Daniel Grizelj/DigitalVision via Getty Images

By Samuel Rines

It’s early. Earnings season has only just begun. But a few meaningful themes are already beginning to emerge.

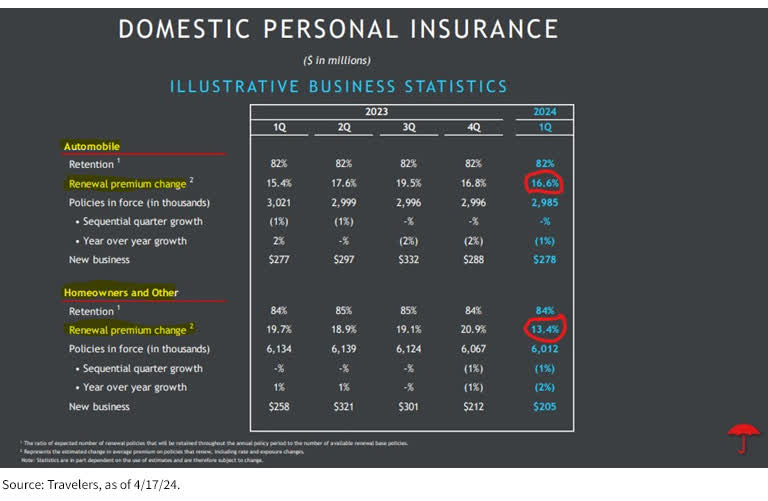

Travelers Investor Presentation

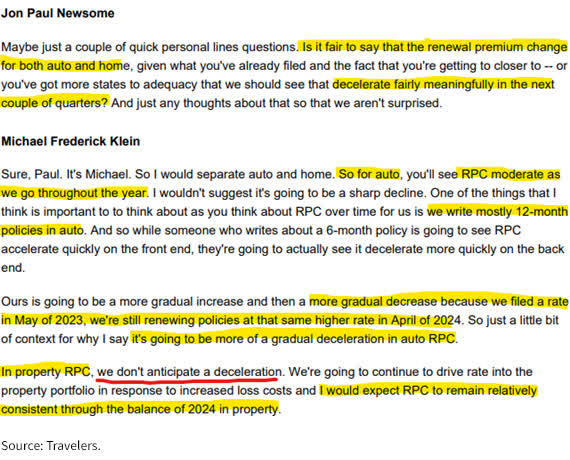

Travelers Earnings Call

If it is rate cuts you want, Travelers (TRV) is not your friend. Services have been a headache for the FOMC, and that is not going to rapidly dissipate. Travelers sees no meaningful deceleration in renewal premium changes for property insurance from the current *checks notes* 13.4% in 2024. Auto insurance? There will be only a “moderation” from 16.6%. When it comes to inflation, this is a primary example of how sticky certain portions can be under the surface. This stickiness insures no rate cuts until late 2024.

Then there is the consumer. For all the mixed signals, there is a modicum of clarity coming through. Retail sales are lying. The U.S. consumer remains fine.

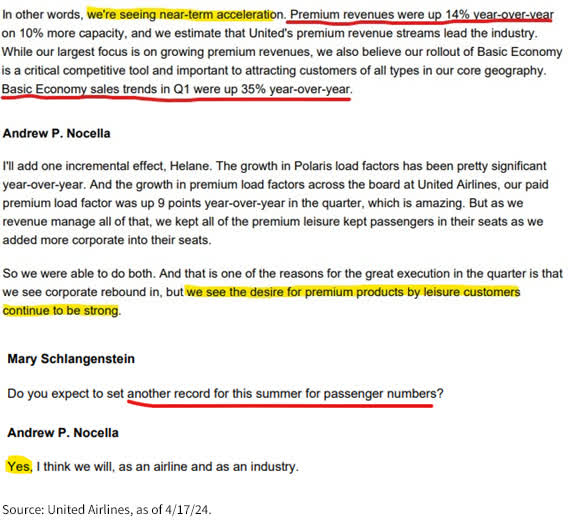

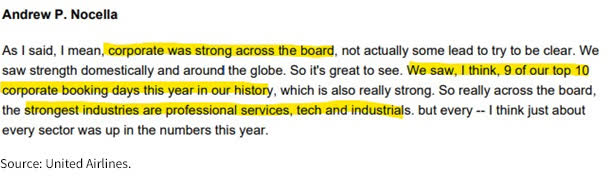

United Airlines Earnings Call

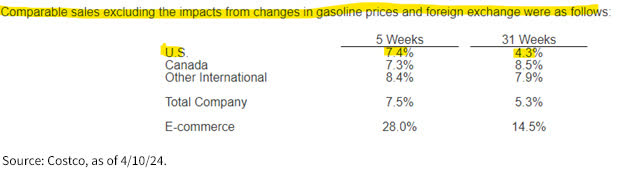

Costco Monthly Sales Report

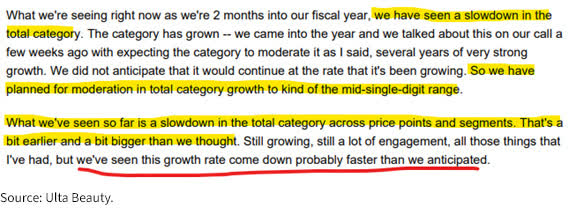

Ulta Beauty at J.P. Morgan Retail Round-Up

There are certainly puts-and-takes. United Airlines (UAL) benefitted from accelerating demand in the first quarter, with both premium (high-end consumer and business travelers) and basic economy (lowest fare) up nicely from a year ago. Confidence in the future? In spades. That should not be shrugged off. The good start to the year is set to continue. Consumer demand for premium tickets? That is strong, too.

Ulta (ULTA) has other things to say. At a glance, it would appear that the beauty business is falling off a cliff. That is not entirely the case. The “beauty boom” is waning, but Ulta is guiding to positive comparable sales. That is a slowing of sales growth, not a disaster. A growth of 4% to 5% in comparable growth for the year is not an indication of the death of the consumer. For its part, Costco (COST) saw its sales accelerate in March.

United Airlines Earnings Call

Not to mention, United Airlines called out the return of business travel as a tailwind for the year as well. That will spiral into the broader hospitality industry, further bolstering the services economy.

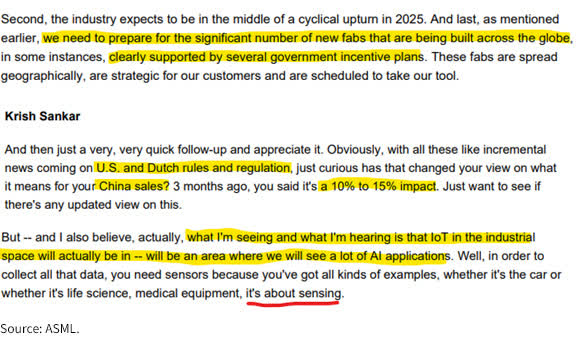

ASML Earnings Call

The ASML (ASML) call was intriguing for numerous reasons. Did ASML miss orders? Yes. Was that the primary takeaway? No. ASML makes the machines that make the chips for AI and other applications. There is no doubt about the optimism surrounding AI and its associated opportunities. But there was an interesting twist to the narrative from the ASML call.

The fabrication facilities being built across the globe -particularly in the U.S. – will go online in the coming years. AI is not driving a single-year type of tailwind. It is a multiyear build-out of capacity that provides visibility into longer-term demand. Even with the headwinds from U.S. restrictions on technology sales to China, the 10% to 15% hit is not overly meaningful to the outlook. The kicker? The long-awaited development of the Internet of things (IoT) is more likely given the AI boom and the need for data. That takes more chips. More chips equals more ASML machines.

Why does any of this matter? For a few reasons. The consumer is not dead, and neither is the economy. That’s good news. But the insurance premium problem is not going away. Services inflation is ensuring that the FOMC does not cut in the near term. Insurance is a significant component of that equation, and the guidance is not in the Fed’s favor. If ASML is to be believed (and it should be), AI investment is not a short-term thing. The CHIPS Act and other policy initiatives are ensuring that more fabrication facilities are built, and those take time and equipment to build and operate.

It is early. There will be more lessons to be learned. So far, earnings are telling us it’s more of the same. Inflation remains sticky, the consumer is alive and AI has a longer-than-expected reach.

Samuel Rines, Macro Strategist, Model Portfolios

Sam Rines serves as a Macro Strategist, Model Portfolios at WisdomTree extending the firm’s custom model portfolio management capabilities. Prior to WisdomTree, Samuel was a Managing Director of CORBU, a research firm we struck up a relationship with to deliver model portfolios. Samuel is a global macro expert focused on the investment implications of politics and policy. His PolyMacro research has been widely followed by large family offices, institutional investors and the media. Prior to joining CORBU, Samuel was the Chief Economist and Investment Strategist at Avalon Advisors. Before joining Avalon, Samuel was a portfolio manager at Chilton Capital Management, where he launched the Chilton ESG Equity Strategy and a long/short technology portfolio. Samuel started his career as the cross-asset analyst for a small hedge fund. He is the author of the book “After Normal: Making Sense of the Global Economy “.