ilkercelik/E+ via Getty Images

YieldMax MSTR Option Income Strategy ETF (NYSEARCA:MSTY) is an income-based ETF that actively manages an options strategy in order to create income for the investor. MSTY’s strategy focuses on a single-name stock, MicroStrategy (MSTR) as its core position by selling options on the underlying asset in order to generate income. This actively-managed, passive ETF offers a unique opportunity to investors seeking to hold exposure to MicroStrategy, whether short-short, short-long, long-long, or long-short. Given the equal risk involved and the substantial income-yielding component, I recommend MSTY with a BUY rating.

As a disclaimer, I am bearish on the underlying stock, MicroStrategy.

MicroStrategy Holds Less Bitcoins Than You Think (Q2 Earnings Preview)

Given that this portfolio strategy commits to neither being long or short MSTR shares, I believe it provides a strong opportunity for investors seeking to passively invest in MSTR through an actively managed options strategy.

How It Works

YieldMax’s portfolio strategy consists of actively managing an options book on the underlying asset. The firm generates income through two components. The first is through shorting, or selling, synthetic covered calls or puts to generate income. The strategy oftentimes consists of long options positions to manage risk; however, the primary objective is to short options depending on the direction of the underlying stock.

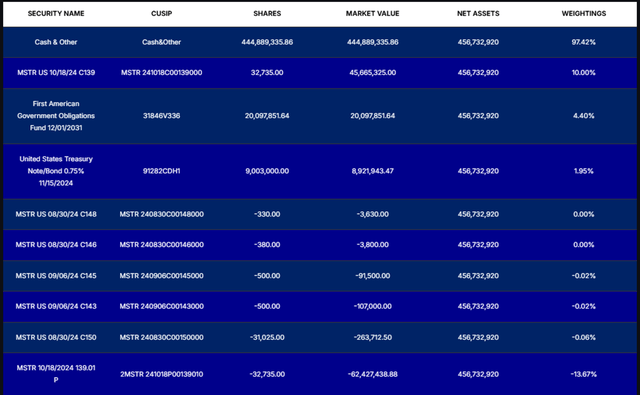

The second income component is the fund’s holdings of short-term US treasuries as collateral. Comparing MSTY to another strategy YieldMax manages, AMDY (AMDY), MSTY holds substantially fewer treasuries than AMDY. This may be the result of the level of volatility MSTR holds when compared to AMDY’s underlying, Advanced Micro Devices (AMD). Instead, MSTY holds a substantial amount of “cash and other” in the portfolio, which is likely held in money market funds that may provide a lower income yield. Despite this factor, MSTY’s returns to investors are substantially higher than AMDY as the forward distribution rate is 100.54%. The portfolio currently stands net bullish on the underlying given the short-straddle position at 10% short-long and 13% short-short, each expiring on October 18, 2024.

The cost of owning MSTY is 99bps, substantially below the distribution rate offered by the strategy, suggesting MSTY may be a strong candidate for passive income while retaining equity-options exposure. In the instance of a rate cut by the Federal Reserve, MSTY may offer investors passive income that may be more appealing when compared to fixed income strategies. MSTY currently has $446mm in net assets and an average daily trading volume of 809k.

During normal trading periods, MSTY shares track closely to the underlying asset, MSTR.

This is likely the result of investor sentiment towards the underlying asset given the active trading volume seen in the ETF. On the other hand, MSTY deviates from MSTR during times of heightened volatility as seen in the August 23-24 timeframe.

Given this factor, MSTY may offer investors more “stability” when investing in MicroStrategy as the ETF remains prudent in sticking with the investment initiative of straddling MSTR shares.

Conclusion

MSTY offers passive equity investors the ability to invest in an actively managed options strategy as it pertains to MSTR shares. This portfolio offers investors an income component as a result of short-selling options on the underlying asset, providing an appealing income component to those that wish to maintain exposure to the equity. Given the portfolio’s ability to generate a substantial amount of income on the underlying name, I rate MSTY with a BUY rating.

Again, I remain bearish on the underlying stock. This is not a recommendation for the purchase of MSTR shares. The sole purpose of this report is to understand the mechanics of the derivatives strategy that MSTY offers. The rating associated with MSTY applies to MSTY alone.