Distribution Is Sustainable As Long We Develop Time Travel By 2027

Viorika/iStock via Getty Images

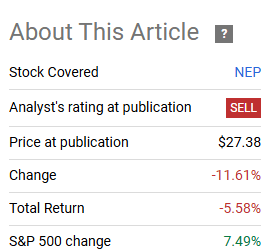

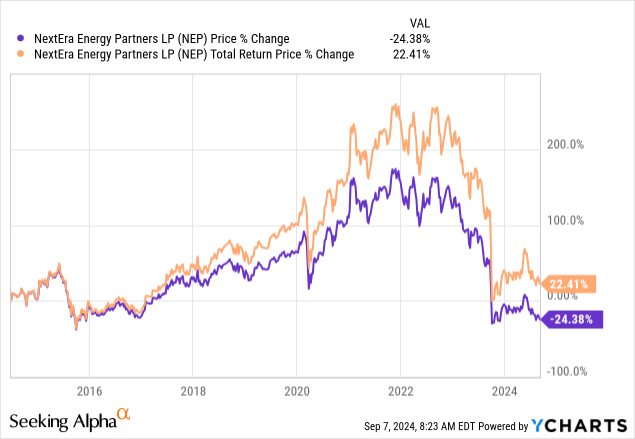

In April of this year, we switched NextEra Energy Partners LP. (NYSE:NEP) to a Sell rating.

So we would not count on the current distribution becoming your annualized total return profile in the next 5 years. We rate NextEra Energy Partners, LP units a Sell and think there is substantial downside once the distribution is realigned.

Source: Lower For Longer

The stock realized that resistance was futile and moved lower.

Seeking Alpha

Previous to that, as well, we have been skeptical of the merits of this investment.

Seeking Alpha

Over the past few months, there have been two major developments. The first being that the Federal Reserve has decided to ease faster than what we would have anticipated. Alongside that, NEP threw down the gauntlet on the distribution once again for the bears. We go over our thoughts on these and tell you why options offer a far better risk reward here for those chasing the income.

Eased To Please

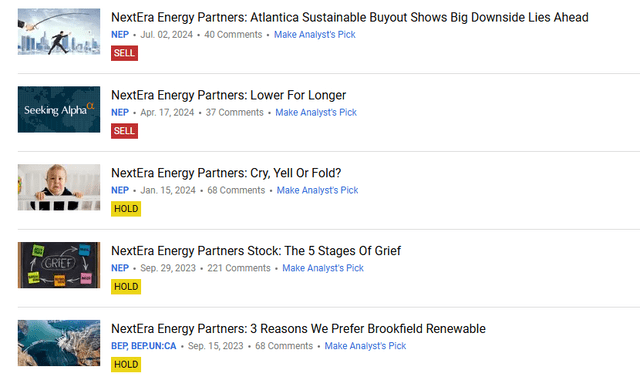

Anyone else remember the end of 2023? 5 rate cuts were priced in for the Federal Reserve during 2024. We offered our take that this was completely insane and not likely to happen. In case you think this is part of your hallucination, here is a picture to jog your memory.

Bloomberg

So our first question for the “Rate Cuts Ergo Buy Junk” crowd is, why do you believe this round of forecasts is any more accurate than the last? The current easing priced in just before the first rate cut (yes we will get one), is unprecedented.

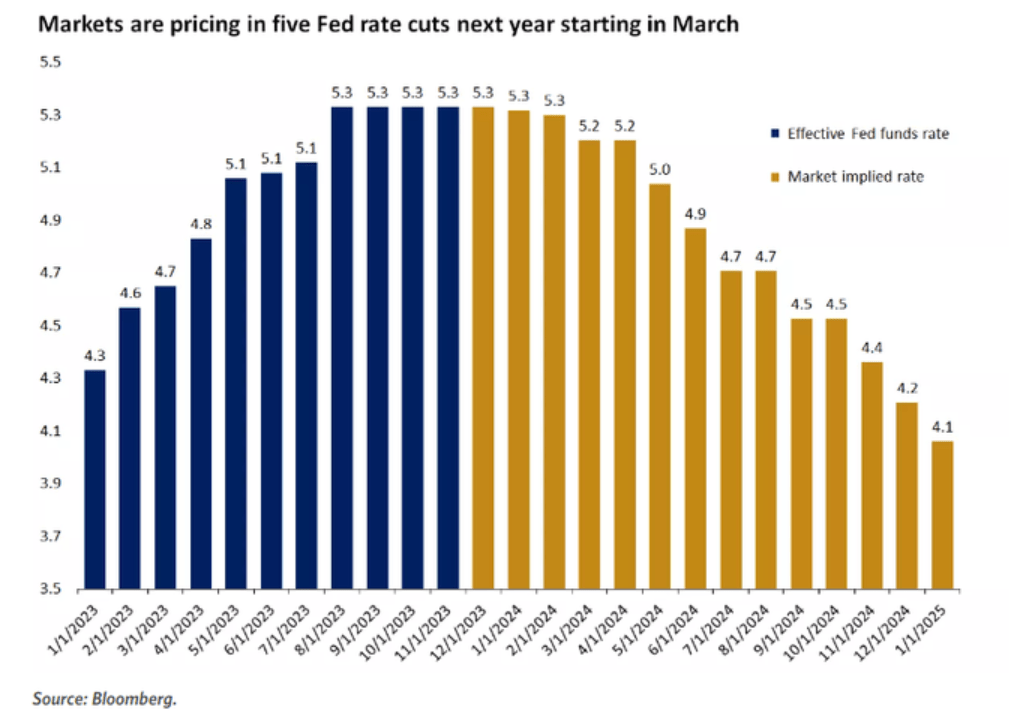

Societe Generale

So we would once again advise caution on this theory that ZIRP (Zero Interest Rate Policy) is on our doorstep. Do also keep in mind that the explosive budget deficits that we are seeing are unlike anything we have had before. The economy is not in a recession and the US government is running 6%-7% deficits. So it is highly probable that the long end of the yield curve revolts at some point and throws all these yield chasing exercises moot. The one scenario where these cuts play out and the long end stays depressed, would be a very strong recession. We just ended the longest inversion we have had on the yield curve. Guess what usually follows,

Bloomberg

NEP equity is likely to be taken to the cleaners in that scenario.

Distribution Poker

One of the hilarious reasons to own NEP that we keep reading, is that it is raising its distribution. Imagine if your teenage son or daughter came and told you that they plan to improve their finances by spending even more than what their budget allows. How impressed would you be?

NEP is in a bad situation, and it did not sell those pipeline assets because it was drowning in cash. The company continues to pay out everything it is making with the hopes that the convertible equity portfolio financing (CEPF) buyouts in 2027 will fix themselves. The bull case has always been that if NEP pays out everything it makes, they cannot lose. The last 10 years begs to differ on that theory. NEP has done about 2% compounded in total returns after those big payouts.

Still, Q2-2024 results were better than what we expected. The adjusted funds actually beat analyst estimates as well. The firm should have chosen to keep the distribution static, but instead doubled down on its growth target. It announced a distribution increase and stuck to its target of distribution growth through 2026. This looks like a desperate gamble to hook in more income investors. There is no clear viable plan if the stock stays under $35 and the CEPF’s have to be financed. While debt is a separate issue, interest rate cuts won’t directly help with CEPF. The stock needs to be materially higher for non-dilutive equity issuance and NEP believes the only path to that, is via pushing through its distribution hikes.

How To Play

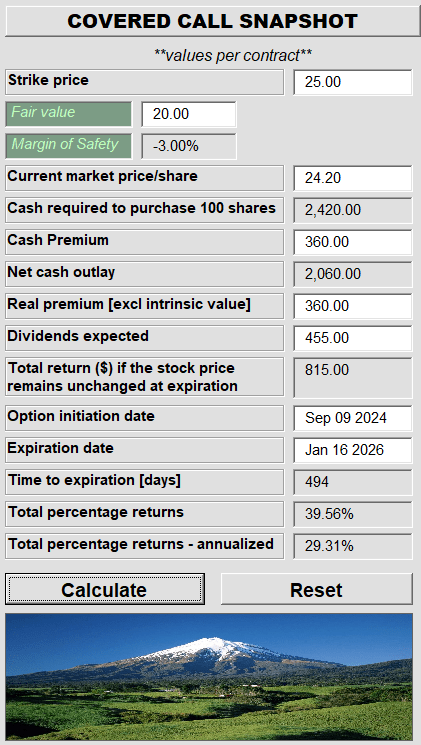

The stock is expensive if you apply the buyout multiples of Atlantica Sustainable (AY). But the options premiums are quite high, to say the least. This allows investors an opportunity, at these levels, to play for the distribution without risking too much. If we had to do this, we would use longer dated calls, and these will give you excellent returns if the price stays flattish.

Author’s App

The fact that you are getting a 29% yield for a flat price is something that should tell you that those distributions are most likely going to be cut. But the good part here is that by selling the call, you have cut your cost basis down (see the line that says net cash outlay) to $20.60. This gets you fairly close to our fair value and of course reduces your risk. We believe this risk reduction focus is a key reason we have kept volatility low in our portfolio.

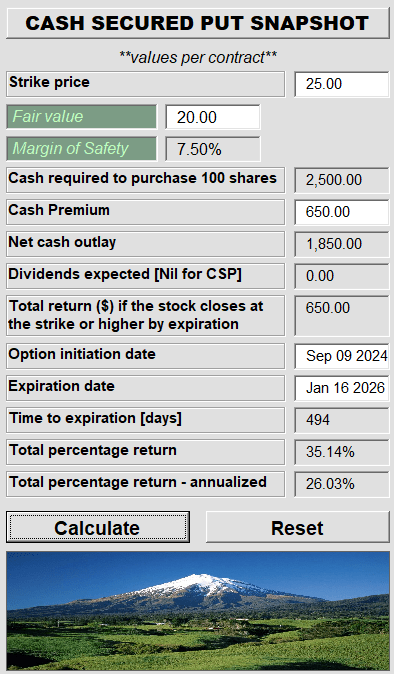

A similar case can be made by selling the cash secured puts. Here, you are collecting your distributions up front. This actually creates a margin of safety of sorts for us as the amount collected upfront, forces the net cash outlay below fair value. One point to note here is that this put option is slightly in the money, i.e. strike is greater than the stock price.

Author’s App

So to make this return, you are counting on some level of stock appreciation. Hence, this yield is not directly comparable with the covered call yield. Since we are bearish on the stock, we will definitely not be doing these trades. But we think these are good choices for those who are not bullish on the stock price, but believe the distribution will be sustained.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult a professional who knows their objectives and constraints.