

Loan Assignments |

5.8% |

|

Convertible Bonds |

0.2% |

|

Money Market Fund |

5.1% |

As we can see, the only securities that were held by the Neuberger Berman High Yield Strategies Fund as of the most recent financial report were debt securities. As mentioned earlier, domestic currency debt securities do not have the potential to provide net capital gains over their lifetimes, so we are basically stuck with the coupon payments made by these securities to the fund. This could be problematic for reasons that I discussed in a recent article:

As of today, the ten-year U.S. Treasury note yields 3.715%. That is a 2.34% after-tax yield for an investor in the highest tax bracket. The most recent year-over-year inflation rate based on the (flawed) consumer price index is 2.9%. Thus, the ten-year U.S. Treasury currently has a negative after-tax real yield.

…

Most U.S. dollar-denominated bonds are priced based on a spread above the ten-year U.S. Treasury that supposedly accounts for the risk that any issuer apart from the United States government might default. Thus, the fact that the ten-year U.S. Treasury currently has a negative after-tax real yield suggests that the yield on every other type of bond is too low for the risks involved in holding it to maturity. Thus, this analysis suggests that bonds are overpriced.

In addition, in another article, I showed that all of the interest rate cuts that are likely to occur are already priced into bonds. Thus, the only way for domestic bond investors to realize further upside from today’s levels is if the Federal Reserve cuts interest rates by more than the market currently expects. The market is currently pricing in ten 25-basis point cuts between now and the end of 2025, so the only realistic way that the central bank will cut interest rates by more than the market is currently pricing in is if a very severe recession occurs. Many analysts are expecting a recession to set in either later this year or early next year, but it is uncertain how severe it will be. Regardless, it is fairly apparent that any further upside in bonds is very limited. Thus, if the fund’s management wants to generate any more capital gains than the fund already has, then it will need to invest in something other than U.S. dollar-denominated domestic bonds. As we just saw, it is not doing that to any significant degree.

The fact that the assets in the fund appear to have very limited upside does not necessarily pose a problem if the fund is able to cover its distribution with its net investment income. The Neuberger Berman High Yield Strategies Fund has a yield that will provide a decent return even if there is no share price movement. We will have a look at its distribution coverage in just a bit.

Leverage

As is the case with most closed-end funds, the Neuberger Berman High Yield Strategies Fund employs leverage as a method of boosting the effective yield and total return that it earns from the assets in its portfolio. I explained how this works in my last article on this fund:

In short, the fund borrows money and then uses that borrowed money to purchase junk bonds or other income-producing assets. As long as the purchased assets have a higher yield than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. As this fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, that will usually be the case.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not using too much leverage since that would expose us to too much risk. I do not generally like to see a fund’s leverage exceed a third as a percentage of its assets for this reason.

As of the time of writing, the Neuberger Berman High Yield Strategies Fund has leveraged assets comprising 27.50% of its portfolio. This is a fairly significant decrease from the 33.92% leverage that the fund had the last time that we discussed it, which is actually rather surprising. After all, as we saw in the introduction, the fund’s share price has barely moved in seven-and-a-half months, so we would not expect to see the fund’s leverage decrease by 6.42%.

The steep decrease in leverage is even more surprising when we consider that the fund’s net asset value has only increased by 0.38% since our previous discussion:

In numerous previous articles, I have shown that an increase in net asset value should result in a decrease in a fund’s leverage ratio, all else being equal. We do see the decrease in leverage here and a corresponding increase in the fund’s net asset value, but a 0.38% increase in net asset value is not enough to result in that large of a leverage decrease. Therefore, this fund must have paid off some of its leverage at some point in the past seven months or so.

The fund’s leverage ratio is now below the one-third of assets level that we would ordinarily prefer to see, which is an improvement over what we have seen previously. The fund’s leverage is also reasonable when compared to its peers:

|

Fund Name |

Leverage Ratio |

|

Neuberger Berman High Yield Strategies Fund |

27.50% |

|

Allspring Income Opportunities Fund |

30.80% |

|

BlackRock Corporate High Yield Fund |

25.56% |

|

Credit Suisse High Yield Bond Fund |

26.33% |

|

Pioneer High Income Fund |

31.20% |

|

Western Asset High Income Fund II |

32.28% |

(all figures from CEF Data)

As we can clearly see, the Neuberger Berman High Yield Strategies Fund has a leverage ratio that is lower than the 29.15% median of this peer group. This is a positive sign, and it strongly suggests that the fund is not employing too much leverage for its strategy. Overall, we should not need to lose any sleep over the fund’s use of leverage. This fund is quite reasonable in this respect.

Distribution Analysis

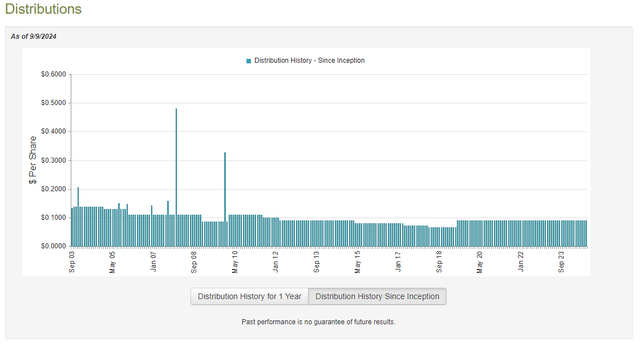

The primary objective of the Neuberger Berman High Yield Strategies Fund is to provide its investors with a very high level of total return. However, bonds deliver the bulk of their total return through coupon payments made to their investors. In addition, this is a closed-end fund, so it aims to primarily deliver its total return through direct payments made to its investors. To that end, the Neuberger Berman High Yield Strategies Fund pays a monthly distribution of $0.0905 per share ($1.086 per share annually) to its investors. This gives the fund a very attractive distribution yield of 13.15% at the current share price.

Unfortunately, this fund has not been particularly consistent with respect to its distribution over its history. However, it has done reasonably well since June 2019:

As I stated in my previous article on this fund:

This long-term history might prove to be a turn-off for those investors who are seeking to earn a safe and secure income from the assets in their portfolio despite the fact that it has managed to maintain a stable payout over the past few years. We want to investigate this further, as the Federal Reserve’s switch away from the very loose financial conditions of the post-pandemic period resulted in most fixed-income funds taking significant losses and being forced to cut their distributions in order to preserve their net asset values. It is curious that this fund was able to accomplish a feat that its peers were unable to accomplish, and it could suggest that this fund is at risk of cutting its distribution. This appears to be what the market is suggesting given its very high yield relative to other similar funds. We should therefore investigate further.

The most recent financial report that is available for the Neuberger Berman High Yield Strategies Fund is the semi-annual report for the six-month period that ended on April 30, 2024. A link to this report was provided earlier in this article. As this is a newer report than the most recent one that was available at the time of our previous discussion, it should work pretty well to provide us with an update on the fund’s financial condition.

For the six-month period that ended on April 30, 2024, the Neuberger Berman High Yield Strategies Fund received $11,572,098 in interest from the assets in its portfolio. The fund, perhaps surprisingly, had no other income, so its total investment income was also $11,572,098. It paid its expenses out of this amount, which left it with $7,057,486 available for shareholders. That was not sufficient to cover the $14,098,447 that it paid out in distributions during the period.

The fund therefore cannot sustain its current distribution in the absence of capital gains. As we already discussed, this could be problematic because domestic bonds have limited upside potential at this point.

With that said, the fund did manage to cover the difference between its distribution and net investment income with capital gains over the six-month period that ended on April 30, 2024. For the period, the fund reported net realized losses of $4,753,067, but this was more than offset by $20,446,639 in net unrealized gains. Overall, the fund’s net assets increased by $11,668,330 after accounting for all inflows and outflows during the period.

Assuming that the market does not correct and causes the fund to give up the unrealized capital gains, it can probably sustain the distribution for another few quarters. However, after that, there could be issues. Investors in this fund are therefore advised to keep an eye on the fund’s net asset value per share to ensure that it does not decline too much.

Valuation

Shares of the Neuberger Berman High Yield Strategies Fund are currently trading at a 2.62% premium on net asset value. This is a more attractive price than the 3.51% premium that the shares have averaged over the past month. However, the current price does still mean that anyone purchasing the fund today is paying more for the fund’s assets than they are actually worth.

Conclusion

In conclusion, the Neuberger Berman High Yield Strategies Fund is a fairly popular junk bond fund due largely to its incredibly high yield. Perhaps surprisingly, the fund managed to cover its distribution during the first half of its fiscal year, but there is no guarantee that it will be able to do that on a permanent basis due to the very limited upside for bond prices right now. The fund theoretically has the ability to invest in foreign assets though, so that improves the fund’s potential to earn the capital gains that it needs to cover the distribution. It does not appear to be exploiting that ability right now, though.

The fact that the fund has a premium is somewhat problematic as that means that investors are potentially overpaying for bonds that are, at best, fairly priced right now. If it can sustain the current distribution, the premium might be acceptable since the higher yield relative to peers will make up for it. Investors might still want to be cautious, however.