f11photo

Introduction

Guess what?

Real estate is back!

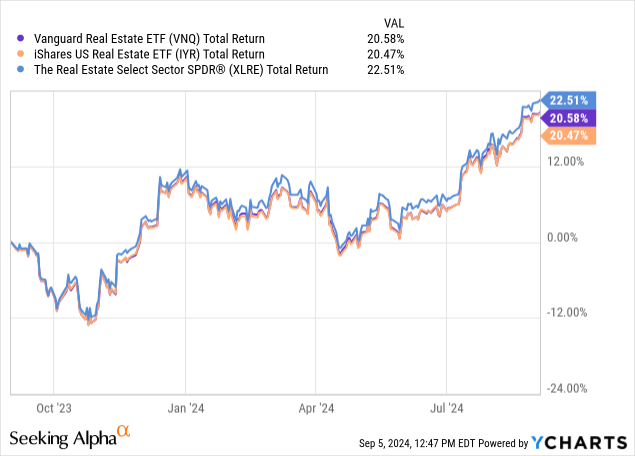

All three major real estate ETFs are up more than 20% over the past 12 months. This is entirely caused by the rally that started in April, as we can see in the chart below.

On the one hand, this is fantastic news, as I have discussed many REIT opportunities this year. In general, real investors are in a great spot again.

On the other hand, it’s not very easy to find bargains anymore, as valuations have increased substantially since April.

Hence, in this article, I’ll do two things:

- I’ll give you an overview of fundamental developments in the commercial real estate (“CRE”) industry. This tells us where the pitfalls and opportunities are and can help us make informed decisions.

- In order to provide food for thought, I’ll discuss three of the best REITs for this environment. This is based on (secular) CRE fundamentals and the value these REITs bring to the table.

So, as we have a lot to discuss, let’s get right to it!

A Closer Look At CRE Fundamentals

A few days ago, Wells Fargo published its second-quarter CRE chartbook, which included some fantastic insights. According to the bank, commercial real estate is showing signs of stabilization, although conditions remain soft.

Looking at the chart below, we see that vacancy rates continue to increase in all areas but retail real estate. The good news is that the rate of increase has come down substantially.

Wells Fargo

On top of that, CRE property valuations are stabilizing, as the MSCI all-property price index has risen for the third consecutive month in July.

Moreover, the transaction volume is increasing, indicating a recovery in market activity. The market also benefits from fewer banks tightening lending standards, which is good news for liquidity.

However, on a quarterly basis, year-over-year prices are still down in all segments except for industrial real estate, which is witnessing a re-acceleration in values.

Wells Fargo

Moreover, because the good news is mainly green shoots, the bigger picture also shows rising delinquency rates, with higher default rates in every single segment except for hotel real estate, which is still recovering from the pandemic.

Now, let me add some color to the individual CRE sectors using the table below:

- In the multifamily segment, demand surged, driven by poor affordability in the single-family housing market. This also kept the vacancy rate stable at 7.8% and rent growth at a modest level of 0.9%. I expect this to continue, as the mix of elevated housing prices and high rates has done a number on affordability.

Wells Fargo

- In the industrial segment, demand was strong. However, new construction pressured the vacancy rate and caused rent growth to soften further. However, according to other research reports I have read in the past few months, I believe it’s fair to assume we can expect a recovery in the first half of 2025.

- Retail continues to see strong demand. Despite very poor consumer sentiment, quick-service restaurants, discount groceries, and other affordable and essential platforms are doing just fine. This also explains why vacancy rates in this segment are not rising. I also believe that favorable supply plays a major role here.

- The office segment remains a dumpster fire. There is no other way of putting it. Although absorption improved a bit, overall leasing demand remained weak. Vacancies are still an issue, and it is unlikely that central business districts will recover soon. Even worse, a significant amount of pre-pandemic leased space is about to roll over.

Where To Put Our Money?

Essentially, all real estate sectors bring something bullish to the table. However, I decided to leave out multifamily housing, as I am not a huge fan of the risk/reward of the nation’s largest multifamily REITs.

I picked three other areas.

In the industrial sector, secular growth remains strong, fueled by e-commerce and economic re-shoring. This keeps demand for warehouses and logistics centers elevated. Especially if 2025 sees a recovery in vacancy rates and pricing, I believe this sector has a very bright future.

This may not come as a surprise. In light of what we just discussed, I believe retail remains a great place to be, especially REITs that deal with cost-conscious consumers and essential goods.

Moreover, I believe hotels offer opportunities. However, in this case, I prefer luxury, upscale, and entertainment. Especially, experiential real estate is expected to do well, as RLA Global wrote earlier this year. Ever since the end of the pandemic, we see that social media, e-commerce, and other online trends have not reduced our focus on having a good time in the “real world.” There are still great opportunities in these areas, even in light of poor consumer sentiment.

Here are the picks I came up with:

Rexford Industrial Realty (REXR)

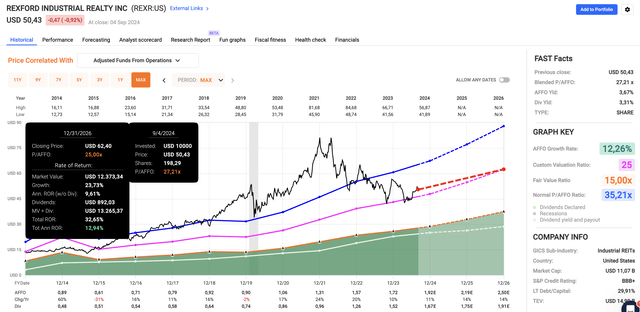

This may not have come as a surprise, as Rexford is a REIT I have discussed a number of times in the past. My most recent article on the company was published on August 9, when I called it “One Of My Best Ideas In Real Estate.”

Essentially, I like both Rexford and its larger peer, Prologis (PLD). However, only Rexford made it into this article, as I prefer its valuation.

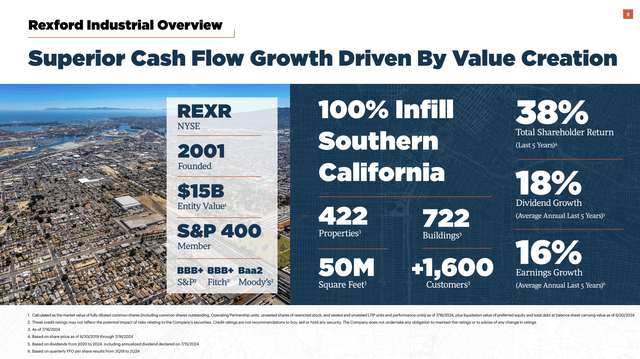

What makes Rexford special is its focus on Southern California’s infill market. In this market, it owns 422 properties, including 722 buildings that cater to more than 1,600 customers.

With that said, I agree with people who make the case that California has challenges, as it is one of the states that lost a lot of high-income taxpayers to “red” states after the pandemic, including major corporations like Tesla (TSLA), SpaceX, Trimpble, Chevron (CVX), Snowflake (SNOW), and many others.

Build Remote

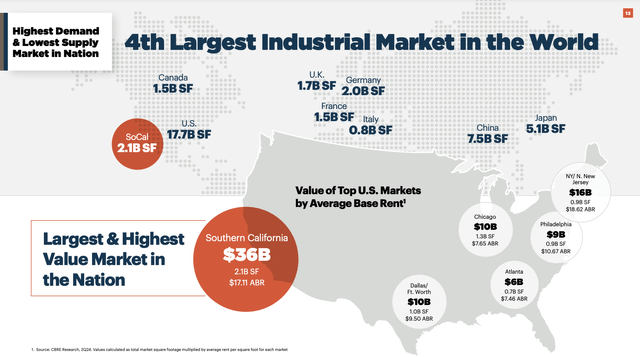

Although this is a worrisome trend, I like SoCal for different reasons. For example, it is the fourth-biggest industrial market in the world, almost four times as large as Chicago and more than twice as large as New York/New Jersey.

This market is dominated by many clusters, including high-tech aerospace, and supported by top-notch colleges in the State that have created a favorable environment for innovation – despite the many (social) issues facing the state.

The market also enjoys support from two of the biggest ports in the world, Los Angeles and Long Beach. These ports are critical for markets way beyond California.

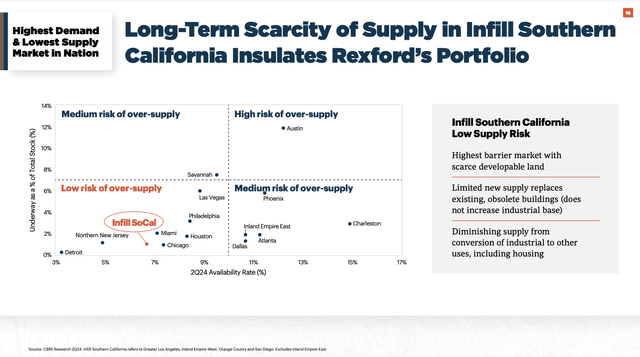

Even better, SoCal’s infill markets have serious supply constraints. On top of tough zoning laws and an increasing focus on residential real estate, it needs to be said that the market is wedged between mountains and the ocean. This gives the market tremendous pricing power.

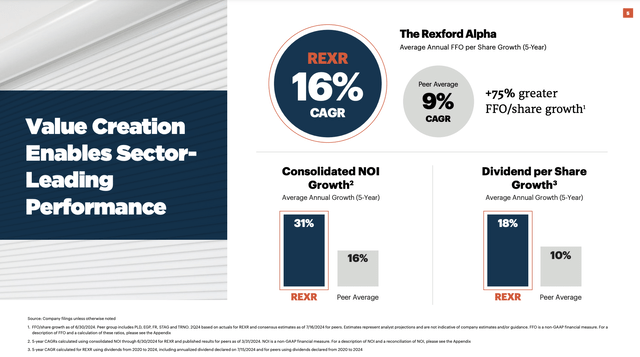

All of these tailwinds have allowed the company to grow its net operating income (“NOI”) by 31% per year over the past five years, roughly twice its peer average of 16%. This has provided 18% annual dividend growth during this period, eight points above the peer average.

Currently yielding 3.3%, the dividend has a payout ratio of 71% and the support of very healthy financials.

On top of the benefits that come with a BBB+ credit rating (one step below the A range), the company sees 35% internal NOI growth over the next three years, most of it coming from repositioning/redevelopment and mark-to-market rent adjustments.

Moreover, in light of economic challenges, it saw a higher occupancy rate and strong leasing spreads.

Rexford has been doing a great job managing its business in 2Q24, as it saw a net positive absorption rate of 400,000 square feet. Its same-property occupancy increased by 70 basis points to 97.3%, with an implied vacancy rate of 2.7%. That’s well below the 3.9% average of SoCal’s infill market – a great result in a tough market environment!

The company saw a net effective rent spread of 79% and cash spreads of 58%. According to the company, this strong demand resulted in an impressive 80% retention and backfill rate.

Additionally, the company benefits from strong leasing, especially in the 10,000 to 100,000 square foot size segment, which saw a 24% increase in leasing activity compared to the prior quarter. In general, the company believes this focus on “smaller” tenants gives it an edge. So far, this has proven to be the correct strategy. – Leo Nelissen Article (August 9)

Looking ahead, analysts agree with the company’s upbeat forecast, expecting 11% per-share AFFO (adjusted funds from operations) growth in 2024, potentially followed by 14% growth in both 2025 and 2026.

Using a 25x multiple gives us a target stock price of $62 and an annual return outlook of 12-14%.

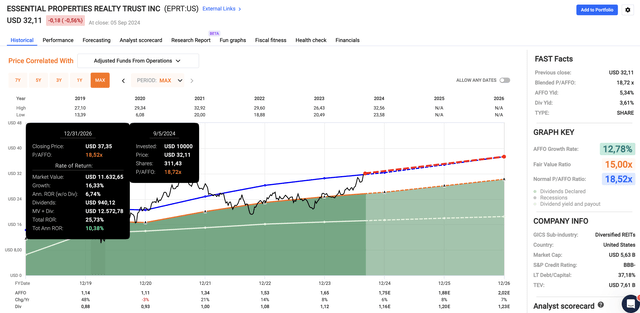

Essential Properties Realty Trust (EPRT)

As we discussed in the first part of this article, retail REITs with a focus on essential properties remain in a great spot. This includes the REIT that has the word “essential” in its name.

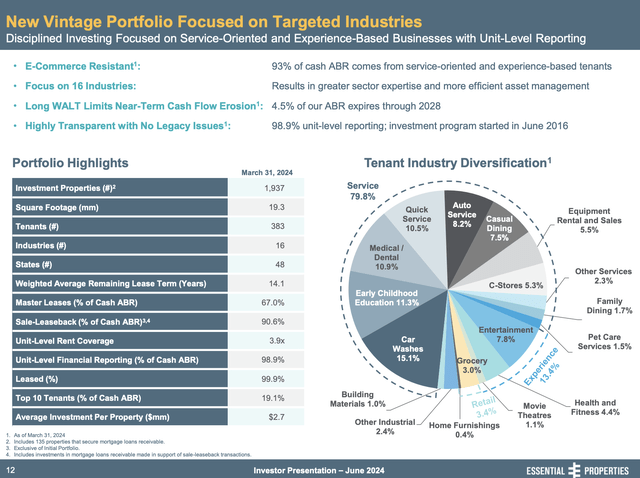

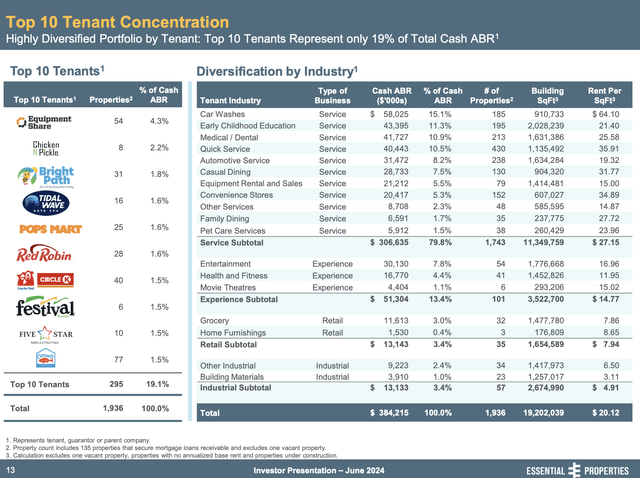

Essential Properties Realty Trust owns more than 1,900 net ease properties in 16 industries, leased to 383 tenants across 48 states. These properties have a weighted average remaining lease term of 14.1 years and are mostly sale-leaseback deals (“SLB”).

A sale-leaseback transaction is a deal where a company sells its building to improve liquidity. In exchange for this liquidity, it now has to pay rent to a landlord. In this case, the landlord is EPRT.

SLB deals benefit from an environment of elevated rates, as many tenants prefer to sell their buildings instead of taking on expensive debt.

Moreover, as we can see below, most of these transactions are in essential areas like auto services, education, healthcare, convenience stores, and others.

Essential Properties Realty Trust

Although I am not a huge fan of renting to middle-market companies, EPRT has done a great job finding the right tenants. As of 2Q24, it had a 99.8% occupancy rate, with no tenant accounting for more than 4.7% of its annual base rent.

Essential Properties Realty Trust

Additionally, in the second quarter, the company invested $334 million across 35 transactions. These deals had a weighted average cash yield of 8% and carried a weighted average initial lease term of almost 18 years with an annual rent escalation of 1.9%.

It also has a fantastic balance sheet, as it ended the second quarter with a leverage ratio of 3.8x and more than $1.1 billion in liquidity.

The dividend isn’t bad, either!

Currently yielding 3.6%, the REIT has a 61% payout ratio and a five-year CAGR of 5.7%.

Looking ahead, analysts expect per-share AFFO to grow by 6% this year, potentially followed by 8% and 7% growth in 2025 and 2026, respectively.

Using its 18.5x multiple, we get a fair stock price target of $37, implying an annual return of 10-11%.

Although EPRT has a lower yield than some of its bigger net lease peers, I prefer its growth profile and valuation, making EPRT a perfect pick for this article.

VICI Properties (VICI)

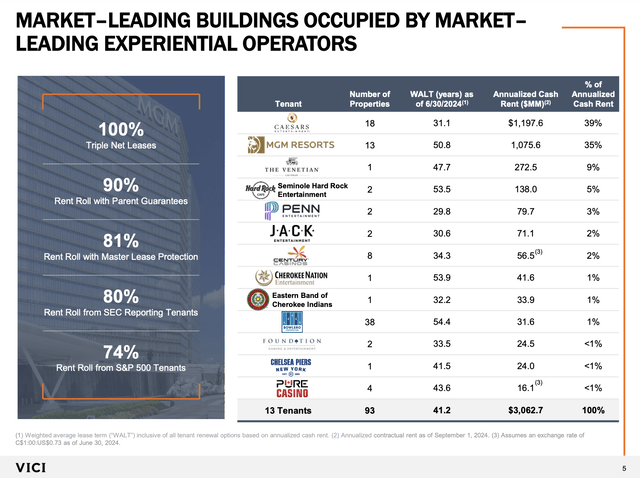

When it comes to experiential real estate and luxury leisure, it is impossible to beat VICI Properties.

The company even went with the title “Invest In The Experience” in its most recent investor presentation.

If there’s one thing VICI is known for, it probably is its massive footprint in Vegas. As we can see below, the company generates 74% of its annual rent from Caesars Entertainment (CZR) and MGM Resorts (MGM), two of the companies that dominate Las Vegas. When adding The Venetian, which pays more than $270 million in annual rent, it generates more than 80% of its revenue from top-tier entertainment giants.

However, 53% of its rent comes from non-Vegas assets, including Caesars Atlantic City, Harrah’s Lake Tahoe, MGM Detroit, and many others.

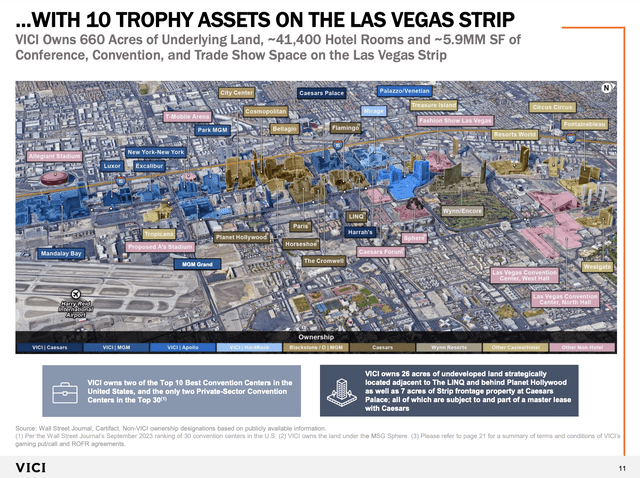

In Las Vegas, it (co-)owns major properties like Mandalay Bay, Luxor, Excalibur, New York-New York, MGM Grand, Park MGM, Caesars Palace, Harrah’s, and Palazzo/Venetian.

What makes this business so strong is the fact that it’s one of the few REITs in an industry with high barriers to entry. Its assets are differentiated instead of commoditized and protected by average lease terms of more than 40 years.

The “problem” is that in order to grow, the company needs to focus on other properties, as it is hard to grow by adding mega resorts in Las Vegas.

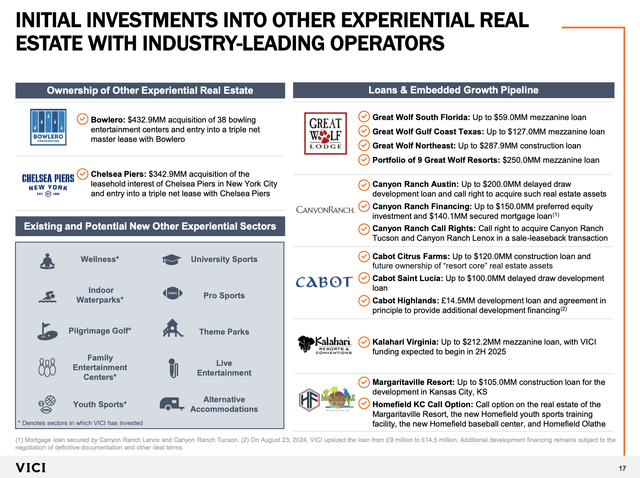

Hence, the company is expanding by adding bowling alleys, spa facilities, youth sports, and others. Although I do not really care for these assets, it’s a good strategy to grow in areas with secular growth.

Even better is that these deals consist of favorable lending arrangements, including the option for VICI to own assets of companies enjoying strong secular growth. This includes CanyonRach, a highly successful spa operator that offers sale-leaseback opportunities.

These operations are supported by a balance sheet with a 5.4x leverage ratio (within its 5.0-5.5x target ratio) and $3.2 billion in liquidity.

Moreover, so far, these operations have allowed the company to consistently grow its dividend.

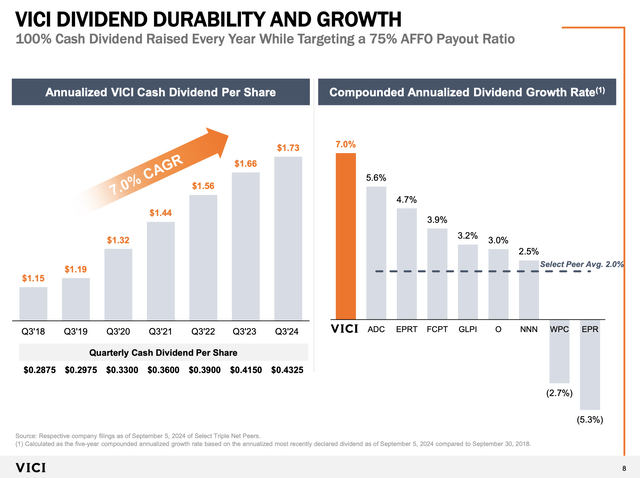

Since going public, the dividend has grown by 7.0% per year. Currently, VICI yields 4.9% with a 64% payout ratio. It has also beaten all major net lease giants when it comes to dividend growth.

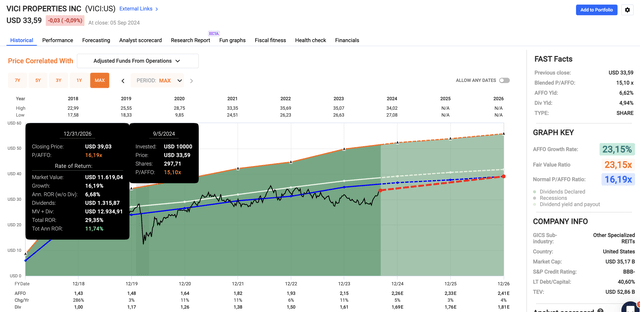

With regard to its valuation, VICI currently trades at a blended P/AFFO ratio of 15.1x, roughly a point below its long-term average.

If we include expected annual per-share AFFO growth of 3-5% using the FactSet data in the chart below, we get a fair stock price of $39 and an implied annual return of 10-12%.

Despite its recent stock price rally, I believe VICI is one of the best REITs on the market. Especially in light of secular tailwinds in this leisure segment, I believe the company has a promising future.

Takeaway

Real estate is making a strong comeback, with major ETFs up over 20% in the past year, largely driven by gains since April.

While this is great news for investors, rising valuations make it harder to find bargains.

My deep dive into the commercial real estate market reveals stabilization, but also persistent challenges like rising vacancy and delinquency rates, especially in the office space.

Despite these headwinds, opportunities exist in the industrial, retail, and hotel sectors, with highly attractive picks that include Rexford Industrial Realty, Essential Properties Realty Trust, and VICI Properties.

I believe these REITs leverage sector-specific strengths and secular tailwinds and are in a great spot for long-term growth – even in a tricky market/economic environment.