Monty Rakusen

Dear readers/followers,

In this article, I’ll be updating my thesis on National Fuel Gas (NYSE:NFG), a company I reviewed roughly 2 years ago. Since that review, and my position which is around 0.11%, it has significantly underperformed. This has been one of my less successful investments in the energy sector, where I have typically done rather well for myself. I managed to snag Enbridge (ENB) at a superb valuation, and some other energy companies as well. But NFG, that one was a dud.

Since my last article, which you can find here, the company has underperformed in the market, showing a negative RoR of over 10% during a time when the S&P500 has gone up more than 40%. The company plays on nat gas through its utility segment but also provides transport through its pipelines as well as owning some attractive storage terminals.

If you only look at the company’s fundamentals and what it could achieve, the company looks like an excellent play. That’s also what “lured” me in here. Did I underestimate or overestimate the company? I believe the market is applying an incorrectly high discount here because the company is actually very solid, despite a 12% earnings decline followed by another 1% in 2024E (expected).

Beyond that, however, this company is set to soar and improve. That is why, as of today, I am actually adding to my position in National Fuel Gas, and why the company’s few negatives do not really faze me.

What we have to understand going in is the company’s correlation to nat gas. This is strong, and results in some really unfavorable trends at times – such as between -10 and -12, as well as between -22 and -24. Volatility is part of the play here. I believe that I went in low enough and that the earnings would be able to outweigh the volatility here.

But I was wrong.

Revisiting upside and good fundamentals in the Gas utility space

First off, I want to make it clear that this company is a dividend king. The company has a very good history of increasing payouts and currently yields over 3.5%, which is solid, especially when you consider what this business is.

What NFG is, is a company headquartered in New York that operates a very solid integrated collection of nat gas portfolio assets, which we find in a total of four segments. As mentioned, it does storage pipeline and utility – but NFG also does gathering and Exploration/production (upstream). This obviously comes with risks, but also comes with an upside.

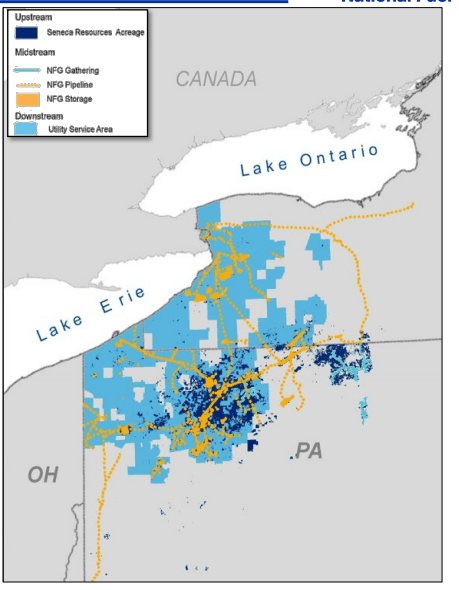

The company has access to 1.2M acres in Appalachia, with production of 1 Bcf per day from the area, and has invested almost $3B in its midstream assets since the tail end of GFC back in -10. Most of its interstate pipeline capacity is under contract, and the company reported 3Q24 back in July.

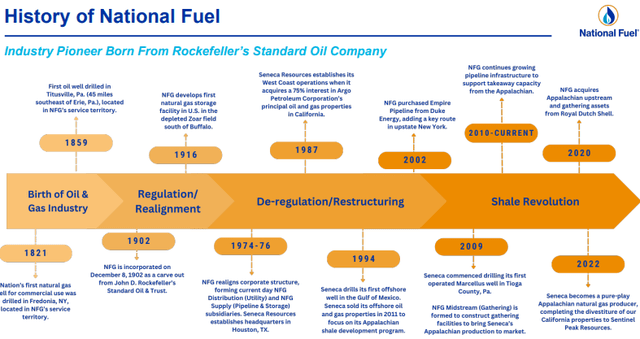

The reasoning to invest in NFG is based in part around its strong traditions and its history – because it has a history going back over 200 years.

Being a company born out of the legendary Rockefeller’s SOC, the company now represents a majority-upstream, minority midstream/downstream company. What I mean by this is that around 50% of company adjusted EBITDA comes not from the utility portion of its business, but from things like exploration and production from the aforementioned million-plus acres in Appalachia. The company’s midstream and downstream assets are significant as well – downstream has access to 754k utility customers connected to an infrastructure into which $900M has been invested since the GFC, and we find our operations primarily here.

NFG IR (NFG IR)

The company, as such, mixes regulated and non-regulated operations, including the Seneca Resources company which holds the Appalachian assets. The NFG midstream company has the gathering segment, and has a total throughput of 1.3 Bcf/d, with 400 miles of gathering pipeline. Midstream is also part-regulated by FERC, with 2,600 additional miles of pipeline with contracted transport and storage capacity.

The utility segment is found in PA and NY, rate base of about $1.2B, and in this area, the company is a market leader because it provides more than 90% of space heating load in the operating footprint.

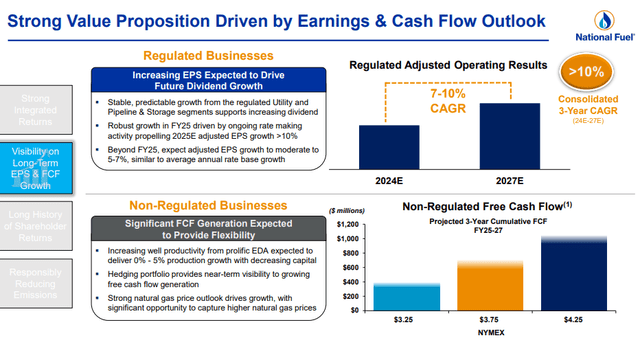

The company’s argument for investing is that it manages to balance regulated with non-regulated businesses in a way that optimizes returns for shareholders. Visibility of regulation with strong execution upstream, combining windfalls of cash with rate base growth to enhance capital efficiencies. Again, this is easy to “fall for”, and I accepted buying the company at valuation levels which in retrospect did turn out to be somewhat excessively positive in the short term.

Nothing is wrong with the fundamentals here. NFG has 122 years of dividend payments, and 54 years of increases, showing in truth what a dividend king can do.

“The dream” is the effective cooperation of these two segments in a way that enhances returns. This has not been the case as of the past 2 years, as earnings have gone the other way.

Part of the recent swings have to do with rate cases. There are plenty of rate cases that affect the company currently ongoing, both in PA and NYC, as well as in midstream. The company hasn’t reached clarity in any of these cases in the US, with multi-year settlement negotiations currently ongoing. NFG is seeking improved returns, but regulators are not biting – yet. In the other two fields, the company has seen more success. On the supply side, new settlement terms were approved by FERC in June, which adds about $55M in increased revenue on regulated midstream alone. In PA, the company also managed to reach a joint settlement for the first time in a very long time (-07).

It shouldn’t be a surprise that the keystone risk to the thesis is the company’s correlation to gas on one hand, and the rate case exposure to the other. The company has shown us plenty of volatility in the past few years, and a negative trend that has been ongoing for several years until it finally started recovering a few months back.

Thankfully, the company’s fundamentals are also improving. NFG has delivered very quickly – going from over 3x net debt/EBITDA to almost 2.1x in less than 4 years, and that was after a big buyback in -20. Only S&P Global has BBB-. Fitch has BBB here, and the company has just north of a billion dollars in liquidity at this time.

It’s clear to me, both from company trends, rate case timings, and potential, as well as current energy trends, that NFG’s trough and low could be this year. The company believes this to be the case, and for 2025E to be a significant increase in earnings in EPS, as well as an increase in EBITDA. As we can see, the major overhang to the company remains the company’s nat gas prices – but quite literally every other KPI is pointing positive here, with plenty of forward potentials.

On the back of this, I believe the negative trends for the company are overstated. I would argue that 2025E is likely to bring at least $6.3/share, with another improvement in 2026E, and this implies not only an upside but a high upside.

Let’s look at a valuation for the business and see what the thesis and results could be here.

I view 10-15% as likely, and 20-30% annualized as entirely possible.

As the sub-heading implies, a 15% annualized upside requires National Fuel Gas to trade at no more than 10x P/E. I believe a dividend king with BBB rated credit and no meaningful catastrophic narratives is worth more than 10x P/E, despite being in a volatile space. But that 10x P/E implies 15% annualized upside if we assume a 10-19% EPS growth annually, which I consider to be likely from this level onward.

So that’s the conservative estimate, as things go here.

What about if we want to be what I consider to be realistic?

Well, in that scenario we can start talking about 11-12x P/E ranges, which represent the 5-7 year P/E averages here. And despite moving upward since its lows, the company would still present you with an annualized return potential of 21%+ at 11.3x, and over 29% at 12.5x P/E. That comes to nearly 66% total RoR potential in less than 2 years and is worth considering (Source: Paywalled F.A.S.T graphs link)

I fully admit to you, that this article is late – and I apologize for it. I should have revisited NFG over 3 months ago when the price was truly in the toilet. Back when we moved below $50/share, that’s when we really should have backed up the truck – but I missed out on it, and now I “have” to buy at just under $60 instead. Still a great price, but not as mind-numbingly awesome as under $50/share.

But let’s consider for a moment that the 20-year average for this dividend king is actually 16x P/E.

If we find this to be a likely turnout, then we could be looking at returns of over 44% per year, or 113% RoR in 2 years.

Now, granted – going there would really require us to see some good recoveries in nat gas – but if nat gas goes up even close to significantly, I believe NFG will be one of the beneficiaries of such a move – so I wouldn’t call the development impossible.

My “base case” remains a 12x P/E though – and the 20-25% annualized RoR is what I work with. It’s what I base my investment on.

And it’s why, despite the commodity risks of investing in a majority upstream nat gas utility, I remain at a “Buy” rating for NFG here, and am going to add more shares to my growing position at a 3.47% yield, expecting a double-digit RoR.

This means my thesis for the company is as follows.

Thesis

- NFG is a fundamentally appealing, integrated commodities business and utility with an attractive operational profile. At the right price and conservative upside, this company constitutes an absolute “Buy”.

- However, recent risks including debt, inflation, operations in states traditionally opposed to hydrocarbons, and a rich valuation based on continued commodity pricing upside add to the risk here.

- This, however, is weighted by the company’s recent reduction in leverage, a potentially positive outlook for nat gas, and other KPI’s leading us in the “opposite” direction. I view the upside as potentially in the double digits here.

- I come in at a “Buy” for the period of 2024 and in August/September – my target remains $70/share, no higher, which was also the target the last time I updated on this particular company.

Remember, I’m all about :

-

Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them. (Italicized)

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has realistic upside based on earnings growth or multiple expansions/reversion.

As of this time, I cannot call the company “cheap”, though it was back a few months ago, but would consider it a worthy “Buy” here.