RapidEye/iStock via Getty Images

Pyxis Oncology (NASDAQ:PYXS) is an antibody and antibody-drug conjugate (ADC) developer that I covered back in March. At that time, I rated it a hold, as the company had the funds it needed to run its trials, but there was no near-term clinical catalyst. This article looks at updates from the company and the near-term catalyst of PYX-201 data.

The clinical timeline

While I lamented slippage to the timeline of clinical readouts in my previous article on PYXS, the timeline for data from the phase 1 trial of PYX-201, the company’s anti-extra domain B fibronectin ADC doesn’t seem to have changed much. I take that as a good sign that further slippage in reporting results from that phase 1 study is less likely.

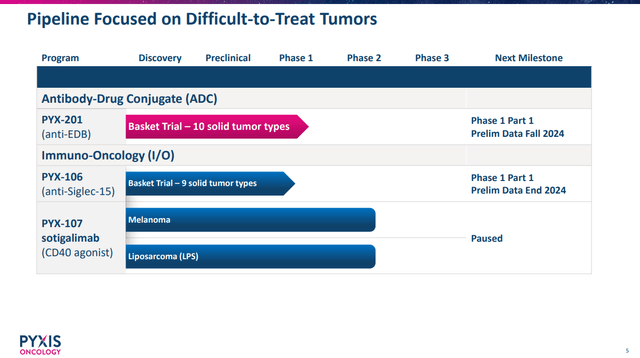

PYXS development pipeline. (PYXS Corporate Presentation, September 2024.)

Indeed, PYXS’s September 2024 corporate presentation still notes a timeline for data from PYX-201 in the of fall 2024, and data from PYX-106, an anti-Siglec-15 antibody at the end of 2024.

What might we expect from PYX-201

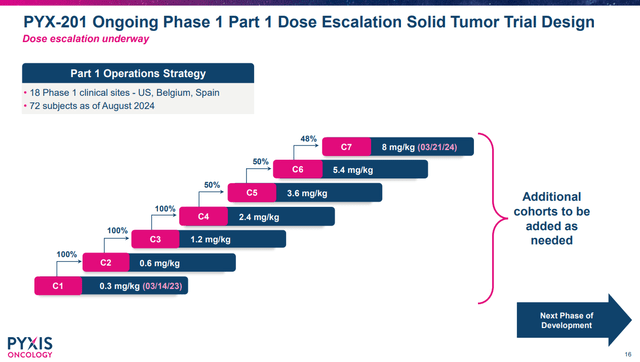

PYXS’s Q2’24 earnings press release notes the company had dosed 72 patients with PYX-201 in the dose escalation study in a range of cancer types. It would be ideal if, from that, the company is able to see evidence of objective responses at the higher doses of PYX-201. If PYXS’s reports 72 patients’ worth of data with no responses, even if some of the data is at lower doses that probably wouldn’t be expected to work, the market won’t likely be excited about that.

Overview of PYX-201 dose escalation. (PYXS Corporate Presentation, September 2024.)

Notably, Italian-Swiss biotech Philogen S.p.A. (PHIL on the Borsa Italiana) has a pipeline based on biologics, targeting extra domain B of fibronectin, conjugated to cytokines. For example, the company’s drug Nidlegy (daromun) consists of L19 (an antibody fragment targeting extra domain B of fibronectin) conjugated to interleukin 2 (L19IL2) and L19 conjugated to tumor necrosis factor (L19TNF). That drug has already produced a positive result in a phase 3 trial in melanoma, and a Marketing Authorization Application (MAA) was validated by the European Medicines Agency (EMA) on June 20, 2024. The validation of an MAA by the EMA does not represent marketing approval, but instead a first step in the review process of that MAA, similar to the US Food and Drug Administration filing a New Drug Application for review. In any case, while Philogen and its partner Sun Pharmaceutical Industries Limited (Reuters: SUN.BO) haven’t received marketing approval yet, the point remains that other companies are having success targeting extra domain B of fibronectin.

For PYX-201, one hint of activity thus far is comments from the company in the Q1’24 earnings press release in May.

Based on encouraging early responses with late-stage patients across multiple tumor types, we are actively studying dose ranges from 5.4 mg/kg to 8 mg/kg, refining our understanding of PYX-201’s therapeutic window…

Lara S. Sullivan, President and CEO of PYXS, May 14, 2024.

It isn’t clear to me if the “early responses” mentioned include confirmed partial responses (or complete responses) or just some tumor shrinkage, so some caution on interpreting the above statement is warranted. It should also be noted that at the time of Q1’24 earnings, the company had dosed 42 patients PYX-201 and was planning to dose an additional 16 patients (compare that to the 72 patients mentioned in August 2024). Whether or not more patients represent trouble identifying the best dose, or something else, such as enrolling additional patients with select tumor types, isn’t clear currently.

Financial Overview

PYXS had $155.7M in cash, cash equivalents, and short-term investments, as of June 30, 2024, which it believes will fund operations into H2’26. PYXS also had a further $1.5M in restricted cash at the end of Q2’24. R&D expenses were $13.9M in Q2’24 and G&A expenses were $6.1M in the same quarter. PYXS reported a net loss of $17.3M in Q2’24, and net cash used in operating activities was $23.7M in the first six months of 2024. At the current rate of burn, PYXS could continue for over three years into H2’24. Of course, PYXS’s more conservative estimate of the runway into H2’26 makes sense, given the success of either asset could involve increases in R&D expenses. Indeed, the company’s Q2’24 earnings press release refers to its cash as funding “the next phase of PYX-201 clinical development, which the Company plans to announce in the fall of 2024.”

There were 58,942,243 shares of PYXS’s common stock outstanding as of August 14, 2024. PYXS has a market cap of $214.5M ($3.64 per share).

Conclusions, rating, and risks

I think now could be the time for a potential run-up to occur, if fall starts on September 22, 2024, and data is expected in fall 2024, with more data by year-end 2024. Further, even if a run-up doesn’t occur, there are two shots on goal there, giving PYXS the opportunity to impress and potentially allowing an early exit from any long trade if the first readout isn’t positive. For example, an underwhelming readout from PYX-201 might not be met with as much of a drop in the share price, given PYX-106 would be around the corner. Further, I estimate year-end cash of $132M, or about $2.24 per share, which could also limit downside. Considering the potential of PYX-201, including hints from the company, and competitors’ development success with semi-related drugs (extra domain B fibronectin-targeting drugs), along with PYXS’s financials, I rate the name a buy.

The risks of any long are several-fold, of which I’ll note three here. Firstly, while the fact that the company sees the next phase of a development for PYX-201 so close to reporting results could be considered as boding well for the stock, there is no guarantee the market would see any results from the clinical work with PYX-201 as quite so promising.

Secondly, the company could end up delaying the release of data from PYX-106, as there have been delays previously. Such delays would weaken the thesis that PYX-106 data being ahead could limit downside if PYX-201 data isn’t received well.

Lastly, PYXS could engage in business development activities, such as the acquisition of additional technology to build its pipeline, which might not be perceived by the market as positive. Indeed, such development could involve spending cash now for a theoretical benefit later.