Monty Rakusen

Almost a year ago, I stated that NACCO Industries (NYSE:NC) was risky, despite its seemingly cheap valuation. Since my article, the stock has vastly underperformed the broad market, as it has declined 25% whereas the S&P 500 has rallied 30%. After such a huge divergence, some investors may be tempted to conclude that the stock has become attractive, as the time may have come for the stock to cover part of the lost ground. However, the coal producer remains risky and is likely to continue underperforming the broad market over the long run. Therefore, investors should remain on the sidelines.

Business overview

NACCO Industries has a history of more than a century. It is the largest coal producer in the U.S. and one of the 10 largest coal producers in the world, with annual sales of coal of about 5.5 million tons.

The consumption of coal has stagnated over the last decade due to the coordinated efforts of most countries on shifting to cleaner fuels, such as natural gas and renewable energy sources. Indeed, the consumption of coal remained essentially flat between 2013 and 2022. However, the war in Ukraine, which began in early 2022, reinvigorated the coal industry. The U.S. and the European Union imposed strict sanctions on Russia for its invasion of Ukraine. As Russia was producing approximately one-third of natural gas consumed in the European Union, the global natural gas market became extremely tight and thus the price of natural gas skyrocketed to a 13-year-high in 2022.

The rally of gas prices caused a generational global energy crisis, which led many countries to resort to coal in order to reduce the average price of their energy mix and thus mitigate the impact of the crisis on their budgets and their citizens. As a result, the price of coal nearly tripled, from $167 per ton at the end of 2021 to an all-time high of $447 per ton in 2022. NACCO Industries greatly benefited from that development, as it grew its earnings per share 50%, from $6.69 in 2021 to a 10-year high of $10.06 in 2022.

However, the tailwind from the energy crisis has been fading for NACCO Industries since early last year. The global gas market has absorbed the impact of the sanctions, primarily thanks to abnormally warm winter weather for two years in a row. As a result, the price of coal has reverted to the level it was before the onset of the energy crisis. This is bad news for NACCO industries, which is highly sensitive to the price of coal. Indeed, the company incurred a loss per share of -$5.29 in 2023. As this loss is equal to 21% of the current market capitalization of the stock, it is undoubtedly significant.

Even worse, almost all the countries around the globe are currently making unprecedented efforts to shift from fossil fuels to renewable energy sources in order to shield themselves from a potential future energy crisis. Thanks to these efforts, there is an excessive number of clean energy projects under development right now. Global investment in clean energy projects surged 17% in 2023, to a new all-time high of $1.8 trillion. As a result, global investment in clean energy has almost doubled since 2020.

Whenever all the ongoing projects begin to generate energy, in 2–5 years from now, they are likely to exert additional pressure on the price of coal.

To be fair, NACCO Industries has certainly realized its fast-changing business landscape, and thus it has been trying to diversify away from coal. To this end, it has grown its Mitigation Resources division in recent years. The completed and the ongoing projects of the company include the restoration of more than 164,000 feet of streams and 839 acres of wetland and thus NACCO Industries aims to become one of the top 10 providers of stream and wetland mitigation services in the southeastern U.S. Nevertheless, this segment is still extremely small to move the needle in the total results of the company.

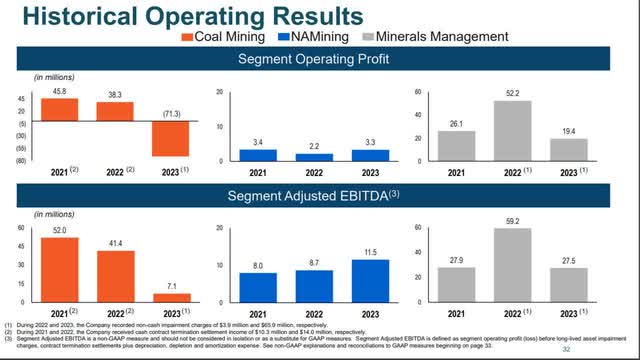

Operating Results of NACCO Industries (Investor Presentation)

Source: Investor Presentation

As shown in the above chart, the Mitigations Resources segment is not even included in the major segments that affect the total profitability of NACCO Industries. Instead, the Coal Mining division remains the main determinant of the total earnings (or losses) of the company.

It is worth noting that the Minerals Business, which involves leasing royalties and mineral interests to third-party exploration and production companies, comprises a significant portion of total earnings, as shown in the above chart. However, this business is highly volatile and cyclical, without promising growth prospects ahead. To cut a long story short, while NACCO Industries has been trying to protect itself from the ongoing secular shift of most countries from coal to green energy sources, it is still highly sensitive to the cycles of the price of coal. As a result, it does not have tangible growth prospects ahead.

Balance sheet

The management of NACCO Industries should be praised for maintaining a strong balance sheet. The company has net debt (as per Buffett’s formula: Net debt = total liabilities – cash – receivables) of $71 million, which is just 38% of the market capitalization of the stock. A healthy balance sheet is paramount for NACCO Industries, which faces headwinds in its core business. On the other hand, a strong balance sheet is not sufficient to render the stock attractive.

Underperformance

NACCO Industries has underperformed the S&P 500 in almost any time horizon one can examine. To be sure, the stock has dramatically underperformed the benchmark over the last decade (-50% vs. +172%), the last five years (-50% vs. +84%) and the last 12 months (-16% vs. +22%). When a stock underperforms the broad market in almost any time horizon, it indicates that it does not have a durable competitive advantage. Instead, its business faces long-term headwinds.

Moreover, in order for a stock to outperform the S&P 500 meaningfully over the long run, it should be able to generate an average annual return in excess of 10%. Given the stagnant consumption of coal and the threat from the boom in renewable energy sources, NACCO Industries is unlikely to generate such a high annual return over the long run.

Final thoughts

The stock of NACCO Industries has shed 30% this year, primarily due to the decline of coal prices, which has resulted from the fading tailwind from the war in Ukraine. Due to the striking divergence of the stock from the broad market, some investors may think that the stock has become overripe for a rebound. However, NACCO Industries remains unattractive and risky due to the headwinds facing its core business. Therefore, investors should refrain from purchasing the stock.